UPDATED 3/29/2024

Caregiver Supports Project Website: hps://www.dcyf.wa.gov/services/foster-parenng/caregiver-

supports-project

Q: When did all caregivers start receiving payments directly from DCYF?

A: Most caregivers have always received reimbursement directly from DCYF, with the excepon of homes

with Child Placing Agencies (CPAs) who received their DCYF reimbursements through their CPA. This

changed in January 2024 when DCYF started sending invoices to all caregivers, including caregivers with

CPAs. The rst reimbursement all caregivers received directly from DCYF was in February 2024, for

services provided in January 2024. In January 2024, all caregivers including CPA caregivers received the

monthly invoice from DCYF and were required to verify their invoice in order to receive foster care

reimbursement for services provided for the month. Reimbursements for January services were at the

new Caregiver Support rates, see table on the project website.

Q: What is an invoice?

A: DCYF will mail caregivers an invoice each month that lists the services a caregiver provided for a child

or youth placed in their homes. This includes nights in placement and respite. Mileage will sll be

submied separately. This invoice can also be viewed in the Social Services Payment System (SSPS)

Provider Portal for all caregivers that have set up a Secure Access Washington (SAW) account and have

registered for the SSPS Provider Portal. This document includes instrucons for seng up a SAW account

and registering for the Portal as well as seng up direct deposit and claiming an invoice over the phone

using Invoice Express. You can also nd direcons for seng up direct deposit on the project website

under the Payments secon in the Seng Up Direct Deposit presentaon. That secon also includes

direcons for registering for the Provider Portal in the Signing up for SAW and the Provider Portal

presentaon.

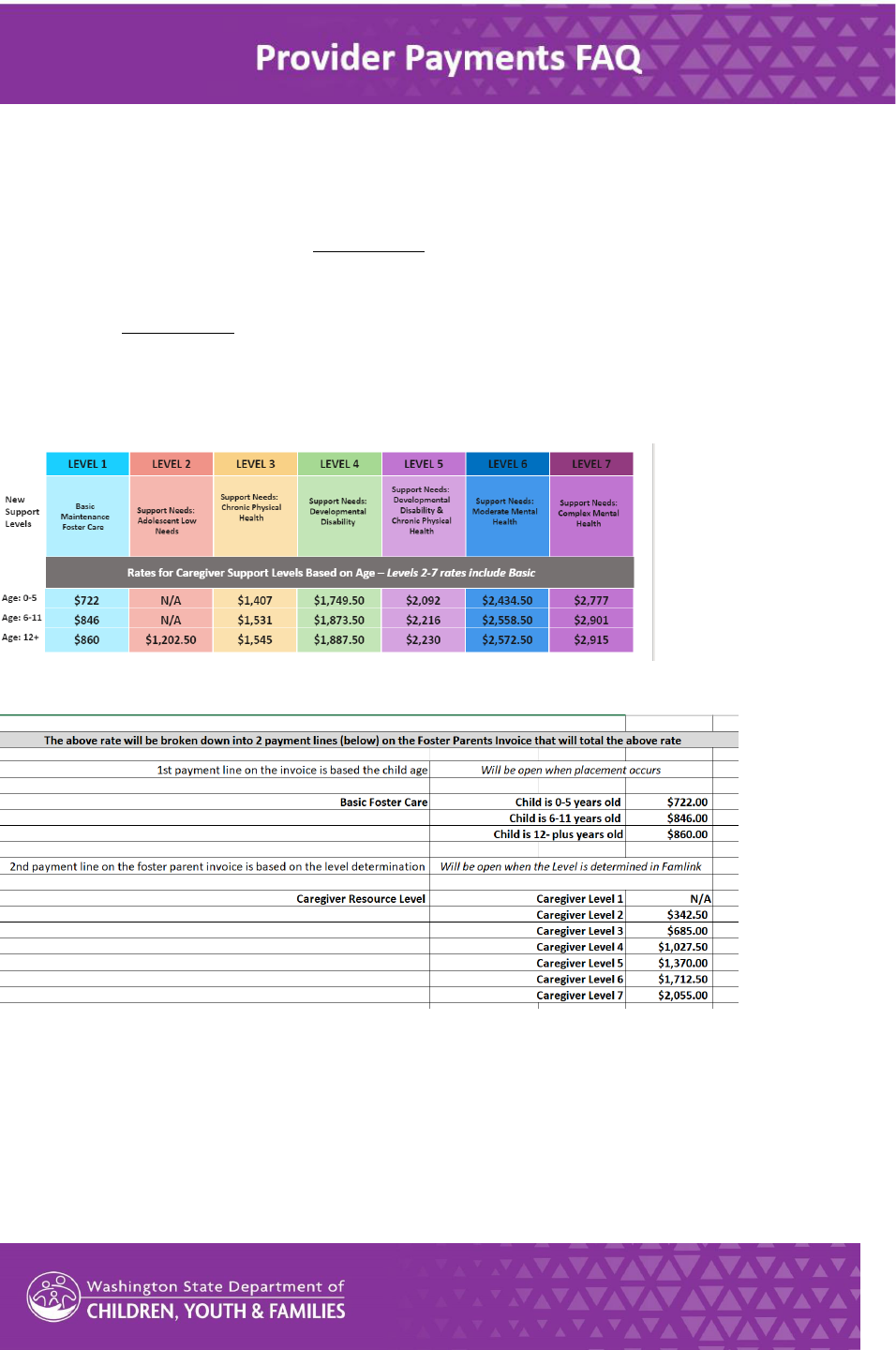

Q: How are rates broken down on an invoice?

A: Chart 1 below shows the rates for Basic Foster Care (level 1) as well as level rates for levels 2-7. The

level rates for levels 2-7 in Chart 1 represent the full amount of reimbursement for a given Caregiver

Support Level, which is inclusive of the Basic Foster Care Rate. Table 1 below Chart 1 explains how rates

are broken down on the invoice. On an invoice, caregivers will see the Basic Foster Care rate as a

separate line item than the Caregiver Support Level reimbursement. If a child or youth has support

needs consistent with Level 1, the Caregiver Support Level will be level 1 and the caregiver will receive

only the Basic Foster Care rate and will not receive a separate Caregiver Support Level reimbursement.

