Page 1 of 147

DCAAM 7640.1; DCAA Contract Audit Manual

Chapter 8

Cost Accounting Standards

Table of Contents

8-000 - Cost Accounting Standards

8-001 Scope of Chapter

8-100 Section 1 – Introduction to Cost Accounting Standards

8-101 Introduction to Cost Accounting Standards

8-102 Background of Cost Accounting Standards Board

8-102.1 Establishment of Cost Accounting Standards Board (CASB)

8-102.2 CAS Working Group

8-103 CAS Coverage Requirements and CAS Exemptions

8-103.1 Educational Institutions - CAS

8-103.2 CAS Exemptions

8-103.3 Types of Coverage

8-103.4 Effect of Contract Modifications

8-103.5 Effect of Basic Ordering Agreements

8-103.6 Effect of Letter Contracts

8-103.7 CAS Flowdown Clause - FAR 52.230-2

8-103.8 Submission of Disclosure Statement

8-103.9 Additional Exemptions on a Particular Standard

8-103.10 CAS Waivers

8-104 CAS Audit Responsibility

Page 2 of 147

8-104.1 Basic Functions

8-104.2 Auditor's Function on Subcontracts Subject to CAS8-104.3 Contract

Audit Coordinator (CAC)

8-104.3 Contract Audit Coordinator (CAC)

