UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☑

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From _____ To _____

Commission File Number 001-13836

JOHNSON CONTROLS INTERNATIONAL PLC

(Exact name of registrant as specified in its charter)

Ireland 98-0390500

(Jurisdiction of Incorporation) (I.R.S. Employer Identification No.)

One Albert Quay, Cork, Ireland, T12 X8N6

(353) 21-423-5000

(Address of Principal Executive Offices and Postal Code) (Registrant's Telephone Number)

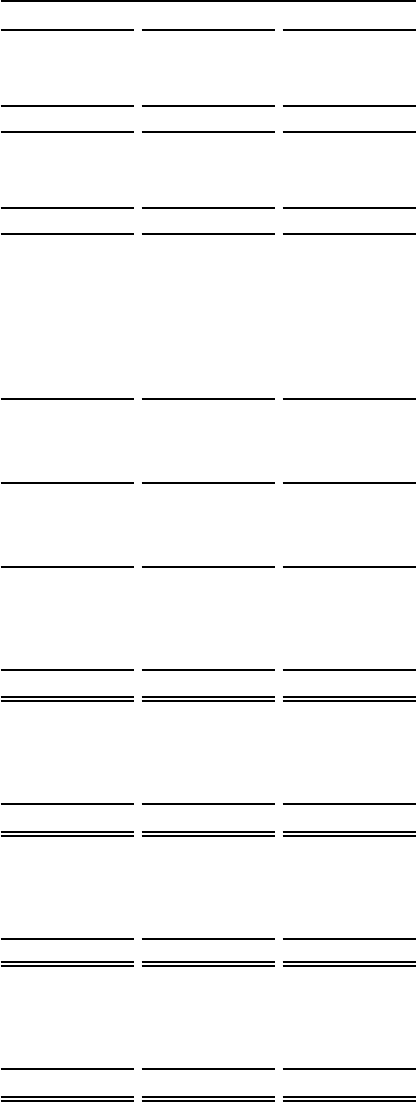

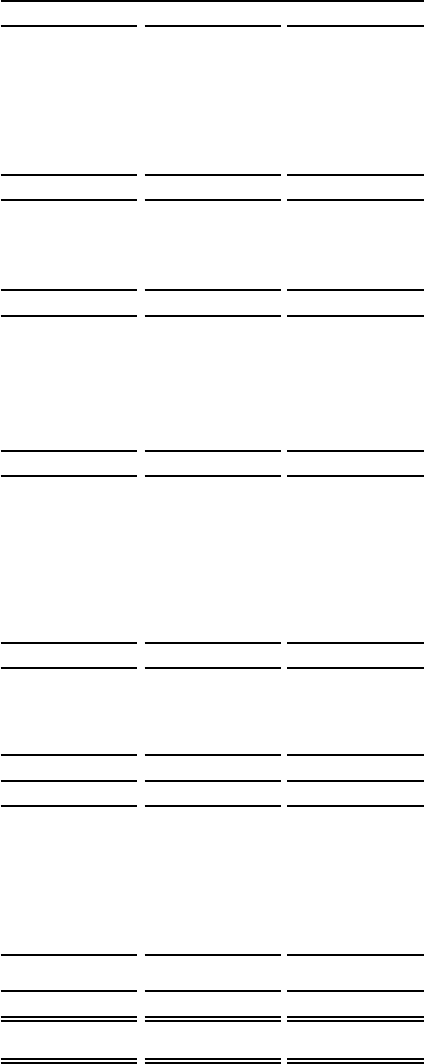

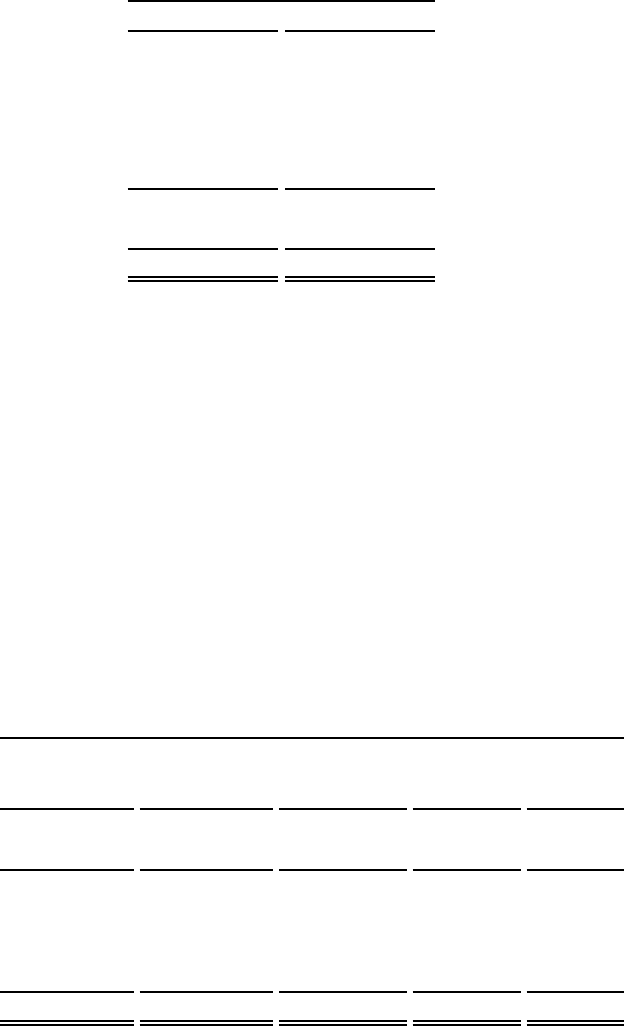

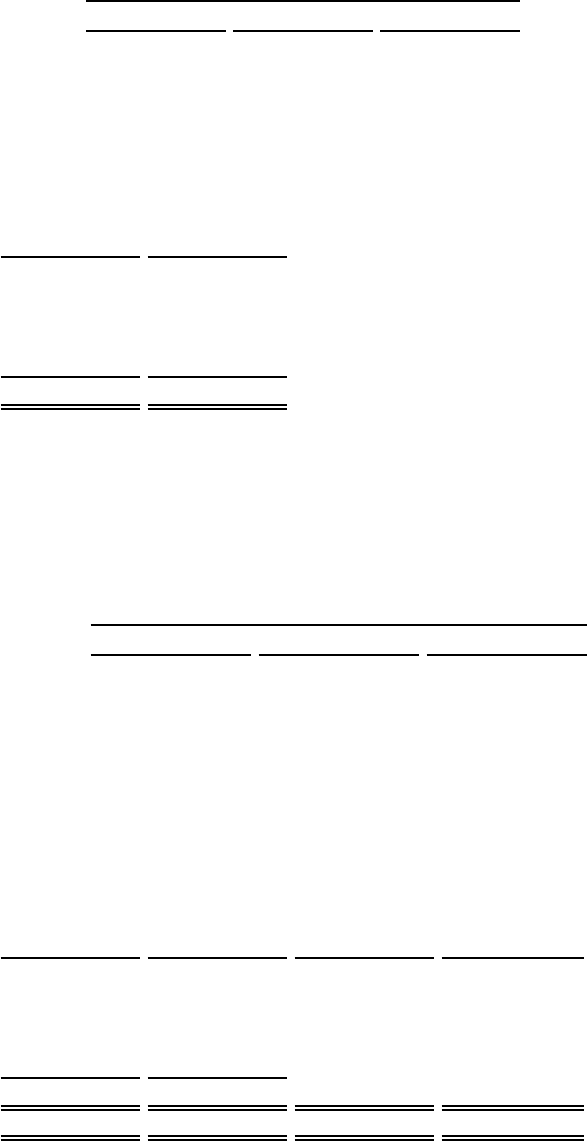

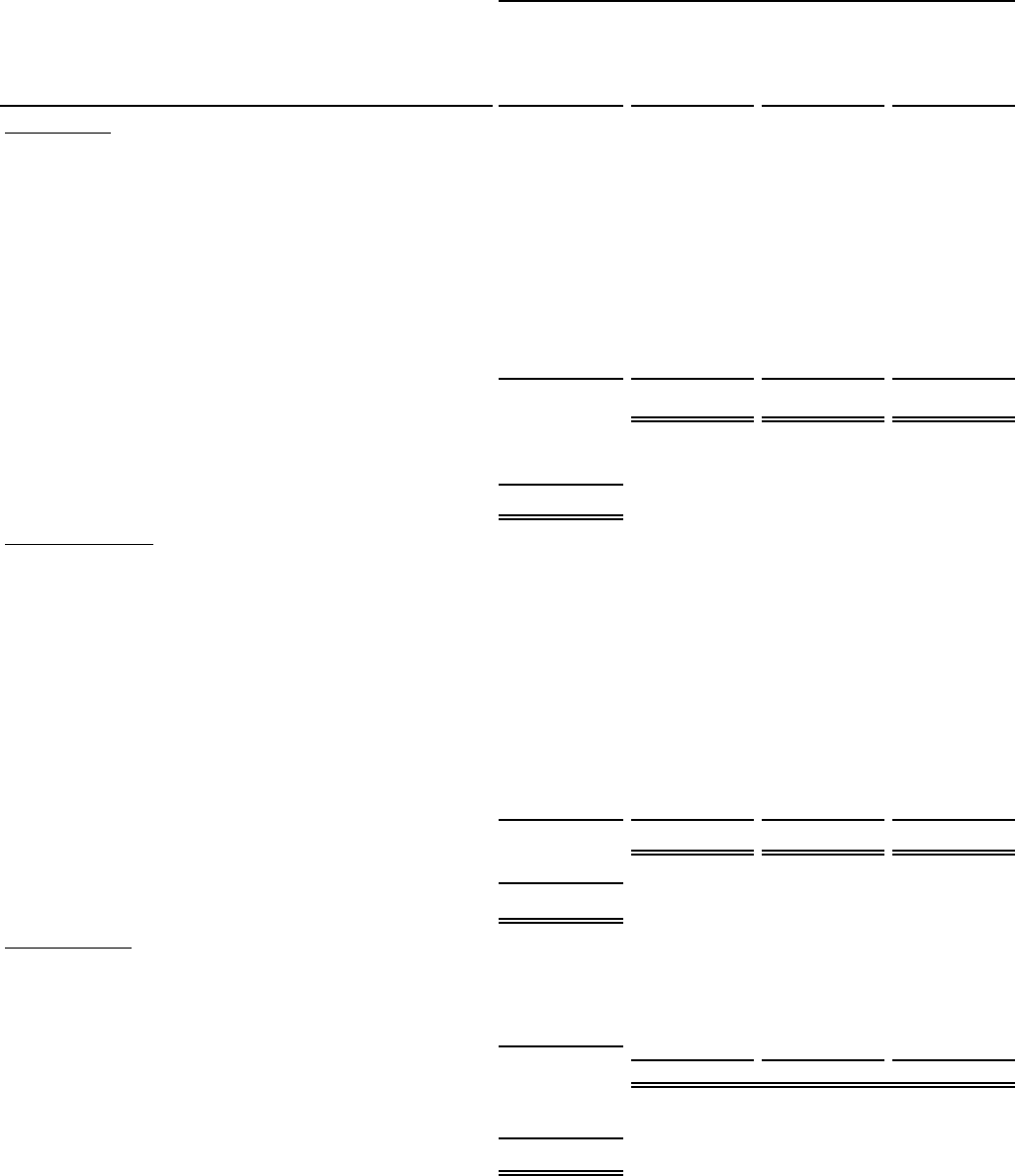

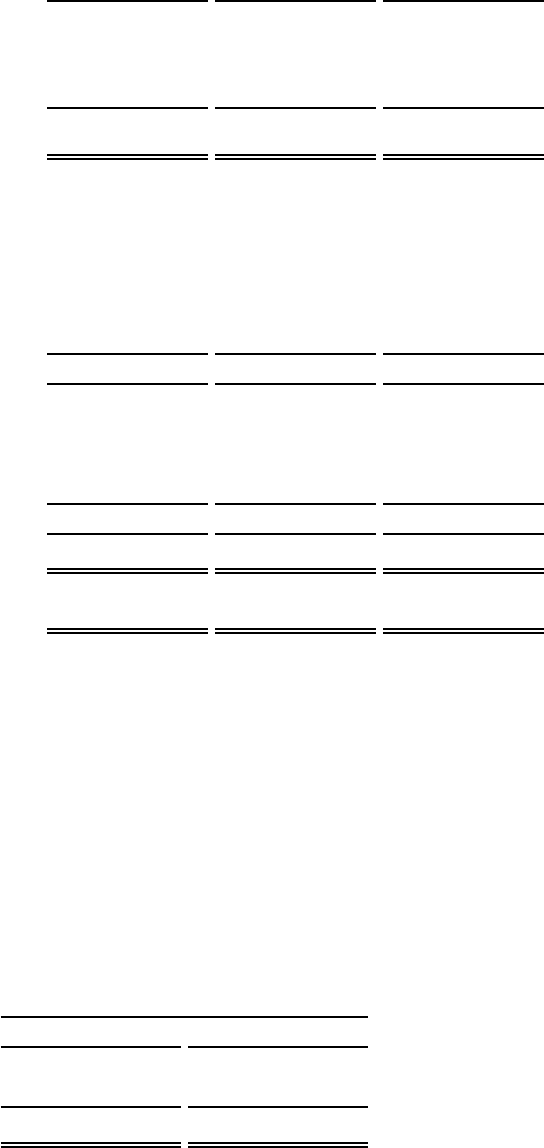

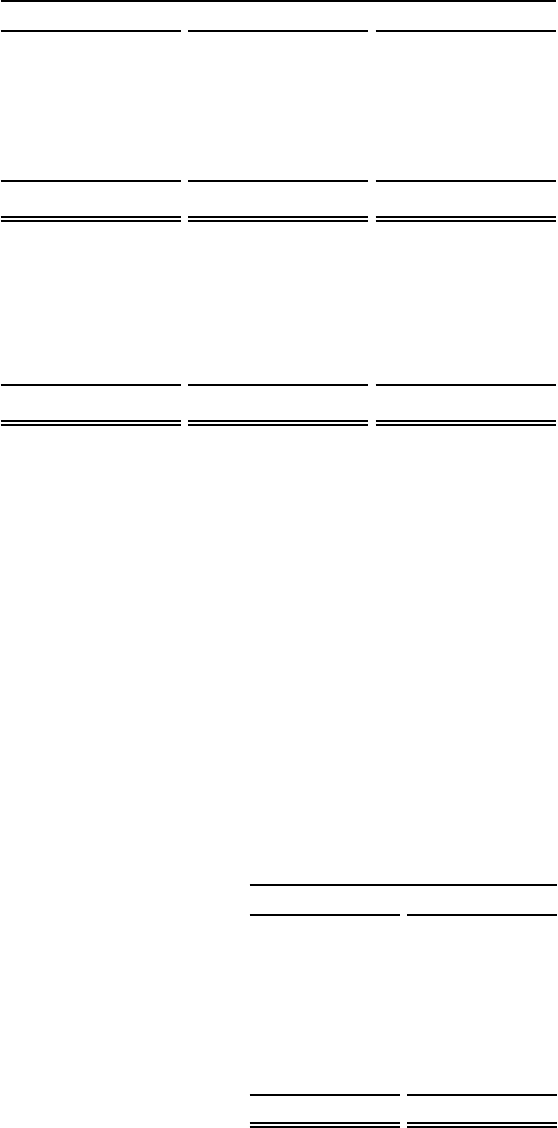

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

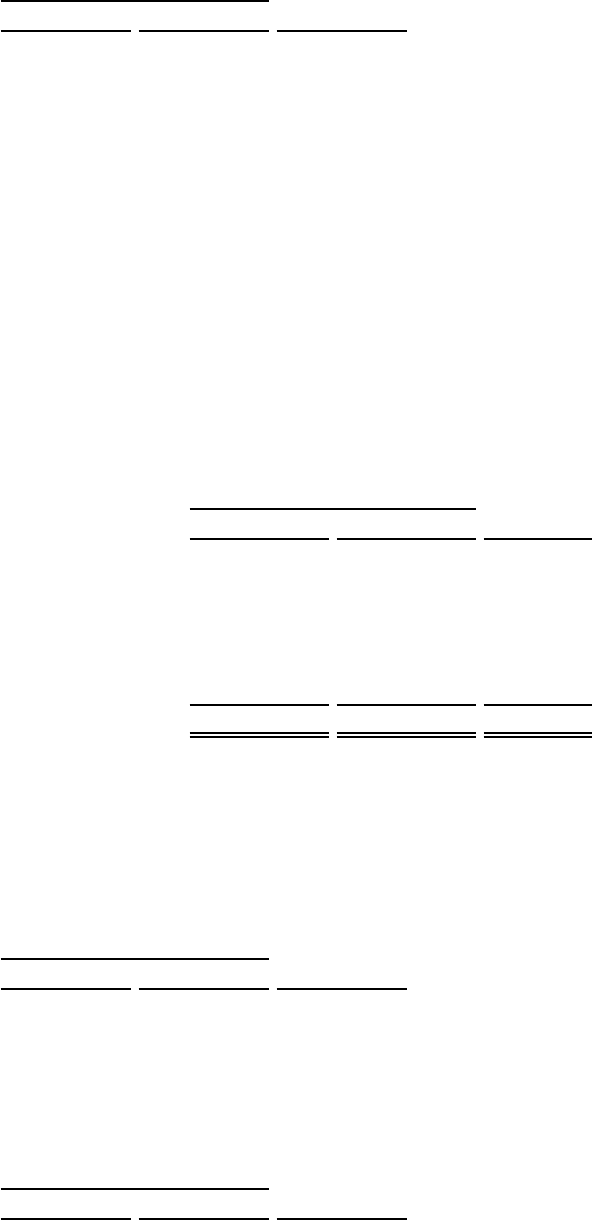

Title of Each Class

Trading

Symbol

Name of Each Exchange

on Which Registered Title of Each Class

Trading

Symbol

Name of Each Exchange

on Which Registered

Ordinary Shares, Par Value $0.01 JCI New York Stock Exchange 4.250% Senior Notes due 2035 JCI35 New York Stock Exchange

3.625% Senior Notes due 2024 JCI24A New York Stock Exchange 6.000% Notes due 2036 JCI36A New York Stock Exchange

1.375% Notes due 2025 JCI25A New York Stock Exchange 5.70% Senior Notes due 2041 JCI41B New York Stock Exchange

3.900% Notes due 2026 JCI26A New York Stock Exchange 5.250% Senior Notes due 2041 JCI41C New York Stock Exchange

