BEFORE THE UNITED STATES DEPARTMENTS OF COMMERCE,

TRANSPORTATION, AND STATE

WASHINGTON, DC

In the Matter of:

Information Docket on Claims

Raised about State-Owned Airlines

In Qatar and the United Arab Emirates

)

)

)

)

)

)

)

)

)

Docket Nos. DOC-2015-0001;

DOS-2015-0016; and

DOT-OST-2015-0082

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT STATE-OWNED

AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

Communications regarding this document

should be served upon:

Etihad Airways, PJSC, c/o

F. Martin Dajani

District of Columbia Bar #472187

Vice President Legal, Americas

901 15th Street, NW, Suite 610

Washington DC, 20005

May 31, 2015

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

2

BEFORE THE UNITED STATES DEPARTMENTS OF COMMERCE,

TRANSPORTATION, AND STATE

WASHINGTON, DC

In the Matter of:

Information Docket on Claims

Raised about State-Owned Airlines

In Qatar and the United Arab Emirates

)

)

)

)

)

)

)

)

)

Docket Nos. DOC-2015-0001;

DOS-2015-0016; and

DOT-OST-2015-0082

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT STATE-OWNED

AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

I. INTRODUCTION

In a paper dated January 28, 2015,

1

the three largest American airlines, and indeed the

three largest airlines in the world by most measures,

2

American Airlines, Delta Air Lines, and

United Airlines (hereinafter the “Big 3 Carriers”) took the unprecedented step of seeking to roll

back decades of United States “Open Skies” policy, which refers to the United States’ efforts to

liberalize air services between the U.S. and other countries. United States Open Skies Policy

calls for bilateral air services governed by competition, consumer benefits, and reduced

regulatory intervention, rather than artificial constraints, arbitrary limits on air services, and other

barriers to competition. The United States has been relentless in its efforts to bring more

1

“Restoring Open Skies: The Need to Address Subsidized Competition from State-Owned Airlines in Qatar

and the UAE” (“Big 3 Carriers’ Paper”).

2

By market capitalization, passengers carried, number of destinations, passenger-kilometers flown, and fleet

size.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

3

competition, better products, and enhanced services to consumers in the United States and

around the world. To this end, the United States has successfully consummated over 100 Open

Skies-type air transport agreements, including such agreements with the United Arab Emirates

(“UAE”) and Qatar. The Brookings Institute conservatively estimates that Open Skies

agreements have generated at least $4 billion in annual gains to travelers, and that additional

large gains are available through consummating more Opens Skies agreements.

3

In the over 30-year history of United States Open Skies Policy, the United States has

never revoked or placed post-execution restrictions on an Open Skies agreement, and has pressed

countries around the world to recognize the benefits of competition in a manner similar to that of

this country. U.S. consumers, and all consumers seeking to travel to or from the U.S., have been

the direct beneficiaries of these Open Skies agreements, with hundreds of new destinations

available to Americans, and making the U.S. more accessible to millions around the world.

Unfortunately, the Big 3 Carriers seek to put their own narrow interests before public benefit,

consumer welfare, and competitive markets.

4

3

“Open Skies: Estimating Travelers’ Benefits from Free Trade in Airline Services,” C. Winston and J. Yan,

May 13, 2015, American Economic Journal: Economic Policy 2015, 7(2); 370-414, available at

http://www.brookings.edu/~/media/Research/Files/Articles/2015/05/13-open-skies-free-trade-airlines-

winston/Open-Skies-Published.pdf?la=en. Their view is shared by leading aviation groups, including the

Global Travel Association Coalition (GTAC), whose members include the Airports Council International,

Cruise Line International Association, International Air Transport Association, International Civil Aviation

Organization, Pacific Asia Travel Association, World Economic Forum, World Tourism Organization and

World Travel & Tourism Council. The GTAC adopted the “Agenda for Growth and Development,” in

which it emphasized “the need for improved and expanded connectivity and capacity” and confirmed “that

the continued liberalization of international air transport, both bilateral and multilateral, could provide

opportunities for ensuring the free flow of travel and trade,” available at http://www.wttc.org/-

/media/upload/gs15/gtac%20document%20final.pdf.

4

“Airlines are Making Record Profits, but Don’t Expect a Cheaper Seat,” Washington Post, April 30, 2015,

available at http://www.washingtonpost.com/news/business/wp/2015/04/30/airlines-are-making-record-

profits-but-dont-expect-a-cheaper-seat/. “American Airlines, which excels at not much of anything, just

banked $1.2 billion in profit during its most profitable three months in history. The nation’s other major

airlines are also swimming in record profits[.]”

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

4

Etihad Airways is the national airline of the United Arab Emirates. We were established

in November 2003 by the Abu Dhabi government. Like many carriers around the world,

including many members of Star Alliance, oneworld, and SkyTeam, the three global mega-

alliances founded by the Big 3 Carriers, Etihad is government-owned.

5

We have been since our

inception, and we have been since our designation in the current United States-United Arab

Emirates Air Transportation Agreement (the “US-UAE Air Services Agreement”), which has

been in place since March 11, 2002.

6

Yet, despite no changes in our ownership model, and with

the Big 3 Carriers benefiting from a post-bankruptcy, post-consolidation, and post-voluntary

capacity reduction operating environment, the Big 3 Carriers have launched an attack on

competition, targeting Etihad, Emirates, and Qatar Airways. They have also attacked other

carriers that threaten their market hegemony and have sought to frustrate the efforts of other

airlines that seek to compete in the United States.

7

Consistent with this approach of collectively

seeking to eliminate competition, they now wish to suppress competition from Etihad, Emirates,

and Qatar Airways.

There is a lot of bluster in the Big 3 Carriers’ claims. Etihad and other Gulf carriers have

been accused of receiving “subsidies and other unfair benefits,” “captur[ing] U.S. airline market

share,” “shifting American aviation jobs overseas,” “negatively impacting the U.S. economy,”

5

Indeed, the French government recently announced it had acquired a further 2% of Air France-KLM,

increasing their holding from 16% to 18%, “French Government Seeks Shareholder Power at Air France-

KLM,” The Wall Street Journal, May 8, 2015, available at http://www.wsj.com/articles/french-

government-seeks-shareholder-power-at-air-france-klm-1431097199.

6

United States-United Arab Emirates Air Transportation Agreement as of March 11, 2002, available at

http://www.state.gov/e/eb/rls/othr/ata/u/.

7

“EU says U.S. Delays on Norwegian Air License Breaches Aviation Deal,” EurActive, December 3, 2014,

available at http://www.euractiv.com/sections/transport/eu-says-us-delay-norwegian-air-licence-breaches-

aviation-deal-310532. Delta, American and United actively oppose Norwegian Air’s attempts to secure a

U.S. license. Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

5

and many other rhetorical flourishes and unsubstantiated claims.

8

For example, according U.S.

aviation trade organization, Airlines 4 America, in each month of 2014 U.S. carriers added

workers to their respective payrolls. The 2014 full time equivalent total of 384,600 employees

represents an increase of approximately 6,300 employees from 2010.

9

At times the rhetoric has been over the top, such as weaving the September 11 terrorist

attacks into the narrative.

10

However, despite this costly anti-competitive, anti-consumer

campaign, the Big 3 Carriers’ complaints are bereft of any substance.

In their public papers, the Big 3 Carriers have not accused Etihad of being

anticompetitive, charging “prices that are unreasonably high . . . or artificially low,”

11

or harming

consumer welfare. Indeed, in the Big 3 Carriers’ 55 page paper, consumer choice is mentioned

only once, and even then only in a cursory manner.

12

Most significantly, nowhere in their paper

do the Big 3 Carriers allege that they have been harmed, let alone offer any proof of harm. They

also fail to argue, let alone demonstrate, how their proposed restrictive remedies would benefit

consumers or competition. That is not by mistake—it is by design. While the Big 3 Carriers

8

“Restoring Open Skies Executive Summary,” available at http://www.openandfairskies.com/wp-

content/themes/custom/media/Executive-Summary.pdf.

9

See “A4A Recaps Year of Progress as U.S. Airlines Report Improved Financial Reports in 2014 to the

Benefit of Customers, Employees and Shareholders,” March 11, 2015, available at

http://airlines.org/news/2014-passenger-airline-results-and-2015-spring-air-travel/#.

10

See “U.S. Airlines To Take on State Owned Gulf Rivals,” CNN Quest Means Business, February 16, 2015,

available at http://www.cnn.com/videos/business/2015/02/16/qmb-delta-ceo-richard-anderson-intv.cnn.