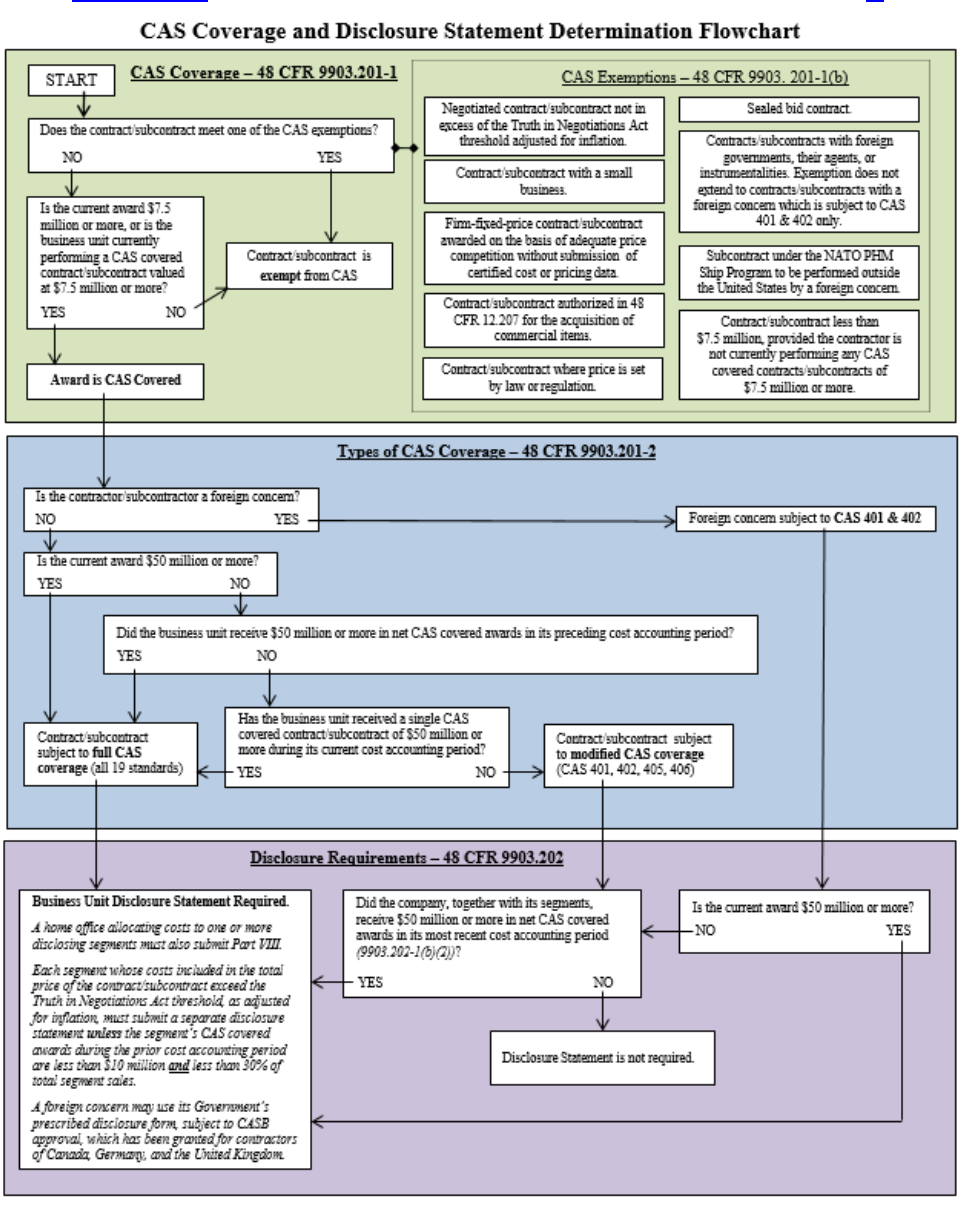

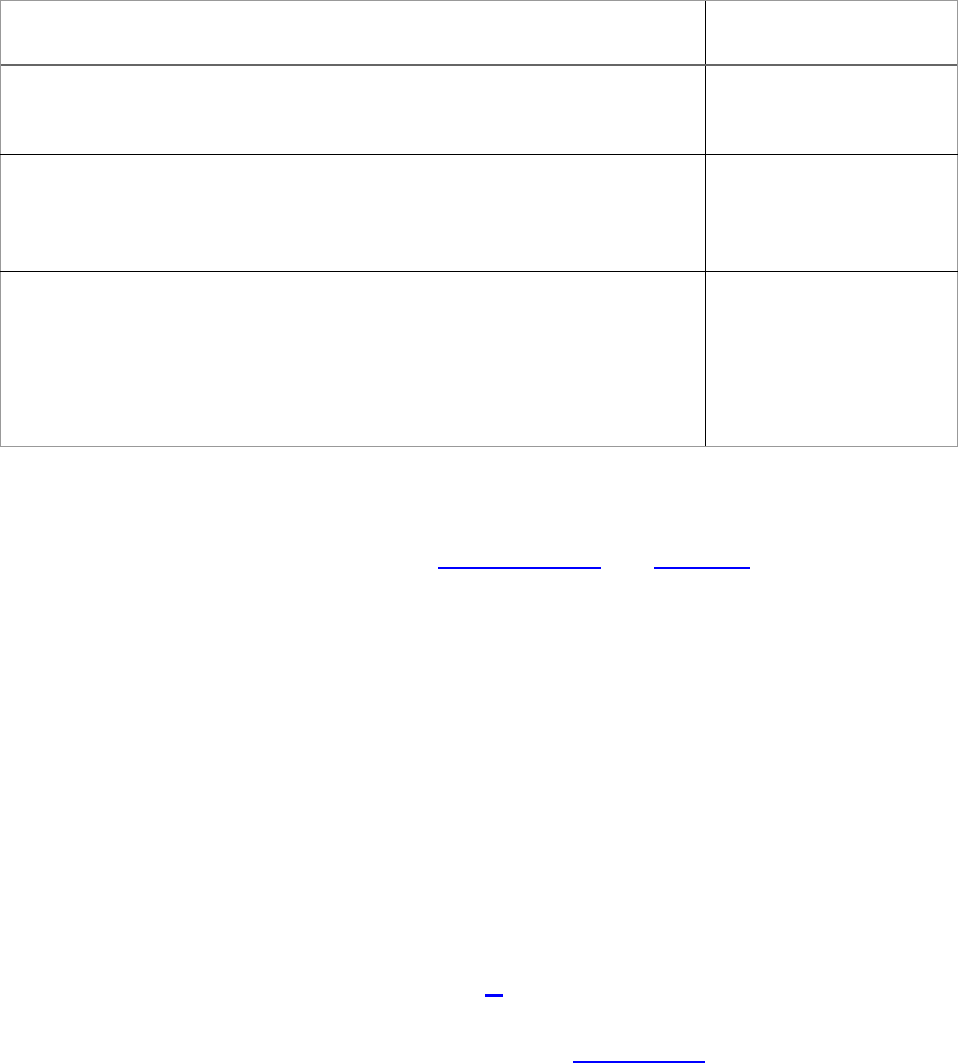

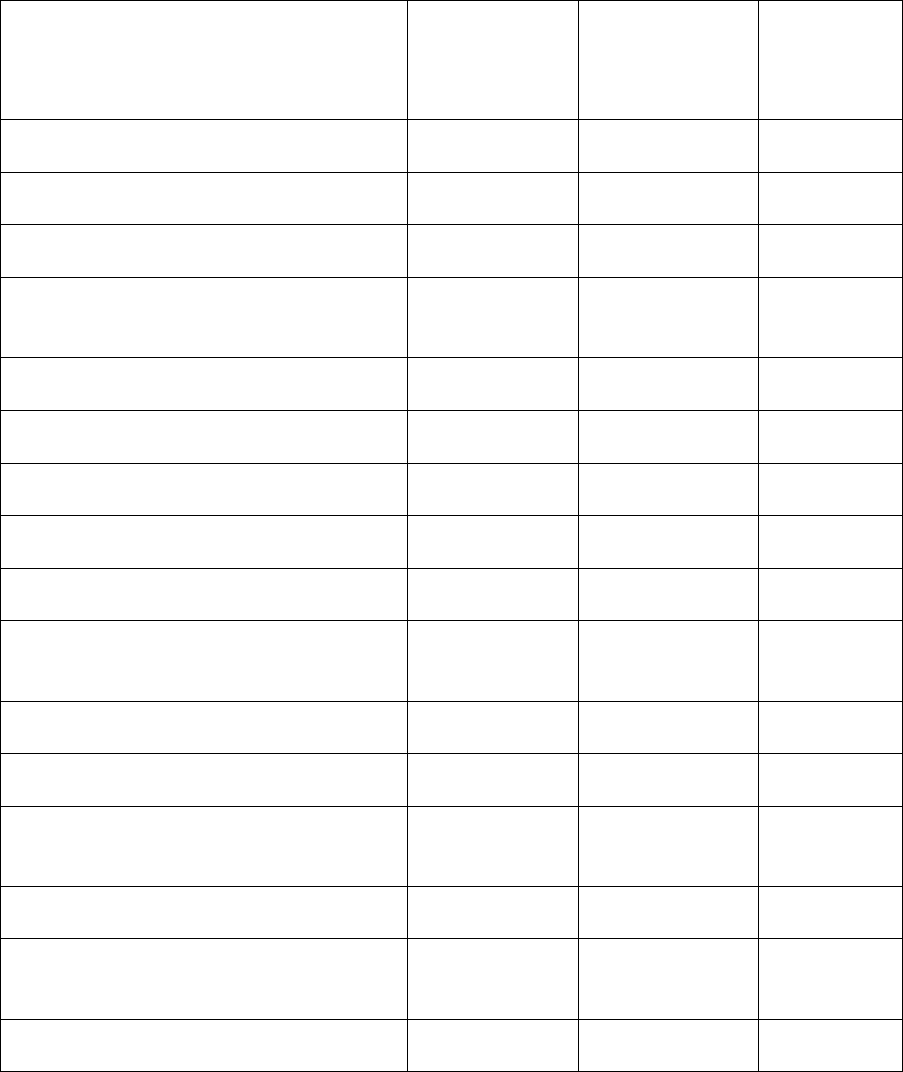

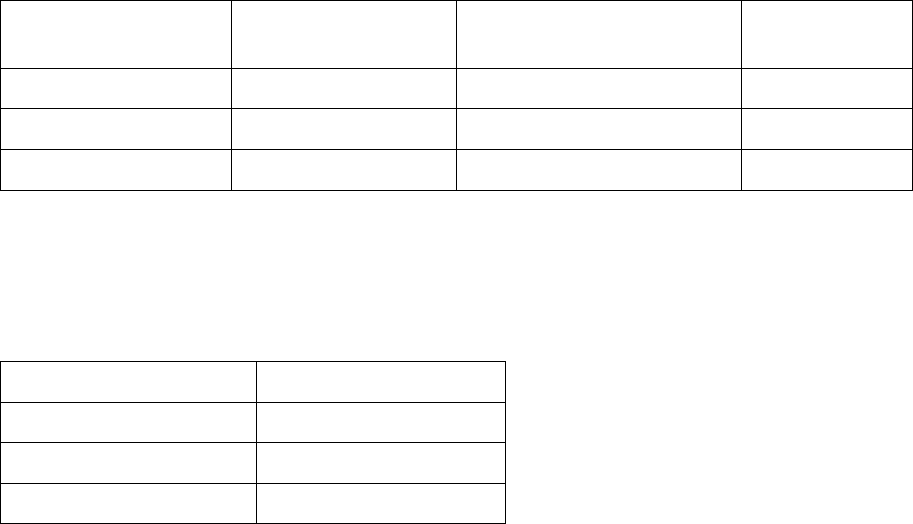

Figure 8-1-1 -- CAS Coverage and Disclosure Statement Determination

8-200 Section 2 – Disclosure Statement Adequacy

8-201 Introduction

8-202 Assessment of Initial Disclosure Statement for Adequacy

8-203 Assessment of Revised Disclosure Statement for Adequacy

8-204 Techniques for Reviewing Disclosure Statement Adequacy

8-300 Section 3 – Audits of Compliance with Cost Accounting

Standards Board (CASB) Rules, Regulations, and Standards,

and with FAR

8-301 Introduction

8-302 Noncompliance with CAS

8-302.1 Requirements

8-302.2 Types of Noncompliance

8-302.3 Compliance Considerations

8-302.4 Discussions with the CFAO and the Contractor

8-302.5 Coordination for Consistent Treatment

8-302.6 CAS Coordination in CAC/CHOA/GAC Complexes

8-302.7 Reporting CAS Noncompliance

8-302.8 Reporting FAR Noncompliance

8-303 Audit of Disclosure Statement and/or Established Practices to Ascertain

Compliance with CAS and FAR

8-303.1 Requirements

8-303.2 Initial Audits of Compliance

8-303.3 Changes to Disclosure Statements and/or Established Practices

Page 3 of 147

8-304 Audit of Estimated, Accumulated, and Reported Costs to Ascertain

Compliance with CAS and FAR

8-304.1 Requirements

8-304.2 Compliance Audits

8-304.3 Reporting of Compliance Audit Results

8-400 Section 4 - Cost Accounting Standards

8-401 Cost Accounting Standard 401 - Consistency in Estimating,

Accumulating and Reporting Costs

8-401.1 Consistency between Estimating and Accumulating Costs

8-401.2 Consistency in Reporting Costs

8-401.3 Illustrations

8-402 Cost Accounting Standard 402 - Consistency in Allocating Costs

Incurred for the Same Purpose

8-402.1 Illustrations

8-403 Cost Accounting Standard 403 - Allocation of Home Office Expenses to

Segments

8-403.1 General

8-403.2 Guidance

8-404 Cost Accounting Standard 404 - Capitalization of Tangible Assets

8-404.1 General

8-404.2 Assets Acquired in a Business Combination Using the Purchase

Method of Accounting

8-404.3 Illustrations - Compliance with the Standard

8-404.4 Illustrations - Applicability Date of Amended CAS 404/409, Effective

April 15, 1996

8-405 Cost Accounting Standard 405 - Accounting for Unallowable Costs

8-405.1 General

8-405.2 Illustrations

8-406 Cost Accounting Standard 406 - Cost Accounting Period

Page 4 of 147

8-406.1 General

8-406.2 Restructuring Costs

8-407 Cost Accounting Standard 407 - Use of Standard Costs for Direct

Material and Direct Labor

8-407.1 General

8-407.2 Illustrations

8-408 Cost Accounting Standard 408 - Accounting for Costs of Compensated

Personal Absence

8-408.1 General

8-408.2 Illustrations

8-409 Cost Accounting Standard 409 - Depreciation of Tangible Capital Assets

8-409.1 General

8-409.2 Illustrations

8-410 Cost Accounting Standard 410 - Allocation of Business Unit General and

Administrative Expenses to Final Cost Objectives

8-410.1 General

8-410.2 Illustrations

8-411 Cost Accounting Standard 411 - Accounting for Acquisition Costs of

Material

8-411.1 General

8-411.2 Illustration

8-412 Cost Accounting Standard 412 - Composition and Measurement of

Pension Costs

8-412.1 General

8-412.2 Assignment of Pension Cost

8-412.3 Full Funding Limitation

8-412.4 Nonqualified Plans

8-412.5 Illustrations

8-412.6 Pension Harmonization Rule

Page 5 of 147

8-413 Cost Accounting Standard 413 - Adjustment and Allocation of Pension

Cost

8-413.1 General

8-413.2 Segment Accounting

8-413.3 CAS 413-50(c)(12) Adjustment For Segment Closing, Plan

Termination or Benefit Curtailment

8-413.4 Illustrations

8-414 Cost Accounting Standard 414 - Cost of Money as an Element of the

Cost of Facilities Capital

8-414.1 General

8-414.2 Interest Rates – Cost of Facilities Capital

8-414.3 Evaluating the Contractor’s Computations

8-415 Cost Accounting Standard 415 - Accounting for the Cost of Deferred

Compensation

8-415.1 General

8-415.2 Illustrations

8-416 Cost Accounting Standard 416 - Accounting for Insurance Cost

8-416.1 General

8-416.2 Guidance

8-416.3 Illustrations

8-417 Cost Accounting Standard 417 - Cost of Money as an Element of the

Cost of Capital Assets Under Construction

8-417.1 General

8-417.2 Guidance

8-417.3 Illustrations

8-418 Cost Accounting Standard 418 - Allocation of Direct and Indirect Costs

8-418.1 General

8-418.2 Guidance

8-418.3 Illustrations

Page 6 of 147

8-419 Reserved

8-420 Cost Accounting Standard 420 - Accounting for Independent Research

and Development Costs and Bid and Proposal Costs (IR&D and B&P)

8-420.1 General

8-420.2 Guidance

8-420.3 Illustrations

8-500 Section 5 - Cost Impact Proposals

8-501 Introduction

8-502 General - Cost Impact Proposals

8-502.1 CAS Clause Requiring Price Adjustments

8-502.2 FAR Requirement for Submission of Cost Impact Proposal

8-502.3 Accounting Practice Changes Related to External Restructuring

8-502.4 Cost Impact Proposal Data Requirements

8-502.5 Adequacy of Cost Impact Proposals

8-502.6 Audit of Cost Impact Proposals

8-502.7 Inclusion of Implementation Costs

8-502.8 Noncompliance with FAR Part 31

8-503 Guidance on Evaluation of Cost Impact Proposals

8-503.1 Required and Desirable Cost Accounting Practice (CAP) Change

Cost Impact Proposals

8-503.2 Unilateral CAP Change Cost Impact Proposals

8-503.3 CAS Noncompliance Cost Impact Proposals

8-503.4 Interest

8-503.5 Offsetting Cost Impacts

8-504 Failure to Submit Cost Impact Proposals

8-505 Conferences and Reports on Audits-Cost Impact Proposals

8-506 Coordination

8-507 Rough Order of Magnitude Calculation for Unresolved Cost Impacts

Page 7 of 147

8-600 Section 6 - Participation on Joint Team Reviews of Contractor

Insurance and Pension Cost

8-601 Introduction

8-602 Audit of Contractor Insurance Cost and Pension Cost

8-602.1 Insurance/Pension Team Reviews

8-602.2 Auditor Participation on CIPR Teams

8-602.3 Effect of the CIPR on Subsequent Audits

8-000 - Cost Accounting Standards **

8-001 Scope of Chapter **

This chapter presents guidance on auditing compliance with the Cost Accounting

Standards Board (CASB) Rules, Regulations, and Standards including related

provisions of FAR. The CASB Rules, Regulations and Standards are codified at 48

CFR Chapter 99 and available on the Electronic Code of Federal Regulations website.

This chapter also includes guidance on auditing cost impact (price adjustment)

proposals, and guidance on auditor participation in joint contractor insurance and

pension reviews.

8-100 Section 1 - Introduction to Cost Accounting Standards **

8-101 Introduction to Cost Accounting Standards **

a. This section provides the legal background and purposes of implementing the

Cost Accounting Standards (CAS), including the rules and regulations, and audit

responsibilities in implementing Section 26 of the Federal Procurement Policy Act,

Public Law 100-679.

b. (41 U.S.C. 1501-1506) Cost Accounting Standards contains the requirement for

certain contractors and subcontractors to comply with the CASB Rules, Regulations,

and Standards, collectively referred to as CAS. The contents of 48 CFR Chapter 99 are

provided as an Appendix to the FAR for user convenience but are not considered part of

FAR.

c. The CAS Preambles consist of:

(1) Part I—Preambles to the Cost Accounting Standards Published by the Cost

Accounting Standards Board,

(2) Part II—Preambles to the Related Rules and Regulations Published by the

Cost Accounting Standards Board, and

Page 8 of 147

(3) Part III—Preambles Published under the FAR System.

d. The Preambles are not regulatory, but instead provide background and rationale

for the Standards and related Rules and Regulations, and for the positions taken by the

CASB in response to public comments. The full text of the Preambles can be accessed

on the DCAA Intranet under Audit Resources, Useful Audit Links, Acquisition

Regulations.

8-102 Background of the Cost Accounting Standards Board **

8-102.1 Establishment of Cost Accounting Standards Board (CASB) **

a. The original CASB was established in 1970 as an agency of Congress in

accordance with a provision of Public Law 91-379. It was authorized to (1) promulgate

cost accounting standards designed to achieve uniformity and consistency in the cost

accounting principles followed by defense contractors and subcontractors under Federal

contracts in excess of $100,000 and (2) establish regulations to require defense

contractors and subcontractors, as a condition of contracting, to disclose in writing their

cost accounting practices, to follow the disclosed practices consistently and to comply

with duly promulgated cost accounting standards.

b. The original CASB promulgated 19 standards and associated rules,

regulations and interpretations. It went out of existence on September 30, 1980.

c. The CASB was reestablished in 1988 within the Office of Federal Procurement

Policy (OFPP), which is under the Office of Management and Budget (OMB), in

accordance with Public Law 100-679. The CASB consists of five members: the

Administrator of OFPP who is the Chairman, and one member each from DoD, GSA,

industry and the private sector (generally expected to be from the accounting

profession).