Examples

• 8 year old child has Level 1 support needs. Caregiver invoice shows Basic Foster Care

reimbursement of $846. There is no Caregiver Support Level reimbursement.

• 5 year old child has Level 5 support needs. Caregiver invoice shows Basic Foster Care

reimbursement of $722 and a Caregiver Support Level reimbursement of $1,370. The total

reimbursement for the caregiver is $2,092.

Note that Caregiver Support Level 2 is for youth aged 12 and older with low support needs so there are

no rates listed for ages 11 and under. Fully licensed caregiver homes with a youth aged 12 or older will

receive reimbursement for a Caregiver Support Level of at least a 2. It will be higher if the youth has

addional support needs. There is a Basic Foster Care rate listed in Chart 1 for youth aged 12 and older,

this is only for Inial License homes. Inial License homes are only eligible for Basic Foster Care

reimbursement and are not eligible for Caregiver Support Level reimbursements, level 2-7. Once a home

is fully licensed, it is eligible for Caregiver Support Level reimbursements.

Chart 1

Table 1

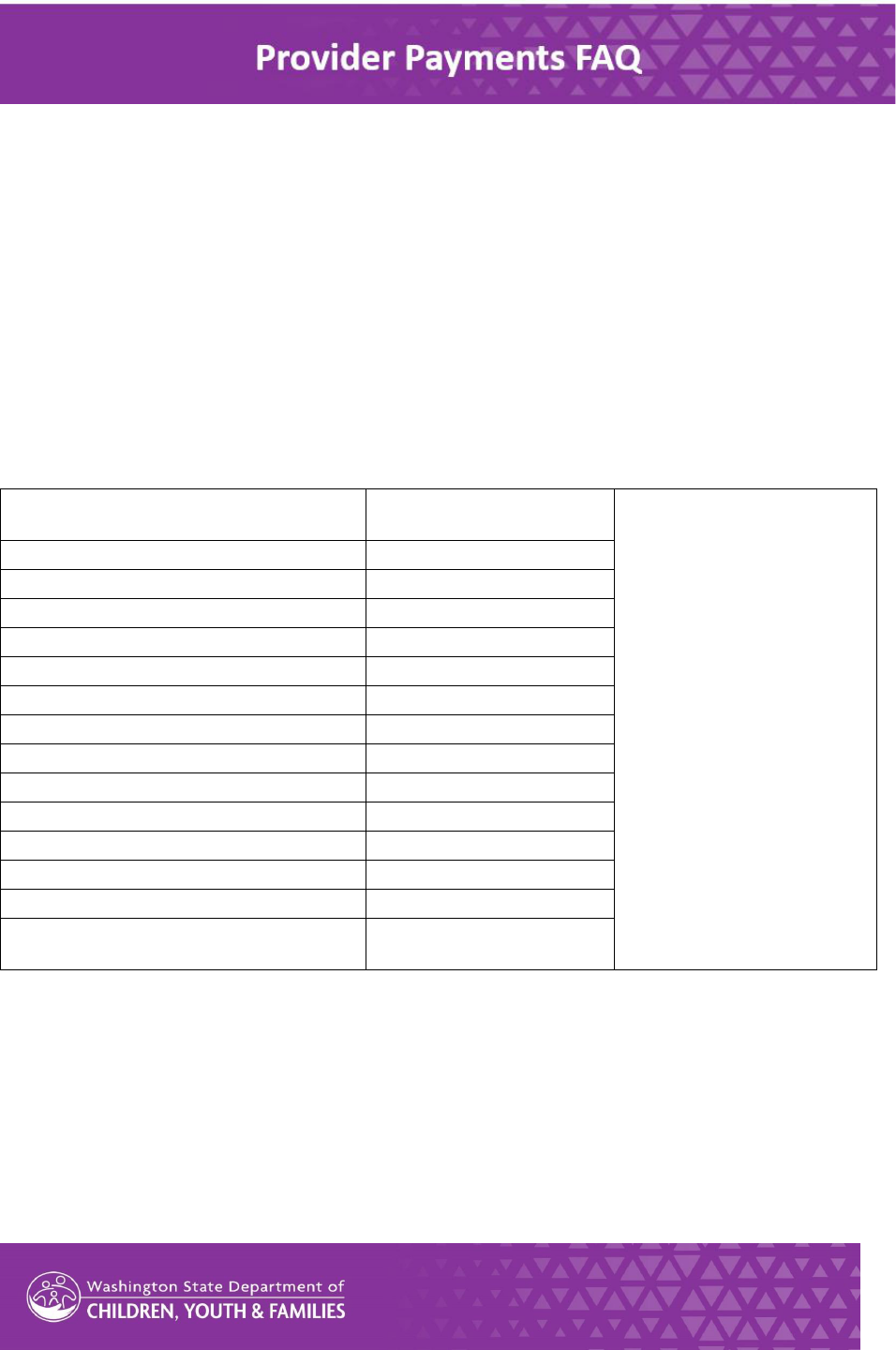

Q: What placement types are eligible for Caregiver Support Level reimbursements (levels 2-7)?

A: Fully licensed caregivers, including Extended Foster Care (EFC) caregivers, have always been eligible

for Basic Foster Care and level reimbursements. This connues in 2024 with implementaon of the

Caregiver Supports Project, fully licensed caregivers including EFC caregivers are eligible for Basic Foster

Care and Caregiver Support Level (level 2-7) reimbursements. Caregivers with an Inial License are only

eligible for Basic Foster Care reimbursements and not Caregiver Support Level (level 2-7)

reimbursements. Other placement types that are not licensed are not eligible for reimbursements. These

placements will sll have a Caregiver Support Level determinaon completed because both licensed and

unlicensed homes are eligible for Placement Supports through the Caregiver Support Model. See table 2

below.