See also “Delta CEO Richard Anderson Links Gulf Airlines Like Emirates and Etihad to 9/11 Attacks,”

International Business Times, February 17, 2015, available at http://www.ibtimes.com/delta-ceo-richard-

anderson-links-gulf-airlines-emirates-etihad-911-attacks-1819378. See also “Gulf Carriers Rebuke Delta

Chief Executive Office Over 9/11 Comment,” USA Today, February 19, 2015, available at

http://www.usatoday.com/story/todayinthesky/2015/02/19/gulf-carriers-rebuke-delta-ceo-over-911-

comment/23690695/.

11

As these terms are used in the US-UAE Air Services Agreement.

12

In contrast, the words “subsidy” and “subsidies” are mentioned 148 times. “Sheikh” is mentioned 23 times.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

6

have rolled out their “parade of horribles,” they have failed to identify any tangible harm to

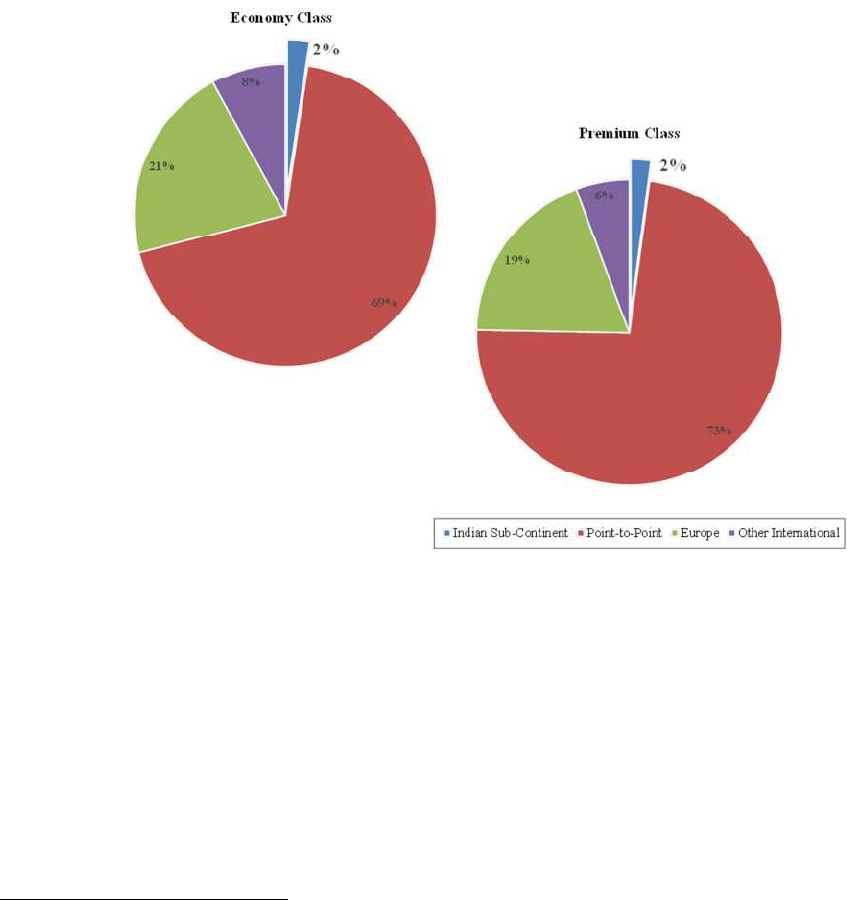

themselves, or to consumer welfare. Their only specific claim is that from 2008 to 2014, they

have allegedly collectively lost five percentage points of their Indian Subcontinent market

share.

13

However, what they neglected to mention is that during the same period their passenger

numbers to the Indian Subcontinent actually grew by 18%.

14

So while their collective market

share actually went down by a relatively insignificant 4.4 percentage points, their actual

passenger volumes grew by over 18%, or 250,000 passengers.

15

This passenger growth clearly

demonstrates the power and effects of Open Skies and liberalized traffic rights.

16

On April 24, 2015, American Airlines CEO Doug Parker summed up the extent of the

“harm” American, and presumably all the Big 3 Carriers, had sustained as a result of Gulf

carriers’ purported violations of the US-UAE Air Services Agreement:

13

Big 3 Carriers’ Paper, Figure 22, page 47.

14

Edgeworth Economics’ “Empirical Investigation and Analysis of Economic Issues Raised In ‘Restoring

Open Skies: The Need to Address Subsidized Competition From State-Owned Airlines in Qatar and the

U.A.E.,’” May 21, 2015, J. Johnson and M. Kheyfets (“Edgeworth Report”). Etihad retained Edgeworth to

independently evaluate the economic claims made by the Big 3 Carriers and their proxies. See sec III,

infra. Etihad submitted this report to the respective dockets on May 22, 2015.

15

Edgeworth Report, para 22. This includes the growth in both economy and premium passengers of the Big

3 Carriers during this period.

16

On May 15, 2015, the Big 3 Carriers released a report entitled “Assessing the Impact of Subsidized Gulf

Carrier Expansion on U.S.–International Passenger Traffic,” Compass Lexecon, May 13, 2015 (“Lexecon

Report”). The Lexecon Report, which is based on undisclosed data, is flawed in many ways, including: (1)

it assumes as fact and builds into its assumption that certain carriers are “subsidized;” (2) that there is a

linear or other direct connection between global economic growth and implied demand for passenger traffic

on specific routes; (3) that certain carriers (i.e. the Big 3 Carriers) are “entitled” to a certain share of traffic

based upon factors such as “per capita income and population;” (4) their model does not appear to account

for other carriers that compete in the relevant market, such as Turkish Airlines and Air India, among others;

and (5) that any growth in excess of these self-styled factors constitutes “stolen” market share. None of

these concepts are included in any modern air services agreement, let alone the US-UAE Air Services

agreement.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

7

“We think the situation in the Middle East is serious and needs to be addressed

and if it’s not addressed it could have material consequences to our industry over

time.

. . . [B]ut the other European carriers have seen severe impact to their profitability

because of the growth of these subsidized airlines and we don’t care to see that

happen in the United States.”

17

American’s statement bears repeating: The Big 3 Carriers are seeking to rewrite decades of U.S.

Open Skies Policy and potentially over 100 consummated Open Skies agreements because

competition from Etihad, Qatar, and Emirates could, over time, have material consequences to

the three biggest airlines in the world. In doing so, they seek to deprive consumers of one of the

few remaining elements of competition in an increasingly concentrated and oligopolistic

international aviation market.

We also note that the Big 3 Carriers are waging a proxy fight, seeking to use United

States bilateral treaties to which European countries are not even a party to wage a fight on

behalf of some of their immunized European global alliance “partners.”

18

This critical element

of the Big 3 Carriers’ campaign is particularly ironic in that they claim to be “fighting” for

American jobs. The Big 3 Carriers also fail to acknowledge the substantial positive economic

impact of Etihad on the US economy, an impact that is meticulously documented by Oxford

17

First Quarter 2015 American Airlines Group Inc. Earnings Conference Call, available at http://edge.media-

server.com/m/p/akdcucv6/lan/en. (emphasis provided).

18

Lufthansa/Austrian/Swiss is United’s European partner. Air France/KLM is Delta’s European partner.

Both European airlines are leading a similar anticompetitive campaign in Europe. British Airways, in

contrast, support Open Skies, competition and innovation, and is not part of these efforts. Indeed British

Airway’s parent IAG stated, among other things, that “the benefits to U.S. consumers, businesses and

employment are plain to see. The global competitiveness of the U.S. economy has been significantly

enhanced by the aviation policies the DOT has pursued over the last 30 years. Turning back the clock

now would be folly.” IAG Public Comments submitted to the respective dockets on May 14, 2015 (DOT-

OST-2015-0082-0063) (emphasis provided). We encourage the Agencies to review carefully IAG’s

thoughtful submission.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

8

Economics in its May 2015 study.

19

This study has quantified the economic impact of Etihad on

the USA in terms of both the core contribution stimulated by its activities and the wider

economic benefits its services enable for others. With six unique routes linking the USA to the

Middle East and beyond, in 2015 Etihad’s economic footprint in the USA is expected to amount

to a GDP contribution of $2.9 billion and some 24,000 US jobs. After twelve years of growth in

its worldwide network, the air connectivity Etihad creates is estimated to boost the productivity

of the US economy by $410 million.

