Board of Governors of the Federal Reserve System

Federal Deposit Insurance Corporation

National Credit Union Administration

Office of the Comptroller of the Currency

Page 1 of 7

June 17, 2016

Joint Statement on the New Accounting Standard on

Financial Instruments - Credit Losses

Purpose

The Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance

Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the

Comptroller of the Currency (OCC) (hereafter, the agencies) are issuing this joint statement to

provide initial information about the new accounting standard, Accounting Standards Update

(ASU) No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit

Losses on Financial Instruments.

1

The Financial Accounting Standards Board (FASB) recently issued this new accounting

standard, which introduces the current expected credit losses methodology (CECL) for

estimating allowances for credit losses. The new accounting standard allows a financial

institution to leverage its current internal credit risk systems as a framework for estimating

expected credit losses.

This joint statement also provides initial supervisory views regarding the implementation of the

new accounting standard. This important accounting change requires the attention of each

financial institution’s board of directors and senior management.

Scope of the New Accounting Standard

The new accounting standard applies to all banks, savings associations, credit unions, and

financial institution holding companies (hereafter, institutions), regardless of asset size.

Key Elements of the New Accounting Standard

Under CECL, the allowance for credit losses is a valuation account, measured as the difference

between the financial assets’ amortized cost basis and the net amount expected to be collected on

the financial assets (i.e., lifetime credit losses).

2

To estimate expected credit losses under CECL, institutions will use a broader range of data than

under existing U.S. generally accepted accounting principles (GAAP). These data include

1

The FASB issued ASU 2016-13 on June 16, 2016. A complete copy of the document is available here.

2

Paragraph 326-20-30-1 states, “The allowance for credit losses is a valuation account that is deducted from the

amortized cost basis of the financial asset(s) to present the net amount expected to be collected on the financial

asset.”

Page 2 of 7

information about past events, current conditions, and reasonable and supportable forecasts

relevant to assessing the collectability of the cash flows of financial assets.

Single measurement approach: Impairment measurement under existing U.S. GAAP is often

considered complex because it encompasses a number of impairment models for different

financial assets.

3

In contrast, the new accounting standard introduces a single measurement

objective to be applied to all financial assets carried at amortized cost, including loans held for

investment and held-to-maturity securities.

Scalability: While there are differences between today’s incurred loss methodology and CECL,

the agencies expect the new accounting standard will be scalable to institutions of all sizes.

Similar to today’s incurred loss methodology, the new accounting standard does not prescribe the

use of specific estimation methods. Rather, allowances for credit losses may be determined using

various methods. Additionally, institutions may apply different estimation methods to different

groups of financial assets. Thus, the new standard allows institutions to apply judgment in

developing estimation methods that are appropriate and practical for their circumstances. The

agencies do not expect smaller and less complex institutions will need to implement complex

modeling techniques.

Purchased credit-deteriorated assets: Another change from existing U.S. GAAP involves the

treatment of purchased credit-deteriorated assets. For such assets, the new accounting standard

requires institutions to estimate and record an allowance for credit losses at the time of purchase,

which is then added to the purchase price rather than being reported as a credit loss expense. In

addition, the definition of purchased credit-deteriorated assets

4

is broader than the definition of

purchased credit-impaired assets in current accounting standards.

Accounting for available-for-sale debt securities: The new accounting standard also updates

the measurement of credit losses on available-for-sale debt securities. Under this standard,

institutions will record credit losses on available-for-sale debt securities through an allowance for

credit losses rather than the current practice of write-downs of individual securities for other-

than-temporary impairment.

Retained accounting concepts: The new accounting standard does not change the existing

write-off principle in U.S. GAAP or current nonaccrual practices, nor does it change the current

accounting requirements for loans held for sale, which are measured at the lower of amortized

cost or fair value.

3

Current U.S. GAAP includes five different credit impairment models for instruments within the scope of CECL:

ASC Subtopic 310-10, Receivables-Overall; ASC Subtopic 450-20, Contingencies-Loss Contingencies; ASC

Subtopic 310-30, Receivables-Loans and Debt Securities Acquired With Deteriorated Credit Quality; ASC Subtopic

320-10, Investments-Debt and Equity Securities-Overall; and ASC Subtopic 325-40, Investments-Other-Beneficial

Interest in Securitized Financial Assets.