0.375% Senior Notes due 2027 JCI27 New York Stock Exchange 4.625% Senior Notes due 2044 JCI44A New York Stock Exchange

3.000% Senior Notes due 2028 JCI28 New York Stock Exchange 5.125% Notes due 2045 JCI45B New York Stock Exchange

1.750% Senior Notes due 2030 JCI30 New York Stock Exchange 6.950% Debentures due December 1, 2045 JCI45A New York Stock Exchange

2.000% Sustainability-Linked Senior Notes due 2031 JCI31 New York Stock Exchange 4.500% Senior Notes due 2047 JCI47 New York Stock Exchange

1.000% Senior Notes due 2032 JCI32 New York Stock Exchange 4.950% Senior Notes due 2064 JCI64A New York Stock Exchange

4.900% Senior Notes due 2032 JCI32A New York Stock Exchange

Securities Registered Pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

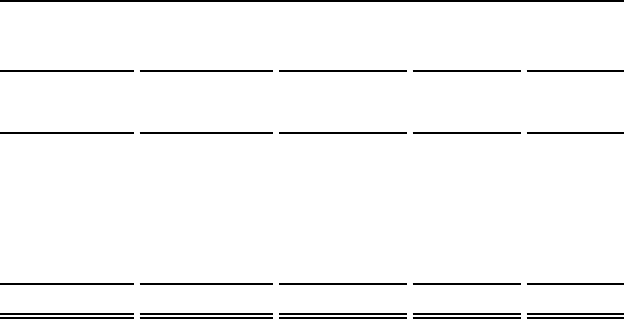

Large accelerated filer

þ

Accelerated filer

¨

Non-accelerated filer ¨ Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of March 31, 2023, the aggregate market value of Johnson Controls International plc Common Stock held by non-affiliates of the registrant was approximately $41.2 billion

based on the closing sales price as reported on the New York Stock Exchange. As of November 30, 2023, 680,673,839 ordinary shares, par value $0.01 per share, were

outstanding.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. þ

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

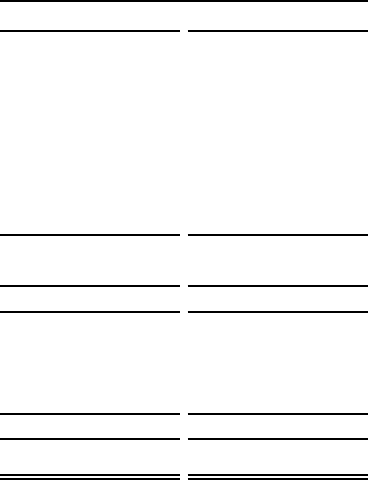

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the annual general meeting of shareholders to be held on March 13, 2024 are

incorporated by reference into Part III.

