Basic understanding

of a company’s

financial statements

September 2020

2PwC | Basic Understanding of a Company's Financials

Table of contents

What are financial statements? 3

Balance sheet 5

Income statement 16

Cashflow statement 24

2

What are financial

statements?

3PwC | Basic Understanding of a Company's Financials

4PwC | Basic Understanding of a Company's Financials

Financial statements are written records that illustrates the business activities and the financial performance of a company. In

most cases they are audited to ensure accuracy for tax, financing, or investing purposes.

A methodically work through of the three financial statements in order to assess the Financial health of a company.

Balance Sheet

Income Statement

Statement of Cash Flows

The financial statements

• Statement of financial position

• Statement of operation/profit and loss

Balance Sheet is a snapshot at a point in time. On the top half you

have the company’s assets and on the bottom half its liabilities and

Shareholders’ Equity (or Net Worth). The assets and liabilities are

typically listed in order of liquidity and separated between current and

non-current.

The income statement covers a period of time, such as a quarter or

year. It illustrates the profitability of the company from an accounting

(accrual and matching) perspective. It starts with the revenue line and

after deducting expenses derives net income.

The cash flow statement look at the cash position of the company .

It answers it answers the questions ; How much of the organisation’s

cash goes to its creditors and shareholders? Does it keep enough for

its own investment and growth? has 3 components cash from

operations, cash used in investing, and cash from financing. It

“undoes” all of the accounting principles and shows the cash flows of

the business.

Source CFI

Balance sheet

5PwC | Basic Understanding of a Company's Financials

6PwC | Basic Understanding of a Company's Financials

Simplified Balance Sheet

Assets

Current assets

Cash 20,000

Accounts receivable 3,000

Inventory 60,000

Prepaid expenses 11,000

Total current assets 94,000

Non current assets

Property plant &

equipment

110,000

Intangible assets 10,000

Total non current assets 120,000

Total assets 214,000

Liabilities

Current liabilities

Accounts payable 2,000

Accrued expenses 1,000

Total current liabilities 3,000

Non current liabilities 11,000

Bank loan 100,000

Shareholder equity

Common shares 89,000

Retained Earnings 11,000

Total liabilities and

shareholders equity

214,000

Current vs non-current

Current

Assets

Balance sheet

The Balance sheet has

3 main categories:

Assets

Liabilities

Equity

Assets

• Expected to be converted into

cash in less than 1 year

• Accounts receivable, inventory

Liabilities

• Will be paid in less than 1 year

• Trade accounts payable

Non-current

Assets

• Expected to be held greater

than 1 year

• Property, plant, and equipment

Liabilities

• Repayment terms longer than

1 year

• Loan repayable over a 5 year

period

Source CFI

7PwC | Basic Understanding of a Company's Financials

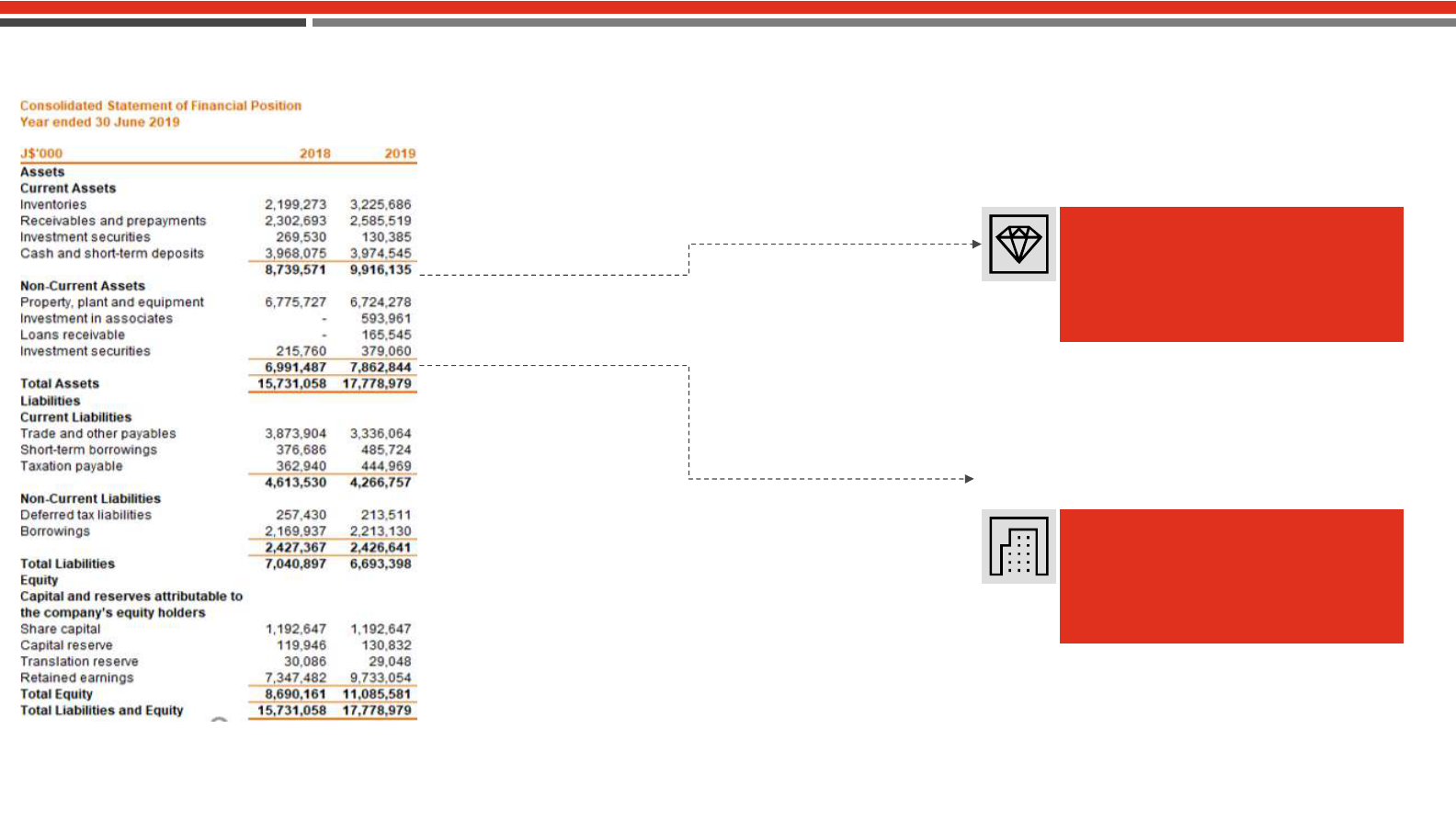

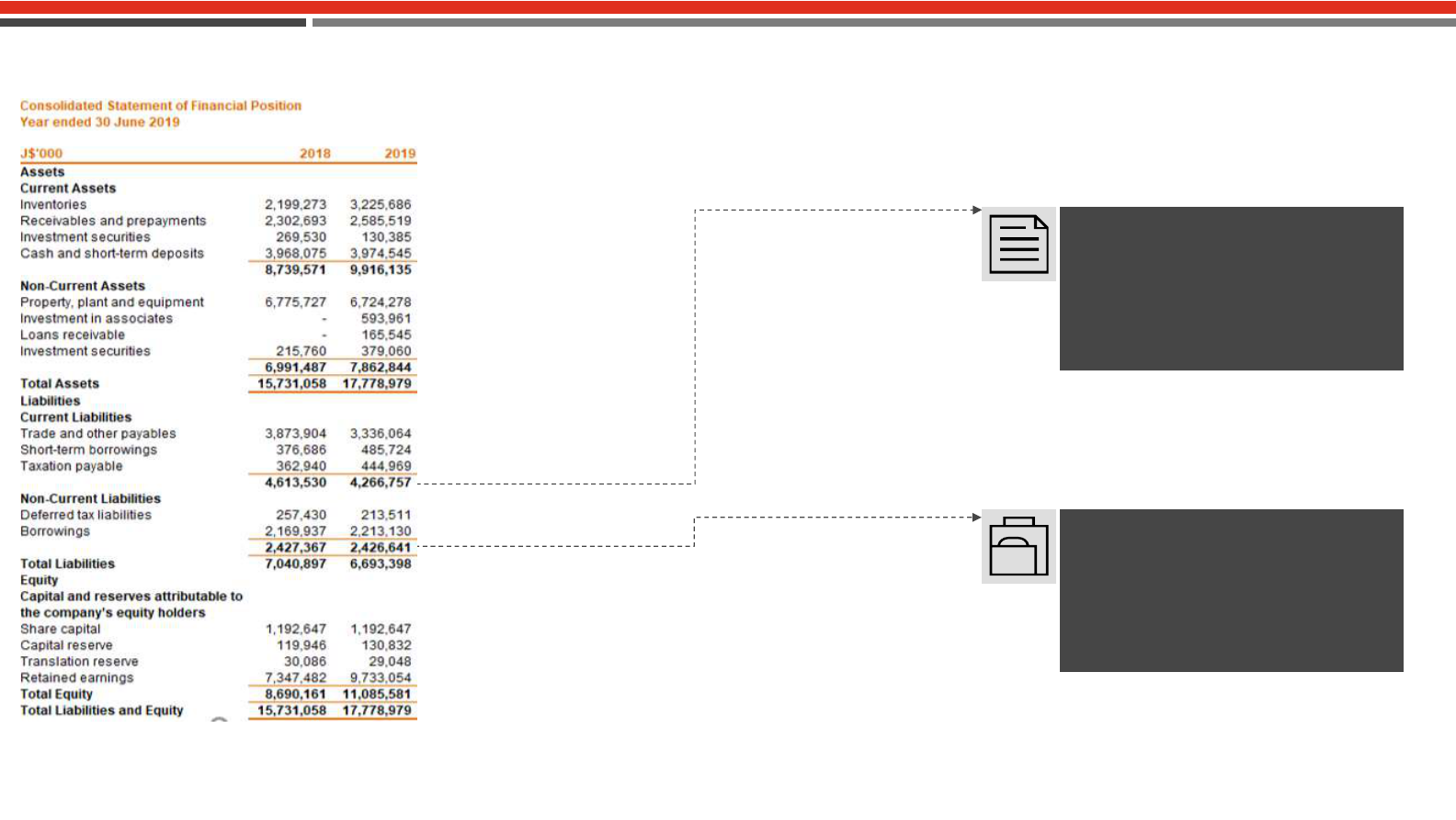

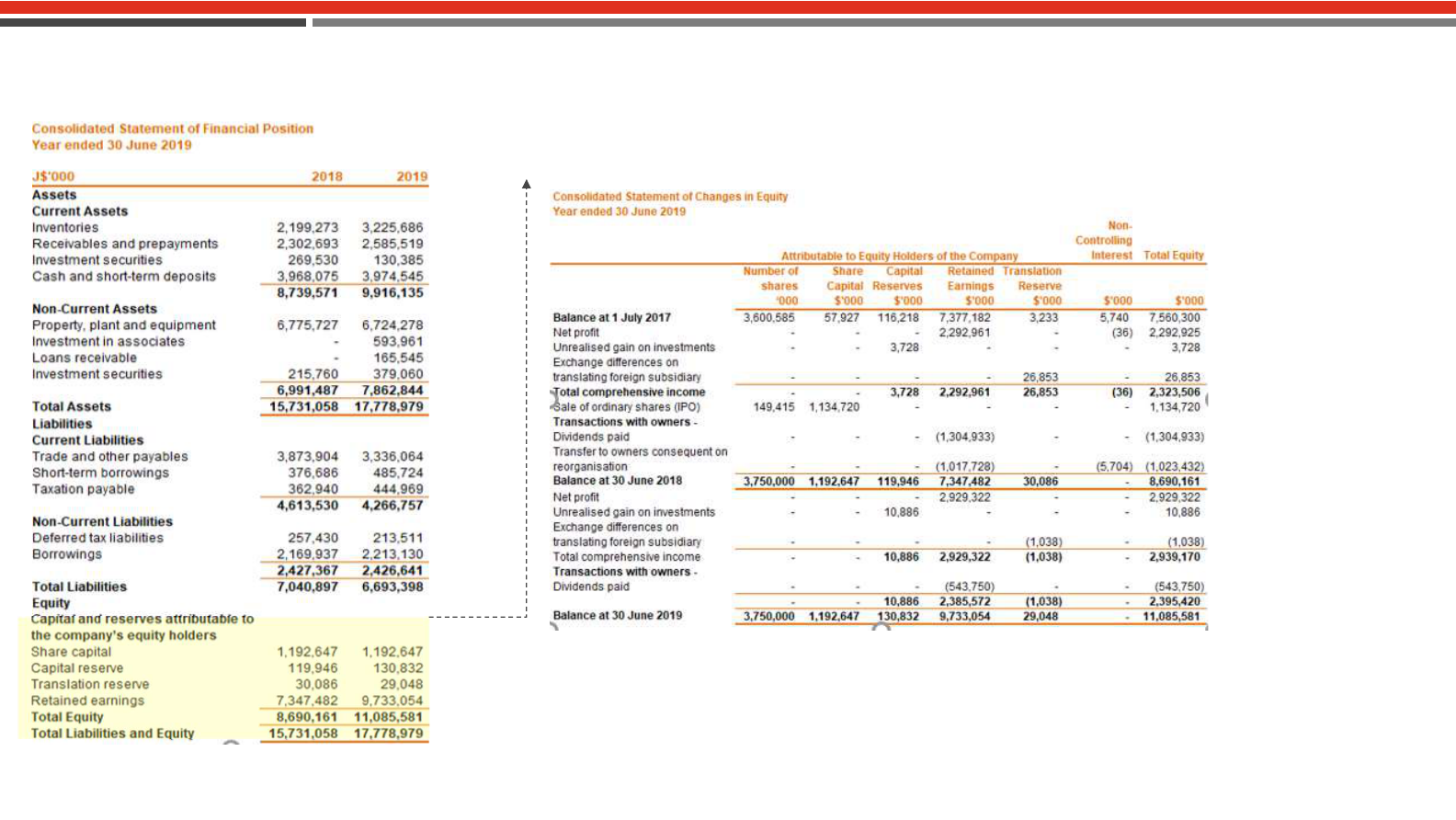

See accompanying notes.