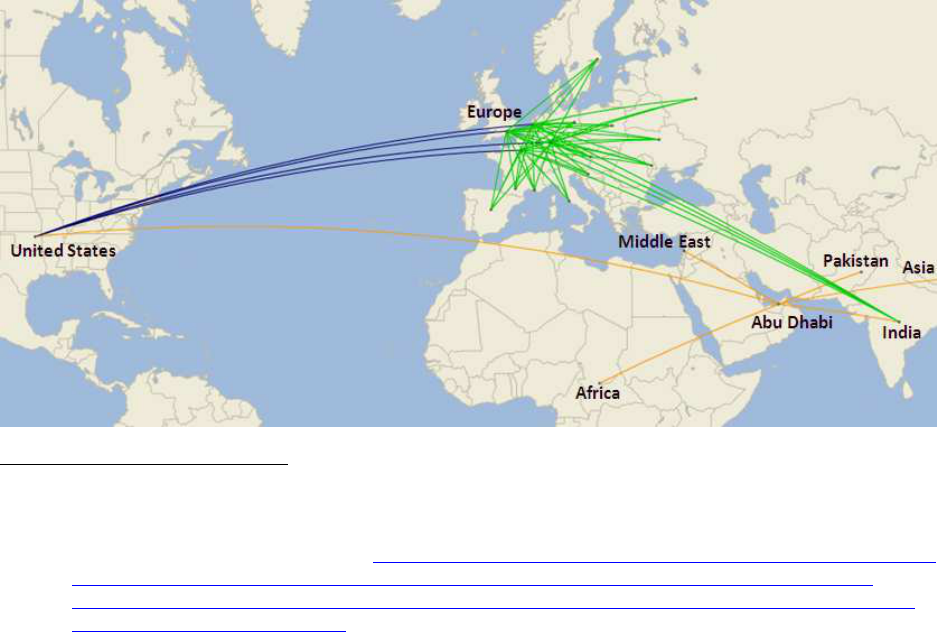

The Big 3 Carriers affirmatively and voluntarily choose not to directly serve Etihad’s key

Middle East and Indian Subcontinent markets in a meaningful way.

20

Instead they are routing

U.S. passengers through congested European hubs and on to their European alliance partners to

serve certain destinations. Indeed, the Big 3 Carriers’ campaign is little more than a regulatory

attempt to further cement their oligopoly, particularly on transatlantic markets. In an article

entitled “The Pathetic State of Airline Travel Today Was Predicted Long Ago,” Time Magazine

laments:

“‘The airline industry is increasingly looking like an uncompetitive oligopoly,’

Andrew Ross Sorkin wrote in a recent New York Times analysis. Sorkin pointed

to the insights of analyst Vinay Bhaskara, who in late 2014 wrote in Airway

19

“The Economic Impact of Etihad Airways on the United States Economy,” Oxford Economics, May 2015.

Etihad submitted this report to the respective dockets on May 27, 2015.

20

As of March 2015, United has two flights to India. See “Why United Is the Only U.S. Airline That Flies to

India,” The Street, March 10, 2015, available at http://www.thestreet.com/story/13072290/1/why-united-is-

the-only-us-airline-that-flies-to-india.html. According to aviation consultant Bob Mann, “U.S. carriers

would continue to serve most markets in India through partnerships, with or without the Gulf airlines,

although the increasing number of Boeing 787s in the U.S. fleet could open more markets. By contrast,

Gulf carriers led by Etihad are heavily involved in India.” Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

9

News, ‘We are unquestionably living in an air travel oligopoly,’ in which virtually

all power in the industry lies in the hands of very few players.”

21

The fact that the Big 3 Carriers are waging this battle against competition in coordination with

and on behalf of their European “competitors” should come as no surprise either. Fortune

Magazine’s Christopher Elliott recently observed:

“On first glance, the transatlantic routes may look competitive. There are 172 air

carriers servicing transatlantic routes, according to Hopper. And fares are down

about 10% from last summer. But look closer: the 27 carriers belonging to the

three main carrier alliances (SkyTeam, Star Alliance, and oneworld) operated

over 85% of those flights.

It gets worse. The average U.S.-Europe route is served by 7 carriers, but if you

consider each alliance as a single carrier, the average number of carriers per route

falls below 4. The average share for the largest carrier on these routes is 57%, but

it rises to 79% when you combine alliance carriers.”

22

There is a simple solution to all the Big 3 Carriers’ complaints: If the Big 3 Carriers

sincerely wish to serve the Middle East and Indian Subcontinent, then they should simply serve

the Middle East and Indian Subcontinent, and bypass their self-selected European midway points

and European “partners.” Instead, they have chosen not to serve these important regions

themselves and yet seek to block others from doing so. What the Big 3 Carriers propose is the

antithesis of both Open Skies and competition.

21

“The Pathetic State of Airline Travel Today Was Predicted Long Ago,” Time Magazine, April 24, 2015,

available at http://time.com/money/3831903/airlines-high-prices-bad-service-mergers/.

22

“The Surprising Cause of High Summer Airfares: ‘Legally-sanctioned price collusion,’” Fortune

Magazine, April 30, 2015, available at http://fortune.com/2015/04/30/airlines-summer-europe-fares/.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

10

In June 2014, over 6 months before the Big 3 Carriers’ current anti-competitive

campaign, Delta testified under oath to the House Financial Services Committee that their

withdrawal from the India market was due to Air India’s purchases of American-manufactured

Boeing aircraft with financing from the United States Export-Import Bank:

“‘Only two years earlier Air India had used separate guarantees to secure below-

market financing for the purchase of Boeing 777s and deploy them between JFK

and Mumbai, in direct, head-to-head competition with Delta at significantly

reduced ticket prices. Delta had no choice but to exit that market,’ Mr. [Richard]

Anderson’s statement reads. ‘I personally presented this problem to the bank

following the bank’s September 2011 deal, but my concerns fell on deaf ears.’”

23

On March 6, 2015, Delta began to hedge its assertion. According to Delta spokesman Trebor

Banstetter:

“Delta Air Lines would be flying direct to India from Seattle were it not for

government subsidies given to competitor Emirates Airlines. ‘They (the Middle

East airlines) don’t have the same profit imperative we do,’ he said. ‘They can

operate a flight that loses money to gain market share.’ He added that this makes

competition difficult, which is why Delta stopped offering service to India from

Seattle.”

24

On May 15, 2015, the Big 3 Carriers went “all in” on the Gulf Carrier-India story. At the

National Press Club Luncheon with Airline CEOs, Delta unequivocally asserted that its “exit”

23

“Why Can’t You Fly Delta to India? CEO Blames Ex-Im Bank, Global Atlanta,” Global Atlanta, June 27,

2014, available at http://www.globalatlanta.com/article/27000/why-cant-you-fly-delta-to-india-ceo-

blames-ex-im-bank/.

24

“Delta: We’d Fly Direct to India if it Weren’t For Unfair Competition from Mideast Airlines,” Puget Sound

Business Journal, March 6, 2015, available at http://www.bizjournals.com/seattle/news/2015/03/06/delta-

wed-fly-direct-to-india-if-it-werent-for.html?page=2. Etihad is unaware of any time in which Delta

operated a direct service between Seattle and any city in India. Delta did suspend its Amsterdam-Mumbai

service in 2015.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

11

from the India market was due to the “Gulf Carriers.”