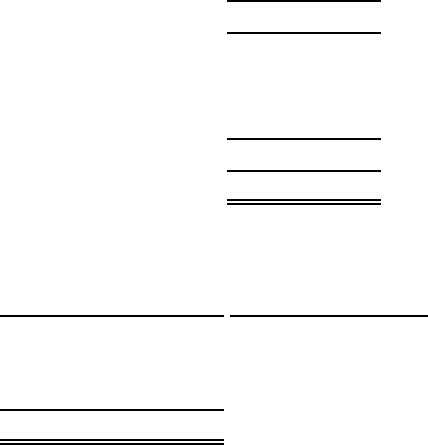

1

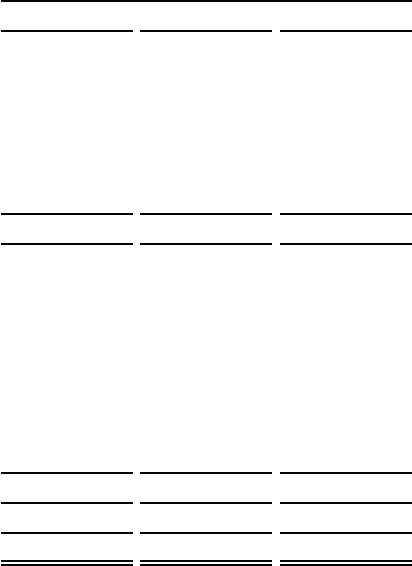

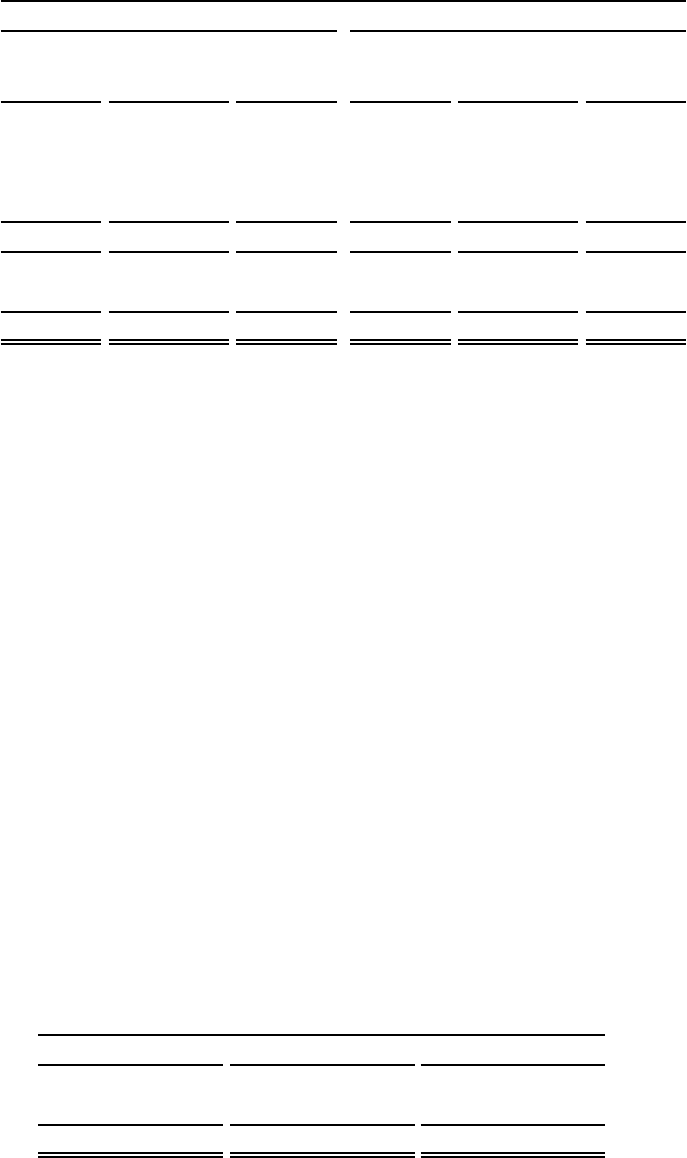

JOHNSON CONTROLS INTERNATIONAL PLC

Index to Annual Report on Form 10-K

Year Ended September 30, 2023

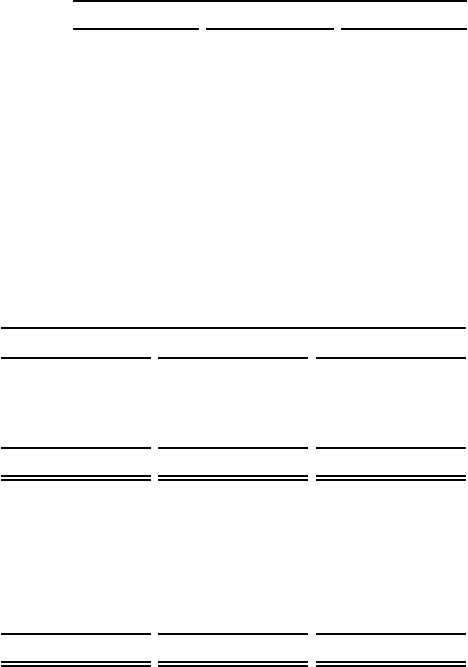

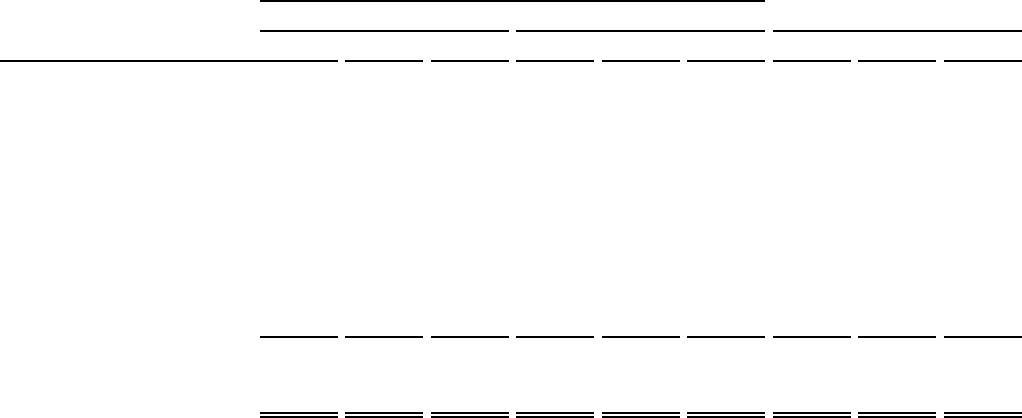

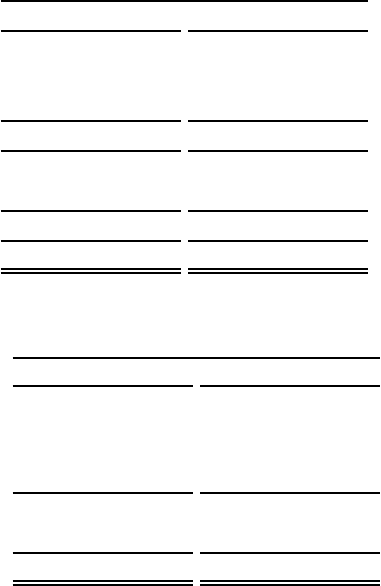

Page

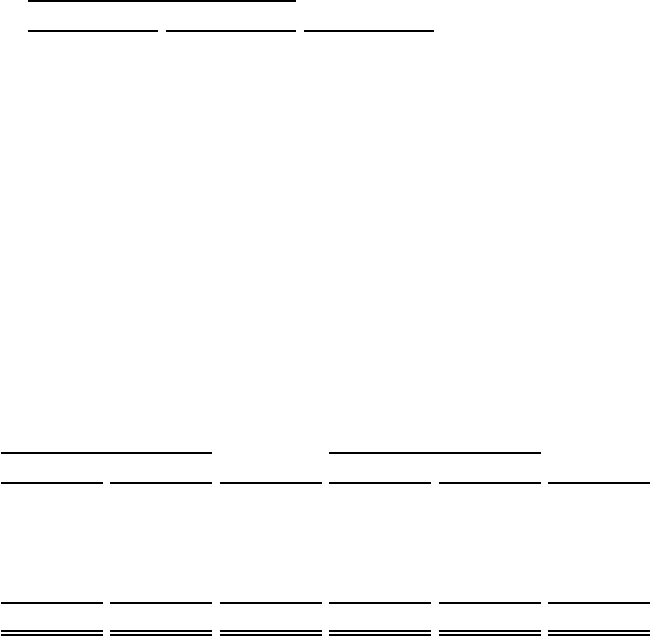

CAUTIONARY STATEMENTS FOR FORWARD-LOOKING INFORMATION .......................................................

3

PART I.

ITEM 1. BUSINESS .................................................................................................................................................

3

ITEM 1A. RISK FACTORS ........................................................................................................................................

11

ITEM 1B. UNRESOLVED STAFF COMMENTS .....................................................................................................

26

ITEM 1C. CYBERSECURITY ...................................................................................................................................

26

ITEM 2. PROPERTIES .............................................................................................................................................

26

ITEM 3. LEGAL PROCEEDINGS ...........................................................................................................................

26

ITEM 4. MINE SAFETY DISCLOSURES ..............................................................................................................

26

EXECUTIVE OFFICERS OF THE REGISTRANT .................................................................................

27

PART II.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES .......................................................................

28

ITEM 6. [RESERVED] .............................................................................................................................................

29

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS ...................................................................................................................

30

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK ..........................

46

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ...........................................................

47

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE .....................................................................................................................

106

ITEM 9A. CONTROLS AND PROCEDURES ..........................................................................................................

107

ITEM 9B. OTHER INFORMATION ..........................................................................................................................

108

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS ......... 110

PART III.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE ...................................

110

ITEM 11. EXECUTIVE COMPENSATION .............................................................................................................

110

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS ................................................................................................

110

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE ......................................................................................................................................

111

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES ............................................................................

111

PART IV.

ITEM 15. EXHIBIT AND FINANCIAL STATEMENT SCHEDULES ...................................................................

112

ITEM 16.

FORM 10-K SUMMARY .......................................................................................................................... 112

INDEX TO EXHIBITS ..............................................................................................................................

113

SIGNATURES ...........................................................................................................................................

118

2

CAUTIONARY STATEMENTS FOR FORWARD-LOOKING INFORMATION

Unless otherwise indicated, references to "Johnson Controls," the "Company," "we," "our" and "us" in this Annual Report on

Form 10-K refer to Johnson Controls International plc and its consolidated subsidiaries.

The Company has made statements in this document that are forward-looking and therefore are subject to risks and

uncertainties. All statements in this document other than statements of historical fact are, or could be, "forward-

looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements

regarding the Company’s future financial position, sales, costs, earnings, cash flows, other measures of results of

operations, synergies and integration opportunities, capital expenditures, debt levels and market outlook are forward-looking

statements. Words such as "may," "will," "expect," "intend," "estimate," "anticipate," "believe," "should," "forecast," "project"

or "plan" and terms of similar meaning are also generally intended to identify forward-looking statements. However, the

absence of these words does not mean that a statement is not forward-looking. The Company cautions that these statements are

subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond the Company’s

control, that could cause the Company’s actual results to differ materially from those expressed or implied by such forward-

looking statements, including, among others, risks related to: The Company's ability to develop or acquire new products and

technologies that achieve market acceptance and meet applicable quality and regulatory requirements; the ability to manage

general economic, business and capital market conditions, including the impact of recessions, economic downturns and global

price inflation; fluctuations in the cost and availability of public and private financing for our customers; the ability to innovate

and adapt to emerging technologies, ideas and trends in the marketplace, including the incorporation of technologies such as

artificial intelligence; the ability to manage macroeconomic and geopolitical volatility, including shortages impacting the

availability of raw materials and component products and the conflicts between Russia and Ukraine and Israel and Hamas;

managing the risks and impacts of potential and actual security breaches, cyberattacks, privacy breaches or data breaches,

including business, service, or operational disruptions, the unauthorized access to or disclosure of data, financial loss,

reputational damage, increased response and remediation costs, legal, and regulatory proceedings or other unfavorable

outcomes; our ability to remediate our material weakness; maintaining and improving the capacity, reliability and security of

the Company's enterprise information technology infrastructure; the ability to manage the lifecycle cybersecurity risk in the

development, deployment and operation of the Company's digital platforms and services; changes to laws or policies governing

foreign trade, including economic sanctions, tariffs, foreign exchange and capital controls, import/export controls or other trade

restrictions; fluctuations in currency exchange rates; changes or uncertainty in laws, regulations, rates, policies, or

interpretations that impact the Company's business operations or tax status; the ability to adapt to global climate change, climate

change regulation and successfully meet the Company's public sustainability commitments; the outcome of litigation and

governmental proceedings; the risk of infringement or expiration of intellectual property rights; the Company's ability to

manage disruptions caused by catastrophic or geopolitical events, such as natural disasters, armed conflict, political change,

climate change, pandemics and outbreaks of contagious diseases and other adverse public health developments; the ability of

the Company to drive organizational improvement; any delay or inability of the Company to realize the expected benefits and

synergies of recent portfolio transactions; the ability to hire and retain senior management and other key personnel; the tax

treatment of recent portfolio transactions; significant transaction costs and/or unknown liabilities associated with such

transactions; labor shortages, work stoppages, union negotiations, labor disputes and other matters associated with the labor

force; and the cancellation of or changes to commercial arrangements. A detailed discussion of risks related to Johnson

Controls’ business is included in the section entitled "Risk Factors" (refer to Part I, Item 1A, of this Annual Report on Form 10-

K). The forward-looking statements included in this document are made only as of the date of this document, unless otherwise

specified, and, except as required by law, Johnson Controls assumes no obligation, and disclaims any obligation, to update such

statements to reflect events or circumstances occurring after the date of this document.