Table 2

PLACEMENT TYPE

Level 2-7 Paid to Foster

Parent

Placement Resource

Specialists (PRS) complete

Caregiver Support Level

Determinaon for all of

these placement types but

reimbursements are not

generated for all placement

types. The level is

determined for placement

types that do not receive

foster care reimbursements

because Fiscal must know

what caregiver support level

to pay contracted providers

via the CPA Contract and the

Caregiver Supports Contract.

Basic Foster Care 0-5

YES

Basic Foster Care 6-11

YES

Basic Foster Care 12+

YES

Basic Foster Care Minor with Child

YES

EFC Basic Foster Care

YES

EFC Basic Foster Care with Youths Child

YES

Inial Child Specic Basic 0-5

NO

Inial Child Specic Basic 6-11

NO

Inial Child Specic Basic 12+

NO

Inial Child Specic Minor with Child

NO

EFC Inial Child Specic Basic

NO

EFC Inial Child Specic Minors / Child

NO

Relave Placement – Tracking Only

NO

Suitable Person Placement – Tracking

Only

NO

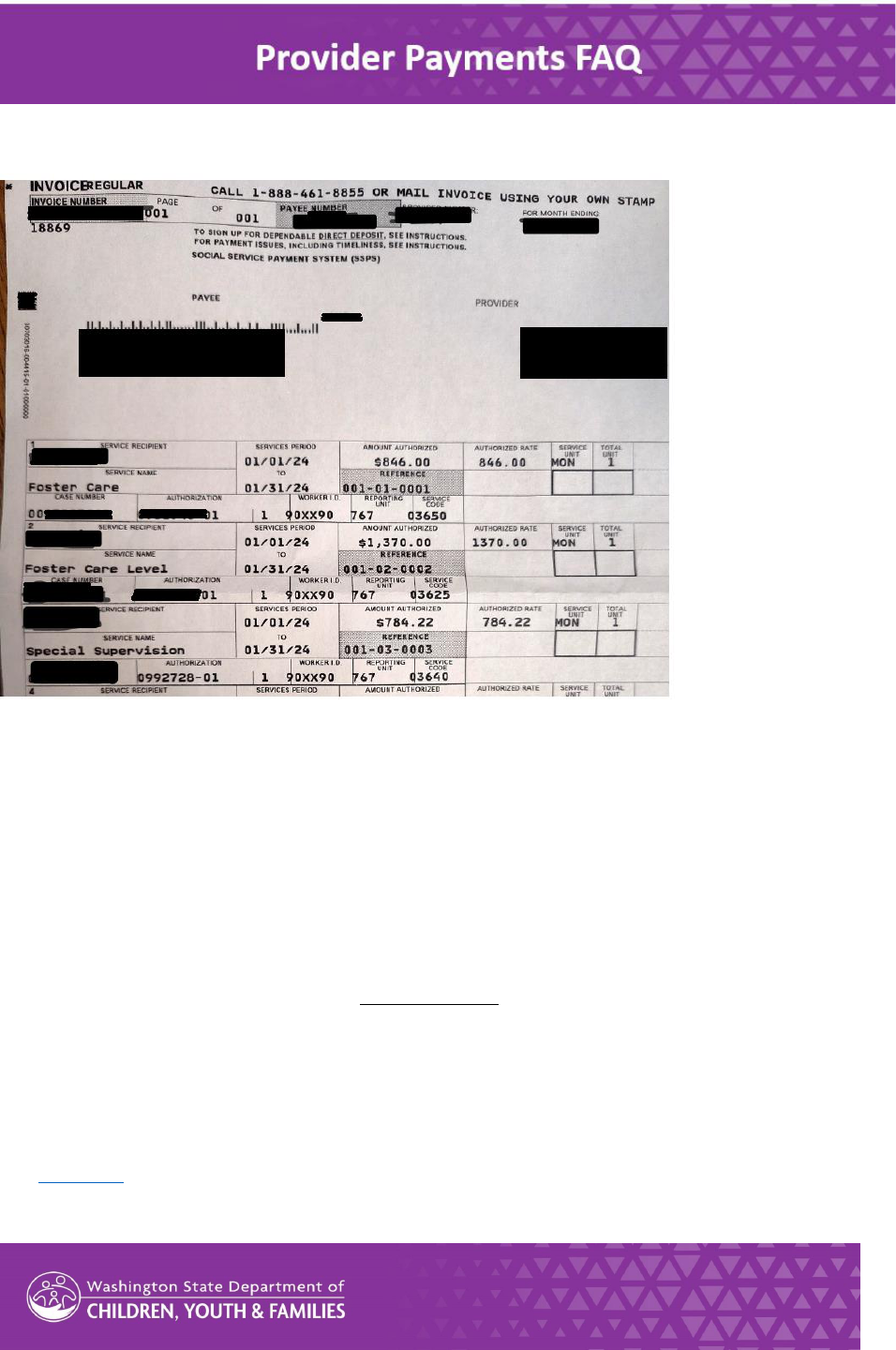

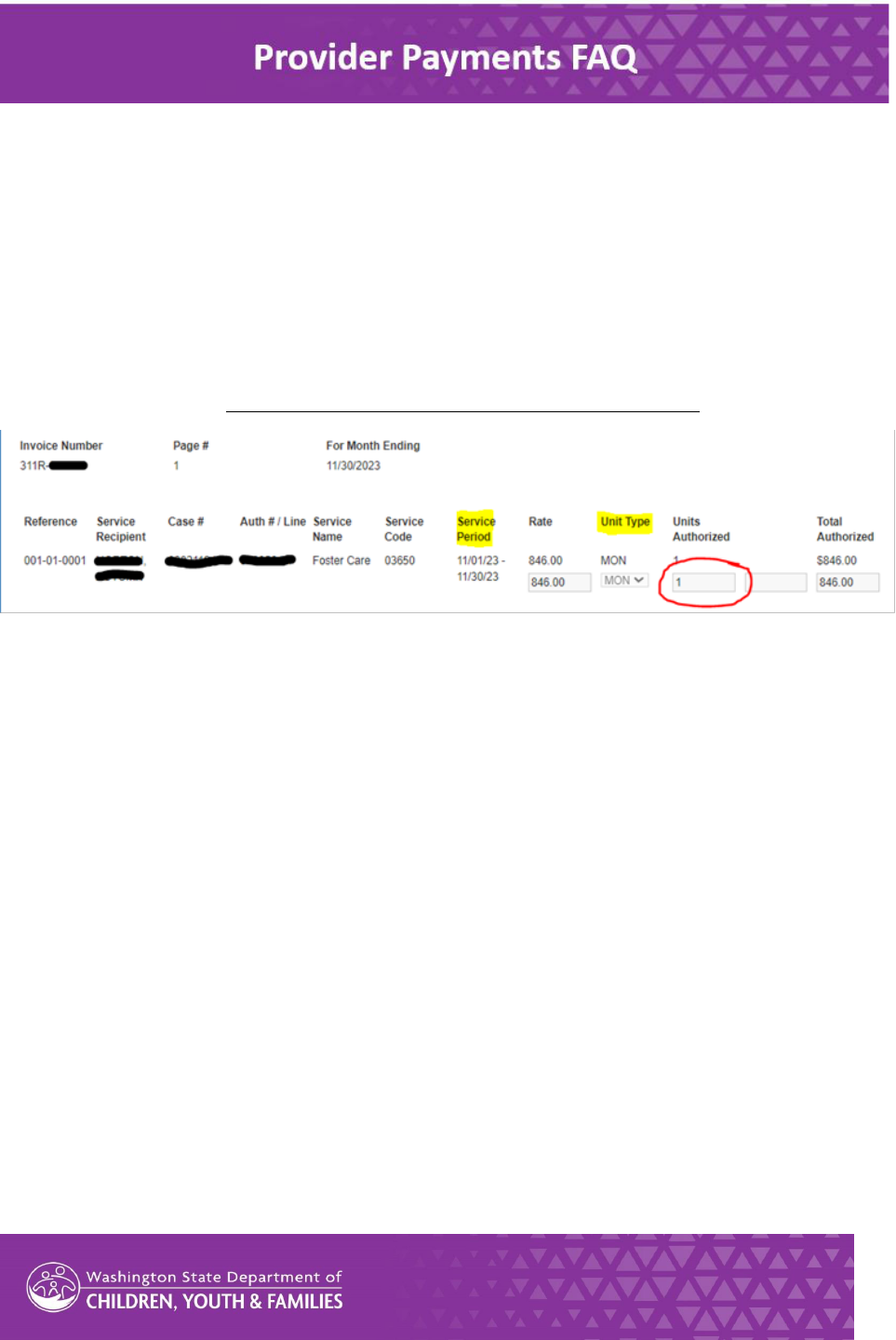

Q: What does an invoice look like?

A: Below is an example of an invoice. It shows dierent payments as separate line items. Note that the

Basic Foster Care reimbursement (Foster Care) is a separate line item from the Caregiver Support Level

reimbursement (Foster Care Level). If the Caregiver Support Level is level 1, there will be a Basic Foster

Care reimbursement but no addional Caregiver Support Level reimbursement. Any other types of

reimbursement like respite would also be separate line items. This invoice example includes an

addional Special Supervision reimbursement on the separate line.

Q: If I do not claim and submit my monthly invoice will I be paid?

A: No, you must claim your monthly invoice in order to receive payment for services.

Q: If I already receive Adopon Support reimbursements or other payments from DCYF such as travel

and mileage by direct deposit, do I need to sign up for direct deposit again to get foster care

reimbursements?

A: No, you do not need to set up direct deposit again with DCYF to receive foster care reimbursements

via direct deposit. If you already have direct deposit set up for any payments from DCYF, you will receive

your Basic Foster Care and Caregiver Support Level reimbursements via direct deposit. Note that if you

would like to use direct deposit, it must be set up with DCYF, some homes may have direct deposit set up

with their CPA instead. Starng in January 2024, all caregivers will need to verify invoices in order to

receive foster care reimbursements. DCYF recommends registering for the SSPS Provider Portal to make

this easier and more mely. When you claim your invoices and you already have direct deposit with