8-102.2 CAS Working Group **

a. To interpret the CASB rules and regulations for implementing in DoD

procurement practices, DoD established in 1976 a CAS Steering Committee and

Working Group. During its existence, the CAS Working Group issued a number of

Interim Guidance Papers on a variety of subjects, most of which are still effective and

have been incorporated into this chapter. The Interim Guidance Papers were approved

by the Office of the Secretary of Defense (R&E) and given wide distribution.

b. The papers issued by the CAS Working Group that are still in effect are listed

below. The full text of the papers can be accessed on the DCAA Intranet under Audit

Resources, Useful Audit Links, Acquisition Regulations:

Page 9 of 147

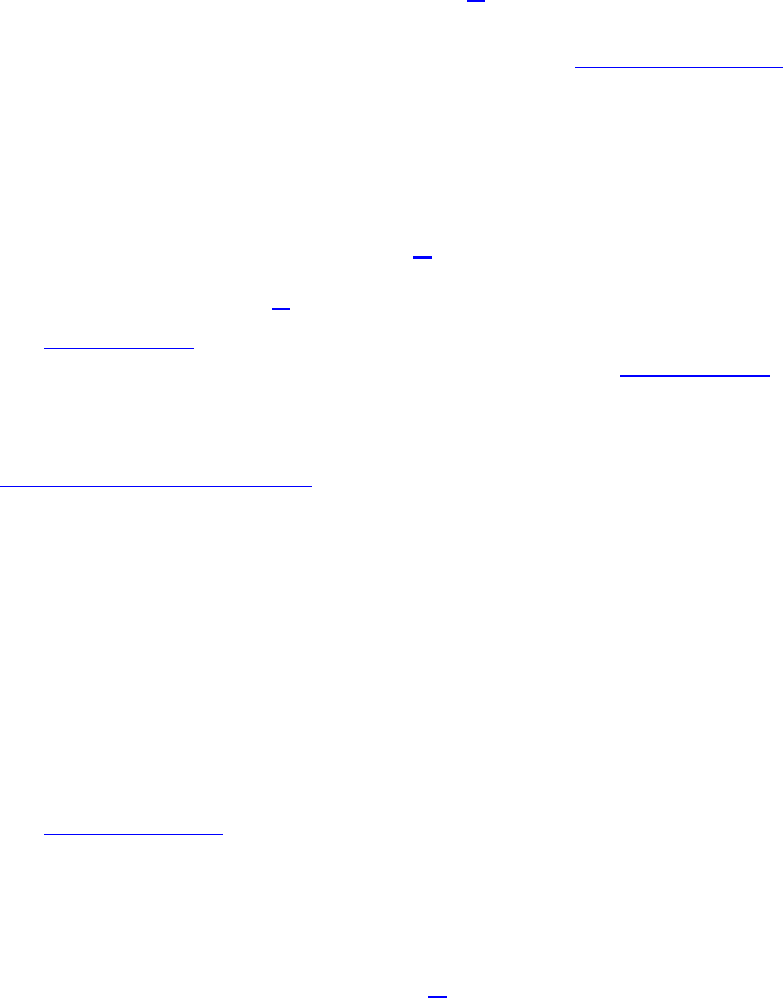

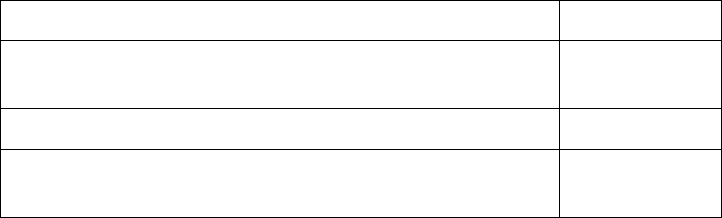

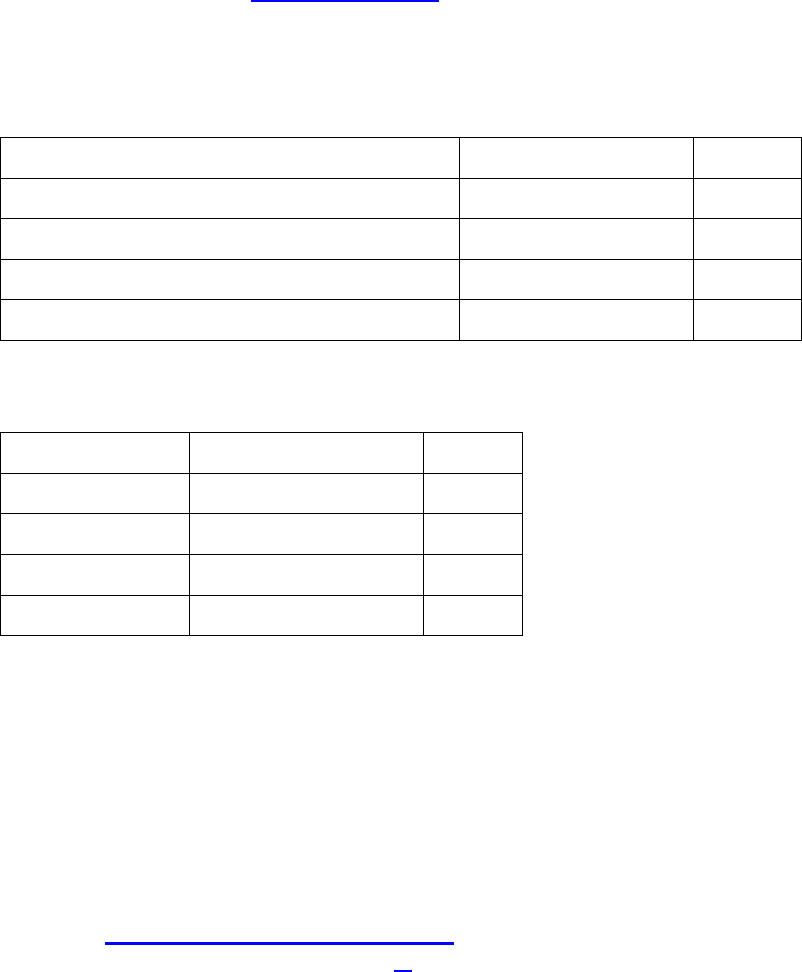

Table 8-1-1

No. Subject

76-2 Application of CAS to Contract Modifications and to Orders Placed Under

Basic Agreements

76-3 Policy for Application of CAS to Subcontracts

76-4 Determining Increased Costs to the Government for CAS Covered FFP

Contracts

76-5 Treatment of Implementation Costs Related to Changes in Cost Accounting

Practices

76-6 Application of CAS Clause to Changes in Contractor’s Established Practices

when a Disclosure Statement has been Submitted

76-7 Significance of "Effective" and "Applicability" Dates Included in CAS

76-9 Measurement of Cost Impact on FFP Contracts

77-10 Retroactive Implementation of CAS When Timely Compliance is Not Feasible

77-13 Applicability of CAS 405 to Costs Determined to be Unallowable on the Basis of

Allocability

77-15 Influence of CAS Regulations on Contract Terminations

77-16 Applicability of CAS to Letter Contracts

77-17 Identification of CAS Contract Universe at a Contractor’s Plant

77-18 Implementation of CAS 414 - Cost of Money as an Element of the Cost of

Facilities Capital; and DPC 76-3

77-19 Administration of Leased Facilities Under CAS 414

77-20 Policy for Withdrawing Adequacy Determination of Disclosure Statement

78-21 Implementation of CAS 410, Allocation of Business Unit G&A Expenses to Final

Page 10 of 147

Cost Objectives

78-22 CAS 409 and the Development of Asset Service Lives

79-23 Administration of Equitable Adjustments for Accounting Changes not Required

by New Cost Accounting Standards

79-24 Allocation of Business Unit G&A Expense to Facilities Contracts

81-25 Change in Cost Accounting Practice for State Income and Franchise Taxes as a

Result of Change in Method of Reporting Income from Long Term Contracts

8-103 CAS Coverage Requirements and CAS Exemptions **

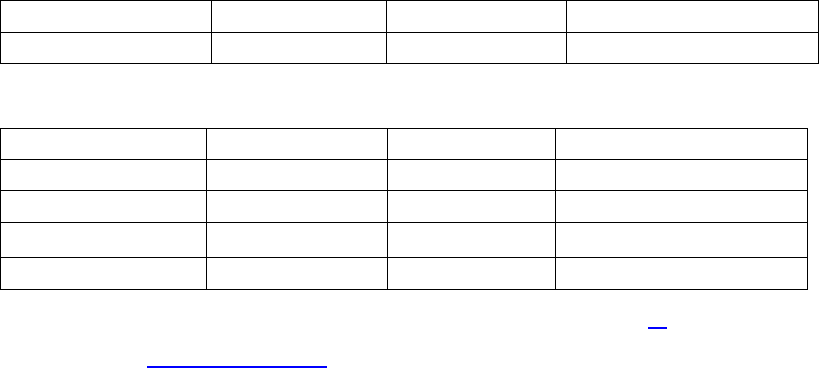

The following subsections contain a summary of CAS coverage requirements (see

Figure 8-1-1).

8-103.1 Educational Institutions – CAS **

Contracts and subcontracts with educational institutions are subject to special

CAS coverage (see chapter 13). Contracts and subcontracts performed by federally

funded research and development centers operated by educational institutions are

subject to CAS coverage for commercial companies.

8-103.2 CAS Exemptions **

The following categories of contracts and subcontracts are exempt from all CAS

requirements (48 CFR 9903.201-1):

a. Sealed bid contracts.

b. Negotiated contracts and subcontracts (including interdivisional work orders)

less than the Truth in Negotiations Act (TINA) threshold.

Page 11 of 147

c. Contracts and subcontracts with small businesses. FAR Subpart 19.3

addresses determination of status as a small business. A small business (offeror) is

one that represents, through a written self-certification, that it is a small business

concern in connection with a specific solicitation and has not been determined by the

Small Business Administration (SBA) to be other than a small business. The

contracting officer accepts an offeror's representation unless that representation is

challenged or questioned. If the status is challenged, the SBA will evaluate the status of

the concern and make a determination. (Specific standards appear in Part 121 of Title

13 of the Code of Federal Regulations.)

d. Contracts and subcontracts with foreign governments or their agents or

instrumentalities or, insofar as the requirements of CAS other than CAS 401 and CAS

402 are concerned, any contract or subcontract awarded to a foreign concern. Because

CAS does not define the terms “agents or instrumentalities” or “foreign concern,” a

foreign contractor’s status must be inferred from whether it operates as a for-profit

business concern or a non-profit governmental organization, as in the following

examples:

(1) Contractor ABC is a foreign company partly owned by its government.

ABC manufactures aircraft parts and assemblies, which it sells to various government

and commercial customers under prime contracts and subcontracts. ABC operates for

profit and tracks its expenses, revenues, and net income, which it reports to its owners.

For CAS purposes, ABC is deemed a foreign concern because it operates as a for-profit

business concern, and therefore must comply with CAS 401 and 402 on its U.S.

Government contracts and subcontracts.

(2) Contractor XYZ is a foreign research laboratory owned and operated by its

government. XYZ primarily provides medical research and testing for its government

department, and it also routinely offers its services to other government and private

customers and charges according to a schedule of prices that are intended to cover its

costs and overhead. XYZ tracks its sources and uses of funds and reports this

information to the head of the government department of which it is a part. For CAS

purposes, XYZ is deemed an agent or instrumentality of its government because it

operates as a non-profit government organization, and therefore is exempt from CAS.

e. Contracts and subcontracts in which the price is set by law or regulation.

f. Firm-fixed-price contracts and subcontracts for the acquisition of commercial

items.

g. Contracts or subcontracts less than $7.5 million, provided that, at the time of

award, the business unit of the contractor or subcontractor is not currently performing

any CAS-covered contracts or subcontracts valued at $7.5 million or greater. “Currently

performing” is defined in 48 CFR 9903.301, Definitions. A contract is being currently

performed if the contractor has not yet received notification of final acceptance of all

supplies, services, and data deliverable under the contract (including options).

“Currently performing” is intended to reflect the period of time when work is being

Page 12 of 147

performed on contractual effort. The period ends when the Government notifies the

contractor of final acceptance of all items under the contract. If a contractor is currently

performing a CAS-covered contract of $7.5 million or greater, CAS coverage is triggered

and new awards are subject to CAS (unless they meet another exemption under

48 CFR 9903.201-1(b)).

h. Subcontracts under the NATO PHM Ship program to be performed outside the

United States by a foreign concern.

i. Firm-fixed-price contracts and subcontracts awarded on the basis of adequate

price competition without submission of certified cost or pricing data.

j. In cases where the prime contract is exempt from CAS under any of the

exemptions at 48 CFR 9903.201-1 any subcontract under that prime is always exempt

from CAS.