PART I

ITEM 1 BUSINESS

General

Johnson Controls International plc, headquartered in Cork, Ireland, is a global leader in smart, healthy and sustainable

buildings, serving a wide range of customers in more than 150 countries. The Company’s products, services, systems and

solutions advance the safety, comfort and intelligence of spaces to serve people, places and the planet. The Company is

committed to helping its customers win and creating greater value for all of its stakeholders through its strategic focus on

buildings.

Johnson Controls was originally incorporated in the state of Wisconsin in 1885 as Johnson Electric Service Company to

manufacture, install and service automatic temperature regulation systems for buildings and was renamed Johnson Controls,

3

Inc. in 1974. In 2005, Johnson Controls acquired York International, a global supplier of heating, ventilating and air-

conditioning ("HVAC") and refrigeration equipment and services. In 2014, Johnson Controls acquired Air Distribution

Technologies, Inc., one of the largest independent providers of air distribution and ventilation products in North America. In

2015, Johnson Controls formed a joint venture with Hitachi to expand its building related product offerings. In 2016, Johnson

Controls, Inc. and Tyco International plc ("Tyco") completed their combination (the "Merger"), combining Johnson Controls'

portfolio of building efficiency solutions with Tyco’s portfolio of fire and security solutions. Following the Merger, Tyco

changed its name to “Johnson Controls International plc.”

In 2016, the Company completed the spin-off of its automotive business into Adient plc, an independent, publicly traded

company. In 2019, the Company closed the sale of its Power Solutions business, completing the Company’s transformation into

a pure-play building technologies and solutions provider.

The Company is a global leader in engineering, manufacturing and commissioning building products and systems, including

residential and commercial HVAC equipment, industrial refrigeration systems, controls, security systems, fire-detection

systems and fire-suppression solutions. The Company further serves customers by providing technical services, including

maintenance, management, repair, retrofit and replacement of equipment (in the HVAC, industrial refrigeration, security and

fire-protection space), and energy-management consulting. The Company's OpenBlue digital software platform enables

enterprises to better manage their physical spaces by combining the Company's building products and services with cutting-

edge technology and digital capabilities to enable data-driven “smart building” services and solutions. The Company partners

with customers by leveraging its broad product portfolio and digital capabilities powered by OpenBlue, together with its direct

channel service and solutions capabilities, to deliver outcome-based solutions across the lifecycle of a building that address

customers’ needs to improve energy efficiency, enhance security, create healthy environments and reduce greenhouse gas

emissions.

Business Segments

The Company conducts its business through four business segments:

• Building Solutions North America which operates in the United States and Canada;

• Building Solutions EMEA/LA which operates in Europe, the Middle East, Africa and Latin America;

• Building Solutions Asia Pacific which operates in Asia Pacific; and

• Global Products which operates worldwide and includes the Johnson Controls-Hitachi joint venture.

The Building Solutions segments:

• Design, sell, install and service HVAC, controls, building management, refrigeration, integrated electronic security and

integrated fire-detection and suppression systems; and

• Provide energy-efficiency solutions and technical services, including data-driven "smart building" solutions as well as

inspection, scheduled maintenance, and repair and replacement of mechanical and controls systems.

The Global Products segment designs, manufactures and sells:

• HVAC equipment, controls software and software services for residential and commercial applications;

• Refrigeration equipment and controls;

• Fire protection and suppression; and

• Security products, including intrusion security, anti-theft devices, access control, and video surveillance and

management systems.

The Company’s segments provide products and services to commercial, institutional, industrial, data center, governmental and

residential customers.

For more information on the Company’s segments, refer to Note 19, "Segment Information," of the notes to consolidated

financial statements.

Products, Systems, Services and Solutions

The Company sells and installs its commercial HVAC equipment and systems, control systems, security systems, fire-detection

and fire suppression systems, equipment and services primarily through its extensive direct channel, consisting of a global

network of sales and service offices. Significant sales are also generated through global third-party channels, such as

4

distributors of air-conditioning, controls, security and fire-detection and suppression products. The Company’s large base of

current customers leads to significant repeat business for the maintenance, retrofit and replacement markets. The Company is

also able to leverage its installed base to generate sales for its service business. Trusted building brands, such as YORK®,

Hitachi Air Conditioning, Metasys®, Ansul, Ruskin®, Titus®, Frick®, FM:Systems®, PENN®, Sabroe®, Silent-Aire®,

Simplex® and Grinnell®, together with the breadth and depth of the products, systems and solutions offered by the Company,

give it what it believes to be the most diverse portfolio in the building technology industry.

The Company has developed software platforms, including on-premises platforms and cloud-based software services, and

integrated its products and services with digital capabilities to provide data-driven solutions to create smarter, safer and more

sustainable buildings. The Company's OpenBlue platform enables enterprises to better manage their physical spaces delivering

sustainability, new occupant experiences, safety and security by combining the Company’s building expertise with cutting-edge

technology, including artificial intelligence and machine learning-powered service solutions such as remote diagnostics,

predictive maintenance, workplace management, compliance monitoring and advanced risk assessments. The Company

leverages its digital and data-driven products and services to offer integrated and customizable solutions focused on delivering

outcomes to customers, including OpenBlue Buildings-as-a-Service, OpenBlue Net Zero Buildings-as-a-Service and OpenBlue

Healthy Buildings. These services are generally designed to generate recurring revenue for the Company as it supports its

customers in achieving their desired outcomes.

In fiscal 2023, products and systems accounted for 76% of sales and services accounted for 24% of sales.

Competition

The Company conducts its operations through a significant number of individual contracts that are either negotiated or awarded

on a competitive basis. Key factors in the award of contracts include system and service performance, quality, price, design,

reputation, technology, application engineering capability, availability of financing and construction or project management

expertise. Competitors for HVAC equipment, security, fire-detection, fire suppression and controls in the residential and non-

residential marketplace include many local, regional, national and international providers. Larger competitors include

Honeywell International, Inc.; Siemens Smart Infrastructure, an operating group of Siemens AG; Schneider Electric SA; Carrier

Global Corporation; Trane Technologies plc; Daikin Industries, Ltd.; Lennox International, Inc.; GC Midea Holding Co, Ltd.

and Gree Electric Appliances, Inc. In addition, the Company competes in a highly fragmented building services market. The

Company also faces competition from a diverse range of established companies, start-ups and other emerging entrants to the

buildings industry in the areas of digital services, software as a service and the Internet of Things. The loss of any individual

contract or customer would not have a material adverse effect on the Company.

Business Strategy

The Company’s business strategy is to sustain and expand its position as a leader in smart and sustainable building solutions by

offering a full spectrum of products and solutions for customer buildings across the globe. The Company’s core strategy

remains focused on creating growth platforms, driving operational improvements and creating a high-performance culture. The

Company has strong positions in attractive and growing end-markets across HVAC, controls, fire, security and services,

enhanced by its comprehensive product portfolio and substantial installed base. The Company believes that it is well positioned

to capitalize on the emerging and prevalent trends in the buildings industry, including sustainability, healthy buildings/indoor

environmental quality and smart buildings. To capitalize on these trends, the Company remains focused on maintaining leading

positions in delivering building products, systems and solutions, as well as enabling growth through digital, to develop and

leverage new digital technologies and capabilities into outcomes powered by its OpenBlue software platform. In furtherance of

these goals, the Company has three strategic priorities:

Capitalize on Key Growth Vectors: Sustainability, healthy buildings/indoor environmental quality and smart buildings represent

key growth opportunities for the Company. The Company seeks to leverage its existing portfolio breadth and investments in

product development, combined with the expansion of its digital products and capabilities powered by OpenBlue, to offer

differentiated solutions and innovative deal structures to help customers achieve their objectives. The Company intends to

expand its capabilities by investing in products and technologies, as well as expanding its partnerships, to power innovation that

will allow it to provide differentiated services that are tailored to its customers’ desired outcomes.

Accelerate in High Growth Digital Services, Regions and Verticals: The Company is focused on transforming its large service

business through digital technology, further enabled by the Company’s installed base, domain expertise and global coverage.

The Company is focused on developing and deploying connected equipment, systems and controls that will support the

provision of digital services and solutions. The Company further intends to expand its presence in high growth regions and

5

invest in high growth verticals within the markets it serves, including healthcare, commercial offices/campus, education and

data centers.

Sustain a High-Performance, Customer-Centric Culture: The Company recognizes that developing talent and creating positive

customer experiences is central to accomplishing its business strategies. The Company is investing in its talent to build a

diverse workforce that is digital capable, solutions oriented and focused on continuous learning and growth. The Company aims

to leverage its talent capabilities and training to create a customer-focused culture to drive customer loyalty and decisions.

To realize these priorities, the Company is leveraging its technology leadership, comprehensive product portfolio, global

presence, substantial installed base and strong channels to monetize the lifecycle opportunities of install, service, retrofit and

replacement which are established and delivered by the Company’s direct field businesses and third-party channels across the

globe. The Company is augmenting its strategic priorities with disciplined execution, productivity enhancements and

sustainable cost management to create a path to realize expanded margins and enhanced profitability.

Backlog

The Company’s backlog is applicable to its sales of systems and services. At September 30, 2023, the backlog was

$13.6 billion, of which $12.1 billion was attributable to the building solutions (field) business. The backlog amount outstanding

at any given time is not necessarily indicative of the amount of revenue to be earned in the upcoming fiscal year.

At September 30, 2023, remaining performance obligations were $19.6 billion, which is $6.0 billion higher than the Company's

backlog of $13.6 billion. Differences between the Company’s remaining performance obligations and backlog are primarily due

to the following:

• Remaining performance obligations include large, multi-purpose contracts including services to be performed over the

initial term of the building contract (typically 25 to 35 years) versus backlog which includes only the lifecycle period

of the contract (approximately five years);

• Remaining performance obligations exclude certain customer contracts with a term of one year or less and contracts

that are cancellable without substantial penalty versus backlog which includes short-term and cancellable contracts;

and

• Remaining performance obligations include the full remaining term of service contracts with substantial termination

penalties versus backlog which includes one year for all outstanding service contracts.

The Company believes backlog is a useful measure of evaluating the Company's operational performance and relationship to

total orders.

Raw Materials

Raw materials used by the Company’s businesses in connection with their operations include steel, aluminum, brass, copper,

polypropylene and certain flurochemicals used in fire suppression agents. The Company also uses semiconductors and other

electronic components in the manufacture of its products. During fiscal 2022 and portions of fiscal 2023, the Company

experienced material cost increases due to global inflation, supply chain disruptions, labor shortages, increased demand and

other regulatory and macroeconomic factors. The collective impact of these trends were favorable to revenue due to increased

demand and price increases to offset inflation, while negatively impacting margins due to supply chain disruptions and cost

pressures. However, throughout fiscal 2023, the Company experienced improved margins as supply chain disruptions eased and

higher priced backlog was converted to sales, as discussed in Item 7. Management's Discussion and Analysis of Financial

Condition and Results of Operations. Although the Company has experienced recent improvement in its supply chain, the

Company could experience further disruptions, shortages and price inflation in the future, the effect of which will depend on the

Company’s ability to successfully mitigate and offset the impact of these events. In fiscal 2024, commodity prices and

availability could fluctuate throughout the year and could significantly affect the Company’s results of operations. For a more

detailed description of the risks related to the availability of raw materials, components and commodities, see Item 1A. Risk

Factors.