DCYF set up, reimbursements will be made via direct deposit for all eligible children and youth placed in

your home.

This document includes instrucons for seng up a SAW account and registering for the Portal as well as

seng up direct deposit with DCYF. You can also nd direcons for seng up direct deposit on the

project website under the Payments secon in the Seng Up Direct Deposit presentaon. That secon

also includes direcons for registering for the Provider Portal in the Signing up for SAW and the Provider

Portal presentaon.

Q: If I set up direct deposit, will that switch my Adopon Support or other DCYF payments to direct

deposit?

A: Yes. If you set up direct deposit with DCYF, all payments from DCYF will be made via direct deposit.

Q: When should I claim my invoice?

A: Caregivers can view and claim invoices as soon as they are posted in the SSPS Provider Portal or aer

an invoice is received in the mail if you are not registered for the Portal. However, DCYF highly

recommends waing unl the last day of the month to claim invoices. This way, if there is a placement

move, the invoice is accurate. When validang services in an invoice, caregivers are claiming service

provided for the whole month so if the child changes placement before the end of the month, invoices

already submied will be inaccurate and result in overpayment which DCYF will need to x. For example,

caregivers receive an invoice for the full month of October around the 20

th

of October. When the

caregiver claims the invoice, they are claiming services provided for the full month of October, October

1

st

-31

st

. If the child changes placement on October 25

th

and the invoice has previously been claimed for

the full month and submied, it will result in overpayment for the 31 days instead of the correct amount

of me, the 1

st

through the 24

th

. DCYF will need to correct any overpayments.

Q: What if I forget to claim my invoice unl the following month?

A: You will receive reimbursements about 3-5 days aer an invoice is claimed and submied if you have

direct deposit. It will take longer if you are receiving a check in the mail. Reimbursements start

generang on the rst of the following month aer services were provided (reimbursements for October

services generate November 1

st

). If you have direct deposit and submit your invoice by the end of the

month of service, you should see payment in your account within the rst ve days of the following

month (submit invoice October 31

st

and receive payment by November 5

th

). If you do not submit

October payments unl mid-November, you will receive October payment about 3-5 days aer invoices

are submied in November.