25

While this new explanation provided an

expedient and timely talking point for the current debate, it underscores the tenuous nature of the

totality of the Big 3 Carriers’ claims regarding their choice not to compete in India. The truth of

the matter is that none of the Big 3 Carriers or their pre-consolidation predecessors ever served

India in a meaningful way, irrespective of Air India, Etihad, other Gulf carriers, or the actions or

inactions of any other airline. Indeed, to the limited extent the Big 3 Carriers ever served India,

the scheduling changes to which they claim in 2015 were the result of Etihad’s actions largely

took place before Etihad even existed. Even by the Big 3 Carriers’ fanciful standards, it defies

logic to blame an airline that did not exist for actions the Big 3 Carriers took years ago. Travel

writer Rohan Anard compiled the following service summary dating back to the 1960s:

25

“National Press Club Luncheon with Airline CEOs, May 15, 2015,” available at

http://www.press.org/news-multimedia/videos/npc-luncheon-airline-ceos.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

12

26

While the Big 3 Carriers attempt to paint carriers in the Middle East as a monolith, there

are more than 30 airlines based in the Middle East region. The three largest are Emirates, based

in Dubai, UAE; Qatar Airways, based in Doha, Qatar; and Etihad Airways, based in Abu Dhabi,

UAE. While the Big 3 Carriers label us “the Gulf carriers,” we have no relationship with each

other. We do not work together or lobby together—we compete vigorously. We are of different

26

“Delta Uses India Withdrawal to Underscore ‘Unfair’ Practices of Gulf Carriers, Rohan Anard,” Upgrd,

available at http://upgrd.com/aerospace/the-challenges-of-the-us-india-nonstop-market-its-time-for-facts-

and-figures2.html. “One of the biggest ironies of the airline industry is that global carriers will never

hesitate to resort to trash talking and finger pointing, irrespective of the overall financial health of the

passenger air travel market. The reality is that Delta has the capability to launch nonstop flights from

Seattle to India any day if it wishes, but is not willing to admit that it could not even viably support 1-stop

service to Mumbai, one of the largest U.S.–India O&D markets, from its Amsterdam hub despite enormous

feed from Delta and KLM across the Atlantic.” Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

13

sizes, and have different hubs, growth strategies, and owners. Indeed, unlike the Big 3 Carriers

who have teamed up to take full advantage of the Noerr-Pennington Doctrine exception to the

application of the Sherman Act and related United States antitrust laws, we are filing this paper

on behalf of Etihad and Etihad alone.

27

Although there has been great temptation to respond to the Big 3 Carriers’ baseless

allegations in real time, Etihad has chosen to follow the thoughtful process proposed by the three

United States agencies reviewing this issue: the Departments of Commerce, State, and

Transportation (the “Agencies”). We have chosen not to respond directly to an inflammatory

advertising campaign (including television, radio, print, web, and social media, among others),

and selective disclosures (the contents of which we do not know) to certain government

agencies.

28

Instead, over the past two weeks, we have filed a series of studies, expert reports,

and this response.

In this submission, we outline the relevant legal, policy, and economic framework that

govern the US-UAE Air Services Agreement, and explain how Etihad’s actions are not only

fully consistent with the treaty, but also with applicable law. We will also explain how Etihad

services benefit American consumers. In doing so, it will be necessary to point out where the

Big 3 Carriers have been hypocritical in their allegations, particularly as they relate to purported

subsidies. We will also show that the Big 3 Carriers have chosen to apply a legal standard that is

27

Eastern Railroad Presidents Conference v. Noerr Motor Freight, Inc., 365 U.S. 127, 135 (1961); United

Mine Workers v. Pennington, 381 U.S. 657, 670 (1965).

28

Indeed, Etihad has had to file requests pursuant to the Freedom of Information Act (“FOIA”) to attempt to

get access to materials the Big 3 Carriers have purportedly provided to the United States government. It is

a fundamental tenet of United States law and jurisprudence that there should be a right to face one’s

accuser and have access to all relevant evidence. That the Big 3 Carriers are forcing Etihad to use FOIA

and other discovery tools, rather than being transparent with their allegations and the data on which they

rely, is further indication of the lack of veracity of their allegations and their true intentions.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

14

wholly inapposite to this case. We will demonstrate empirically that our key United States

markets have grown over the relevant period, resulting in more passengers for Etihad and also

the Big 3 Carriers. Moreover, Etihad is actually feeding passengers onto US domestic carriers,

including Delta, United and American. In 2014, Etihad delivered 182,000 connecting passengers

onto U.S. airlines and this is forecast to grow to approximately 300,000 in 2015.

These points will lead to the inescapable conclusion that: (1) Etihad is not subsidized: (2)

the Big 3 Carriers cannot explain how to account for the over $70 billion in government benefits

they have received since 2000; (3) Etihad’s conduct and that of the UAE is fully consistent with

the applicable air services agreement, U.S. law, and international treaty; (4) the WTO rules cited

by the Big 3 Carriers are not relevant in this case; (5) the relevant US markets in which Etihad

and other carriers compete have grown over time, resulting in more passengers and more revenue

for all carriers, all while maintaining high load factors and demand; (6) the Big 3 Carriers cannot

demonstrate that they have suffered any actionable harm; and (7) government-to-government

consultations are inappropriate under the circumstances.

II. THE US-UAE AIR SERVICES AGREEMENT, ALLEGED STATE SUBSIDIES,

AND THE APPLICABLE LEGAL STANDARD

Introduction

Even though subsidies are not prohibited under the US-UAE Air Services Agreement,

Etihad categorically rejects the Big 3 Carriers’ claims that it receives subsidies. The Big 3

Carriers assert that Etihad has received over $17 billion in subsidies since 2004.

29

They arrive at

this amount by aggregating equity that our shareholder has taken in the airline, shareholder

29

Big 3 Carriers’ Paper at p.12.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

15

loans,

30

and amounts that they characterize as grants, essentially concluding that any element of

state ownership is prohibited. They also claim that all Etihad contracts with related parties

should be considered subsidies. They cite excerpts from partial financial summaries filed by

Etihad in certain countries for licensing purposes and media stories.

31

Their assertions are

without merit.

Etihad’s Ownership and Equity

The Abu Dhabi government is the sole shareholder of Etihad. Through resolutions of the

Abu Dhabi Executive Council, the Abu Dhabi government has approved $14.3 billion of capital

(equity and loans) since 2003. Of this amount, $9.1 billion reflects our shareholder’s equity in

Etihad, and $5.2 billion are shareholder loans made to Etihad. The approved equity came in

several tranches: $2.3 billion between 2004 and 2009, $2.9 billion between 2010 and 2012, and

$3.9 billion between 2013 and March 2015. While our shareholder’s equity grew through these

investments, so did Etihad’s value. In 2005, Etihad had 10 aircraft and served 18 destinations.

In 2014, Etihad operated a fleet of 110 aircraft and served 103 destinations. Moreover, during

this same period, Etihad evolved from a traditional airline to a sophisticated aviation services

group, with interests in related businesses such as ground handling, cargo and maintenance

operations at Abu Dhabi International Airport, travel management and distribution capabilities,

and airline loyalty programs.

32

30

The Big 3 Carriers place our shareholder loans in quotation marks (“loans”) in the apparent hope that the

Agencies will respond favorably to sarcasm.

31

The Big 3 Carriers do not reveal how they obtained these documents, and the extent to which they may

have had to make misrepresentations to sovereign regulatory bodies to obtain these materials.

32

These transactions included acquisitions of stakes in certain frequent flyer programs, including: topbonus

(2012), Jet Privilege (2014) and MilleMiglia (2014). In July 2013, Etihad acquired three subsidiaries of the

Abu Dhabi Airports Company (ADAC) – Abu Dhabi Cargo Company (ADCC), Abu Dhabi In-Flight

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

16

During this time, Etihad also acquired minority equity stakes in other airlines, including

Air Berlin, Jet Airways, and Alitalia. This allowed Etihad to accelerate its growth, though we

are still dwarfed by competing airlines from the United States and Europe, all of which have

consummated mega-mergers during the same period. Etihad pursued a strategy similar to that of

other airlines that have become more vertically integrated. For example, in 2012, only 5 years

after emerging from bankruptcy protection, Delta purchased an oil refinery in Pennsylvania.

33

In

2013, Delta purchased Endeavor Air and also acquired a 49% stake in Virgin Atlantic.

34

Lufthansa and Singapore Airlines, among others, have also acquired or developed a number of

ancillary businesses as part of their extensive aviation-related portfolios.

In other words, as our shareholder’s equity stake increased, so did the value of its

investment. To put our capitalization in context, Delta’s current market capitalization is over

$38 billion.

35

American Airlines has a market capitalization of almost $34 billion, and United’s

market capitalization is over $20 billion. That is almost $100 billion dollars of current combined

market capitalization, which of course excludes billions of dollars of debts and other obligations

disclaimed during multiple bankruptcy proceedings, and billions of dollars of employee pension

obligations assumed by the U.S. government-operated Pension Benefit Guarantee Corporation.

36

Catering (ADIFC) and the ground handling business Abu Dhabi Airport Services (ADAS). In July 2014,

Etihad acquired the aircraft maintenance services provider Abu Dhabi Aircraft Technologies (ADAT).

33

“How Delta Bought A Refinery And Wound Up Saving Its Rivals A Ton Of Cash,” Business Insider,

September 2, 2014, available at http://www.businessinsider.com/delta-airlines-fuel-prices-2014-8.