Intellectual Property

Generally, the Company seeks statutory protection for strategic or financially important intellectual property developed in

connection with its business. The Company protects its intellectual property investments in a variety of ways. The Company

works actively in the U.S. and internationally to ensure the enforcement of copyright, trademark, trade secret, and other

6

protections that apply to the Company's products, services, software, solutions, and branding. Certain intellectual property,

where appropriate, is protected by contracts, licenses, confidentiality or other agreements.

The Company owns numerous U.S. and non-U.S. patents (and their respective counterparts), the more important of which cover

those technologies and inventions embodied in current products or which are used in the manufacture of those products.

Internal development allows the Company to maintain competitive advantages that come from product differentiation and

closer technical control over its products and services. While the Company believes patents are important to its business

operations and in the aggregate constitute a valuable asset, no single patent, or group of patents, is critical to the success of the

business. The Company, from time to time, grants licenses under its patents and technology and receives licenses under patents

and technology of others.

The Company’s trademarks, certain of which are material to its business, are registered or otherwise legally protected in the

U.S. and many non-U.S. countries where products and services of the Company are sold. The Company, from time to time,

becomes involved in trademark licensing transactions.

Most works of authorship produced for the Company, such as computer programs, catalogs and sales literature, carry

appropriate notices indicating the Company’s claim to copyright protection under U.S. law and appropriate international

treaties.

Environmental, Health and Safety Matters

Laws addressing the protection of the environment and workers’ safety and health govern the Company’s ongoing global

operations. They generally provide for civil and criminal penalties, as well as injunctive and remedial relief, for noncompliance

or require remediation of sites where Company-related materials have been released into the environment.

A portion of the Company’s products consume energy and use refrigerants. Increased public awareness and concern regarding

global climate change has resulted in more regulations designed to reduce greenhouse gas emissions. These regulations tend to

be implemented under global, national and sub-national climate objectives or policies, and target the global warming potential

(“GWP”) of refrigerants, equipment energy efficiency, and the combustion of fossil fuels as a heating source. The Company

continues to invest in its product portfolio to meet emerging emissions regulations and standards.

The Company has expended substantial resources globally, both financial and managerial, to comply with environmental laws

and worker safety laws and maintains procedures designed to foster and ensure compliance. Certain of the Company’s

businesses are, or have been, engaged in the handling or use of substances that may impact workplace health and safety or the

environment. The Company is committed to protecting its workers and the environment against the risks associated with these

substances.

The Company’s operations and facilities have been, and in the future may become, the subject of formal or informal

enforcement actions or proceedings for noncompliance with environmental laws and worker safety laws or for the remediation

of Company-related substances released into the environment. Such matters typically are resolved with regulatory authorities

through commitments to compliance, abatement or remediation programs and, in some cases, payment of penalties. In addition,

governments in the United States and internationally have increasingly been regulating perfluorooctane sulfonate ("PFOS"),

perfluorooctanoic acid ("PFOA"), and/or other per- and poly-fluoroalkyl substances ("PFAS"), which are contained in certain of

the Company's firefighting foam products. These regulations include declining emission standards and limits set as to the

presence of certain compounds. See Note 21, "Commitments and Contingencies," of the notes to consolidated financial

statements for further discussion of environmental matters.

Government Regulation and Supervision

The Company's operations are subject to numerous federal, state and local laws and regulations, both within and outside the

United States, in areas such as consumer protection, government contracts, international trade, environmental protection, labor

and employment, tax, licensing and others. For example, most U.S. states and non-U.S. jurisdictions in which the Company

operates have licensing laws directed specifically toward the alarm and fire suppression industries. The Company's security

businesses currently rely extensively upon the use of wireline and wireless telephone service to communicate signals. Wireline

and wireless telephone companies in the U.S. are regulated by the federal and state governments. In addition, government

regulation of fire safety codes can impact the Company's fire businesses. The Company’s businesses may also be affected by

changes in governmental regulation of refrigerants, PFAS, energy efficiency standards, noise regulation and product safety

regulations, including changes related to hydro fluorocarbons/emissions reduction efforts, energy conservation standards and

the regulation of fluorinated gases. These and other laws and regulations impact the manner in which the Company conducts its

7

business, and changes in legislation or government policies can affect the Company's worldwide operations, both favorably and

unfavorably. For a more detailed description of the various laws and regulations that affect the Company's business, see

Item 1A. Risk Factors.

Regulatory Capital Expenditures

The Company’s efforts to comply with numerous federal, state and local laws and regulations applicable to its business and

products often results in capital expenditures. The Company makes capital expenditures to design and upgrade its fire and

security products to comply with or exceed standards applicable to the alarm, fire suppression and security industries. The

Company also makes capital expenditures to meet or exceed energy efficiency standards and comply with applicable

regulations, including the regulation of refrigerants, hydro fluorocarbons/emissions reduction efforts and the regulation of

fluorinated gasses, particularly with respect to the Company’s HVAC products and solutions. The Company’s ongoing

environmental compliance program also results in capital expenditures. Regulatory and environmental considerations are a part

of all significant capital expenditure decisions; however, expenditures in fiscal 2023 related solely to regulatory compliance

were not material. It is management’s expectation that the amount of any future capital expenditures related to compliance with

any individual regulation or grouping of related regulations will not have a material adverse effect on the Company’s financial

results or competitive position in any one year. See Note 21, "Commitments and Contingencies," of the notes to consolidated

financial statements for further discussion of environmental matters.

Human Capital Management

Overview and Governance

The development of a High-Performance Culture enables the Company to achieve its purpose to build smarter, healthier, and

more sustainable tomorrows. The Company’s strategic drivers provide the direction that guides its workforce toward a culture

of continuous improvement and innovation to exceed customers’ expectations and provide solutions for global challenges in the

building systems industry.

The responsibility to develop and maintain a High-Performance Culture is owned, embedded and executed throughout the

Company. The Chief Human Resources Officer ("CHRO") is responsible for establishing the Company’s strategy to drive a

High-Performance Culture and ensuring its execution across the Company. The Compensation and Talent Development

Committee of the Board of Directors is the primary overseer of the Company’s High-Performance Culture strategy and

execution, ensuring that the Company presents an employee value proposition that supports retention and the attraction of

external talent. The Governance and Sustainability Committee is the primary overseer of employee health and safety. The Chief

Executive Officer ("CEO"), the CHRO, the General Counsel, the Vice President of Global Environment Health & Safety, the

Vice President of Diversity, Equity and Inclusion and other senior leaders within the Company are responsible for the execution

of the strategy and engage with the Compensation and Talent Development Committee, the Governance and Sustainability

Committee and the full Board of Directors on the critical components driving the Company’s High-Performance Culture,

including discussions of future of work, human capital trends, processes and practices, diversity, equity and inclusion, health

and safety, talent development, succession planning, and talent and culture best practices. Key components driving the

Company’s High-Performance Culture include:

Health and Safety

Health and Wellness, Safety and Environment are the three pillars of the Company’s Zero Harm vision. The Company’s health

and safety programs are designed around global standards with appropriate variations addressing multiple jurisdictions and

regulations, specific hazards and unique working environments of the Company’s manufacturing, service and install, and

headquarter operations.

The Company requires each of its locations to perform regular safety audits to ensure proper safety policies, program

procedures, analyses and training are in place. In addition, the Company engages an independent third-party conformity

assessment and certification vendor to audit selected operations for adherence to its global health and safety standards. Safety

culture and values-based safety initiatives have been deployed within the Company to sustain and further enhance performance.

The Company utilizes a mixture of leading and lagging indicators to assess the health and safety performance of its operations.

Lagging indicators include the OSHA Total Recordable Incident Rate ("TRIR") and the Lost Time (or Lost Workday) Incident

Rate ("LTIR") based upon the number of incidents per 100 employees (or per 200,000 work hours). In fiscal 2023, the

Company had a TRIR of 0.37 and a LTIR of 0.12.

8

Diversity, Equity and Inclusion

The Company is dedicated to creating a workplace where diversity is celebrated, where every employee feels included and

valued, and where equitable practices are the norm. By prioritizing diversity, equity, and inclusion, the Company aims to foster

a culture of innovation, collaboration, and respect that drives its success in the global marketplace. Diversity, Equity, and

Inclusion (“DEI”) is a core component of the Company’s strategy to drive a High-Performance Culture, recognized as adding

value to the Company’s creation and delivery of innovative high performing products and enabling solutions to its customers’

toughest problems. The Company has recently elevated its focus on ‘equity’ to further enable all employees to have access to

the opportunities, resources, support and networks they need to develop and succeed. The Company empowers employees to

take an active role in creating a culture that values uniqueness, celebrates creativity and drives innovation. The Company

encourages employees to enable an inclusive culture through active participation in Business Resource Groups ("BRGs") -

employee-led voluntary organizations of people with similar interests, experiences, or demographic characteristics. The

Company continues to increase participation in its BRG chapters worldwide across nine categories: African American, Asia

Pacific, LGBTQ+, Emerging Leaders, Hispanic, Disabilities, Veterans, Women and Sustainability. In 2023, the Company

established BRGs focused on Wellness and Caregiving in response to feedback through its Voice of the Employee events. Each

BRG is open to all employees and sponsored and supported by senior leaders across the enterprise. The Company’s BRG

structure includes monthly learning series, an active recruitment platform, an innovation hub, community engagement and

feedback sessions. The Company also engages BRGs to support the acquisition and development of diverse talent internally and

externally.

As a world leader in building technologies, the Company is committed to enabling employees to bring their authentic selves to

work each day, which in turn adds value, fosters creativity, and inspires change across the organization. The Company

recognizes that it is its people that make the Company exceptional. The Company has developed robust policies and strategies

to support this vision in its operations and its communities, including strategies addressing social impact and employee

experience. The Company is committed to the implementation of its DEI mission, vision and roadmap including a focus on

employee experience, business resource groups, learning and development and external impact.

The Company recognizes that fostering a diverse, equitable, and inclusive environment requires ongoing commitment,

accountability, and continuous improvement. The Company regularly assesses its progress, recognizes employee contributions,

and holds leaders accountable for driving DEI initiatives. The Company also creates mechanisms for open dialogue and

feedback from employees to ensure that everyone’s voices are heard.

The Company has implemented several measures that focus on ensuring accountabilities exist for fostering a diverse, equitable

and inclusive environment:

• Diversity Objectives: The CEO and other senior leaders have diversity and inclusion objectives in their annual

performance goals.

• Attracting Diverse Talent: BRGs are instrumental in positively impacting the attraction of diverse talent to the

Company. BRGs support these efforts through external engagement and support of talent acquisition sourcing

initiatives. The Company’s global flagship Future Leaders Internship Program continues to expand the diversity of its

outreach and focus on the skills needed to advance the Company’s growth initiatives.

• Honoring Employee Contributions: The Company’s Diversity Distinction Awards serve as a recognition and

encouragement for workforce contributions to the Company’s DEI efforts. Awarded to eight employees three times per

year, the nomination driven Diversity Distinction Awards have become a highly regarded recognition of employee’s

contribution to the progress of the Company’s DEI journey.