You have a year from the service month to claim an invoice. If it is longer than 12 months aer the

service month, the invoice will not be valid and you will have to contact your duciary.

Q: How do I claim an invoice in order to get reimbursed?

A: Starng January 2024, all licensed caregivers will receive an invoice from DCYF. These will come

through the mail or be available through the SSPS Provider Portal for those that are registered. Those

registered for the Portal will also receive a mailed invoice. Caregivers will verify the service units in the

invoice through the Provider Portal, or by using the telephone Invoice Express system, or by lling out

the paper invoice received through the mail and mailing it back to SSPS. The number for Invoice Express

is listed on the top of the paper invoice received through the mail. Do not use mulple methods of

claiming an invoice or it will cause the system to not make a payment. Caregivers are highly encouraged

to claim and submit invoices at the end of the month to ensure accuracy of hours reported. When

caregivers receive an invoice, they need to review the service period on the invoice to make sure the

dates match when a child or youth enters or leaves a home. Pay close aenon to the end date, when a

youth leaves your home. The department only reimburses through the last night a child or youth rests

their head in the home, DCYF does not reimburse the date the youth leaves the home.

• If the Service Period dates are listed correctly on the invoice, leave the Unit Type as MON for

month (even if the child or youth is not in your home the full month) and enter Units Authorized

as “1” and Submit. Never modify the Rate or Total Authorized amount elds.

o If a child or youth is in your home less than the full month, as long as the Service Period

reects the correct dates (for example, 11/05/23 - 11/30/23 or 11/01/23-11/24/23) that the

child or youth was in your home, the Unit Type should remain as MON (month) and you can

enter Units Authorized as ”1” and Submit. The system will prorate the payment

automacally.

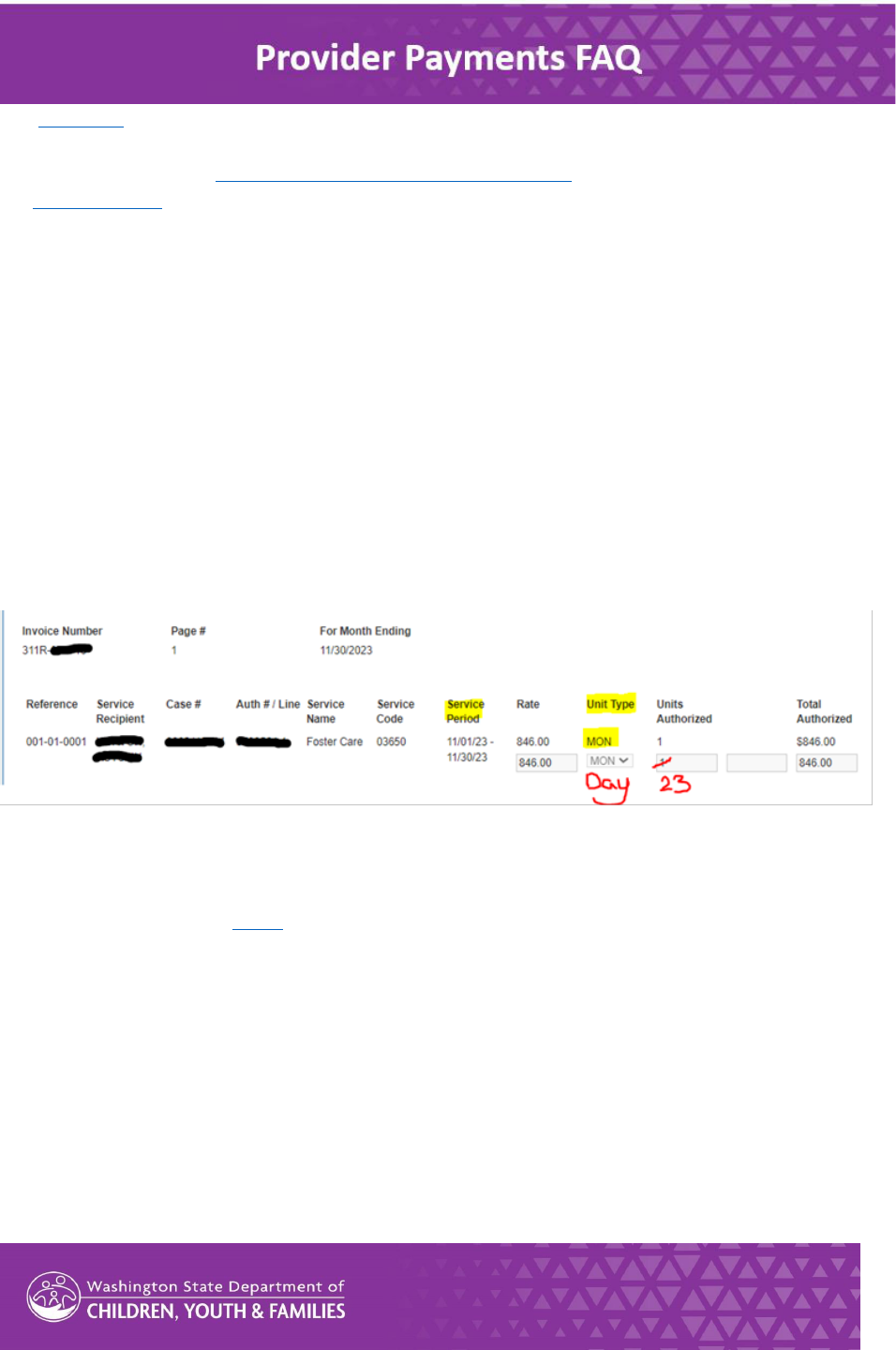

• If the Service Period dates are incorrect, for example it shows a whole month of service or the

dates listed do not reect the number of nights the child or youth was in your home, you will

need to amend the invoice. Change the Unit Type dropdown to DAY and then enter the number

of days the child or youth was in your home in the Units Authorized eld and click Submit.

Remember: do not include in your count the date that the child or youth le your home as DCYF

does not reimburse for this.