8-103.3 Types of Coverage **

a. Full coverage requires business units (as defined in CAS 410-30(a)(2)) comply

with all of the CAS in effect on the contract award date and with any CAS that become

applicable because of new standards (CAS clause at FAR 52.230-2). Full coverage

applies to contractor business units that:

(1) Received a single CAS-covered contract award, including option amounts,

of $50 million or more, or

(2) Received $50 million or more in CAS-covered contract awards during the

immediately preceding cost accounting period.

b. Modified CAS coverage (CAS clause at FAR 52.230-3) requires only that the

contractor comply with CAS 401, 402, 405, and 406. Modified CAS coverage applies to

contractor business units that received less than $50 million in net CAS-covered awards

in the immediately preceding cost accounting period.

c. When any one contract is awarded with modified CAS coverage, all CAS-

covered contracts awarded to that business unit during that cost accounting period are

also subject to modified coverage, except that when a business unit receives a single

CAS-covered contract award of $50 million or more, that contract is subject to full

coverage. Thereafter, any covered contract awarded during that accounting period and

the subsequent accounting period is subject to full CAS coverage.

d. The CAS status of a contract or subcontract (full coverage, modified coverage,

or exempt from CAS), remains the same throughout its life regardless of changes in the

business unit’s CAS status in the current or subsequent cost accounting periods (i.e., a

contract awarded with modified coverage remains subject to such coverage throughout

its life even if subsequent period contracts are awarded with full coverage).

e. Subcontract coverage. (1) When a subcontract is awarded under a CAS-

Page 13 of 147

covered prime contract (and higher-tier subcontract), CAS coverage of the subcontract

is determined in the same manner as prime contracts awarded to the subcontractor's

business unit; i.e., determine if any of the exemptions from CAS at 48 CFR 9903.201-1

apply to the subcontract (see 8-103.2). (2) Working Group Paper 76-3, Policy for

Application of CAS to Subcontracts, states that the standards applicable to the prime

contract at the time it was awarded are also applicable to the subcontract. One might

interpret this to mean that if a prime contract is subject to full CAS coverage, the

subcontract is also subject to full CAS coverage. This appears to conflict with the

guidance at 8-103.3e(1) that states that CAS coverage for subcontracts is determined in

the same manner as it is determined for prime contracts awarded to the subcontractor's

business unit. There is no conflict, however, because the Working Group Paper was

issued before the category of modified coverage was created. When the Working

Group Paper was issued, no distinction was made between full and modified coverage.

As stated in 8-103.3e(1), CAS coverage at the subcontract level should continue to

reflect the same CAS coverage as prime contracts awarded to the same business unit.

8-103.4 Effect of Contract Modifications **

Contract modifications made under the terms and conditions of the contract do

not affect its status with respect to CAS applicability. Therefore, if CAS was applicable

to the basic contract, it will apply to the modification. Conversely, if the basic contract

was exempt from CAS, the modification will also be exempt regardless of the amount of

the modification. However, if the contract modification adds new work it must be treated

for CAS purposes as if it were a new contract. In this case, if the modification exceeds

the threshold, it will be CAS-covered (see CAS Working Group Paper 76-2).

8-103.5 Effect of Basic Ordering Agreements **

Basic agreements and basic ordering agreements (BOAs) are not considered

contracts (FAR 16.702(a) and 16-703(a)). Since orders must be considered individually

in determining CAS applicability, only orders that exceed the threshold will be CAS-

covered (see CAS Working Group Paper 76-2).

8-103.6 Effect of Letter Contracts **

CAS is applicable to letter contracts exceeding the threshold as of the date of the

award. Definitizing the contract will not activate any new standards since definitization

is a contract modification rather than a new contract (see CAS Working Group Paper

77-16).

8-103.7 CAS Flowdown Clause - FAR 52.230-2 **

Page 14 of 147

The CAS clauses at FAR 52.230-2(d) and FAR 52.230-3(d) (for full and modified

coverage, respectively) require a contractor to include the substance of the CAS clause

in all negotiated subcontracts (at any tier) into which the contractor enters. This is

commonly referred to as the "CAS flow down clause”. As discussed in 8-103.3e

however, if a subcontract meets one of the CAS exemptions at 48 CFR 9903.201-1 (see

8-103.2), the subcontract will not be subject to CAS. For example, a CAS-covered

prime contractor could not place the requirement for CAS compliance on a subcontract

with a small business because 48 CFR 9903.201-1(b)(3) specifically exempts contracts

and subcontracts with small businesses from CAS requirements.

8-103.8 Submission of Disclosure Statement **

The requirements for submission of a Disclosure Statement (48 CFR 9903.202-

1(b)) are:

a. Any business unit (as defined in CAS 410-30(a)(2)) that is selected to receive

a CAS-covered contract or subcontract of $50 million or more, including option

amounts, shall submit a Disclosure Statement before award.

b. Any company which, together with its segments (see CAS 410-30(a)(7)),

received net CAS-covered awards totaling more than $50 million in its most recent cost

accounting period shall submit a Disclosure Statement. When a Disclosure Statement

is required under these criteria, it must be submitted before award of the first CAS-

covered contract in the immediately following cost accounting period. However, if the

first covered award is made within 90 days of the start of the cost accounting period, the

contractor is not required to file until the end of the 90 days.

c. When required, a separate Disclosure Statement must be submitted for each

segment having more than the Truth in Negotiations Act (TINA) threshold of costs

included in the total price of any CAS-covered contract or subcontract, unless:

(1) The contract or subcontract is exempted by 48 CFR 9903.201-1, or

(2) In the most recently completed accounting period, the segment's CAS-

covered awards are less than 30 percent of total segment sales for the period and less

than $10 million.

d. Any home office (as defined in CAS 403-30(a)(2)) that allocates costs to one

or more disclosing segments performing CAS-covered contracts must submit a part VIII

of the Disclosure Statement.

e. A foreign contractor must disclose in writing its cost accounting practices in

accordance with the contract clause at 48 CFR 9903.201-4(f). A foreign contractor may,

in lieu of filing Form CASB DS-1, use a form prescribed by its Government as long as

the CASB has determined the form satisfies the CAS disclosure objectives (48 CFR

9903.202-1(e)). CASB has approved the use of alternative forms for contractors of:

(1) Canada,

Page 15 of 147

(2) Federal Republic of Germany, and

(3) United Kingdom.

8-103.9 Additional Exemptions on a Particular Standard **

Subsection 62 of each cost accounting standard will provide for any additional

exemptions associated with a particular standard.

8-103.10 CAS Waivers **

a. The CAS statute (Public Law 100-679) authorizes the CAS Board to waive

CAS requirements on individual contracts and subcontracts. 48 CFR 9903.201-5

addresses CAS waivers.

b. The CAS Board has granted authority to waive CAS to heads of executive

agencies. Implementing guidance is in FAR 30.201-5 and DFARS 230.201-5. FAR

2.101 defines “executive agency” as executive, military, and independent departments.

Delegation of waiver authority may not be made lower than the senior contract

policymaking level of the agency.

c. Heads of executive agencies may waive CAS under the following two

circumstances:

● The contract or subcontract is less than $15 million, and the segment

performing the work is primarily engaged in the sale of commercial items

and has no contracts or subcontracts subject to CAS, or

● “Exceptional circumstances” exist whereby a waiver of CAS is necessary to

meet the needs of the agency. Exceptional circumstances are deemed to

exist only when the benefits to be derived from waiving CAS outweigh the

risk associated with the waiver. A waiver for exceptional circumstances

must be in writing and include a statement of the specific circumstances

that justify granting the waiver. The Defense Procurement and Acquisition

Policy on January 31, 2003 issued guidance, which provides that all three

of the following criteria must be met for a waiver of CAS to be considered

under “exceptional circumstances” for DOD contracts.

(1) The property or services cannot reasonably be obtained under the

contract, subcontract, or modification, as the case may be, without the grant of the

waiver,

(2) The price can be determined to be fair and reasonable without the

application of the Cost Accounting Standards, and

(3) There are demonstrated benefits to granting the waiver.

8-104 CAS Audit Responsibility **

8-104.1 Basic Functions **

Page 16 of 147

FAR 30.202-6, 30.202-7, and 30.601 outline the basic functions of the contract

auditor in the implementation of the standards. They provide that the contract auditor

shall be responsible for making recommendations to the cognizant Federal agency

official (CFAO). The CFAO is the contracting officer assigned by the cognizant Federal

agency to administer CAS. Within DoD, the CFAO is the cognizant ACO. The auditor’s

recommendations to the CFAO include whether:

● a contractor's Disclosure Statement, submitted as a condition of

contracting, adequately describes the actual or proposed cost accounting

practices as required by 41 U.S.C. 1501 through 1506 as implemented by

the CASB,

● a contractor's disclosed cost accounting practices are in compliance with

FAR Part 31 and applicable cost accounting standards,

● a contractor's or subcontractor's failure to comply with applicable cost

accounting standards or to follow consistently its disclosed or established

cost accounting practices has resulted, or may result, in any increased cost

paid by the Government, and

● a contractor's or subcontractor's proposed price changes, submitted as a

result of changes made to previously disclosed or established cost

accounting practices, are fair and reasonable.

8-104.2 Auditor's Function on Subcontracts Subject to CAS **

As specifically related to subcontracts subject to CAS, the auditor's functions

tend to fall into the following areas:

a. The auditor will audit the books and records of prime contractors and higher

tier subcontractors to determine that appropriate CAS clauses are included (FAR

52.230-2, 52.230-3, and 52.230-6) in awarded subcontracts. In addition, the auditor will

determine that, when applicable, subcontractor Disclosure Statements have been

obtained.

b. 48 CFR 9903.202-8(a) and FAR 42.202(e)(2) provide that the company

awarding the CAS-covered subcontract is responsible, except as noted in c. and d.

below, for securing subcontractor compliance with CASB rules, regulations, and

standards. Notwithstanding these provisions, in most cases compliance audits of CAS-

covered subcontracts will be performed by the auditor cognizant of the subcontractor in

conjunction with the performance of other regularly scheduled audit assignments.

When DCAA audits a prime contractor that also holds covered subcontracts, the auditor

should routinely include the subcontracts in the CAS-covered audits. Even though the

audit responsibility may not have been formally assigned, the auditor, to protect the

Government's interest, must consider all covered work held by the contractor when

making CAS-related audits. At locations where no Government prime contracts exist,

the auditor should attempt to identify the existence of CAS-covered subcontracts either

during the performance of regular ongoing audits or through routine examinations of

existing acquisition records. Once identified, these subcontracts will also be subject to

audit tests for CAS compliance.

Page 17 of 147

c. Under the provisions of 48 CFR 9903.202-8(b) a subcontractor may satisfy

disclosure requirements by identifying to the prime contractor the CFAO to whom its

Disclosure Statement was previously submitted. 48 CFR 9903.202-8(c)(1) provides that

the subcontractor may submit a Disclosure Statement that contains privileged and

confidential information directly to the subcontractor's CFAO. In this case, a preaward

determination of adequacy is not required. Instead, the CFAO will advise the auditor to

perform postaward audits of compliance.

d. In accordance with 48 CFR 9903.202-8(c)(2), subcontractors not subject to

Disclosure Statement requirements may claim that other CAS-related audits by prime

contractors would jeopardize their proprietary data or competitive position. In such

cases, the subcontractor may request the Government to perform the audits.

e. FAR 30.607 specifies that when a price adjustment or noncompliance

determination is made at the subcontract level, the CFAO for the subcontractor shall

provide the negotiation memorandum or determination to the CFAO of the next higher-

tier contractor who may not change the determination of the CFAO at the lower-tier

subcontractor. In addition, the section provides that remedies are made at the prime

contract level if a subcontractor refuses to submit a required GDM or DCI proposal.