4

The new accounting standard defines purchased financial assets with credit deterioration as acquired individual

financial assets (or acquired groups of financial assets with similar risk characteristics at the date of acquisition) that

have experienced a more than insignificant deterioration in credit quality since origination, based on the assessment

of the acquirer.

Page 3 of 7

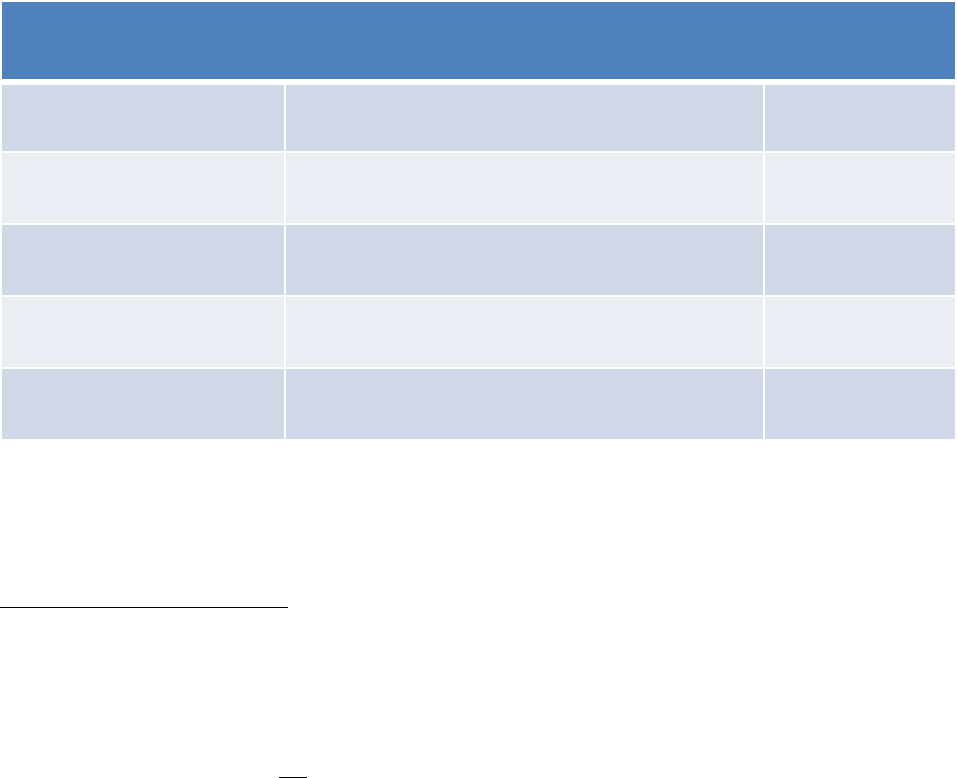

Effective dates: The FASB has set the following effective dates for the new standard, which

depend on an institution’s characteristics:

• Public business entities (PBE) that are U.S. Securities and Exchange Commission (SEC)

filers

5

(SEC filers): Fiscal years beginning after December 15, 2019, including interim

periods within those fiscal years.

• Other PBEs (non-SEC filers

6

): Fiscal years beginning after December 15, 2020,

including interim periods within those fiscal years.

• Non-PBEs (private companies): Fiscal years beginning after December 15, 2020,

including interim periods beginning after December 15, 2021.

For all institutions, early application of the new standard is permitted for fiscal years beginning

after December 15, 2018, including interim periods within those fiscal years.

The table summarizes the effective dates.

Effective Dates

U.S. GAAP

Effective Date

Regulatory

Reporting

Effective Date*

PBEs that are SEC filers

(SEC filers)

Fiscal years beginning after December 15, 2019,

including interim periods within 2020

March 31, 2020

Other PBEs

(non-SEC filers)

Fiscal years beginning after December 15, 2020,

including interim periods within 2021

March 31, 2021

Non-PBEs

(private companies)

Fiscal years beginning after December 15, 2020,

including interim periods beginning after December 15,

2021

December 31, 2021

Early application for all

entities

Early application permitted for fiscal years beginning

after December 15, 2018, including interim periods

within those fiscal years

*For institutions with calendar year ends

5

An SEC filer, as defined in U.S. GAAP, is an entity that is required to file its financial statements with the SEC

under the federal securities laws or, for an FDIC-insured depository institution, the appropriate federal banking

agency under Section 12(i) of the Securities and Exchange Act of 1934.