Q: If I claim my invoice through the Provider Portal, do I need to take any acon with the paper invoice

copy I also receive through the mail?

A: No. If you are registered for the Provider Portal you will be able to claim and submit invoices through

the Portal, but you will also receive a mailed copy of the invoice. If you claim and submit an invoice

through the Provider Portal, you do not need to do anything with the mailed copy. If you choose to claim

an invoice via phone using the Invoice Express system or by lling out the paper invoice and mailing it

back to SSPS, do not also claim and submit through the Provider Portal. Claiming and subming an

invoice through mulple methods will result in duplicaon and processing errors. The number for Invoice

Express is listed on the top of the paper invoice received through the mail.

This document includes instrucons for seng up a SAW account and registering for the Portal as well as

claiming an invoice over the phone using Invoice Express. You can also nd direcons for registering for

the Provider Portal in the Signing up for SAW and the Provider Portal presentaon which is available on

the project website under the Payment secon.

Q: What if a child does not stay in my home for the enre service period (one month)?

A: When you receive your invoice, make sure that the Service Period dates listed are correct. If they are

correct, even if it is not the full month of service, you can leave the Unit Type as MON (month) and then

enter “1” into Units Authorized and Submit. The system will automacally prorate the reimbursement.

Do NOT modify the Rate or Total Authorized elds. If the Service Period dates listed do NOT reect the

correct amount of days a child or youth was in your home during the month, you will need to amend the

invoice. Keep in mind that the department only reimburses through the last night a child or youth rests

their head in the home, DCYF does not reimburse the date the youth leaves the home. If you need to

amend the invoice, change the Unit Type dropdown to DAY and enter the number of nights the child or

youth was in your home in the Units Authorized eld. In the example below, a child was in the home

starng 11/01/23 and le the home 11/24/23. You will not be able nor do you need to update the

Service Period dates, just change the Unit Type to DAY and enter the correct Units Authorized. Once

again, do not modify the Rate or Total Authorized elds.

Q: What happens if there is an error on my invoice?

A: As noted in the queson above (When should I claim my invoice?), DCYF strongly suggests that

caregivers wait to claim invoices unl the end of the month so invoices are accurate. This way, if a child

or youth leaves a home on the 25

th

of the month, and the caregiver waits unl the last day of the month

to claim the invoice, they will be able to make the appropriate updates to the invoice. Otherwise, if the

invoice is claimed on the 20

th

, it will show reimbursement for the enre month instead of only unl the

25

th

and if the caregiver claims that invoice for the whole month they will need to repay DCYF for the

overpayments for the addional dates where the child or youth was not in their home.

• If a Caregiver Support Level reimbursement (invoice Service Name = Foster Care Level) does not

show up on an invoice or is incorrect, for example a level 3 rate is shown when caregiver is

expecng a level 4 rate, please reach out to your Placement Resource Specialist (PRS) who is

listed on your Caregiver Support Level Determinaon Leer.

o Remember: Basic Foster Care is a separate line item (invoice Service Name = Foster

Care) than the Caregiver Support Level reimbursement (invoice Service Name = Foster

Care Level) so the Basic Foster Care reimbursement and the Caregiver Support Level

reimbursement together are the total Caregiver Support rate received by a caregiver. See

queson above (How are rates broken down on an invoice?) for more informaon.

• If the service type, listed on invoice as Service Name, is wrong, for example it is showing Tiered

Placement instead of Foster Care or Foster Care Level, claim zero service units because this is the

wrong type of reimbursement. If you claim payments when the Service Name is incorrect, you

will need to pay back DCYF for the incorrect reimbursement. If the service type is wrong, also

reach out to your Social Worker or Fiduciary so it can be corrected.

Q: How does DCYF prorate Service Period reimbursements?

A: Proraon is calculated by dividing the monthly rate by 30.42, which is the average number of days in a

month, to get a daily rate and mulplying that by the number of days a child or youth was in the home.

For example, if a child or youth was in the home 11/05/23 - 11/30/23 they were in the home 24 days

(DCYF does not reimburse for the day the child or youth leaves the home). If the monthly rate is $846,

the prorated amount would be calculated as follows:

$846 monthly rate / 30.42 = 27.81

$27.81 x 24 days = $667.44 (Total Authorized)

Never adjust the Rate or Total Authorized amount on the invoice, the system does this automacally.

Q: Are there any issues with DCYF employees that are also foster parents being reimbursed for foster

care by DCFY?

A: No, all caregivers including DCYF employees will be reimbursed for foster care services directly by

DCYF. Wage payments from your state agency employer, including DCYF, and foster care reimbursements

are paid separately. The foster care reimbursement will come from SSPS and should not be taxable.

Q: How long do I have to enter the security token from SSPS that is used to register for the Provider

Portal?

A: The security token provided by SSPS is valid for 90 days before the caregiver needs to contact SSPS for

a new one.

This document includes instrucons for seng up a SAW account and registering for the Portal. You can

also nd direcons for registering for the Provider Portal in the Signing up for SAW and the Provider

Portal presentaon which is available on the project website under the Payment secon.

Q: Will I lose access to the SSPS Provider Portal if I do not use it for a period of me?

A: No, users will not lose access to the portal due to non-use. If you change provider numbers, you will

need to re-register for the portal using the new SSPS provider number. You do not have to create a new

SAW account.

Q: Will foster care reimbursements remain tax-free?

A: Yes, foster care reimbursement will remain non-taxable. Respite payments are taxable.

Q: Will mileage be paid via direct deposit?

A: If you have direct deposit set up with DCYF, yes, mileage will also be paid via direct deposit. You must

set up direct deposit to receive any payments this way. Prior to 2024, CPA homes would receive mileage

reimbursement through their CPA. All homes, including CPA homes, will receive mileage reimbursement

directly from DCYF starng in 2024.

This document includes instrucons for seng up direct deposit with DCYF. You can also nd direcons

for seng up direct deposit on the project website under the Payments secon in the Seng Up Direct

Deposit presentaon.

Q: Will my direct deposit informaon ever be deacvated?