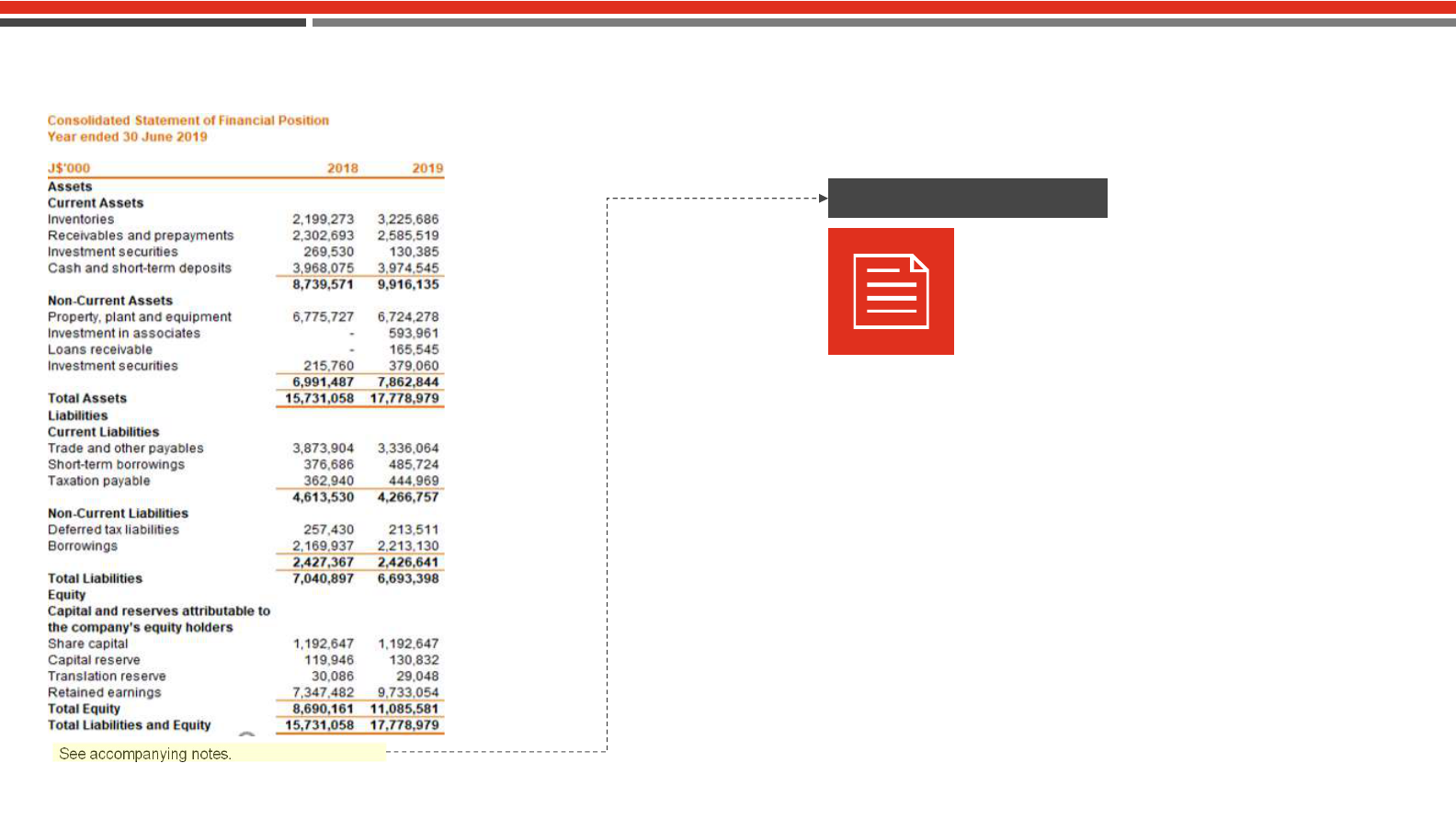

Illustrative balance sheet (assets )

Current

Assets

• Expected to be converted into

cash in less than 1 year

• Accounts receivable, inventory

Non-current

Assets

• Expected to be held greater than

1 year

• Property, plant, and equipment

8PwC | Basic Understanding of a Company's Financials

8

Cash and Investments

• Investments in equity or

debt instruments to be

held for capital gain and/or

income

Cash and investments

A company will hold external investments for two reasons:

• Excess cash

• Accumulating cash to make a large purchase

A company can also make internal investments

• (less than year)

Internal

investments

Long termShort term

External

investments

• (more than year)

• Investment in subsidiaries,

associates and joint

ventures

8

Source CFI

9PwC | Basic Understanding of a Company's Financials

Intangible Asset

Intangible assets are items of value that are

used to generate revenues and have no

physical substance.

Unearned/Differed Revenue

Unearned revenue arises when a company

sells something it has not yet delivered e.g.

licenses, subscriptions 12 month

subscription sold for $1,200 in January:

Goodwill

• Non-current asset

• Company has intangible Value

e.g. brand, customers,intellectual capital

If a company is purchased for more than

the fair value of net assets (assets less

liabilities):

Purchase price X

Fair value of net assets acquired (X)

Goodwill X

Earned: $100 $300 $600 $900 $1,200

Jan Mar Jun Sep Dec

Unearned $1,100 $900 $600 $300 $0

Other assets

Trademarks

Patents

Copyrights

Source CFI

10PwC | Basic Understanding of a Company's Financials

Current

Liabilities

• Will be paid in less than 1 year

• Trade accounts payable

Non-current

Liabilities

• Repayment terms longer than 1

year

• Loan repayable over a 5 year

period

Illustrative balance sheet (liabilities)

See accompanying notes.

11PwC | Basic Understanding of a Company's Financials

New buildings

Building

improvements

Leasehold

improvements

Other liabilities

Commitments

Commitments are future obligations that a company agrees to.

Contingencies

Contingencies are liabilities that may or may not happen, depending

on circumstance.

e.g. lawsuit

The liability must be recorded if:

1.A loss will be suffered in the future

2.The loss amount can be reasonably estimated

If not, just disclose a note.

Contingent gains are never recorded in financial statements.

Source CFI

12PwC | Basic Understanding of a Company's Financials

Illustrative balance sheet (statement of shareholder’s equity)

See accompanying notes.