Talent Development

To maintain a High-Performance Culture, the Company must ensure the continued development and advancement of its

employees. The Company has adopted a continual improvement approach to talent development, working to support

employees’ growth while defining the skills and capabilities the organization will need in future years. To assess current

enterprise capabilities and define future needs, strategic talent reviews and succession planning occur on a planned cadence

annually – globally and across all business areas. The Company continues to provide opportunities for its employees to grow

their careers, with approximately half of open management positions filled internally during fiscal year 2023.

The Company believes that high performance is an outcome of an employee’s ability to change, adapt, and grow their

capabilities throughout their career. This talent development approach includes self and multi-rater assessments, functional and

9

leadership competency models, providing employees a personalized approach to their development planning and skill

acquisition. The Company emphasizes real-life, real-time learning that enables each employee to meet the demands of

challenging and changing work and focuses on reinforcing key principles that are designed to support an individual’s

effectiveness in his or her current job and in their future development. The Company provides technical and leadership training

to employees, customers and suppliers who work for or with the Company’s products and services.

The Company’s focus on employee development has been structured over the last several years through programs designed to

imbed essential skills with employees and reinforce strategic goals aligning with the Company’s culture, including:

• Digital Transformation: In support of Company’s growth strategy, the Company is investing in developing digital

leadership with personalized and targeted training programs designed to create digitally capable leaders, salespersons,

engineers and technicians.

• Diversity and Inclusion: The Company has developed a structured diversity and inclusion training curriculum across

the levels and stages of individuals' careers to develop and align employees with the Company’s diversity and

inclusion strategy and values. In fiscal year 2023, the Company expanded the diversity curriculum, adding new

training programs to develop careers of under-represented talent and a toolkit for managers to guide their self-led

inclusion efforts.

• Organizational Engagement: The Company periodically measures the engagement of its employees using a quarterly

pulse survey. In fiscal 2023, the survey was launched and conducted three times. The engagement survey provides

managers with their own data dashboard to view their own engagement results and can be utilized by managers at all

levels to understand how to improve the Company’s culture and employee engagement. Managers are provided with

resources to interpret their results and plan their actions following each survey.

In fiscal 2023, the Company offered a robust curriculum of over 197,000 activities that were completed by employees,

consisting of videos, courses, e-learning, documentation, articles and books, including over 4,000 active (in person or virtual)

learning courses. In fiscal 2023, over 1.26 million learning activities were completed by approximately 86,300 employees. The

total learning hours consumed by employees was 1.22 million hours, averaging almost 14 hours per employee including time

invested in formal learning and standard time invested in self-paced reading or video consumption.

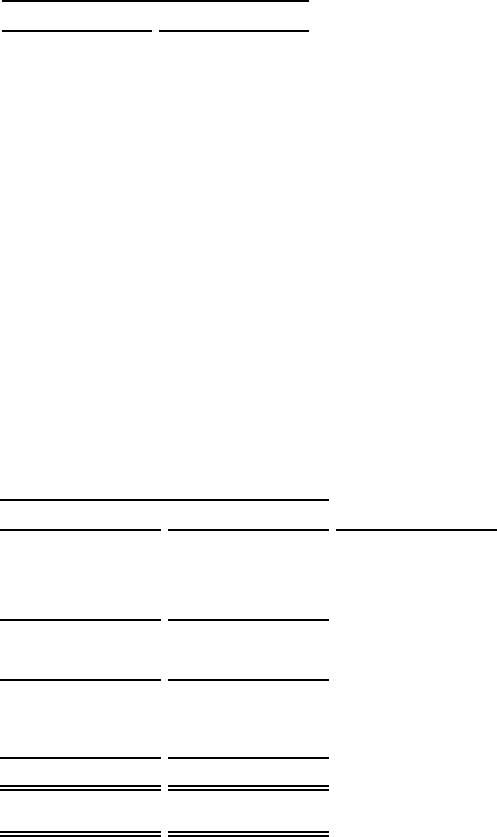

Employee Population and Demographics

As of September 30, 2023, the Company employed approximately 100,000 people worldwide, of which approximately 37,000

were employed in the United States and approximately 63,000 were outside the United States. Approximately 22,000

employees are covered by collective bargaining agreements or works councils and the Company believes that its relations with

its labor unions are generally positive.