34

Delta Air Lines 2014 United States Securities and Exchange Commission (SEC) Form 10K, available at

http://d1lge852tjjqow.cloudfront.net/CIK-0000027904/57b007ce-7d42-4818-a9d6-cdce500d3f52.pdf.

35

Yahoo! Finance Summaries as of May 28, 2015, available at http://finance.yahoo.com/q?s=DAL;

http://finance.yahoo.com/q?s=AAL; and http://finance.yahoo.com/q?s=UAL.

36

See “Financial & Other Governmental Benefits Provided to American Airlines, Delta Air Lines and United

Airlines,” The Risk Advisory Group, May 14, 2015 (“Risk Advisory Benefits Report”). The Risk Advisory

Group identified over $71 billion of quantifiable governmental benefits to the Big 3 Carriers, more than

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

17

Unlike the Big 3 Carriers, who have shown an uncanny ability to regularly disclaim debts and

other liabilities through seemingly regularly scheduled bankruptcy filings, Etihad and other

commercial carriers that do not have the U.S. Bankruptcy Code as a financing tool must carry

and service their debt.

In 2013 Etihad divested 50% of its frequent flyer program (“FFP”). This allowed Etihad

to both recognize its individual value and better position the business for future growth. Etihad

is not the first airline to sell its FFP business. For example, in 2008 Air Canada sold its

remaining interest in its Aeroplan FFP.

37

According to CAPA Chief Financial Analyst Jonathan

Wober, “[t]he visibility you get from establishing it [FFP] as a separate unit and the additional

focus that it then has in terms of becoming profitable in its own right pushes it to generate

revenue from sources other than the core FFP.”

38

The accounting treatment and the recognition

of the gain on the sale of Etihad’s FFP program were fully compliant with International Financial

Reporting Standards.

39

Moreover, the valuation of the transaction, which was at 16.7 times

EBITDA, was fully comparable to similar FFP transactions.

$70 billion of which inured to the benefit of the Big 3 Carriers since 2000. Etihad submitted this report to

the respective dockets on May 15, 2015.

37

“ACE Sells Remaining Stakes in Aeroplan, Jazz Air, Reuters,” May 28, 2008, available at

http://www.reuters.com/article/2008/05/28/us-aceaviation-sales-idUSWNA287920080528.

38

“Airlines are Unlocking New Value in Their Frequent Flyer Programs,” Business Insider, August 11, 2014,

available at http://www.businessinsider.com/r-frequent-flyer-schemes-revamped-to-drive-profits-in-tough-

times-for-airlines-2014-11.

39

Indeed, all Etihad financial statements are prepared in accordance with International Financial Reporting

Standards (“IFRS”) and audited by global accounting firm KPMG. The IFRS standards are available at

http://www.ifrs.com/index.html.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

18

Shareholder Loans and Other Financing

In addition to the aforementioned equity infusions, our shareholder provided loans to

Etihad in several tranches: $3.0 billion between 2004 and 2009, $600 million between 2010 and

2012, and $1.6 billion between 2013 and March 2015. In addition to these loans, Etihad secures

funding in the global markets through channels similar to those of other airlines. As of May

2015, Etihad has raised more than $11 billion from the global aviation, finance, banking, and

leasing markets, including markets based in the U.S. Clearly these institutions consider Etihad to

be a good investment, confirming that the Abu Dhabi government has acted as a rational

investor.

It is important to note that there is nothing in United States aviation law, the US-UAE Air

Services Agreement, or international aviation conventions that prohibit shareholder loans or set

the terms or interest rates on which such loans must be made. While our shareholder would have

been fully justified in taking additional equity in Etihad, given Etihad’s growth and additional

value, our shareholder chose instead to make loans with the express requirement that such loans

be repaid by Etihad. Indeed, even the Big 3 Carriers concede as much by deceptively citing

World Trade Organization (“WTO”) standards and the “Department of Commerce’s subsidy

methodology.”

40

As we explain later in this response, these standards and methodologies do not

apply in relation to aviation traffic rights.

41

40

See Big 3 Carriers’ Paper at p. 16.

41

“The Department of Commerce’s Enforcement and Compliance (formerly Import Administration) is

responsible for coordinating multilateral subsidies enforcement efforts. The primary mission is to assist

the private sector by monitoring foreign subsidies and identifying subsidies that can be remedied

under the Subsidies Agreement of the World Trade Organization of which the United States is a

member,” available at http://esel.trade.gov/esel/groups/public/documents/web_resources/esel_home.hcsp

(emphasis provided). Of course, it is uncontroverted that air traffic rights and areas directly related to

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

19

Miscellaneous Big 3 Carrier Subsidy Claims

In addition to the aforementioned equity and loans, the Big 3 Carriers also claim that

Etihad received $750 million in miscellaneous cash grants from the Abu Dhabi government.

These allegations, which of course pale in comparison to the over $70 billion in governmental

benefits received by Big 3 Carriers and verified by The Risk Advisory Group, are false.

42

The

Big 3 Carriers characterize the Abu Dhabi Tourism Authority’s (“ADTA”) payment of $111

million for the “Abu Dhabi to the World” campaign as a subsidy. They cite no authority for this

proposition other than their own mischaracterization; this is a common theme. In 2008, the

ABTA paid Etihad $111 million as promotional consideration, which included placing their

“Abu Dhabi to the World” slogan on Etihad’s livery. Etihad recognized this ABTA payment as

“other income” in its 2008 annual financial statement, which was reviewed and approved by

KPMG.

The assertion that the Abu Dhabi government paid for Etihad’s sponsorship of English

Premier League football club Manchester City is equally false. In 2011, Etihad and Manchester

City entered into a 10 year sponsorship agreement, which included naming rights for Manchester

City’s stadium. Etihad funded this sponsorship from its own liquidity. It is not uncommon for

airlines to have sponsorships with sports teams and their venues. Indeed, the Big 3 Carriers each

traffic rights are not part of the WTO. The WTO applies to certain ancillary services, such as aircraft repair

and maintenance, computer reservation systems.

42

Risk Advisory Benefits Report, Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

20

have, or in the case of Delta recently had, similar sponsorship arrangements.

43

Sports

sponsorships play an important role in Etihad’s global marketing strategy.

44

The Big 3 Carriers also claim that the fact that UAE airports do not impose passenger

service charges on transit passengers results in a $501 million subsidy.

45

This allegation is so

nonsensical it scarcely merits a response. UAE airports apply their charges to all carriers on an

equal and nondiscriminatory basis. This is very similar to the United Kingdom, which imposes

an air passenger duty on departing passengers but exempts transiting passengers.

46

Under the

US-UAE Air Services Agreement, U.S. airlines are free to transit passengers through Abu Dhabi.

So both the passenger service charge exemption and the ability to transit passengers through Abu

Dhabi are equally available to all carriers that serve the UAE pursuant to the US-UAE Air

Services Agreement, including the Big 3 Carriers.

The Big 3 Carriers also take issue with certain UAE regulations and laws, perhaps

believing an air services agreement also gives them standing to rewrite UAE law. Of course,

they do not have such standing. Moreover, the purported advantages: (1) UAE labor laws and

the absence of unions; (2) the use of a UAE-registered general sales agent; (3) lack of UAE

competition law; and (4) the competence of the UAE General Civil Aviation Authority, are

disingenuous and insult the sovereignty of the UAE.

43

American Airlines sponsors stadiums in Miami, Florida and Dallas, Texas (http://www.aaarena.com/ and

http://www.americanairlinescenter.com/). The Chicago Bulls and Blackhawks play their home games in

the United Center (http://www.unitedcenter.com/). Salt Lake City’s EnergySolutions Arena was formerly

the Delta Center.

44

See “Our Sponsorships,” available at http://www.etihad.com/en-us/about-us/our-sponsorships/.

45

Big 3 Carriers’ Paper at 17.

46

“HM Revenue & Customs Excise Notice 550: Air Passenger Duty, Updated 27 February 2015,” available

at https://www.gov.uk/government/publications/excise-notice-550-air-passenger-duty/excise-notice-550-

air-passenger-duty.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

21

Etihad acknowledges that the UAE’s labor laws differ from those of the United States.

Indeed, even within the U.S., there are varied laws regarding union membership, with some

states having “Right to Work” laws that make collective labor organization more challenging.