A: Yes, per Oce of Financial Management (OFM) policy, any SSPS Provider File that has a direct deposit

account that has not been used for 3 months will be deacvated. If DCYF has not made payments via

direct deposit in the last 3 months, you will need to contact SSPS to reacvate your SSPS Provider File.

You do NOT need to sign up for direct deposit again. You can email DSHS_SSPSMail@dshs.wa.gov or call

SSPS Customer Service at 360-664-6161. The meline for deacvaon of an SSPS Provider File cannot be

changed by DCYF as it is an OFM rule.

Q: I am a licensed foster caregiver with a CPA. In 2023, I received a deposit once a month to my

account from my CPA. Do I need set up direct deposit with DCYF and claim an invoice monthly?

A: Yes, you will need to claim invoices each month. If you would like to receive reimbursement via direct

deposit, yes, you will need to set up direct deposit with DCYF. Otherwise, reimbursement will come

through the mail as a paper check. SSPS will mail invoices to all caregivers each month. Direct deposit

and registraon for the SSPS Provider Portal are oponal but highly recommended because it

streamlines payments. You can nd direcons for seng up direct deposit on the project website under

the Payments secon in the Seng Up Direct Deposit presentaon. That secon also includes direcons

for registering for the Provider Portal in the Signing up for SAW and the Provider Portal presentaon. This

document also includes instrucons for seng up a SAW account and registering for the Portal, seng

up direct deposit with DCYF, and claiming an invoice over the phone using Invoice Express if you do not

wish to use the Portal. If you do not register for the Provider Portal, you also have the opon to ll out

the paper invoice received in the mail and mail it back to SSPS.

If you do not sign up for direct deposit, you will receive a mailed check aer you have claimed your

invoices. If you are registered for the Provider Portal, invoices will be available for review and to claim in

the Portal within 48 business hours of the last DCYF billing cycle versus 3-5 business days from the last

DCYF billing cycle when received via mail. If you are signed up for the Portal, you will sll receive a

mailed invoice but you will have access to the invoice faster in the Portal. DCYF strongly recommends

waing unl the end of the month to claim an invoice, please see queson above (When should I claim

my invoice?). If you are not registered for the Portal, you will need to claim invoices using the Invoice

Express telephone system or by lling out the paper invoice received through the mail and mailing it

back to SSPS. Please see the SSPS Calendar for dates when invoices generate.

There are Zoom calls set up each month through March 2024 to help caregivers. If you are experiencing

any issues with reimbursement or claiming invoices, signing up for Direct Deposit, or registering or using

the Provider Portal you can join a call to get assistance from DCYF sta. The schedule for Zoom calls in on

the Caregiver Supports Project website under the Payments secon.

Q: Is "Provider Portal" our SAW account?

A: Secure Access Washington or SAW is a state applicaon that allows users to login to the SSPS Provider

Portal as well as other state services. Once you have a SAW account and have registered for the Provider

Portal you will access the Provider Portal by logging in to SAW and selecng that service: SSPS Provider

Portal by Department of Social and Health Services.

You can nd direcons for registering for the Provider Portal in the Signing up for SAW and the Provider

Portal presentaon. This document also includes instrucons for seng up a SAW account and

registering for the Portal.

Q: Do I need to claim respite payments on the invoice?

A: Yes, if a caregiver provides respite, those days will be included on the monthly invoice and need to be

reviewed and claimed. The dierence is that respite payments are fee-for-service so they are reportable

to the IRS and these payments are taxed. DCYF will look into opons for streamlining respite payments

and provide more informaon when a soluon is idened.

Q: I submit mileage logs by handing them to the social worker. Does that change?

A: No, mileage logs will sll be submied to the Social Worker who will sign and submit to generate

payment.

Q: Will the invoice come in the mail or is everyone online now?

A: All caregivers will receive a monthly invoice in the mail. If you are registered for the SSPS Provider

Portal you can also access invoice informaon through the Portal.

You can nd direcons for registering for the Provider Portal in the Signing up for SAW and the Provider

Portal presentaon. This document also includes instrucons for seng up a SAW account and

registering for the Portal.

Q: I am licensed through a CPA but regularly do respite for non-CPA kids. Is SSPS in my SAW account

the payment system that I already use for the non-CPA respite kids?

A: Yes.

Q: Will BRS spends be part of the CPA 7 level rate assessment? Or separate?

A: BRS is separate from the Caregiver Supports Model and payments are not impacted.

Q: If a family does not currently have a placement, should they sign up for direct deposit now?

A: You may sign up for direct deposit even if you do not currently have a placement. Note that SSPS

Provider Files will need to be reacvated if no direct deposit payment is made in a 3-month period.

Please see queson above (Will my direct deposit informaon ever be deacvated?).

Q: Will Extended Foster Care (EFC) invoices come through the same way as foster care invoices?

A: Yes. EFC is services also show up on the invoices that come through the mail and are also available in

the SSPS Provider Portal for those that are registered.

Q: If a child or youth is placed aer SSPS payment deadline for the month, will there be a second

invoice? Or do caregivers need to add to the already sent invoice?

A: Yes. A second, supplemental invoice for services that are provided aer the SSPS deadline will be

mailed and will be available online in the Portal.

Q: What is my SSPS Provider Portal “security token”?

A: When registering for the Portal, at step 13 of the Provider Portal Registraon direcons (see training

document) the system will ask users to enter a security token. You can request your security token by

emailing DSHS_SSPSMail@dshs.wa.gov or calling SSPS Customer Service at 360-664- 6161. The security

token provided by SSPS is valid for 90 days before the caregiver needs to contact SSPS for a new one.

Q: Do spouses / partners who are part of your licensed homes need to make their own accounts?

A: No, all of the licensed caregivers will be on the account and separate registraon is not required. Note

that check or payment will come with just one name on it.

Q: Do caregivers receive an email to let them know an invoice is available in the Provider Portal each

month and needs to be claimed?