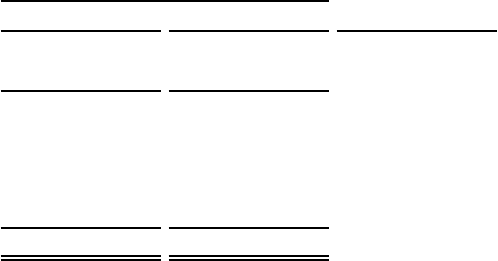

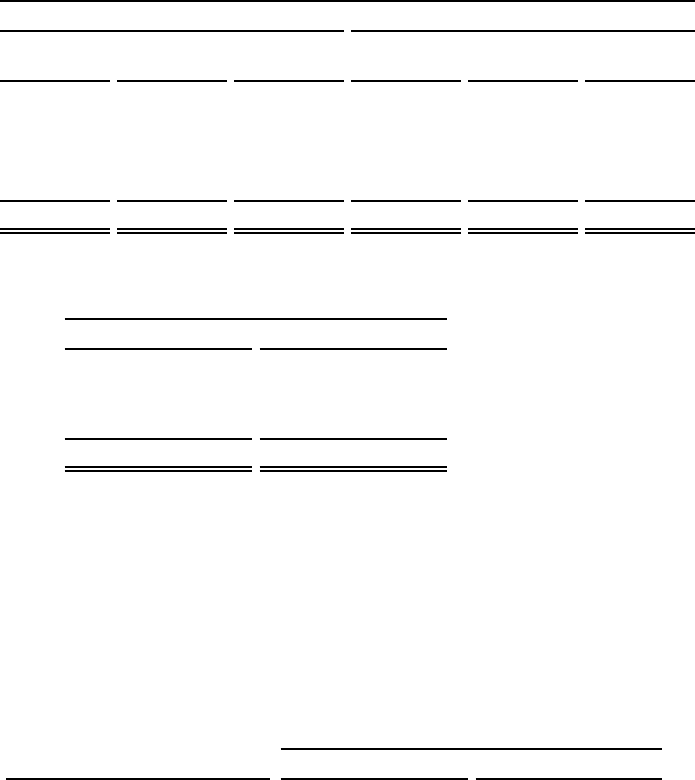

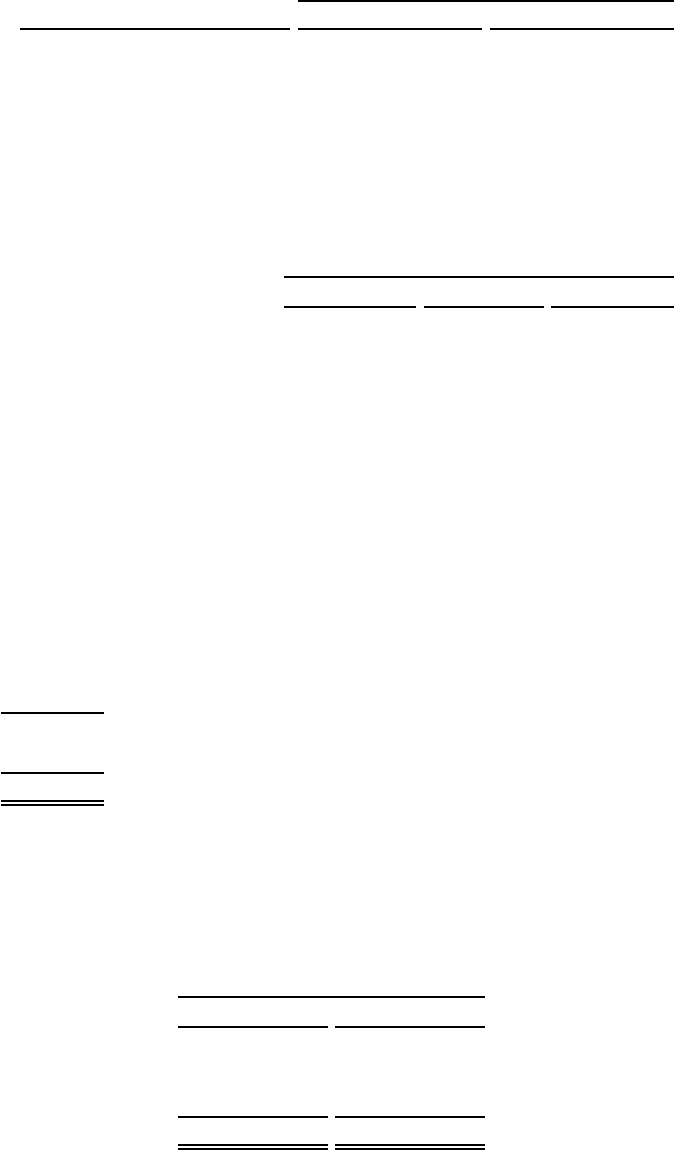

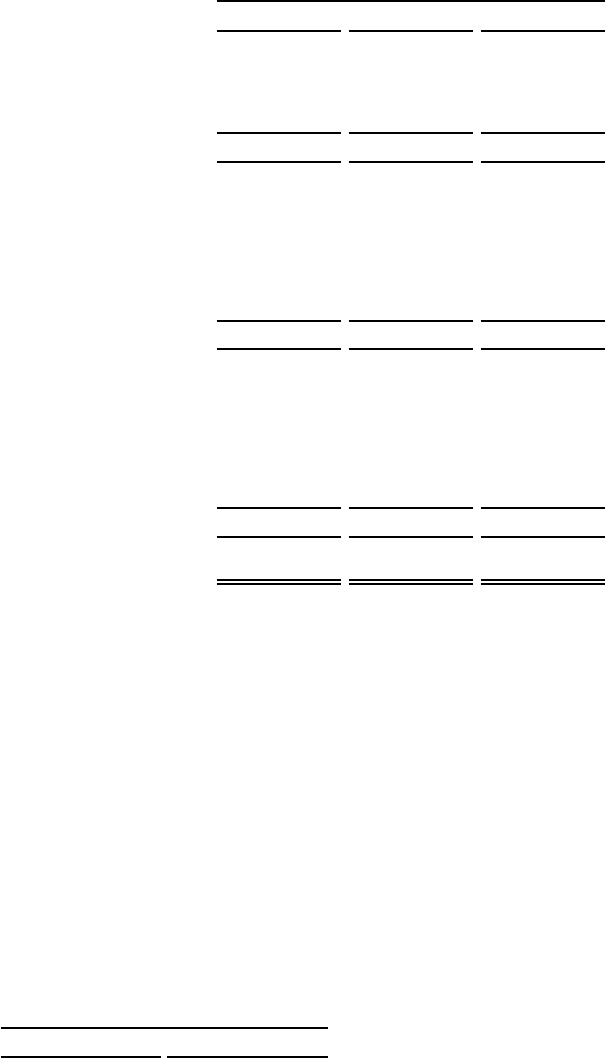

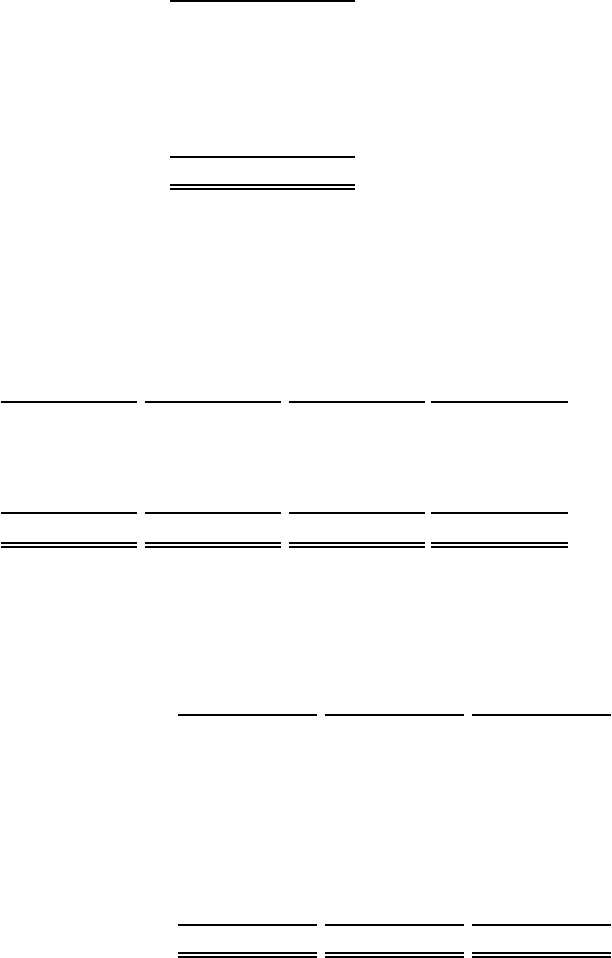

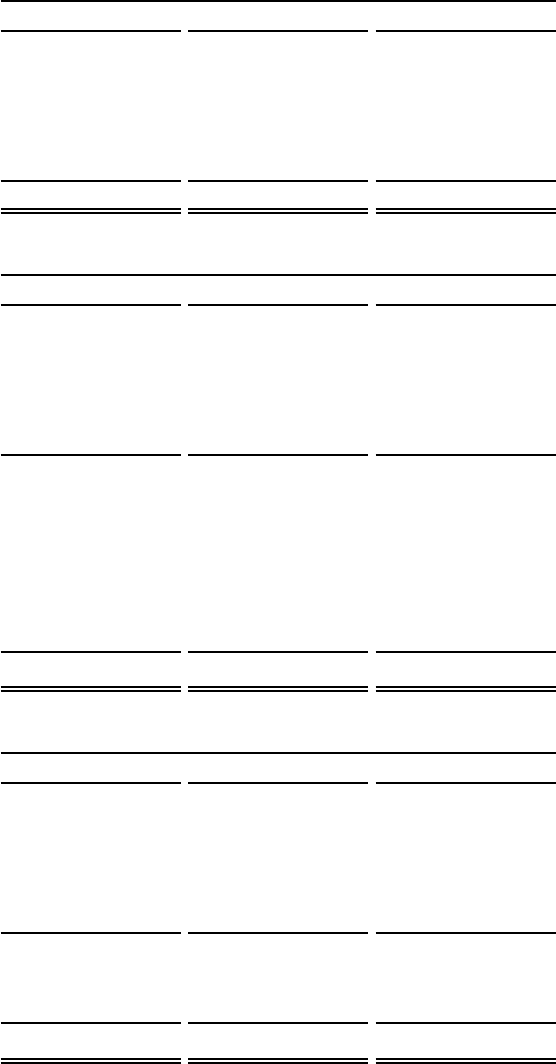

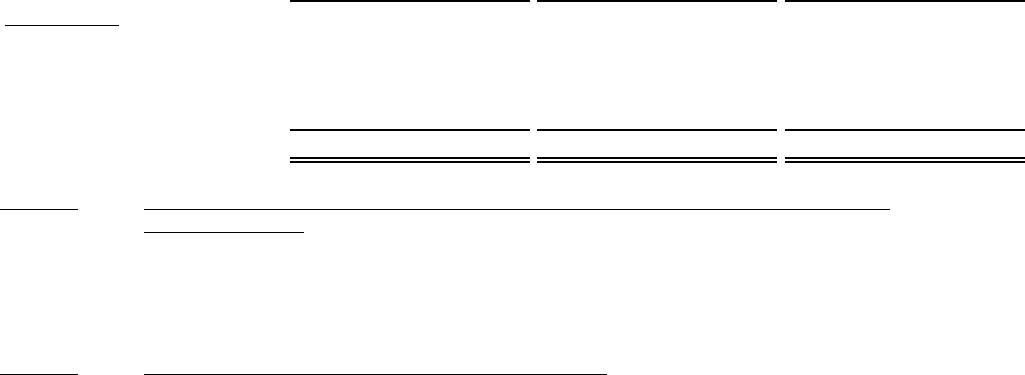

Employee Diversity as of September 30, 2023

Male Female Minority

(1)

Total employees 76% 24% 32%

Managers 79% 21% 22%

(1)

Male and female data represents all employees globally. Minority data represents U.S. employees only.

Seasonal Factors

Certain of the Company's sales are seasonal as the demand for residential air conditioning equipment and services generally

increases in the summer months. This seasonality is mitigated by the other products and services provided by the Company that

have no material seasonal effect.

10

Research and Development Expenditures

Refer to Note 1, "Summary of Significant Accounting Policies," of the notes to consolidated financial statements for research

and development expenditures. The Company has committed to invest a substantial portion of its new product research and

development in climate-related innovation to develop sustainable products and services. The Company invests in enhancements

to the capabilities of its product lines and services to support its strategy, meet consumer preferences and achieve regulatory

compliance. This includes investments in the development of the Company’s OpenBlue platform and related service offerings,

digital product capabilities, energy efficient products, and low GWP refrigerants and technology.

Available Information

The Company’s filings with the U.S. Securities and Exchange Commission ("SEC"), including annual reports on Form 10-K,

quarterly reports on Form 10-Q, definitive proxy statements on Schedule 14A, current reports on Form 8-K, and any

amendments to those reports filed pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, are made available

free of charge through the Investor Relations section of the Company’s Internet website at http://www.johnsoncontrols.com as

soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. Copies of

any materials the Company files with the SEC can also be obtained free of charge through the SEC’s website at http://

www.sec.gov. The Company also makes available, free of charge, its Code of Ethics, Corporate Governance Guidelines, Board

of Directors committee charters and other information related to the Company on the Company’s Internet website or in printed

form upon request. The Company is not including the information contained on the Company’s website as a part of, or

incorporating it by reference into, this Annual Report on Form 10-K.

ITEM 1A RISK FACTORS

Provided below is a cautionary discussion of what we believe to be the most important risk factors applicable to the Company.

Discussion of these factors is incorporated by reference into and considered an integral part of Part II, Item 7, “Management’s

Discussion and Analysis of Financial Conditions and Results of Operations.” The disclosure of a risk should not be interpreted

to imply that such risk has not already materialized. Additional risks not currently known to the Company or that the Company

currently believes are immaterial may also impair the Company’s business, financial condition, results of operations and cash

flows.

Risks Related to Our Business Operations

Our future growth is dependent upon our ability to develop or acquire new products and technologies that achieve

market acceptance with acceptable margins.

Our future success depends on our ability to develop or acquire, manufacture and bring competitive, and increasingly complex,

products and services to market quickly and cost-effectively. Our ability to develop or acquire new products, services and

technologies requires the investment of significant resources. These acquisitions and development efforts divert resources from

other potential investments in our businesses, and they may not lead to the development of new technologies, products or

services on a timely basis. Further, we must continue to effectively adapt our products and services to a changing technological

and regulatory environment to drive growth and defend against disruption caused by competitors, regulators or other external

forces impacting our business and operations. If we are unable to be agile and responsive to disruption in the development of

new products, services and technologies, including technologies such as artificial intelligence and machine learning, our

business, financial condition, results of operations and cash flows could be adversely affected.

Moreover, as we introduce new products, we may be unable to detect and correct defects in the design of a product or in its

application to a specified use, which could result in loss of sales or delays in market acceptance. Even after introduction, new or

enhanced products may not satisfy customer preferences and product failures may cause customers to reject our products.

Further, as we integrate emerging and rapidly evolving technologies such as artificial intelligence and machine learning into our

products and services, we may not be able to anticipate or identify vulnerabilities, design flaws or security threats resulting from

the use of such technology and develop adequate protection measures. As a result, these products may not achieve market

acceptance and our brand image could suffer. We must also attract, develop and retain individuals with the requisite technical

expertise and understanding of customers’ needs to develop new technologies and introduce new products, particularly as we

increase investment in our digital services and solutions business and our OpenBlue software platform. The laws and

regulations applicable to our products, and our customers’ product and service needs, change from time to time, and regulatory

changes may render our products and technologies noncompliant or result in new or enhanced regulatory scrutiny. In addition,

the markets for our products, services and technologies may not develop or grow as we anticipate. The failure of our

technology, products or services to gain market acceptance due to more attractive offerings by our competitors, the introduction

11

of new competitors to the market with new or innovative product offerings or the failure to address any of the above factors

could significantly reduce our revenues, increase our operating costs or otherwise materially and adversely affect our business,

financial condition, results of operations and cash flows.

Failure to achieve and maintain a high level of product and service quality could damage our reputation with customers

and negatively impact our results.

Product and service quality issues could harm customer confidence in our company and our brands. If certain of our product

and service offerings do not meet applicable safety standards or our customers’ expectations regarding quality, safety or

performance, we could experience lost sales and increased costs and we could be exposed to legal, financial and reputational

risks. In addition, when our products fail to perform as expected, we are exposed to warranty, product liability, personal injury

and other claims. We have experienced such quality issues in the past and may experience such issues in the future.

We cannot be certain that our quality controls and procedures will reveal defects in our products or their raw materials, which

may not become apparent until after the products have been placed in use in the market. Accordingly, there is a risk that

products will have defects, which could require a product recall or field corrective action. Such remedial actions can be

expensive to implement and may damage our reputation, customer relationships and market share. We have conducted product

recalls and field corrective actions in the past and may do so again in the future.

In many jurisdictions, product liability claims are not limited to any specified amount of recovery. If any such claims or

contribution requests or requirements exceed our available insurance or if there is a product recall, there could be an adverse

impact on our results of operations. In addition, a recall or claim could require us to review some or all of our product portfolio

to assess whether similar issues are present in other products, which could result in a significant disruption to our business and

which could have a further adverse impact on our business, financial condition, results of operations and cash flows. There can

be no assurance that we will not experience any material warranty or product liability claims in the future, that we will not incur

significant costs to defend such claims or that we will have adequate reserves to cover any recall, repair and replacement costs.

Failure to increase organizational effectiveness through organizational improvements may reduce our profitability or

adversely impact our business.

Our results of operations, financial condition and cash flows are dependent upon our ability to drive organizational

improvement. We seek to drive improvements through a variety of actions, including restructuring and integration activities,

digital transformation, business portfolio reviews, productivity initiatives, functionalization, executive management changes,

and business and operating model assessments. Risks associated with these actions include delays in execution, additional

unexpected costs, realization of fewer than estimated productivity improvements, increased change fatigue, organizational

strain and adverse effects on employee morale. We may not realize the full operational or financial benefits we expect, the

recognition of these benefits may be delayed, and these actions may potentially disrupt our operations. In addition, our failure to

effectively manage organizational changes may lead to increased attrition and harm our ability to attract and retain key talent.

Cybersecurity incidents impacting our IT systems and digital products could disrupt business operations, result in the

loss of critical and confidential information, and materially and adversely affect our reputation and results of

operations.

We rely upon the capacity, reliability and security of our IT and data security infrastructure and our ability to expand and

continually update this infrastructure in response to the changing needs of our business. As we implement new systems or

integrate existing systems, they may not perform as expected. We also face the challenge of supporting our older systems,

which are vulnerable to increased risks, including the risk of further security breaches, system failures and disruptions, and

implementing necessary upgrades. In addition, certain of our employees work remotely at times, which increases our

vulnerability to cybersecurity and other IT risks. If we experience a problem with the functioning of an important IT system as a

result of increased burdens placed on our IT infrastructure or a security breach of our IT systems, the resulting disruptions could

have a material adverse effect on our business.

Global cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to IT

systems to sophisticated and targeted measures known as advanced persistent threats directed at the Company, its products, its

customers and/or its third-party service providers, including cloud providers. These threats and incidents originate from many

sources globally and include malware that takes the form of computer viruses, ransomware, worms, Trojan horses, spyware,

adware, scareware, rogue software, and programs that act against the computer user. Techniques used to obtain unauthorized

access to, or to sabotage, IT systems or networks are constantly evolving and may not be recognized until launched against a

12

target. We and third parties we utilize as vendors to support our business and operations have experienced, and expect to

continue to experience, these types of threats and incidents. We and our third-party service providers have experienced and

expect to continue to experience threats from sophisticated nation-state actors and organized criminal groups who engage in

attacks (including advanced persistent threat intrusions) that add to the risks to our IT systems (including our cloud services

providers’ systems), internal networks, our customers’ systems and the information that they store and process. Our customers,

including the U.S. government, are increasingly requiring cybersecurity protections and mandating cybersecurity standards in

our products, and we may incur additional costs to comply with such demands. We deploy countermeasures to deter, prevent,

detect, respond to and mitigate these threats, including identity and access controls, data protection, vulnerability assessments,

product software designs which we believe are less susceptible to cyber-attacks, monitoring of our IT networks and systems,

maintenance of backup and protective systems and the incorporation of cybersecurity design throughout the lifecycle of our

products. Despite these efforts, the Company has experienced, and will likely continue to experience, attacks and resulting

breaches or breakdowns of the Company’s, or its third-party service providers’, databases or systems. Cybersecurity incidents,

depending on their nature and scope, have resulted, and may in the future result, in the misappropriation, destruction, corruption

or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption

of business operations. Such incidents have remained, and could in the future remain, undetected for an extended period of

time, and the losses arising from such incidents could exceed our available insurance coverage for such matters. In addition,

security breaches impacting our IT systems have in certain cases resulted in, and in the future could result in, a risk of loss or

unauthorized disclosure or theft of information, which could lead to enforcement actions, litigation, regulatory or governmental

audits, investigations and possible liability.

An increasing number of our products, services and technologies, including our OpenBlue software platform, are delivered with

digital capabilities and accompanying interconnected device networks, which include sensors, data, building management

systems and advanced computing and analytics capabilities. If we are unable to manage the lifecycle cybersecurity risk in

development, deployment and operation of our digital platforms and services, they could become susceptible to cybersecurity

incidents and lead to third-party claims that our product failures have caused damages to our customers. This risk is enhanced

by the increasingly connected nature of our products and the role they play in managing building systems.

During the fourth quarter of fiscal 2023, we experienced a cybersecurity incident that disrupted portions of our internal

information technology infrastructure and applications consisting of unauthorized access by a third party, exfiltration of data

and the deployment of ransomware, which in turn caused disruptions and limitation of access to portions of our business

applications that support aspects of our operations and corporate functions. As a result of this incident, we experienced

disruptions to our normal operations which had an adverse impact on our financial performance, as discussed in Item 7,

Management’s Discussion and Analysis of Financial Condition and Results of Operations. We have and may continue to incur

significant costs in connection with the cybersecurity incident and any future cybersecurity incidents, including infrastructure

investments or remediation efforts. Further, we could experience other additional consequences in the future as a result of the

incident, including, reputational damage, exposure to legal claims or enforcement actions and fines levied by governmental

organizations, which in turn could materially and adversely affect our results of operations. In addition, limitations on our

ability to analyze and investigate the incident due to limitations on the availability of historical logs and other forensic data may

impact our ability to identify all of the impacts and root causes of the cybersecurity incident. There can be no assurance that

additional unauthorized access or cyber incidents will not occur or that we will not suffer material losses in the future.

Unauthorized access or cyber incidents could occur more frequently and on a more significant scale to those we have suffered

to date. We could also experience similar consequences as a result of future cybersecurity incidents. Other potential

consequences of future cybersecurity incidents could include the theft of intellectual property and the diminution in the value of

our investment in research, development and engineering, which in turn could materially and adversely affect our

competitiveness and results of operations.

We identified a material weakness in our internal control over financial reporting which, if not remediated

appropriately or timely, could result in the loss of investor confidence and adversely impact our business operations and

our stock price.

As a result of the cybersecurity incident experienced beginning in September 2023, and as disclosed in Part II, Item 9A of this

report, we have identified a material weakness in our internal control over financial reporting related to not maintaining

sufficient information technology (“IT”) controls to prevent or detect, on a timely basis, unauthorized access to certain of the

Company’s financial reporting systems. Accordingly, management concluded that our internal control over financial reporting

was not effective as of September 30, 2023. If we are unable to remediate the material weakness, or if we are otherwise unable

to maintain effective internal control over financial reporting, then our ability to record, process and report financial information

accurately, and to prepare financial statements within required time periods, could be adversely affected. If our financial

statements are not accurate, investors may not have a complete understanding of our operations. Likewise, if our financial

statements are not filed on a timely basis, we could be in violation of covenants contained in the agreements governing our debt

13

and other borrowings. We could also be subject to sanctions or investigations by the stock exchange on which our shares are

listed, the SEC or other regulatory authorities, which could result in a material adverse effect on our business. These outcomes

could subject us to litigation, civil or criminal investigations or enforcement actions requiring the expenditure of financial

resources and diversion of management time, could negatively affect investor confidence in the accuracy and completeness of

our financial statements and could also adversely impact our stock price and our access to the capital markets. Moreover, while

we are implementing measures designed to help ensure that control deficiencies contributing to the material weakness are

remediated as soon as possible, these measures will result in additional costs, including third-party expenditures engaging

security specialists and implementing certain new IT access, security and recovery measures, and such costs could adversely

affect our results of operations, financial condition and cash flows.

Data privacy, identity protection and information security compliance may require significant resources and presents

certain risks.

We collect, store, have access to and otherwise process certain confidential or sensitive data, including proprietary business

information, customer data, personal data or other information that is subject to privacy and security laws, regulations and/or

customer-imposed controls. Despite our efforts to protect such data, our business and our products may be vulnerable to

security incidents, theft, misplaced or lost data, programming errors, or errors that could potentially lead to compromising such

data, improper use of our products, systems, software solutions or networks, unauthorized access, use, disclosure, modification

or destruction of information, defective products, production downtimes and operational disruptions. During the fourth quarter

of fiscal 2023, we experienced a cybersecurity event consisting of unauthorized access, data exfiltration and deployment of

ransomware by a third party to a portion of our internal IT infrastructure. We are currently in the process of analyzing the data

accessed, exfiltrated or otherwise impacted during the cybersecurity incident. The actual or perceived risk of theft, loss,

fraudulent use or misuse of customer, employee or other data as a result of the cybersecurity incident, as well as non-

compliance with applicable industry standards or our contractual or other legal obligations or privacy and information security

policies regarding such data, could result in costs, fines, litigation or regulatory actions. We could face similar consequences in

the future if we, our suppliers, channel partners, customers or other third parties experience the actual or perceived risk of theft,

loss, fraudulent use or misuse of data, including as a result of employee error or malfeasance, or as a result of the imaging,

software, security and other products we incorporate into our products. Such an event could lead customers to select the

products and services of our competitors. Both the cybersecurity incident and similar future incidents could harm our

reputation, cause unfavorable publicity or otherwise adversely affect certain potential customers’ perception of the security and

reliability of our services as well as our credibility and reputation, which could result in lost sales.

In addition, we operate in an environment in which there are different and potentially conflicting data privacy laws in effect in

the various U.S. states and foreign jurisdictions in which we operate and we must understand and comply with each law and

standard in each of these jurisdictions while ensuring the data is secure. For example, proposed regulations restricting the use of

biometric security technology could impact the products and solutions offered by our security business. Government

enforcement actions can be costly and interrupt the regular operation of our business, and violations of data privacy laws can

result in fines, reputational damage and civil lawsuits, any of which may adversely affect our business, reputation and financial

statements.

Some of our contracts do not contain limitations of liability, and even where they do, there can be no assurance that limitations

of liability in our contracts are sufficient to protect us from liabilities, damages, or claims related to our data privacy and

security obligations. While we maintain general liability insurance coverage and coverage for errors or omissions, such

coverage might not be adequate or otherwise protect us from liabilities or damages with respect to claims alleging compromises

of customer data, that such coverage will continue to be available to us on acceptable terms or at all, or that such coverage will

pay future claims. The successful assertion of one or more large claims against us that exceeds our available insurance

coverage, or results in changes to our insurance policies (including premium increases or the imposition of large deductible or

co-insurance requirements), could have an adverse effect on our business.

Infringement or expiration of our intellectual property rights, or allegations that we have infringed upon the intellectual

property rights of third parties, could negatively affect us.

We rely on a combination of trademarks, trade secrets, patents, copyrights, know-how, confidentiality provisions and licensing

arrangements to establish and protect our proprietary rights. We cannot guarantee, however, that the steps we have taken to

protect our intellectual property will be adequate to prevent infringement of our rights or misappropriation or theft of our

technology, trade secrets or know-how. For example, effective patent, trademark, copyright and trade secret protection may be

unavailable or limited in some of the countries in which we operate. In addition, while we generally enter into confidentiality

agreements with our employees and third parties to protect our trade secrets, know-how, business strategy and other proprietary

information, such confidentiality agreements could be breached or otherwise may not provide meaningful protection for our

14

trade secrets and know-how related to the design, manufacture or operation of our products. From time to time we resort to

litigation to protect our intellectual property rights. Such proceedings can be burdensome and costly, and we may not prevail.

Further, adequate remedies may not be available in the event of an unauthorized use or disclosure of our trade secrets and

manufacturing expertise. Finally, for those products in our portfolio that rely on patent protection, once a patent has expired, the

product is generally open to competition. Products under patent protection usually generate significantly higher revenues than

those not protected by patents. If we fail to successfully enforce our intellectual property rights, our competitive position could

suffer, which could harm our business, financial condition, results of operations and cash flows.

In addition, we are, from time to time, subject to claims of intellectual property infringement by third parties, including

practicing entities and non-practicing entities. Regardless of the merit of such claims, responding to infringement claims can be

expensive and time-consuming. The litigation process is subject to inherent uncertainties, and we may not prevail in litigation

matters regardless of the merits of our position. Intellectual property lawsuits or claims may become extremely disruptive if the

plaintiffs succeed in blocking the trade of our products and services and they may have a material adverse effect on our

business, financial condition, results of operations and cash flows.

We rely on our global direct installation channel for a significant portion of our revenue. Failure to maintain and grow

the installed base resulting from direct channel sales could adversely affect our business.

Unlike many of our competitors, we rely on a direct sales channel for a substantial portion of our revenue. The direct channel

provides for the installation of fire and security solutions, and HVAC equipment manufactured by us. This represents a

significant distribution channel for our products, creates a large installed base of our fire and security solutions and HVAC

equipment, and creates opportunities for longer term service and monitoring revenue. If we are unable to maintain or grow this