8-104.3 Contract Audit Coordinator (CAC) **

The CAC will be responsible for assuring, for all organizational units of the

assigned company, that consistent and compatible audit conclusions are reached by all

FAOs involved. Specific responsibilities for all auditors in the coordination process are

in subsequent sections of this chapter. If a CAC has not been assigned to a

multidivisional contractor, the regional director cognizant of the corporate home office

will designate a Corporate Home Office Auditor (CHOA) or Group Audit Coordinator

(GAC), as applicable (see also 8-302.6 for audit coordination within multi-organizational

companies).

Page 19 of 147

8-200 Section 2 - Disclosure Statement Adequacy **

8-201 Introduction **

This section provides audit guidance for determining adequacy of initial and

revised Disclosure Statements submitted on CASB Form DS-1.

a. The adequacy assessment is performed and documented as part of the planning

phase of a compliance examination on an initial or revised Disclosure Statement, prior

to formally accepting the engagement. As further discussed in 8-202 and 8-203,

discuss the assessment with the CFAO and, in the case of an initial Disclosure

Statement, obtain the CFAO’s adequacy determination. A separate audit report on

adequacy will not be issued.

b. The purpose of the adequacy review is to determine whether the disclosed cost

accounting practices to be used for estimating, accumulating and reporting contract

costs, as described, are:

(1) Current, i.e. the disclosed practices are consistent with the contractor’s

intended practice described during the walk through;

(2) Accurate, i.e. the disclosed practices are consistent with the policies and

procedures provided during the walk through; and

(3) Complete, i.e. the contractor completed all items on the CASB Form DS-1 in

accordance with the General Instructions, and each disclosed practice stands on its

own with minimal explanation needed from the contractor.

Additional guidance on determining whether the Disclosure Statement is current,

accurate, and complete will be found in 8-204.

c. If the Disclosure Statement is current, accurate, and complete, the submission is

acceptable for performing an audit of the disclosed practices for compliance with CAS

and FAR Part 31.

d. FAR 30.202-6(b) establishes the CFAO’s written determination that a required

Disclosure Statement is adequate as a condition of contract award. Therefore, the

auditor should expedite the adequacy assessment of the initial Disclosure Statement to

the extent possible.

8-202 Review of Initial Disclosure Statement for Adequacy **

a. All initial Disclosure Statements are required to be audited. Before accepting an

engagement to audit the compliance of an initial Disclosure Statement, the auditor will

review the Disclosure Statement for adequacy as required by FAR 30.202-7(a)(1),

document the conclusion, and discuss the assessment with the CFAO followed by a

memorandum to the CFAO confirming the discussion.

Page 20 of 147

b. The auditor will obtain the CFAO’s determination of adequacy before

commencing the audit of the disclosed practices for compliance with CAS as required

by FAR 30.202-7(b)(1). For this purpose, an informal notification of the CFAO’s

determination is sufficient. The auditor will document the CFAO’s determination in the

working papers. The CFAO’s formal adequacy determination memorandum must be

obtained prior to issuance of the final report.

c. If the CFAO determines the Disclosure Statement to be inadequate and the

contractor revises its Disclosure Statement (FAR 30.202-7(a)(2)(ii)), the auditor will

assess the revision for adequacy and discuss again with the CFAO. Once the

Disclosure Statement is determined adequate, the auditor will begin the audit of the

disclosed practices for compliance with CAS and FAR Part 31.

8-203 Review of Revised Disclosure Statement for Adequacy **

a. FAR 30.604(b) requires the CFAO to review changes to disclosed cost

accounting practices for adequacy and compliance concurrently, and FAR 30.601(c)

directs the CFAO to request and consider the auditor’s advice in CAS administration.

Before accepting an engagement to audit the compliance of a Disclosure Statement

revision, the auditor will review and document the adequacy of the revised portions of

the Disclosure Statement and discuss the assessment with the CFAO.

b. As part of the discussion with the CFAO, the auditor should discuss the risk and

significance of the revised practices, reach agreement on which cost accounting

practices will be audited, and give the CFAO enough information to resolve

inadequacies prior to requesting the audit. The materiality of the cost accounting

practice change also determines the need for the CFAO to request a cost impact

proposal.

c. Since the Disclosure Statement is already deemed adequate (aside from the

revisions), the auditor will not issue a separate memorandum on adequacy of the

revised practices to the CFAO. The auditor’s acknowledgment of the audit request is

sufficient to acknowledge adequacy of the requested practices as part of accepting the

engagement.

d. Purely administrative changes, such as a change of address or point of contact,

would not impact the adequacy or compliance of the disclosed practices and need not

be addressed in a compliance audit. Similarly, a revision that is intended to enhance

the description of an accounting practice but does not change the measurement,

assignment, or allocation of costs is not a cost accounting practice change requiring an

audit. Coordinate with the CFAO on changes that are not considered cost accounting

practice changes and do not require an audit.

8-204 Techniques for Assessing Disclosure Statement Adequacy **

a. To be considered adequate, a Disclosure Statement must be current, accurate,

and complete. Perform the adequacy assessment on an initial Disclosure Statement in

its entirety. Perform the adequacy assessment of a revised Disclosure Statement on

Page 21 of 147

the changed cost accounting practice(s).

(1) A Disclosure Statement is current if it describes the cost accounting

practices which the contractor intends to follow for estimating, accumulating, and

reporting costs on CAS-covered contracts/subcontracts. The Disclosure Statement,

could include practices that are currently in use, will be instituted at some future date,

will be followed with the incurrence of a new cost, or a combination of these.

(a) Ascertain whether the cost accounting practices identified in the

Disclosure Statement are, in fact, the contractor's current practices. Useful data related

to the contractor’s cost accounting practices may be available in the permanent file

and/or in recent audits of the accounting system, incurred costs, indirect cost rates,

and forward pricing proposals. If available information discloses a difference between a

described practice and an existing practice, discuss it with the contractor to ascertain

whether they intend to change the practice.

(b) Obtain a walkthrough of the Disclosure Statement from the contractor.

Have the contractor demonstrate the basis of the described practices and how the

practices are implemented in the accounting system. If the contractor plans to change

a cost accounting practice but the changed practice is not described, the intended

future practice should be described as well as the existing practice in order for the

disclosure to be considered current.

(c) Where the contractor already has covered contracts, but was not

previously required to file a Disclosure Statement, the practices subsequently

described should be the same as those used to estimate and accumulate costs for the

contracts entered into before the Disclosure Statement was required. If there are any

known differences, ascertain whether the contractor is consistently following the cost

accounting practices that were in effect when the initial covered contract was awarded,

or has changed one or more cost accounting practices without notifying the CFAO.

(2) A Disclosure Statement is accurate if it correctly, clearly, and distinctly

describes the actual method of accounting the contractor uses or intends to use for

costs on CAS-covered contracts. vague, ambiguous, and contradictory descriptions of

the contractor's cost accounting practices may hinder subsequent compliance audits,

cause disputes and litigation between contracting parties, and ultimately result in

additional cost to the Government. Carefully evaluate the described practices for

specificity and clarity.

(a) Clerical accuracy is required for the Disclosure Statement. Verify whether

the contractor has checked the appropriate boxes, inserted the applicable code letters,

answered all questions, etc.

(b) Validate the consistency of Disclosure Statement entries using the

Internal Consistency of Disclosed Practices tool delivered in the CaseWare

workpackage.

(c) Be alert for vague, incomplete or ambiguous items which could lead to

Page 22 of 147

alternative accounting interpretations. Ask the contractor to clarify the specific meaning

of such items. If significant items remain unclarified, recommend the CFAO find the

Disclosure Statement inadequate.

(3) A Disclosure Statement is complete if it conforms with the CASB Form DS-1

General Instructions, includes all significant cost accounting practices the contractor

intends to use, and provides enough information for the Government to fully

understand the cost accounting practices being described.

(a) Validate conformance to the General Instructions using the Conformity of

Disclosure Statement with General Instructions tool delivered in the CaseWare

workpackage.

(b) Obtain the contractor’s most recent incurred cost submission, forward

pricing proposal submissions, cost billings, or other recent contract cost data to

ascertain the significant elements of cost for which the contractor should describe cost

accounting practices in its Disclosure Statement. For example, if the cost data

indicates that the contractor is expected to incur and bill manufacturing overhead and

engineering overhead, the Disclosure Statement should specifically identify and

describe the cost accounting practices for each of these cost pools along with the

respective allocation bases and rates.

(c) All significant cost accounting practices for Government contract costs

must be disclosed and adequately described. Ascertain that all the practices are

disclosed either by describing the practice in an appropriately referenced Continuation

Sheet, or by inclusion of or reference to existing written accounting policies and

procedures.

(d) All significant home office costs allocated to Government contracts must

be adequately described in the home office Disclosure Statement Section VIII.

Segment auditors should ascertain that the receiving segment’s Disclosure Statement

identifies each significant home office cost, the home office from which the costs are

received, and the segment’s cost accounting practices for the costs.

b. Discuss adequacy concerns with the CFAO. Include specific evidence to allow

the CFAO to make a determination based on the deficient element of adequacy

(current, accurate, and complete) and to facilitate the notification and resolution of the

inadequacy with the contractor.

8-300 Section 3 - Audits of Compliance with Cost Accounting

Standards Board (CASB) Rules, Regulations, and Standards,

and with FAR **

Page 23 of 147

8-301 Introduction **

a. This section provides audit guidance for the evaluation of the contractor's

Disclosure Statement and the practices used for estimating, accumulating and

reporting costs on contracts subject to 41 U.S.C. 1501 through 1506. The purpose of

the audit is to ascertain whether the disclosed or established practices are in

compliance with the CASB rules, regulations, and standards as well as appropriate

acquisition regulations. The initial audit of a Disclosure Statement’s compliance should

be scheduled for completion within 60 days after the CFAO’s determination of

adequacy of the Disclosure Statement. The aspects of compliance audits covered in

this section are:

(1) General requirements including audit considerations and reporting

procedures.

(2) Audit considerations involved in the initial audit of the Disclosure Statement

for compliance.

(3) Audit requirements associated with the audit of cost accounting practices for

compliance during the proposal evaluation and contract performance.

b. Not only should the audit and subsequent reporting cover those conditions that

constitute actual noncompliances but should also include circumstances where the

occurrence of a planned or pending action will result in a violation of CASB rules,

regulations, or standards. A condition of potential noncompliance exists when:

(1) a contractor with a covered contract proposes a practice that will violate a

cost accounting standard or FAR cost principle when implemented (see 8-302.7f), or

(2) a contractor who does not have a covered contract but currently has or

proposes to implement a practice that, with the award of the initial covered contract,

will result in a violation of the CASB rules, regulations, and standards or appropriate

acquisition regulations. It is important to note that in each of the potential

noncompliance conditions described above, some future action is required before the

contractor is in violation of 41 U.S.C. 1501 through 1506. For example, the offeror

must be awarded a CAS-covered contract before it becomes subject to the rules and

regulations of the CASB. Similarly, a covered contractor must implement an

unacceptable practice to be in actual noncompliance.

c. To facilitate the implementation process, each promulgated standard contains

subparagraph -63 that prescribes the effective date and an applicability date. The

CASB defers the applicability date beyond the effective date in order to provide

contractors adequate time to prepare for compliance and make any required

accounting changes. Under the regulation, a contractor becomes subject to a new

standard only after receiving the first CAS-covered contract following the effective date.

(1) The distinction between the effective and applicability dates is important.

The effective date designates when the pricing of future CAS-covered contracts must

Page 24 of 147

reflect the new standard. It also identifies those CAS-covered contracts eligible for an

equitable adjustment, since only contracts in existence on the effective date can be

equitably adjusted to reflect the prospective application of a new or revised standard.