47

Other states make union organization easier to accomplish. Etihad wonders whether Illinois-

based United considers its “Right to Work” competitors American and Delta to benefit from

“unreasonable conduct” because they are based in Texas and Georgia, as they have alleged

against the Gulf carriers at page 36 of their paper.

48

In any event, Etihad’s overall cost base is

similar to that of its competitors, including the cost bases of the Big 3 Carriers.

Regarding the Big 3 Carriers’ and their proxies’ attempts to place employment terms into

the debate, Etihad finds this to be an odd issue to be injected into a dispute over an air services

agreement. We treat our employees, who come from over 140 countries including the United

States, fairly and with respect. Etihad recruits globally and has over 24,000 staff employed

worldwide. Etihad pays its employees competitive salaries, provides them and their families

with health insurance and other generous benefits including, for our expatriate staff and their

families, housing, schooling, and annual home leave air tickets. In 2014 Etihad was named a

LinkedIn’s Top 100 Most In-Demand Employer and the Employer of the Year at the Middle East

47

Texas and Georgia are considered “Right to Work” states, meaning union organization is more difficult.

Illinois does not currently have a “Right to Work” law. See generally “AFL-CIO, America’s Unions, Right

to Work,” available at http://www.aflcio.org/Legislation-and-Politics/State-Legislative-Battles/Ongoing-

State-Legislative-Attacks/Right-to-Work.

48

Etihad also notes that the United States Department of Justice, apparently at Delta’s request, is

investigating the International Association of Machinists and Aerospace Workers’ attempt to unionize

Delta’s flight attendants. Delta CEO Richard Anderson supports the investigation “so our people can know

the full truth.” See “Fraud Challenge Raised in Delta Flight Attendants’ Union Drive,” available at

http://skift.com/2015/04/12/fraud-challenge-raised-in-delta-flight-attendants-union-drive/. Only 18% of

Delta employees are represented by a union, less than one-fourth the percentage at the other three leading

U.S. airlines, according to regulatory filings by the companies. Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

22

Human Resources Awards.

49

We are not aware of the Big 3 Carriers receiving any similar

awards. Likewise, while Etihad has consistently fulfilled all financial obligations to its

workforce, the Big 3 Carriers cannot say the same. Indeed, at the May 15, 2015 National Press

Club Airline CEO luncheon, Delta CEO Richard Anderson asked the “airline employees in this

room who lost their pensions in bankruptcy or had their pensions frozen to stand up.”

50

Unfortunately for those employees, much of the room stood up.

The Big 3 Carriers’ other regulatory complaints – local registration requirements, lack of

competition law, and competence of the UAE Civil Aviation Authority – reflect a quasi-colonial

attitude and take a very condescending view of non-U.S. law. Etihad, as a foreign airline and

corporation that is pleased to do business in the United States, takes no issue with complying

with U.S. law; that is our obligation. We do not complain about the laws of the United States,

many of which differ considerably from those of the UAE. As for the Big 3 Carriers’ complaints

about a lack of antitrust law in the UAE, they are simply wrong. The UAE competition law is

set forth in Federal Law No. 4 of 2012.

51

Entities operating within the oil and gas, electricity and

49

“The World’s 100 Most in Demand Employers: 2014, The Most Sought After Employers in the World

Based On Billions of Interactions from LinkedIn’s 300,000,000 plus members,” LinkedIn, available at

https://www.linkedin.com/indemand/global/2014. None of the Big 3 Carriers appeared on this list. Many

of their former employees had their pensions involuntarily reduced or terminated by their management.

See Risk Advisory Benefits Report.

50

“National Press Club Luncheon with Airline CEOs, May 15, 2015,” Id, available at

http://www.press.org/news-multimedia/videos/npc-luncheon-airline-ceos (Mr. Anderson’s request starts at

34 minutes). See also “Conflicts Abound at American Airlines’ Pension and 401(k) Plans,” Forbes,

November 14, 2012, available at http://www.forbes.com/sites/edwardsiedle/2012/11/14/conflicts-abound-

at-american-airlines-pension-and-401k-plans/ (“On February 1, 2012, American Airlines announced it

would seek to terminate all four of its pension plans. According to the Pension Benefit Guaranty Corp.,

‘America’s [sic] four defined benefit plans have assets of $8.3 billion and liabilities of $18.5 billion, and

officials at the agency, which sits on the airline’s creditors committee, pressed American to avoid

terminating the plans.’ Under pressure from the PBGC, American relented and On March 7, 2012, AMR

announced it would freeze, not terminate, the pensions of its non-pilot employees.”).

51

UAE Federal Law No. 4 of 2012 on the Regulation of Competition (English version), available at

http://www.economy.gov.ae/English/Publications/Federal%20Law%20No.%204%20of%202012%20on%2

0the%20Regulation%20of%20Competition.pdf.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

23

water, financial services, pharmaceuticals, transportation, telecommunications, and waste

management sectors are exempt.

52

Notwithstanding the UAE sector exemptions, as the Big 3

Carriers are aware, most antitrust and competition laws are applied extraterritorially, and thus

Etihad’s activities are captured by global merger control and substantive antitrust laws, including

those of the European Union, United States, and Australia, among others.

53

With respect to the competence of the UAE General Civil Aviation Authority (“GCAA”),

the Big 3 Carriers would apparently have the U.S. adopt a rule mandating that countries cannot

regulate airlines that have government ownership. There is of course no authority for this brazen

and silly proposal, which would of course eliminate the competence of regulators in scores of

jurisdictions, including Hong Kong, Singapore, New Zealand, China, and Turkey, among others.

The GCAA regulates all aviation in the UAE, including Etihad’s activities.

54

In 2015 the

International Civil Aviation Organization (“ICAO”) awarded the GCAA its top ranking in the

world after conducting an intensive audit of the country’s safety records, procedures and

equipment. The UAE scored a success rate of 98.86%, placing it ahead of South Korea and

Singapore, which placed second and third, respectively.

55

The GCAA is a world class regulator.

The Big 3 Carriers’ insinuations to the contrary merit no consideration.

52

Id.

53

For example, the Australian Competition and Consumer Commission instituted proceedings against UAE-

based Emirates for conduct that allegedly took place outside Australia. See “ACCC Takes Acton Against

Emirates for Alleged Freight Price Fixing,” August 18, 2009, available at https://www.accc.gov.au/media-

release/accc-takes-action-against-emirates-for-alleged-air-freight-price-fixing. See also New Zealand

Commerce Commission v. Emirates (NZ$1.5 million fine), available at http://www.comcom.govt.nz/the-

commission/media-centre/media-releases/detail/2012/two-more-airlines-settle-with-commerce-

commission-in-air-cargo-case-penalties-top-21-million.

54

The UAE General Civil Aviation Authority was created in 1996 by Federal Cabinet Decree (Law 4) to

Regulate Civil Aviation, available at https://www.gcaa.gov.ae/en/aboutgcaa/Pages/aboutus.aspx.

55

See “AJWAA, The Guide to UAE Aviation,” March 2, 2015, available at http://edition.pagesuite-

professional.co.uk//launch.aspx?eid=6b3f9e8d-dcb7-44d0-9ec0-bbeb277169e3 (“The UAE is ranked

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

24

To the extent that Etihad transacts business with government-related entities, Etihad does

so at arm’s length. For example, Abu Dhabi Airport charges ground handling costs of $2,286

per turnaround for a Boeing 777-300ER aircraft. These terms are available to all carriers, and

are consistent with the costs charged at other airports in the Middle East and Southeast Asia. For

example, Kuala Lumpur charges $2,240 per turnaround and Bahrain charges $2,443. Likewise,

Abu Dhabi International Airport’s airport charge of $7,770 per turn, which is applied to all

carriers, is consistent with its regional competitors, including Kuala Lumpur’s $6,427 charge and

Mumbai’s charge of $8,074. Under the US-UAE Air Services Agreement, the respective

countries are required to make such services available on an equal and non-discriminatory basis,

something to which the UAE strictly adheres.

Finally, Etihad does not receive special tax breaks or exemptions from the UAE

government. The UAE is a tax free country, and all companies (including domestic and foreign

airlines) that conduct business in the UAE receive equal tax treatment. Certain states in the

United States do not have income or corporate taxes. The Big 3 Carriers have substantial

operations in those states. Etihad has its U.S. headquarters in New York, which is considered a

high tax state. Etihad does not argue that American benefits from a subsidy since its

headquarters is in Texas, which is considered a low tax state.

The US-UAE Air Services Agreement

Having dispensed with the subsidy myths, we now turn to the US-UAE Air Services

Agreement, which has been in force since 2002 and forms the legal basis for Etihad’s service to

number 1 in the world in aviation safety standard compliance and is considered to be one of the safest

aviation industries in the world after scoring the highest ever ranking in safety standard compliance history

by ICAO.”)

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

25

the United States. The Big 3 Carriers have studiously avoided its terms in their anticompetitive

campaign. That is because this treaty provides no legal basis for the claims the Big 3 Carriers

make or the relief that they seek. Instead, in a leap unrestrained by law or treaty, the Big 3

Carriers introduce WTO standards and more general trade principles that are not, by their terms,

applicable to air transport services.

56

In particular, the Big 3 carriers seek to introduce terms

such as “equity worthiness” and a methodology used by the Department of Commerce in

antidumping cases, into the analysis. However, these are WTO and antidumping and

countervailing duties terms.

57

The United States government has consistently resisted efforts to

incorporate air transportation and traffic rights into the WTO:

“[The United States] delegation continued to believe that the almost total exclusion of air

transport services from the scope of coverage under the GATS had been farsighted and had

contributed to the ongoing liberalization of air transport agreements through air services-specific

agreements and the facilitating activities of ICAO and numerous regional fora. This was equally

true for traffic rights and ancillary air services in support of traffic rights.”

58

Despite the Big 3 Carriers’ copious reliance on WTO law and standards, they do not

appear to advocate bringing all their commercial aviation and air traffic rights into the WTO.

They simply appear to be co-opting these irrelevant standards for the limited purpose of their

current campaign.

56

See WTO Uruguay Round Agreement, Annex 1B: General Agreement on Trade in Services, Annex on Air

Transport Services (“This Agreement, including its dispute settlement procedures, shall not apply to

measures affecting: (a) traffic rights, however granted; or (b) services directly related to the exercise of

traffic rights”), available at https://www.wto.org/english/tratop_e/serv_e/9-anats_e.htm.

57

See 19 CFR Part 351 et seq., and specifically 19 CFR §351.507.

58

See, e.g., World Trade Organization Council for Trade In Services, Report of the First Session of the

Review Mandate Under Paragraph 5 of the Annex on Air Transport Services Held on 12 September 2006,

Note by the Secretariat (September 27, 2006), 06-4615. (S/C/M84, p. 5, para 25).

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

26

The US-UAE Air Services Agreement was drafted by the United States, using a U.S.

template that has been offered to (and accepted by) more than 100 other countries and

jurisdictions. It does not define the term “subsidy.” Instead, Article 12.1 of the US-UAE Air

Services Agreement provides:

Each Party shall allow prices for air transportation to be established by

each designated airline based upon commercial considerations in the marketplace.

Intervention by the Parties shall be limited to:

a. prevention of unreasonably discriminatory prices or practices;

b. protection of consumers from prices that are unreasonably high or

restrictive due to the abuse of a dominant position; and

c. protection of airlines from prices that are artificially low due to direct or

indirect governmental subsidy or support.

59

Given the clear and unambiguous nature of this language as well as the entire treaty, this should

end attempts to seek to “interpret” this language using extrinsic or parol evidence. However, if

the Agencies are to accept the Big 3 Carriers’ invitation to refer to sources outside the US-UAE

Air Services Agreement, one can turn to the current U.S. “Model Open Skies Agreement”

(adopted in 2012). It was drafted solely by the United States government, presumably with input

from U.S. airlines and other U.S. stakeholders. The current model does not even mention the

term “subsidy,” let alone define it.

60

If the Agencies are to further indulge the Big 3 Carriers’ requests to “interpret” the treaty,

the voluminous legislative history and testimony also points to the fact that “subsidy” as used in

modern air services agreements is to be analyzed only in connection with pricing. In the

59

US-UAE Air Services Agreement, Art. 12(1).

60

Current Model Open Skies Agreement Text as of January 12, 2012, United States Department of State,

available at http://www.state.gov/e/eb/rls/othr/ata/114866.htm.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

27

International Air Transportation Competition Act of 1979 (“IATCA”), Congress mandated the

Secretaries of State and Transportation to develop an air transportation agreement negotiating

policy that emphasized “the greatest degree of competition compatible with a well-functioning

international air transportation system.”

61

Congress further mandated that the policy ought to

eliminate discriminatory and unfair competition practices that impair United States airlines in

foreign air transportation, including “excessive landing and user fees,” “unreasonable ground

handling requirements,” “unreasonable restrictions on operations,” “prohibitions against change

of gauge,” and “similar restrictive practices.”

62

These issues, which relate to pricing and

discriminatory practices, are expressly reflected in the US-UAE Air Services Agreement. The

IACTA mandate did not address subsidies. 49 U.S.C. § 40101 makes no mention of the term

“subsidy,” despite the fact that Congress was very aware of the issue. There is no basis for a

formal complaint relating to the IATCA factors, as incorporated into the US-UAE Air Services

Agreement.

As early as 1977, in Senate testimony that formed part of the basis for IATCA, Civil

Aeronautics Board (“CAB”) Chairman A. E. Kahn testified “[w]e are not in the business of

protecting carriers or conferring monopoly markets on them. We are in the business of serving

consumers.”

63

Chairman Kahn then listed the following objectives that ought to be pursued

when negotiating open skies agreements with third countries:

61

49 U.S.C. § 40101(e).

62

49 U.S.C. § 40101(e)(9).

63

International Aviation: Hearings Before the Subcomm. on Aviation of the S. Comm on Commerce, Science,

and Transportation, 95th Cong. 7 (1977) (statement of Alfred E. Kahn, Chairman, Civil Aeronautics

Board).

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

28

One, the elimination of anticompetitive restrictions on charters and

supplemental carriers;

two, expanded opportunities for new low priced-scheduled service;

three, maximum access to markets by expansion, and not contraction,

of nonstop U.S. gateways;

four, adequate multiple carrier designations;

five, avoidance of capacity or frequency restrictions; and

six, maximum flexibility for air carriers to operate to points beyond, or

on the way to, the country with whom the agreement negotiated.

64

Again, there is no mention of “subsidies.”

According to President Jimmy Carter’s letter, submitted into the record at the same

hearing: “We should seek international aviation agreements that permit low-fare innovations in

scheduled service, expanded and liberalized charter operations, non-stop international service,

and competition among multiple U.S. carriers in markets of sufficient size. We should also

avoid government restrictions on airline capacity. While keeping in mind the importance of a

healthy U.S. flag carrier industry, we should be bold in granting liberal and expanded access to

foreign carriers in the United States in exchange for equally valuable benefits we receive from

those countries. Our policy should be to trade opportunities rather than restrictions.” Thus,

even from the progeny of Open Skies, the U.S. did not include subsidies as a consideration for

including in newly deregulated air services agreements.

During the 1979 House Hearing, then Congressman Norman Mineta, (who later became

DOT Secretary), asked then CAB Chairman Cohen to address foreign governments that

subsidize their carriers. After discussing the effects of supra-competitive fares set by foreign

64

Id.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

29

governments, Mr. Cohen turned to infra-competitive subsidized fares. “If we were dealing with

an artificially low fare, and it was low because the other country is subsidizing we would

have to seriously address, and we have provisions in all our bilaterals to address that.”

65

This testimony addresses subsidies specifically in the context of fares, and appears to be the

genesis of the subsidy/pricing language that appears in Article 12.1 of the US-UAE Air Services

Agreement. Again the testimony and congressional record is fully consistent with the US-UAE

Air Services Agreement.

In 1995, DOT published its International Air Transportation Policy (the “Policy”), which

stated in pertinent part:

“[W]e have designed our international aviation strategy to meet the following

objectives: […] Ensure that competition is fair and the playing field is level by

eliminating marketplace distortions, such as government subsidies, restrictions on

carriers’ ability to conduct their own operations and ground-handling, and

unequal access to infrastructure, facilities, or marketing channels.”

66

This is the first official manifestation of the term “subsidies” outside the context of fares

or pricing. When making this reference, DOT had ample opportunity to: (1) define what DOT

meant by the term “government subsidies;” (2) incorporate the Policy language into current or

future air services agreements; and/or (3) do both. However, it chose to not to define “subsidies”

and chose not to incorporate the Policy language into United States air services agreements.

Indeed, the Agencies went in the opposite direction by removing any reference to subsidies from

65

International Air Transportation Competition Act of 1979: Hearings on H.R. 5481 Before the Subcomm. on

Aviation of the H. Comm. on Public Works and Transportation, 96th Cong. 144-145 (1979) (statement of

Marvin S. Cohen, Chairman, Civil Aeronautics Board) (emphasis provided).

66

60 FR 21844.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

30

the current model agreement.

67

While we do not think it is necessary to refer to extrinsic sources

to interpret the plain meaning of the US-UAE Air Service Agreement, if one were to indulge the

Big 3 Carriers’ invitation, clearly the intent is not to define subsidies and not to have subsidies

form any part of the Open Skies agreement, except in the pre-2012 limited context of fares. This

alone should end the Big 3 Carriers’ campaign.

Both the pertinent record and Article 12.1 of the US-UAE Air Services Agreement

demonstrate the intent to limit interventions regarding “subsidies” in situations involving

artificially low fares and the implementation of that limitation in the plain language of the

Treaty. While neither defines what “subsidy” means, it is apparent from these sources what

subsidy does not mean. At the time the United States and UAE negotiated and entered into the

US-UAE Air Services Agreement (using the then current U.S. template), Emirates was the sole

UAE designated carrier. When the U.S. government executed the US-UAE Air Services

Agreement, with the support of the Big 3 Carriers, Emirates was government-owned; it still is.

Had government ownership or equity been inconsistent with the requirements of the US-UAE

Air Services Agreement, the United States would not have signed the treaty.

In terms of other types of government involvement with the designated carriers, the US-

UAE Air Services Agreement and related applicable law are silent. There is no prohibition

against equity or loans made by a government or having a government as an airline’s

shareholder. Moreover, the US-UAE Air Services Agreement is equally silent on direct

government benefits, such as a government-supplied employee pension insurance at below

67

Id., available at http://www.state.gov/e/eb/rls/othr/ata/114866.htm.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

31

market rates from a government insurer that carries a $60 billion-plus deficit,

68

due largely to Big

3 Carrier pensions that it had to assume during the Big 3 Carriers various forays into bankruptcy

court.

69

It is equally silent on whether benefits like the Essential Air Services Program falls

within the meaning of the term “subsidy.”

70

It is also unclear if the United States governments’

Fly America Act Program, which discriminates in favor of U.S. airlines and provides the Big 3

Carriers a robust windfall, is a subsidy for purposes of the air services agreement.

71

Moreover, it

is uncontroverted that the Big 3 Carriers receive subsidized federal and state tax breaks,

subsidies that the Big 3 Carriers must concede fall within their self-styled definition of subsidy.

72

Likewise, it is uncontroverted that U.S. bankruptcy law is only available in the U.S., and that the

Big 3 Carriers have been able to eliminate billions of dollars in employee, supplier, and other

contractual obligations.

73

This favorable policy allows the Big 3 Carriers to shed debts with

impunity and enter into new contracts with the comfort of knowing that if their business turns

down again, they can simply make a new bankruptcy filing. Indeed, the Big 3 Carriers seem to

have built U.S. bankruptcy protection into their business model.

74

These ambiguities underscore

68

“PBCG Deficit Hits Record $61.7B in 2014,” Business Insurance, November 17, 2014, available at

http://www.businessinsurance.com/article/20141117/NEWS03/141119849.

69

Risk Advisory Benefits Report page 7.

70

“Is Essential Air Service Wasting Taxpayer Money,” CBS News, February 24, 2015, available at

http://www.cbsnews.com/news/government-subsidized-essential-air-service-waste-of-taxpayer-money-

some-say/ (“The cost to taxpayers for subsidizing those journeys has quadrupled in the last decade to a

whopping $261 million, which has some lawmakers convinced the program is anything but essential,

reports CBS News’ Kris Van Cleave.”)

71

US government travelers are required by 49 U.S.C. 40118, commonly referred to as the “Fly America Act,”

to use United States air carrier service for all air travel and cargo transportation services funded by the

United States Government.

72

Risk Advisory Benefits Report at pages 8 and 9.

73

Id., at pages 6 at 7.

74

“Is Bankruptcy ‘Business As Usual’ For Airlines?” National Public Radio, November 29, 2011, available

at http://www.npr.org/2011/11/29/142909836/is-bankruptcy-business-as-usual-for-airlines. According to

aviation consultant Robert Mann, “[a]s the industry consolidated, and particularly with the stress that

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

32

the perils of unilaterally attempting to label equity and loans as “subsidies” while arguing that

direct government benefits are not subsidies. The Big 3 Carriers’ arguments and

characterizations are replete with such hypocritical reasoning.

The governing language of the US-UAE Air Services Agreement provides that if a Party

believes that prices in the market are “inconsistent with the considerations set forth in paragraph

(1) of this Article,” then the remedy for that unfair pricing is to seek consultations about such

prices. There is no basis for the Big 3 Carriers to object to the fares offered by Etihad under

Article 12,

75

nor have they at any stage complained about the pricing behavior of any UAE

carrier. There is likewise no basis for any complaint of U.S. carriers being subject to differential

treatment in terms of landing fees, airport access, or other factors set forth in the air services

agreement. In fact, aside from an unsupported supposition that “basic economics suggest that

prices will be driven down”

76

sometime in the future, the Big 3 Carriers’ paper notably does not

raise the argument that the (alleged) government subsidies have created “artificially low” prices.

That is because there is no evidence of any below market pricing.

In fact, the Big 3 Carriers have no basis for objecting to fares offered by Etihad, or sought

consultations about pricing in the market, as permitted by Article 12 because they choose not to

directly compete against Etihad in any non-stop market, and have only limited competitive

emerged after 2001, it became a definite competitive strategy.” [internal attribution omitted.] “Which is to

say, if you haven’t done it, you haven’t wrung out all the costs that you could.” Pete Garcia, who retired as

a vice president for Continental Airlines in 2007 and now runs his own consultancy, agrees. “Bankruptcy,

for the airline industry in particular, is just a way to refinance the business,” he said. “It is a financial

move to keep you in business and give you some time to renegotiate with your lenders.” (emphasis

provided).

75

US-UAE Air Services Agreement, Art. 12(1)(c).

76

Big 3 Carriers’ Paper at 46.

ETIHAD AIRWAYS RESPONSE TO CLAIMS RAISED ABOUT

STATE-OWNED AIRLINES IN QATAR AND THE UNITED ARAB EMIRATES

MAY 31, 2015

33

exposure to Etihad in one-stop markets.

77

Instead, they choose to focus their efforts on the

lucrative North Atlantic market, where they enjoy oligopolistic pricing and hegemonic market

segmentation.

78

Moreover, conspicuously absent in the voluminous materials prepared by the

Big 3 Carriers is any contention that fares offered by Etihad in one-stop markets are

unreasonably low. Indeed, the public contentions being made by the Big 3 Carriers that Etihad is

somehow “violating” the US-UAE Air Services Agreement are especially ironic, given that they

fail to cite a single provision that is allegedly violated.

U.S. carriers have complained that Etihad and other Gulf carriers offer “excessive

capacity” from their hubs to the United States. That term does not appear in the US-UAE Air

Services Agreement, applicable law, or related aviation policy. It is a concept that the Big 3

Carriers simply made up. Setting aside the fallacy of this statement (Etihad offers a single daily

service from Abu Dhabi to each of its U.S. gateways, with the exception of New York, where we

offer two daily flights to the approximately 20 million people who live in the New York

metropolitan area

79

), the US-UAE Air Services Agreement simply does not authorize parties to

reject or block services proposed or operated by carriers of the other Party. In fact, under

Article 11 (“Fair Competition”) of the US-UAE Air Services Agreement, each party must allow

the other party’s airlines to determine the frequency and capacity they offer “based upon

commercial considerations in the marketplace.” The parties simply cannot unilaterally limit the

77

See section III of this paper, infra.

78

According to Professor George Hoffer, University of Richmond, “An oligopoly is a market structure where

you have relatively few players in the market, and since there are so few participants they have quite a bit

of pricing power. In this case, the players are Delta, U.S. Airways, United and American Airlines.

They are making money on international routes by filling up planes, and they have no reason to offer

discounts this year.” “Europe May Be On Sale, But The Ticket To Get There Isn’t,” NPR News, April 28,

2015, available at http://www.npr.org/2015/04/28/401468613/europe-may-be-on-sale-but-the-ticket-to-get-

there-isn-t (emphasis provided).

79

U.S. Census Bureau New York QuickFacts, available at http://quickfacts.census.gov/qfd/states/36000.html.