6

A PBE that is not an SEC filer would include (1) an entity that has issued securities that are traded, listed, or

quoted on an over-the-counter market, and (2) an entity that has issued one or more securities that are not subject to

contractual restrictions on transfer and is required by law, contract, or regulation to prepare U.S. GAAP financial

statements (including footnotes) and make them publicly available periodically (e.g., pursuant to Section 36 of the

Federal Deposit Insurance Act and Part 363 of the FDIC’s regulations). For further information on the definition of a

PBE, refer to ASU 2013-12, Definition of a Public Business Entity, issued in December 2013.

Page 4 of 7

Transition:

7

On the effective date, institutions will apply the new accounting standard based on

the characteristics of financial assets as follows:

• Financial assets carried at amortized cost (e.g., loans held for investment and held-to-

maturity debt securities): A cumulative-effect adjustment will be recognized on the

balance sheet as of the beginning of the first reporting period in which the new standard

is effective.

• Purchased credit-deteriorated assets: Financial assets classified as purchased credit-

impaired assets prior to the effective date will be classified as purchased credit-

deteriorated assets as of the effective date. For all purchased-credit deteriorated assets,

institutions will be required to gross up the amount of the financial asset for its allowance

for expected credit losses as of the effective date and should continue to recognize the

noncredit discount or premium as interest income, if appropriate, based on the effective

yield on such assets determined after the gross-up for the allowance.

• Available-for-sale and held-to-maturity debt securities: Debt securities on which

other-than-temporary impairment had been recognized prior to the effective date will

transition to the new guidance prospectively (i.e., with no change in the amortized cost

basis of these securities).

Initial Supervisory Views

Measurement Methods

The new accounting standard does not specify a single method for measuring expected credit

losses; rather, institutions should use judgment to develop estimation methods that are well

documented, applied consistently over time, and faithfully estimate the collectability of financial

assets by applying the principles in the new accounting standard.

The new accounting standard allows expected credit loss estimation approaches that build on

existing credit risk management systems and processes, as well as existing methods for

estimating credit losses (e.g., historical loss rate, roll-rate, discounted cash flow, and probability

of default/loss given default methods).

8

However, certain inputs into these methods will need to

change to achieve an estimate of lifetime credit losses. For example, the input to a loss rate

method would need to represent remaining lifetime losses, rather than the annual loss rates

commonly used under today’s incurred loss methodology. In addition, institutions would need to

consider how to adjust historical loss experience not only for current conditions as is required

under the existing incurred loss methodology, but also for reasonable and supportable forecasts

that affect the expected collectability of financial assets.

Nevertheless, taking these factors into account, the agencies expect that smaller and less complex

institutions will be able to adjust their existing allowance methods to meet the requirements of

the new accounting standard without the use of costly and complex models.

7

Refer to paragraph 326-10-65-1 for transition related to ASU 2016-13.

8

For example, neither a vintage nor a discounted cash flow method is required for estimating expected credit losses.

Page 5 of 7

Use of Vendors

The agencies will not require institutions to engage third-party service providers to calculate

their allowances for credit losses. If an institution chooses to use a third-party service provider to

assist with this process, the institution should follow the agencies’ guidance on third-party

service providers.

9

The agencies encourage institutions to discuss the availability of historical loss data with their

core loan service providers. System changes related to the collection and retention of data may

be warranted.

Portfolio Segmentation

The new accounting standard requires institutions to measure expected credit losses on a

collective or pool basis when similar risk characteristics exist. Although the new accounting

standard provides examples of such characteristics, smaller and less complex institutions may

continue to follow the practices they have used for appropriately segmenting the portfolio under

an incurred loss methodology or they may refine those practices.

Further, if a financial asset does not share risk characteristics with other financial assets, the new

accounting standard requires expected credit losses to be measured on an individual asset basis.

As with practices applied under the incurred loss methodology, financial assets on which

expected credit losses are measured on an individual basis should not also be included in a

collective assessment of expected credit losses.