(2) The applicability date marks the beginning of the period when the

contractor's accounting and reporting systems must comply with a new or revised

standard. Proposals for contracts to be awarded after the effective date of a standard

should be evaluated carefully for compliance with the new or revised standard. The

proposal need only reflect compliance with the standard from the applicability date

forward. Most standards are applicable at the beginning of the next fiscal year after

receipt of a contractor’s first CAS-covered contract. CAS 418 and 420 are applicable at

the beginning of the second fiscal year, and CAS 401, 402, 405, and 414 are

applicable immediately. Therefore, it is important that the auditor determine the

applicability date of the particular Standard (including any revisions) under audit. Any

change resulting from early implementation by the contractor is to be administered as a

unilateral change. It will result in an equitable adjustment under FAR 52.230-2(a)(4)(iii)

for the period prior to the applicability if the CFAO determines that the unilateral

change is a desirable change.

(3) In unusual situations, the short lead-time between the effective and

applicability dates may create a difficult situation for the contractor. In such a case, the

contractor may request the change be retroactive. The CFAO shall determine whether

the contractor’s request is approved or not; however, the CFAO cannot approve a date

for the retroactive change before the beginning of the year in which the request was

made. Where a contractor can demonstrate to the CFAO that it would be virtually

impossible to comply with the effective or applicability dates of a standard, contracts

can be negotiated after the effective date of the standard based on the accounting

system used before the standard became effective.

(4) Contract terms should include provisions for price adjustments, retroactive to

the applicability date, for significant cost impact resulting from the change in cost

accounting practice to comply with the standard. In addition, the CFAO should

establish a specific date for the contractor to complete the changes to its estimating,

accounting, and reporting systems and Disclosure Statement to comply with the

standard. When this procedure is followed, noncompliances will not be reported.

Equitable adjustments computed as of the applicability date will be submitted as

provided in FAR 30.604(h)(4). (See CAS Working Group Papers 76-7 and 77-10.)

d. Questions have been raised regarding the CAS compliance of termination claims

since:

(1) costs in termination claims may be arranged differently than the cost

presentations in the original estimates, and

(2) termination claims often include as direct costs such items as settlement

costs or unexpired leases that would have been charged indirect if the contract had

been completed. Termination costing procedures, as detailed in FAR 31.205-42, are

Page 25 of 147

still effective. DoD does not view these procedures as violating either CAS 401 or 402,

since terminating a contract creates a situation that is totally unlike completing a

contract. Therefore, these costs would not be considered costs incurred for the same

purpose in like circumstances. Termination contracting officers should assure

themselves that within the context of termination situations, consistency is honored to

the extent that the circumstances are similar. To that end, it would be advisable for a

contractor to document its termination accounting procedures as part of its disclosed

practices. Indirect cost rates used in termination claims must represent full accounting

periods as required by CAS 406. (See CAS Working Group Paper 77-15.)

8-302 Noncompliance with CAS **

8-302.1 Requirements **

a. In accordance with FAR 30.605(b) when the CFAO determines a disclosed or

an established practice is not in compliance, the CFAO shall notify the contractor and

provide a copy of the notice to the auditor. The CFAO also makes a determination of

materiality.

(1) If the CFAO determines that the noncompliance is immaterial, the

contractor must correct the noncompliance and the Government reserves the right to

make contract adjustments if the contractor fails to correct the noncompliance and it

becomes material.

(2) If the CFAO determines that the noncompliance is material, the

contractor is required to submit a description of any cost accounting practice change

needed to bring the practices into compliance, which the auditor will review for

adequacy and compliance. If the proposed change is both adequate and compliant,

the contractor must submit a general dollar magnitude (GDM) proposal. In addition,

adjustment of the prime contract price or cost allowance in accordance with FAR

30.605 may be required. (See 8-500)

b. As in FAR 30.202-6 and 30.202-7, the contract auditor shall be responsible

for conducting audits as necessary to advise the CFAO as to whether the contractor's

disclosed or established practices comply with CAS and FAR Part 31. Because the

audit responsibility is a continuous requirement, instances of noncompliance may be

detected and reported at various stages of the procurement action.

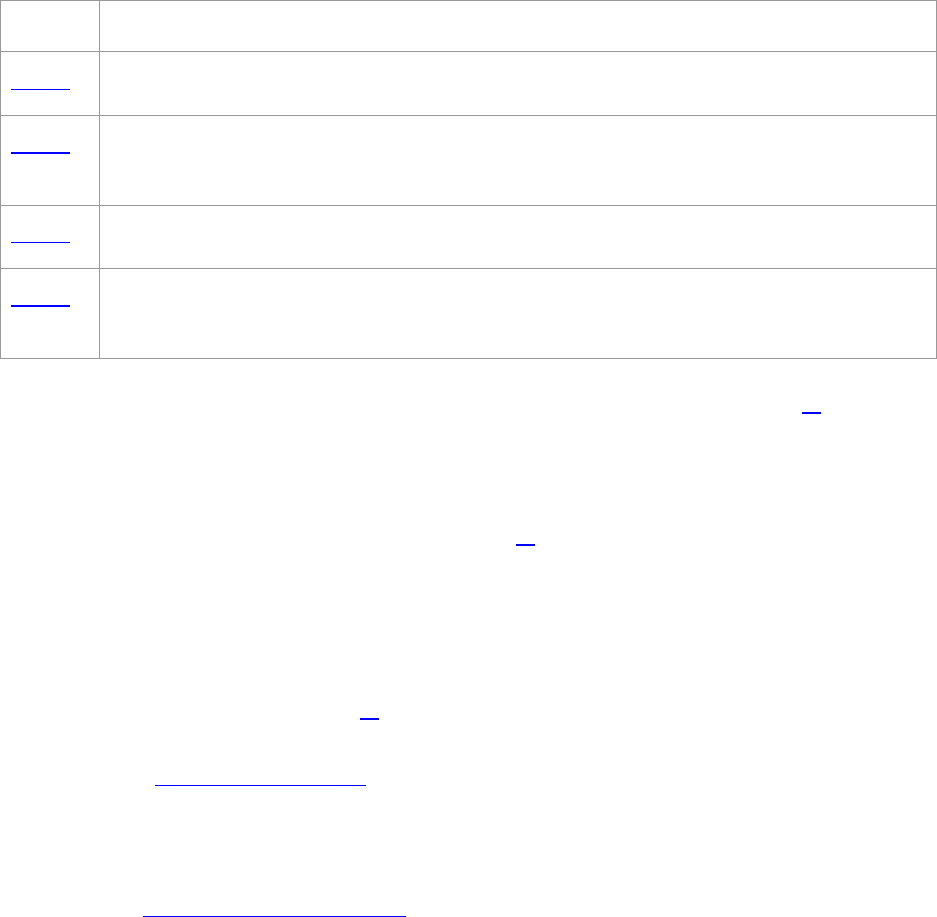

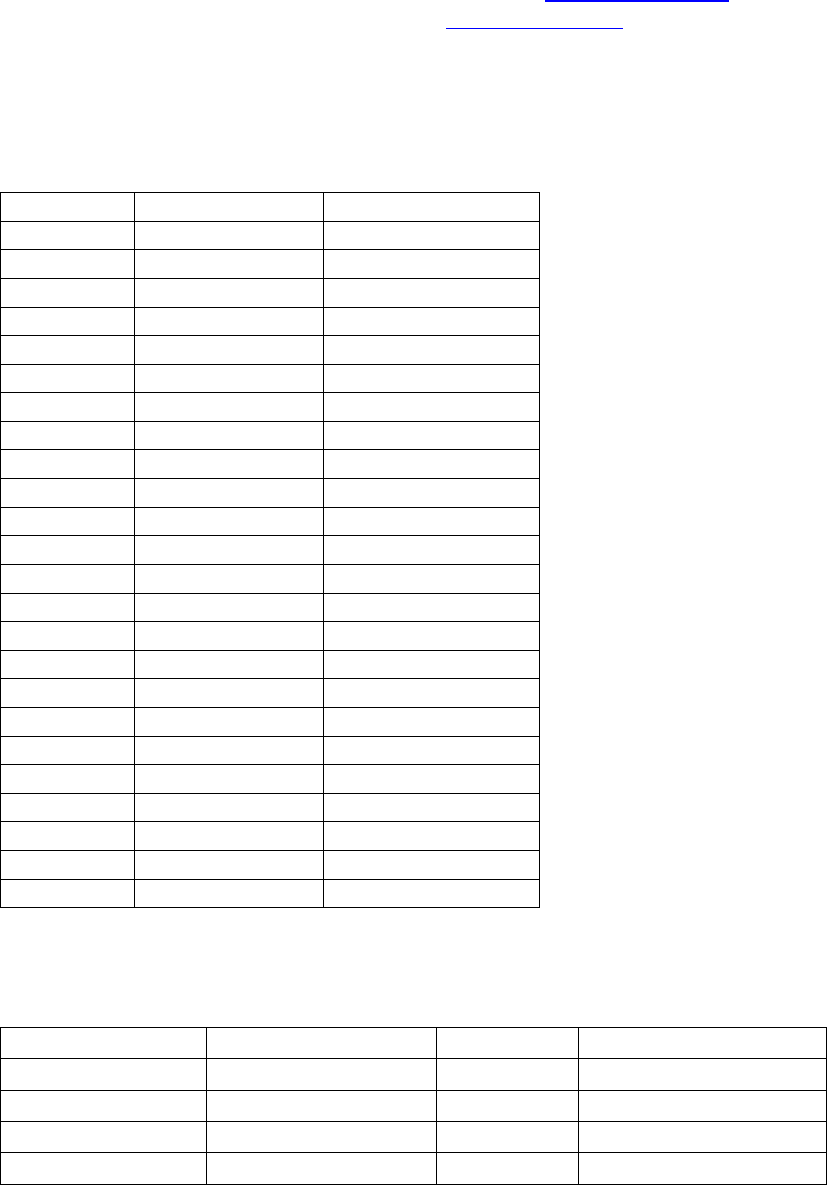

8-302.2 Types of Noncompliance **

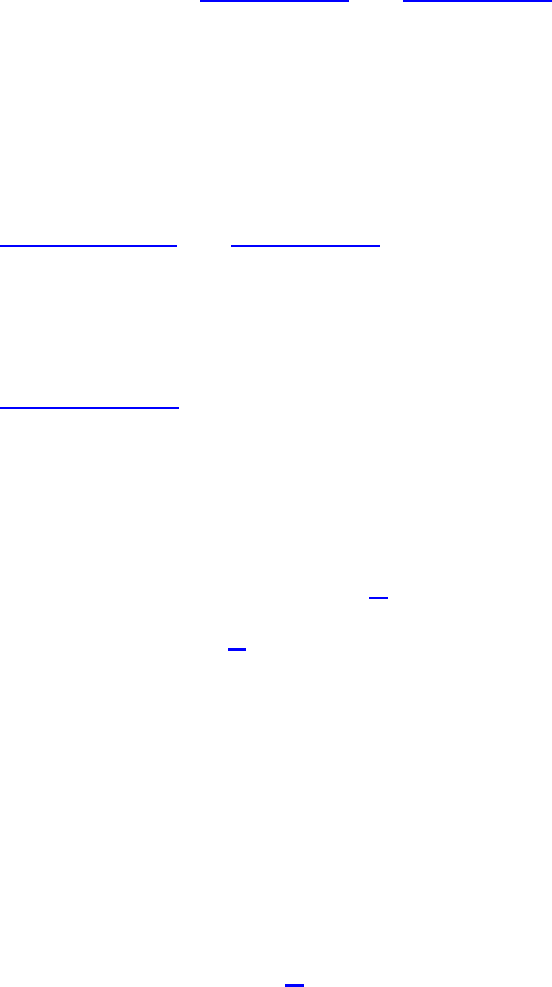

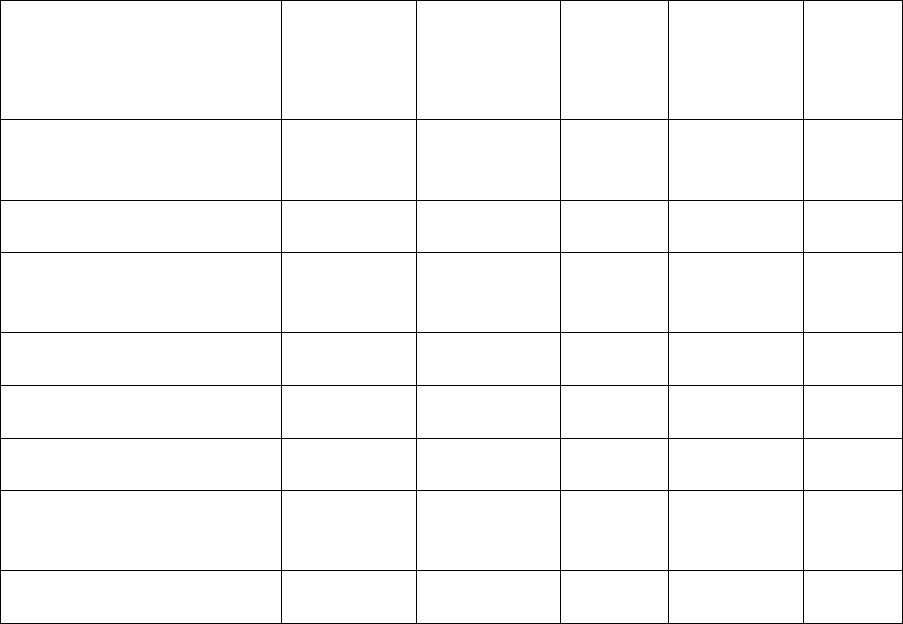

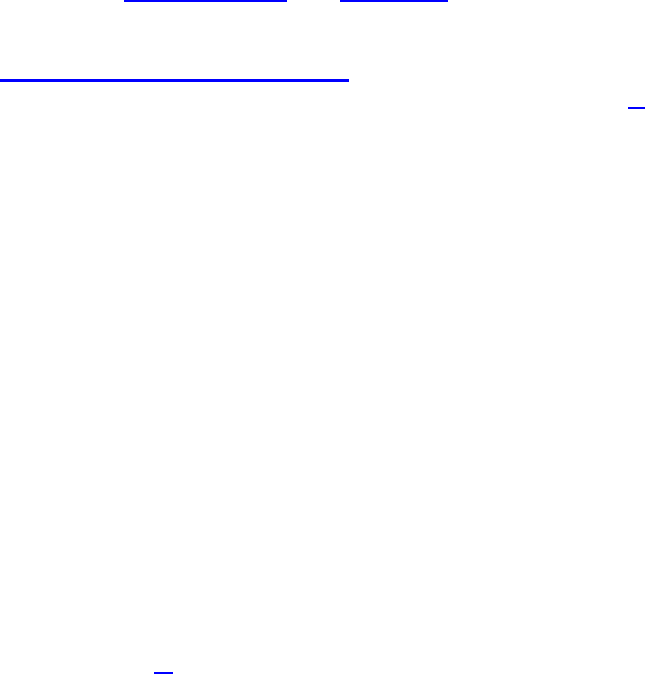

a. Eight types of noncompliance can be identified based on CASB rules,

regulations, and standards and FAR Part 31 as listed below:

Cost Accounting Practice

CAS

FAR

DS-1

Disclosed practices

(1)

(2)

Actual estimating practices

(3)

(4)

(5)

Actual accumulating and reporting

practices

(6)

(7)

(8)

Page 26 of 147

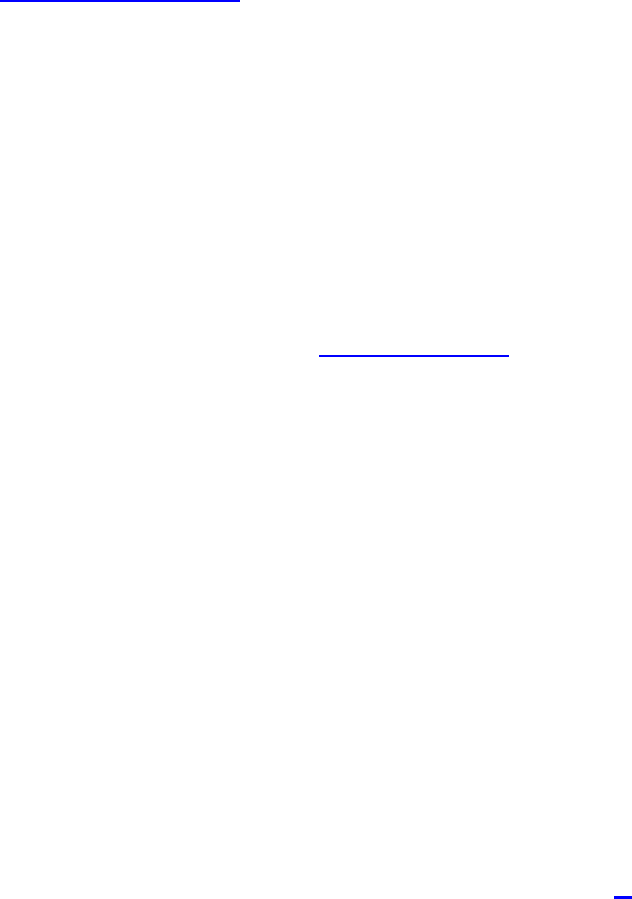

b. These types of noncompliance may be detected during audits of Disclosure

Statements, CAS compliance audits, or other types of audits:

Types of Noncompliance

Typically Detected

During Audits of

(1) Disclosed practices not compliant with CAS.

(2) Disclosed practices not compliant with FAR.

Disclosure statement

Forward pricing

Incurred cost

(3) Actual practices of estimating costs not compliant with CAS.

(4) Actual practices of estimating costs not compliant with FAR.

(5) Actual practices of estimating costs not compliant with the

Disclosure Statement.

Forward pricing

Estimating system

CAS compliance

(6) Actual practices of accumulating or reporting costs not

compliant with CAS.

(7) Actual practices of accumulating or reporting costs not

compliant with FAR.

(8) Actual practices of accumulating or reporting costs not

compliant with the Disclosure Statement.

Incurred costs

Accounting system

CAS compliance

c. In some cases multiple noncompliance conditions may exist. For example,

suppose a contractor allocates the costs of preparing initial bid proposals to cost

objectives on the basis of total cost input. This practice was previously disclosed to the

Government and deemed compliant with FAR 31.205-18 and CAS 420. However, in a

new proposal the contractor included the B&P expenses in the engineering overhead

pool, which was subsequently allocated to the proposed contract over direct

engineering labor dollars. In this situation, the types of noncompliances described in

bullets (3), (4), and (5) above would all apply.

d. The issuance of a new cost accounting standard could result in instances of

multiple types of noncompliance:

(1) Disclosed practices previously determined compliant could become

noncompliant with CAS and/or FAR, and

(2) Actual practices used to estimate and report costs, although in

compliance with disclosed practices, could become noncompliant with CAS and/or

FAR.

8-302.3 Compliance Considerations **

In auditing the contractor's cost accounting practices to ascertain whether they

are compliant with the cost accounting standards and FAR Part 31, the auditor should

follow the guidelines below:

a. In evaluating price proposals and performing audits of estimating system

compliance with DFARS 252.215-7002, the auditor evaluates the consistency between

the contractor's estimating and cost accumulating practices. The auditor may therefore

Page 27 of 147

be in a position, based on past audits, to ascertain whether the contractor complies

with the standard requiring consistency in estimating, accumulating, and reporting

costs.

b. The standard prohibiting double counting (CAS 402) did not introduce an

entirely new ground rule since acquisition regulations contained similar provisions. The

prohibition against double counting in the acquisition regulations however, was

narrower in scope since it basically applied to individual contracts. CAS 402 has

extended the scope by adding the requirement that each type of cost incurred for the

same purpose, in like circumstances, must be either direct or indirect for all final cost

objectives. Prior audits of the contractor's incurred costs may provide information on

whether the cost accounting practices comply with this standard.

c. With respect to noncompliance with FAR Part 31, when a cost accounting

practice has been questioned by the auditor in the past and the CFAO has not made a

final determination, the practice should be questioned again. Once the CFAO makes a

determination on the issue, the decisions will be followed. If the FAR is subsequently

changed or a change in circumstance occurs, a practice should again be evaluated for

compliance.

d. If a cost accounting practice has been questioned because of noncompliance

with FAR Part 31 and the CFAO supported the auditor's position, but the ASBCA or

Court of Claims ruled against the Government, the auditor will not question the practice

again unless there is a subsequent change in FAR or the cost accounting standards

that would negate the decision. However, if the ASBCA or the Court of Claims ruled in

favor of the Government, the practice should be questioned at all other contractor

locations where circumstances are substantially the same.

8-302.4 Discussions with the CFAO and the Contractor **

a. The auditor should discuss noncompliance matters with the CFAO at the

earliest possible opportunity. It is important to keep the CFAO informed of the auditor's

actions and to identify areas where the auditor may need to provide further information

regarding his or her recommendations.

b. As an integral part of the audit, discuss the findings with the contractor. (See

4-300.)

8-302.5 Coordination for Consistent Treatment **

a. Because of the consolidated contract audit function and the relationship of the

CASB rules, regulations, and standards to the DCAA mission, DCAA is in an

advantageous position to ascertain whether the promulgated standards, rules, and

regulations are consistently applied. To fulfill this responsibility, DCAA must effectively

coordinate all phases of audits involving CAS.

b. Consistency in implementing CASB rules, regulations, and standards should

be one of the auditor's primary concerns. Contractors are justifiably sensitive to

unwarranted variations in the audit treatment of similar situations. To assure the

Page 28 of 147

provisions of 41 U.S.C. 1501 through 1506 are applied consistently, audit findings that

are significant in amount or nature should ordinarily be coordinated with the region or

CAD before the reports are issued.

c. When coordination involves other DCAA regional or CAD offices, the

cognizant auditor should refer to his or her region or CAD those matters that cannot be

resolved by the FAOs involved. The region may forward the matter to Headquarters,

Attention PAC, if agreement is not achievable at the regional level. (See 4-900.)

d. Information on other significant problems or controversial situations will also

be provided to Headquarters, Attention PAC. (See 4-900.) This information will assist

in developing guidance to improve auditing and reporting techniques or in referring

matters to the Office of the Secretary of Defense (OSD) when DoD-wide guidance is

needed to achieve uniform and consistent implementation of CAS.

8-302.6 CAS Coordination in CAC/CHOA/GAC Complexes **

a. The DCAA CAC program, for major multi-segment contractors and other

specific groups of contractors, is described in 15-200. The CHOA or GAC will be

designated in accordance with 8-104.3 for multi-segment contractors outside a CAC

complex. The CAC, CHOA, and GAC complexes play a significant part in promoting

consistent treatment of CAS compliance issues among related or similar contractor

segments.

b. Each CAC/CHOA/GAC will:

(1) Obtain from the cognizant FAOs the necessary data to compile a listing

of all known noncompliance issues at each of the segments that comprise the complex.

The listing, along with information on resolution of the issues, should be distributed to

all FAOs that have cognizance of any segment within the complex.

(2) Review and update the listing for new instances of noncompliance and

include information regarding noncompliance issues resolved. Circulate this data to

the cognizant FAOs to keep them informed about current developments.

(3) Before issuing a noncompliance report, discuss the recommendations

with the FAO. This should be done to assure consistent treatment of similar conditions

at the various segments of the complex.

(4) Recommend workshops if needed to evaluate mutual CAS problems,

(see 15-200).

c. FAOs in the complex will:

(1) Inform the CAC/CHOA/GAC of known problem areas.

(2) Inform the CAC/CHOA/GAC immediately when new problem areas are

encountered.

Page 29 of 147

(3) Evaluate problem areas of other organizational units to determine if

similar problems exist or could exist at your location.

(4) Plan audits so findings can be coordinated before reports are issued.

8-302.7 Reporting CAS Noncompliance **

a. In assigning responsibilities to the CFAO and the contract auditor, the

regulations (FAR 42.302(a)(11)), FAR 30.601, and FAR 30.202-6), require the auditor

to conduct audits of Disclosure Statements for compliance and report practices that do

not comply with CASB rules, regulations, and standards. These reports furnish the

CFAO with information and audit recommendations to assist in making determinations

of the reported practices compliance with the CAS Rules and Regulations or FAR Part

31. Noncompliance reports should include only CAS violations that the auditor

considers significant. The auditor should report:

(1) Violations of major requirements of CAS regardless of their effect on

contract costs.

(2) Noncompliance having a significant cost effect on CAS-covered

contracts.

(3) Noncompliance that could eventually result in a significant adjustment

because of changed circumstances even though there is currently no significant effect

on contract costs. Note that a noncompliance report will not be issued when the

auditor determines the noncompliance will never result in a significant adjustment.

(4) Noncompliance that is an inherent part of the contractor’s cost accounting

system and that are of such a nature that the cost impact on CAS-covered contracts

would be difficult or impossible to determine. (In ASBCA Case No. 20998, the Board

upheld the Government's right to determine a contractor to be in noncompliance even

though the Government was unable to determine that increased costs resulted from

the noncompliance. This ASBCA decision should be referenced in all audit reports

recommending noncompliance where the cost impact cannot be determined.)

b. The following are examples of practices that deviate from CAS. Even if such

practices have not resulted in increased cost or no increased cost can be determined,

the conditions described are reportable as noncompliances.

(1) A contractor allocates home office expenses to divisions as fixed

management charges. The charges are less than the amounts that would have been

allocated had the contractor followed CAS 403. The auditor should recommend that

the CFAO advise the contractor that costs will be disapproved when the method used

by the contractor results in an amount exceeding that which would have been allocated

under the standard.

(2) Another contractor estimates labor cost by category, i.e., fabrication

assembly, inspection, etc. The actual costs are accumulated in one undifferentiated

Page 30 of 147

account. Under these circumstances, the auditor would not be able to determine if

there is any cost effect since there are no records to compare. The auditor should

report the noncompliance and recommend that the contractor be required to follow

consistent practices in estimating and accumulating labor costs.

c. The following guidance should be followed in reporting instances of

noncompliance with CAS.

(1) When a CAS noncompliance is identified while performing a CAS

Disclosure Statement compliance audit or a comprehensive CAS compliance audit

(activity codes 19100 and 194xx) the noncompliance will be described in the

assignment’s audit report. The noncompliance will be reported in the CAS assignment

audit report. A separate noncompliance report will not be issued.

(2) When a CAS noncompliance is identified while performing any other audit

functions (i.e., price evaluations, audit of incurred costs, and system audits) a separate

report (activity code 19200) will be used to report the noncompliance. The

noncompliance report and originating GAGAS examination will note that the separate

noncompliance report is an integral part of the examination engagement and each

report will reference the other. The noncompliance may be fully developed and

sufficiently supported in the originating assignment, or limited additional work may be

necessary to fully develop the elements of the auditor’s finding of noncompliance (see

10-211.2c).

(3) To avoid unnecessary and duplicative reporting, the CAS noncompliance

will be fully described in the noncompliance report and other reports may cross-

reference that report.

(4) Generally, when the audit discloses noncompliances with more than one

cost accounting standard, a separate noncompliance audit report should be issued for

each standard. However, noncompliances with two or more standards should be

issued in the same report when the noncompliances arise from the same cause and

the resolution of one resolves the other. Usually, auditors should not issue multiple

audit reports for noncompliances with a single CAS.

(5) Reports will be issued as the auditor discovers instances of

noncompliance during normal audit functions. There is no requirement for final

voucher evaluation memorandums and audit reports on final pricing to include a

"clearance" statement with respect to compliance with 41 U.S.C. 1501 through 1506.

(6) Include a statement regarding the contractor's responsibilities under the

CAS administration clause at FAR 52.230-6(b & c). This statement may read as

follows:

“Within 60 days of the contractor’s agreement to the initial finding of

noncompliance or the CFAO’s determination of noncompliance, the contractor is

required to submit the description of any change necessary to correct a failure to

comply with CAS or follow a disclosed practice. In addition, when requested by the

Page 31 of 147

CFAO, the contractor is responsible for submitting either a general dollar magnitude

(GDM) proposal or a detail cost-impact proposal prepared in accordance with the

requirements of FAR 52.230-6(g) and (i) or (h) and (i) respectively.”

(7) When a CAS noncompliance is identified during a forward pricing audit,

or there is an unresolved CAS noncompliance that relates to the subject matter, and

the impact of the noncompliance on the proposed amounts is significant and

quantifiable, the auditor should question the impact of the noncompliance in the

proposal under audit. A separate 19200 audit assignment should be established to

report the CAS noncompliance (see 8-302.7c.(2)). The proposal audit report should

describe the nature of the CAS noncompliance. Questioning the impact protects the

Government’s interest because the CFAO’s resolution of a noncompliance will only

affect existing contracts negotiated or billed under the noncompliant practice, and will

not affect contract pricing proposals that have not been negotiated.

(8) When a CAS noncompliance is identified during an incurred cost audit, or

there is an unresolved CAS noncompliance that relates to the subject matter, the

auditor should not question the impact of the noncompliance on the proposed amounts.

A separate 19200 audit assignment should be established to report the CAS

noncompliance (see 8-302.7c.(2)). The incurred cost report should describe the nature

of the CAS noncompliance; information related to the status of the 19100, 19200 or

194XX audit report (which includes an estimate of the impact of the noncompliance);

and state that the CAS noncompliance will be handled through the resolution process

specified in FAR 30.605. The contractor should not adjust its incurred cost proposals

and billed costs, nor should the auditor issue a DCAA Form 1 to suspend or disallow

noncompliance cost impacts in an audit of incurred costs. The cost impact must be

resolved by the CFAO in accordance with the requirements of CAS and FAR, which

are separate and distinct from the processes for resolving incurred cost disallowances.

Since the noncompliance cannot be settled by audit determination, do not issue a final

indirect rate letter. DCAA does not have the authority to resolve the CAS

noncompliance as part of its incurred cost audit. The auditor should issue a report with

a modified opinion according to the guidance in CAM 2-402.3 and CAM 10-208.5.

There is no requirement to question the impact of the CAS noncompliance in the

incurred cost report, so the auditor will not have a reservation about the engagement

for the lack of quantifying the impact in the exhibits and schedules of the report.

d. The auditor is responsible for conducting audits as necessary to ascertain

that contractors are complying with CAS. Therefore, a general request by a CFAO for

reports and/or comments on contractor compliance is not needed. If such a request is

received, inform the CFAO that although DCAA does perform compliance audits of

specific Cost Accounting Standards, we do not issue reports on contractor overall

compliance with CAS. (See 8-304.2 regarding compliance audits.) Offer to audit and

report on any specific area that the CFAO may suspect is noncompliant. If a CAS

compliance audit is already planned in the area of concern specified by the CFAO, the

audit should be rescheduled to coincide with the CFAO request. When an audit

relating to a particular identified practice is requested, the auditor and the CFAO will

establish a mutually acceptable date for submitting the audit results. The auditor will

Page 32 of 147

then include the required audit steps to cover the questioned practice in the next

scheduled audit or, if necessary, will schedule a special audit. The CFAO's request to

audit a specific practice should be given prompt consideration, but should not receive

higher priority than proposal evaluations. Acknowledge the audit request or notify the

CFAO of the planned audit in accordance with 4-104. After the audit, issue either a

report on noncompliance or a brief report to inform the CFAO that the audit did not

identify a noncompliance in the specific area cited by the CFAO.

e. Reports on noncompliance.

(1) References to CAS rules and regulations (other than the Standards

themselves) should use the standard Federal Acquisition Regulation System

abbreviated methodology. Include the CFR title number, chapter, part, and section,

subsection, etc. For example:

Use "48 CFR 9903.302" to reference CFR Title 48, Chapter 99, Part 3,

Subpart 302.

Use "48 CFR 9903.302-4" to reference CFR Title 48, Chapter 99, Part 3,

Subpart 302, Section 4.

48 CFR 9904 incorporates the actual 19 CAS standards such as CAS

401. However, 48 CFR 9903 does not incorporate actual CAS standards.

Therefore 48 CFR 9903 subparagraphs should not include the acronym

“CAS” in them. For example, 48 CFR 9903.302-4 is appropriately referred to

simply as 48 CFR 9903.302-4 (i.e., “CAS” 302 is not an appropriate acronym

reference since 48 CFR 9903.302-4 is not a cost accounting standard.)

Once the full citation is used in an audit report, the shorter reference may be

used throughout the balance of the document to improve readability. References to the

Standards are understood to originate in 48 CFR 9904 and therefore by customary

usage may be cited as CAS 401, CAS 418-40, etc.

(2) All Cost Accounting Standards contain illustrations in Section 4XX-60 that

provide examples of cost accounting practices and specify whether or not such

practices would comply with the standard. Do not cite a contractor with noncompliance

with Section -60. To the extent that the contractor’s cost accounting practice matches

an illustration in Section -60 it may be cited to support a noncompliance with Sections

4XX-40 and 4XX-50 of the standard.

(3) Prepare audit reports using the report shell delivered with the CaseWare

working papers. The report Exhibit shall consist of a Statement of Condition and

Recommendation (SOCAR) that fully explains the noncompliance, our conclusions,

and our recommendations. Follow the guidance in CAM 10-211.2c to develop and

document the SOCAR in the working papers.

(4) Provide a copy of the draft SOCAR to the contractor (CAM 4-304.6c).

Include the contractor’s reaction statement, if one is provided, in the Exhibit followed by

the auditor’s response comments if a rebuttal is warranted. The contractor’s reaction

may be summarized in the Exhibit if it is lengthy. In all cases, a full copy of the

contractor’s written reaction should be included as an Appendix.

Page 33 of 147

f. Outstanding noncompliance issues (issues included in a previous

noncompliance report) may affect evaluations and reports related to other audits. If a

noncompliance report has been issued, the evaluation of a price proposal must

comment on and should question the impact of the noncompliance item on the

proposal being evaluated (8-302.7.c(7)). However, the annual incurred cost audit

should not question the impact of the noncompliance (8-302.7.c(8)). If a CAS

noncompliance is found during a proposal evaluation or other audit, the report for that

audit can be issued prior to the issuance of the CAS noncompliance report. However,

a CAS noncompliance report is still required so that the CFAO can take action.

8-302.8 Reporting FAR Noncompliance **

A noncompliance that violates both FAR and similar provisions in CAS should

be reported in one report and processed as required under FAR 52.230-2(a)(5) to

correct the noncompliance and recover any cost impact due the Government (see 8-

302.7 above). A noncompliance with FAR that does not violate CAS (or the contractor

has no CAS-covered contracts) is normally reported and the impact recovered as part

of other audits (e.g., incurred cost, forward pricing).

8-303 Audit of Disclosure Statement and/or Established Practices to Ascertain

Compliance with CAS and FAR **

8-303.1 Requirements **

a. FAR 52.230-2 (full CAS coverage) requires the contractor to adequately

disclose its cost accounting practices for all covered contracts. FAR 52.230-3

(modified CAS coverage) also requires a contractor to adequately disclose its cost

accounting practices under certain circumstances (see 8-103.8.c). An audit of the

initial Disclosure Statement will be made to ascertain compliance with Public Law 100-

679 (41 U.S.C. 1501 through 1506).

b. A noncompliance identified during an evaluation of a price proposal should be

included in a separate activity code 19200 report and submitted to the CFAO with the

evaluation report.