13PwC | Basic Understanding of a Company's Financials

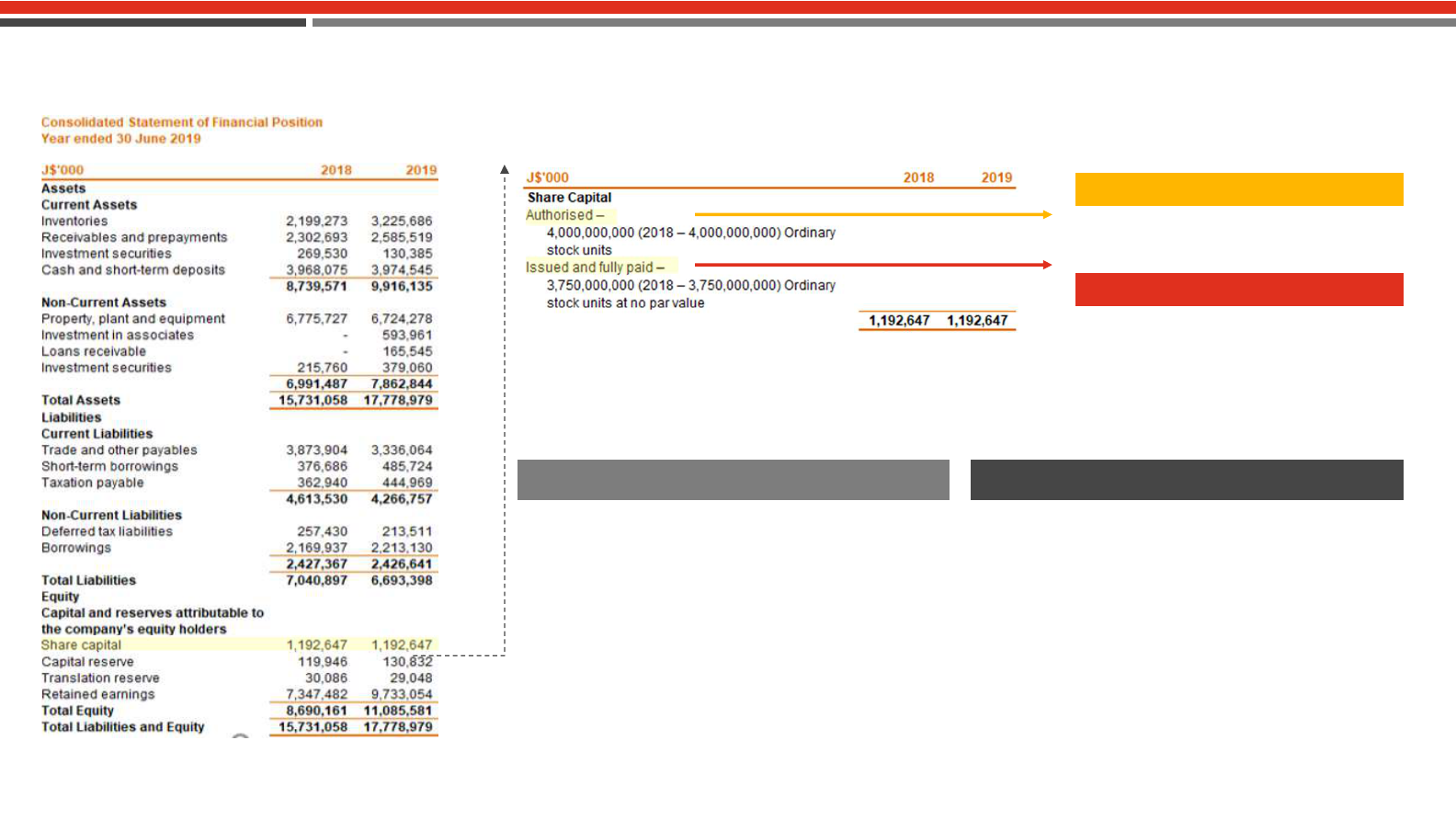

Common shares

• Allow for participation in the profits of the

company

– Comes in the form of a dividend

• Allow for voting rights in a company

– One vote for every share held

• If dissolved, any residual amount after

everyone else is paid would go to the

common shareholders

Preferred shares

Authorised shares

• The total number of shares a

company can sell

Common vs preferred shares

Outstanding (Issued) shares

• The total number of shares a

company has sold/issued

• Offer investors a fixed dividend

– It may not be paid annually

• Will accumulate/pay before common share

dividends

• Most businesses don’t issue because they

are viewed as debt with a tax disadvantage

– Dividends do not reduce taxable income

See accompanying notes.

Source CFI

14PwC | Basic Understanding of a Company's Financials

Aspects of the Equity

Par Receives

Contributed surplus

Paid-up share capital (180,000 x 25¢) $45,000

Contributed surplus (180,000 x 15¢) $27,000

e.g. 180,000 shares 40¢/each 25¢/par

Aspects of the equity

Contributed Surplus Other comprehensive income

Other comprehensive income (OCI):

• certain company gains and losses that are not always recorded

through the income statement

e.g. unrealised gains and losses on investments and hedging

instruments

Source CFI

Understanding the

income statement

and cash flow

15PwC | Basic Understanding of a Company's Financials

Income statement

16PwC | Basic Understanding of a Company's Financials

17PwC | Basic Understanding of a Company's Financials

The Income statement has 3 main sections:

Income Statement

Revenues

Expenses

Profit or loss

18PwC | Basic Understanding of a Company's Financials

VS

Single step vs multi-step income statements

Single Step Multiple Step

Source CFI

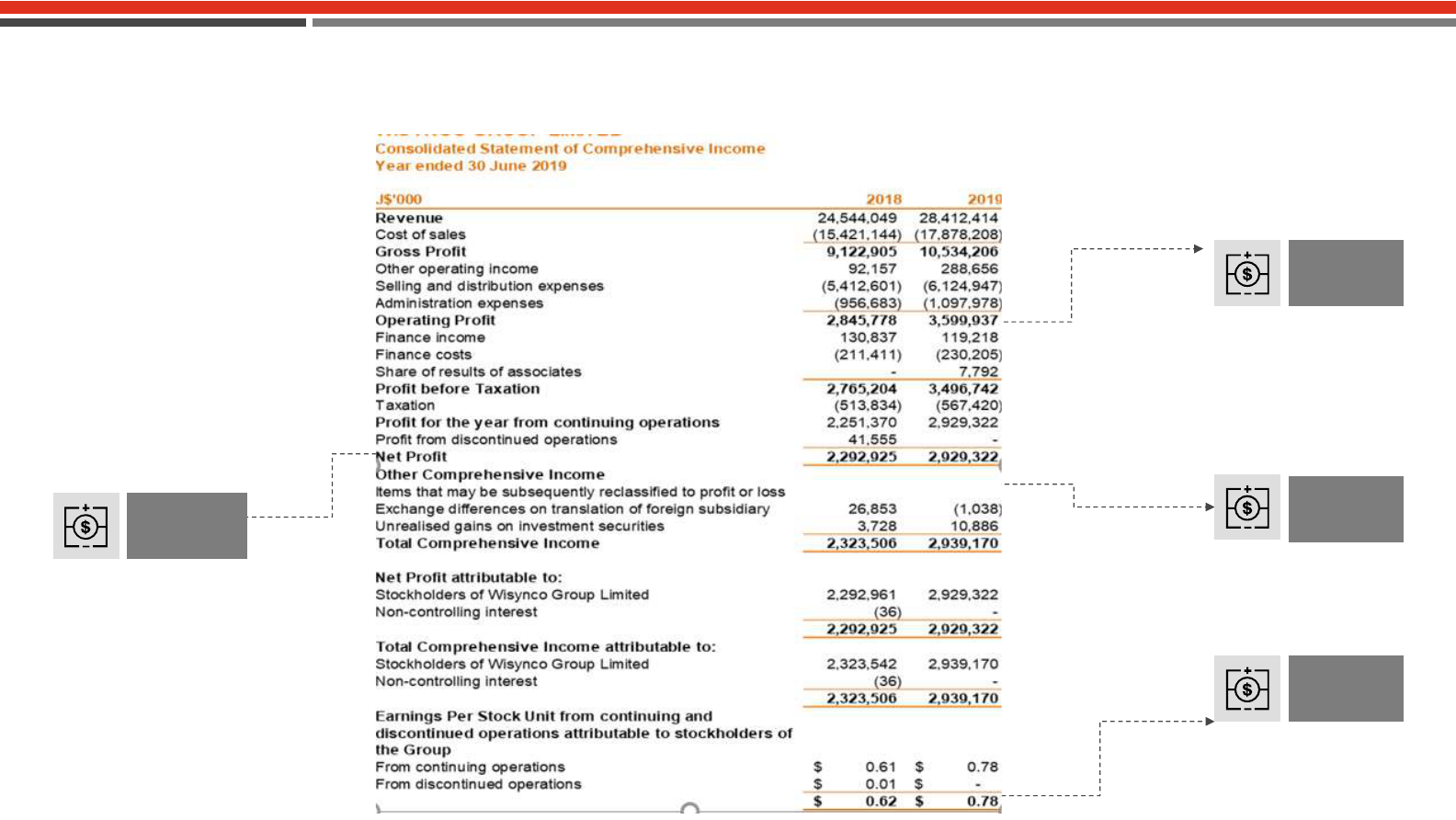

19PwC | Basic Understanding of a Company's Financials

Operating

Profit

EPS –Investor

Ratio

Net Operating

Profit

OCI-other

gains and

losses

The Illustrative income statement

20PwC | Basic Understanding of a Company's Financials

(e.g. materials used in manufacturing)

Cost of goods sold or Cost of sales:

• May be shown as summarised line item

• May be broken Down to its expense items

Direct Materials

Direct Labor

Direct overhead

(e.g. professional services delivered)

(to the production of the goods or services)

Cost of sales

Source CFI

21PwC | Basic Understanding of a Company's Financials

Advertising and

promotion cost

Legal, Insurance and

accounting expenses.

Office supplies Other related

expenses.

Selling, general and administrative expenses.

Selling, general and administrative, or SG&A contains a large number of expense items such as:

Source CFI

22PwC | Basic Understanding of a Company's Financials

Gains and losses

Gains and losses may appear separately or grouped after all

operating items under “other income or expenses”. They are related

to activities that are incidental to operations such as:

Sale of Investments

Foreign exchange translations

Financial Instrument transactions

Source CFI

23PwC | Basic Understanding of a Company's Financials

Other aspects of the Income Statement

Other comprehensive income (OCI):

• certain company gains and losses that are not always recorded

through the income statement

e.g. unrealised gains and losses on investments and hedging

instruments

Other comprehensive income

Source CFI

Cashflow statement

24PwC | Basic Understanding of a Company's Financials

25PwC | Basic Understanding of a Company's Financials

The cash flow statement

Day-to-day business operations;

Revenues and expenses that have been

collected and paid during the year

Depreciation and amortisation are not included.

Non-current assets that support the business:

• Property, plant and equipment

• Business acquisitions

Transactions regarding shares or debt.

Company raises funds by either borrowing or

issuing shares.

Statement of cash flows demonstrates:

• Where cash is being generated

• Where cash is being used in the business

Operating

Investing

Financing

Source CFI

26PwC | Basic Understanding of a Company's Financials

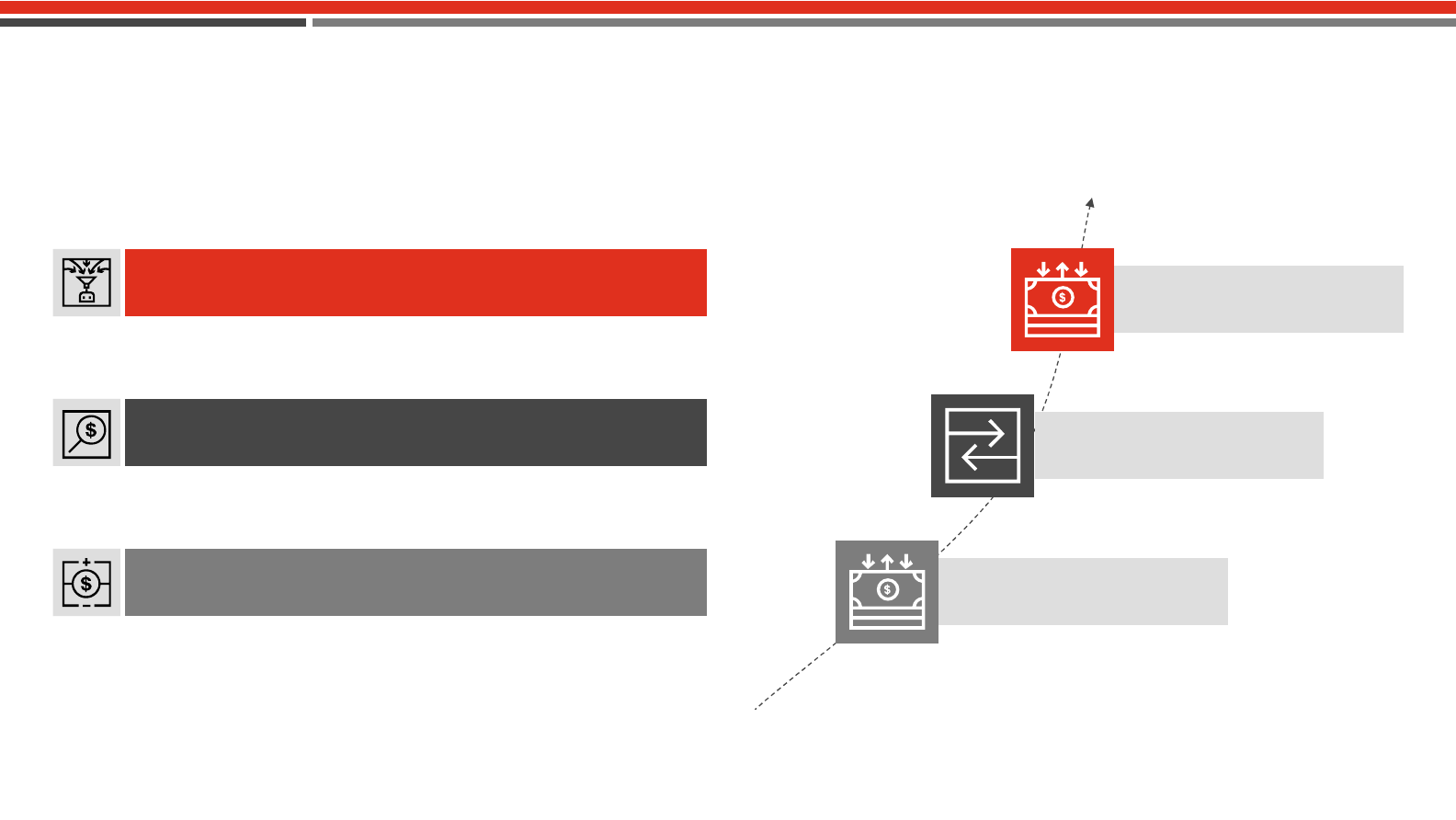

Statement of Cash Flows

The transactions are sorted by activity type:

Operating

Investing

Financing

The closing cash balance

All cash transactions

The opening cash balance

Source CFI

27PwC | Basic Understanding of a Company's Financials

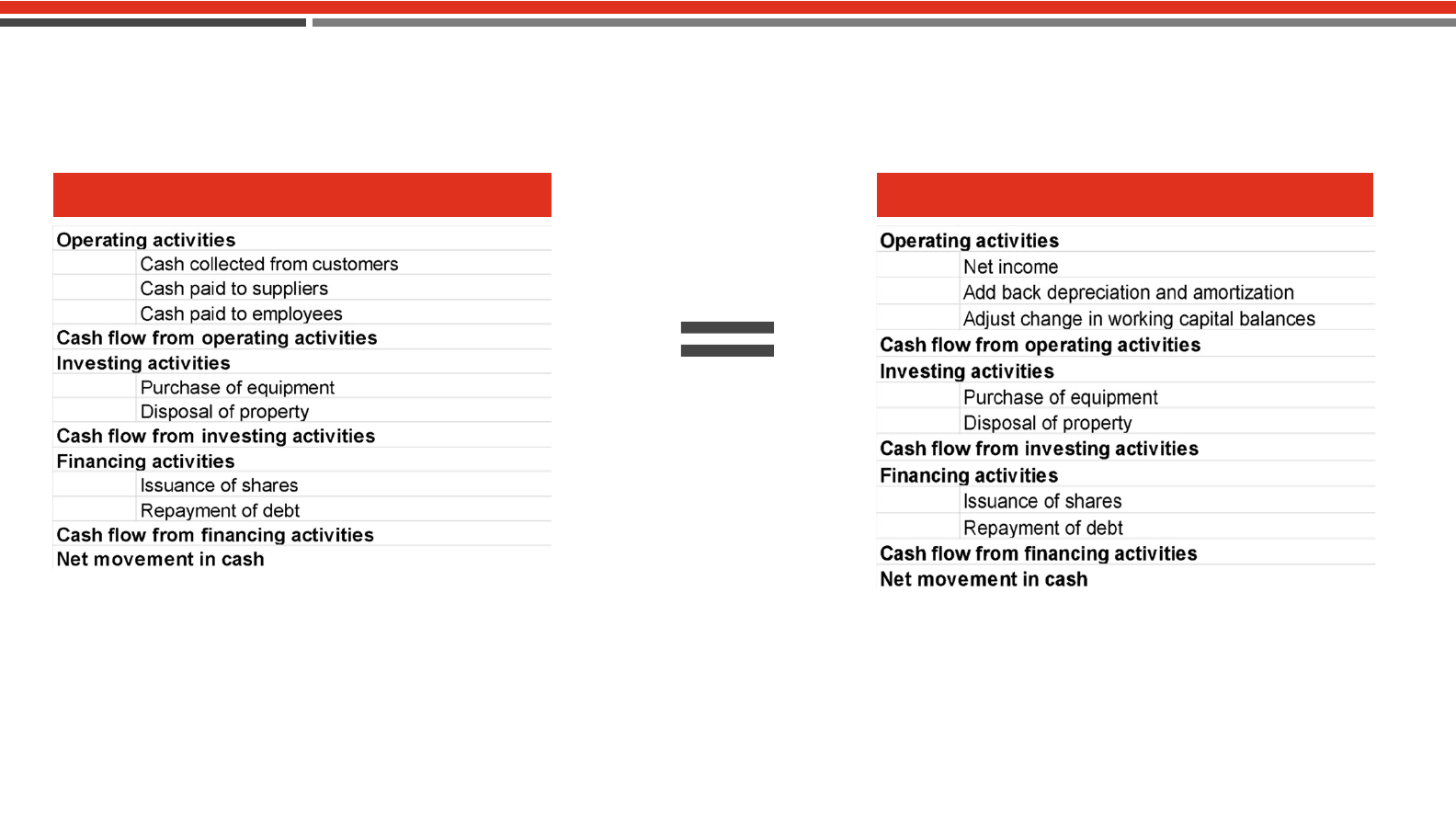

Direct method

Direct method of cash flow starts with cash transactions.

(Transactions are separated into cash received and cash

paid.)

Indirect method

Indirect method of cash flow starts with net income.

(Non-cash adjustments are then added.)

Direct method vs Indirect method

Source CFI

28PwC | Basic Understanding of a Company's Financials

Net cash provided by

operating activities

Changes in working capital

PPE Investment

Financing

requirement/surplus

Represents operating ‘lifeblood’ of business after paying necessary outgoings for financing

and tax

Shows whether business is absorbing funds for working capital or releasing them. Trend

may indicate ether financial stress or loose control over working capital

Companies must invest in PPE to maintain their productive capacity.

A downward trend may indicate a declining company. Identify the necessary sustainable

level of expenditure.

Shows whether internally generated funds are sufficient to cover investments made in fixed

assets and businesses. Continuous deficits indicate that growth depends on regular

injections of external finance.

Key elements in a cash flow statement

Source CFI

29PwC | Basic Understanding of a Company's Financials

See accompanying notes.

For full disclosure:

Notes are provided to allow the

reader of the financial statements to

understand and make judgements of

financial activities of the company.

The Full Disclosure Principle

30PwC | Basic Understanding of a Company's Financials

Indirect Information

Company

accounting

standards

How inventory &

investments are

valued

Financial

instruments

Revenue is

recognized

Property, plant &

equipment is

amortized

Any other

policies

A breakdown of the

types of investments

Debt and financial

instruments

What is included in:

Inventory Intangible assets

PP&E Income taxes

Notes of indirect information:

• Help provide the entire financial picture of

an organisation

• Not related to the numbers in the financial

statements

Commitments Contingencies

Stock based

compensation plans

Three Key Financial Statements Notes

Significant Accounting Policies Direct Information Indirect Information

Source CFI

31PwC | Basic Understanding of a Company's Financials

Performance Ratio

• Net Profit margin,

• return on assets (ROA)

• return on equity(ROE)

• return on capital employed (ROCE),

• gross margin ratios

• Efficiency (

• Solvency Ratios

• Current ratio= Current assets/Current

liabilities

• Leverage or Gearing

• Operating cash flow/Interest paid

• Operating cash flow/Dividends paid

• Operating cash flow/Operating profit

• Dividend yield,

• P/E ratio,

• earnings per share (EPS),

• dividend payout ratio

Ratio Analysis

The Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its

financial statements such as the balance sheet and income statement. Ratio analysis is a cornerstone of fundamental equity analysis.

Solvency Ratios Investor Ratios

32PwC | Basic Understanding of a Company's Financials

The benefits of an annual report

The annual report contains a significant amount of information:

Financial

• Management discussion &

analysis(MD&A)

• Financial statements

• Notes to financial statements

• Messages from the Chair, CEO

• Corporate profile

• MD&A

• Risk and control processes and analysis

Non-financial

Operational

performance

Financial

performance

Strategic

direction

Source CFI

33PwC | Basic Understanding of a Company's Financials

Letters to the

shareholders

01.

Business description

02.

Management’s

Discussion and

Analysis (MD&A)

03.

Reporting on internal

controls

04.

Audit report

05.

Balance sheet,

Income Statement

and Statement of

Cash Flows

06.

Notes to the financial

statements

07.

Earnings per share

08.

Earnings per share

Listing of directors of

the company

09.

Contents of an annual report

The annual report will always include:

Source CFI

34PwC | Basic Understanding of a Company's Financials

Acts as sort of variance

analysis

Explains company

performance

Lists future actions to be

taken

Identifies the key risk

facing the organization

Management discussion and analysis

MD&A provides information regarding past performance and future strategic direction

pwc.com/jm

Thank you

© 2020 PricewaterhouseCoopers. All rights reserved. PwC refers to the Jamaica member firm, and may sometimes refer to the PwC network. Each member firm is a

separate legal entity. Please see www.pwc.com/structure for further details.