Data

To implement the new accounting standard, institutions should collect data to support estimates

of expected credit losses in a way that aligns with the method or methods that will be used to

estimate their allowances for credit losses. Depending on the method selected, institutions may

need to capture additional data. Institutions also may need to retain data longer than they have in

the past on loans that have been paid off or charged off.

9

For the agencies’ guidance on third-party service providers, refer to the following:

• FRB,

Supervision and Regulation Letter 13-19/Consumer Affairs Letter 13-21, “Guidance on Managing

Outsourcing Risk”

• FDIC, Financial Institution Letter 44-2008, “Guidance for Managing Third-Party Risk”

• OCC, Bulletin 2013-29, “Third-Party Relationships: Risk Management Guidance”

• NCUA, Supervisory Letter No. 07-01, “Evaluating Third Party Relationships”

Page 6 of 7

Qualitative Adjustments and Systematic Allowance Processes

Similar to the agencies’ expectations under an incurred loss methodology, institutions should

develop and document their allowance methodology and apply it in a thorough, disciplined, and

consistent manner.

10

Estimating allowance levels, including assessments of qualitative

adjustments to historical lifetime loss experience, involves a high degree of management

judgment, is inevitably imprecise, and results in a range of estimated expected credit losses. For

these reasons, institutions are encouraged to build strong processes and controls over their

allowance methodology.

Future Supervisory Guidance

The agencies are determining the nature and extent of supervisory guidance institutions will need

during the implementation period, with a particular focus on the needs of smaller and less

complex institutions. If institutions have issues or concerns about implementing the new

accounting standard, they should discuss their questions with their primary federal supervisor.

Successful Transition

Until institutions implement the new accounting standard, they must continue to calculate their

allowances for loan and lease losses using the existing incurred loss methodology. Institutions

should not begin increasing their allowance levels beyond those appropriate under existing U.S.

GAAP in advance of the new standard’s effective date. However, institutions are encouraged to

take steps to assess the potential impact on capital.

Although the agencies recognize the impact of CECL will vary from institution to institution, the

agencies encourage institutions to start planning and preparing for their transition to the new

accounting standard by:

• Becoming familiar with the new accounting standard.

• Discussing with the board of directors, industry peers, external auditors,

11

and supervisory

agencies how best to implement the new accounting standard in a manner appropriate to

the institutions’ size and the nature, scope, and risk of their lending and debt securities

investment activities.

• Reviewing existing allowance and credit risk management practices to identify processes

that can be leveraged when applying the new accounting standard.

• Identifying data needs and necessary system changes to implement the new accounting

standard consistent with its requirements, the allowance estimation method or methods to

be used, and supervisory expectations.

• Determining how and when to begin collecting the additional data that may be needed for

implementation.

10

For the agencies’ expectations under the incurred loss methodology, refer to the “Interagency Policy Statement on

the Allowance for Loan and Lease Losses” issued in December 2006.

11

When discussing the new accounting standard and its implementation with their external auditors, institutions and

their audit committees should be mindful of applicable auditor independence requirements.

Page 7 of 7

• Planning for the potential impact of the new accounting standard on capital.

Senior management, under the oversight of the board of directors, should work closely with staff

in their accounting, lending, credit risk management, internal audit, and information technology

functions during the transition period leading up to the effective date of the new accounting

standard as well as after its adoption.

Interagency Coordination

The agencies’ goal is to ensure consistent and timely communication, delivery of examiner

training, and issuance of supervisory guidance pertaining to the new accounting standard. The

agencies will be especially mindful of the needs of smaller and less complex institutions when

developing supervisory guidance describing the expectations for an appropriate and

comprehensive implementation of this standard. The guidance will not prescribe a single

approved method for estimating expected credit losses. Furthermore, because appropriate

allowance levels are institution-specific amounts, the guidance will not establish benchmark

targets or ranges for the change in institutions’ allowance levels upon adoption of CECL or for

allowance levels going forward.

Conclusion

The move to an expected credit loss methodology represents a change to current allowance

practices for the agencies and institutions. The agencies support an implementation of the

FASB’s new accounting standard that is both reasonable and practical, taking into consideration

the size, complexity, and risk profile of each institution.