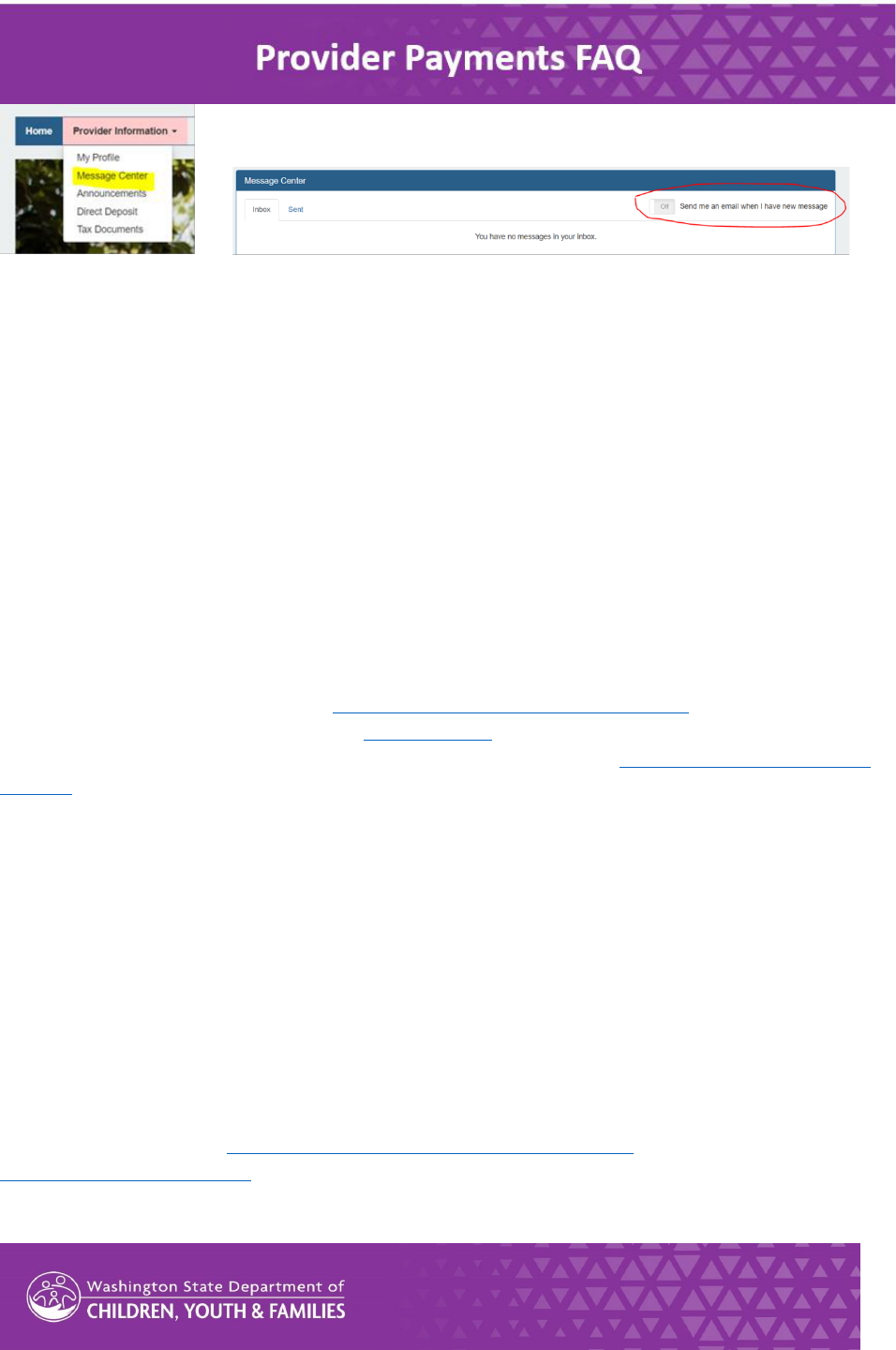

A: Providers need to opt in to receive email nocaons. While in the Portal, Select Message Center

from the dropdown menu on the le of the home screen under Provider Informaon. In the Message

Center, click the toggle on the top right next to “Send me an email when I have a new message” to turn

on nocaons. Once this is on, you will receive emails when an invoice is available in the Portal and

when a payment is generated.

Q: Can a SSPS account become inacve due to non-use?

A: No.

Q: Does the 2024 change to pay all caregivers directly impact the Responsible Living Skills Program

(RLSP)?

A: RLSP is a separate contract and payments for RLSP will connue to be made the same way they are

today, there will not be changes due to the Caregiver Supports Project.

Q: Who should I contact if my payment is late or there is another payment issue?

A: Reach out to your DCYF duciary.

Q: I already have a SAW account, how do I access the Provider Portal?

A: When you login to SAW, there is a buon for Add a Service. Please follow the direcons for adding the

Provider Portal - follow from Slide 11 in Signing up for SAW and the Provider Portal presentaon

available under the Payment secon of the project website. Or follow from Step 8 in the Register for

SSPS Provider Portal secon of the Provider Payments Training document: ProviderPaymentsTraining.pdf

(wa.gov).

Q: Do I need to link my Statewide Vendor (SWV) Number to my SAW account?

A: No, you do not need to link the Statewide Vendor number to your SAW account. When you sign up for

direct deposit, there is a spot on the form to enter your SWV number but you do NOT need to enter

anything in that eld. The SWV is assigned behind the scenes. If you receive a nocaon of a new SWV

number and you’ve already submied direct deposit forms, you do not have to resubmit with that

number entered, it will already be linked automacally.

Q: When will I know that my direct deposit is set up?

A: You will not receive nocaon when direct deposit is set up. You can expect 4-6 weeks from

submission of the form unl the setup is complete. This means you will likely receive one paper check in

the mail between the me that you submit the form unl direct deposit setup is complete. This is due to

invoice deadlines for SSPS (hps://www.dcyf.wa.gov/services/ssps/calendar). You can also email

DSHS_SS[email protected]a.gov or call SSPS Customer Service at 360-664-6161 to request an update on

the status of your setup.

Q: Will the SSPS Provider Prole page update to display that direct deposit is set up?

A: When direct deposit is established, the SSPS Provider Prole page will populate like this: