Shareholder

Toolkit

What Shareholders Need to Know

INTRODUCTION 1

Shareholder Account Information 3

Transfer of Shares 5

Transfer Types and Security Registrations 7

Dividend Distribution 9

Escheatment 10

Restricted Stock 12

Corporate Actions 14

IRS Notices 15

Tax Forms and Descriptions 16

Tax ID Certification and W-8/W-9 Forms 22

Cost Basis 24

Lost Stock Certificate and Dividend Check 26

Direct Registration System 28

GLOSSARY 30

Common Financial Acronyms & Abbreviations 30

Financial Terms 31

Table of contents

2

Introduction

Congratulations — you’re a shareholder!

But, what does that really mean?

The realm of securities transactions and

management continues to increase in complexity

due to technological advances and regulatory

changes. Shareholders and issuers both

play important roles in ownership, but their

responsibilities differ. Many shareholders do not

know their rights and responsibilities or what it

means to be a shareholder.

Being a shareholder comes with advantages, but

you also have responsibilities

to protect your investment by maximizing the

benefits of the programs available through your

transfer agent or employer. For example, you

may have an option to reinvest dividends and

purchase stock directly through your transfer agent.

Shareholders should be aware of the importance of

logging into their account annually, the importance

of cashing their dividend checks regardless of the

amount, keeping their address current, maintaining

proof of ownership via certificate, saving your

statement in a safe place, and monitoring any

corporate action such as a merger or acquisition.

These are just a few of the key informational and

transactional items relevant to shareholders.

Ensuring that the shareholders we serve have the

right information is of paramount importance to

EQ. EQ leads a shareholder education mission to

develop content and media, including publications,

webinars and information guides designed

to provide valuable insights. We created this

Shareholder Toolkit to walk you through what it

means to be a registered shareholder. The guide

provides basic information on common terms,

responsibilities and requirements, while detailing

how shareholders can transact, inquire and manage

their accounts.

Shareholder Education: Navigating the Evolving Securities

Environment

Disclaimer: This document is intended for informational purposes only and is not intended to provide legal, investment, financial

or other advice. For specific questions, please contact your financial advisor or legal counsel.

3

What Does It Mean To Be A

Shareholder?

A registered shareholder owns stock directly with a

company. This is different from holding shares with

a broker. You may have become an owner by simply

investing in a company of your choice, participating

in a stock benefit program by your current or former

employer or inheriting the stock.

By owning a stock directly, you are engaged in

a financial relationship between yourself and the

company in which you hold shares, known as the

issuer. As in any financial relationship, there are

responsibilities on both sides. Steps are taken to

protect against theft, provide accurate withholdings

and prompt payments for annual tax filings. These

measures ensure smooth transitions of ownership

or address, safeguard the proper exercising of

stock options and preserve your investment from

inadvertent escheatment (capture) by a State

Government. You also have the right to make an

impact on the direction of the company in which

you own shares through your proxy vote. As a

shareholder, you also receive cash payments (per

share) if the company decides to pay a dividend.

Shareholder responsibilities include:

• Tax certification (Form W-8 or Form W-9

as applicable)

• Responding to letters and calls to verify contact

• Maximizing the advantages of stock benefit plans

• Programs including Dividend Reinvestment and

Direct Stock Purchase Plans

While this may seem like work, your transfer agent can assist you. EQ prepared this document to empower

shareholders, employee plan participants and investors to increase their knowledge of the industry through

education. If you are a registered shareholder, your transfer agent is responsible for the administration of your

holdings. If you own shares through a brokerage account, different rules may apply and you should consult

your brokerage firm.

To guide your journey and ease you through the various shareholder responsibilities, EQ has separated your

requirements and options into a few categories. Remember these are general guidelines and not advice. You

should always consult your own tax, financial or legal advisors for counsel on your situation.

4

Shareowners can also request an address change by calling EQ Shareowner Services customer

care at 800-356-5343. You will need to provide your social security number and account number.

If you maintain multiple addresses during the year, contact EQ Shareowner Services by one

of the above methods to request an address update before and after you travel to be certain

your mail is delivered to the appropriate location.

Shareholder Account Information

The EQ Shareowner portal was designed to provide

strong data security for shareowners.

If you are a first-time user, you can set up online

access by logging into the following website:

https://shareowneronline.com

Click “Register” at the top right-hand side of the

page and follow the prompts to create your profile

and Unique ID and password. If you have already

registered and know your Unique ID and password,

click “Login”.

You will be able to monitor the status of your

account, review your transactions, change your

address, add bank account information for direct

deposit of dividends or sale proceeds, submit

certain types of stock transfers, purchase additional

shares, request a sale of shares, or enroll in

electronic delivery to name a few. In addition,

logging into your online account at least annually

is one of the best methods to maintain appropriate

contact and avoid escheatment of your stock and/or

dividends as unclaimed property.

Account Address

It is of utmost importance to always maintain

a current address with your transfer agent. EQ

conducts various mailings on behalf of our clients

and it is the most common way we communicate

with our shareowners. Financial regulations require

that certain types of notices always be sent to a

physical address. Failure to maintain an active

address may result in mailings being returned to

us, missing scheduled dividend payments, and

overlooking important information related to your

holdings. In some cases, your account may become

dormant due to inactivity, resulting in your assets

being turned over to the state in accordance with

abandoned property laws.

If you do not have online access, you can

submit a change of address in writing to

the following address:

EQ Shareowner Services PO Box 64856

St Paul MN 55164-9442

Online Account Access at EQ Shareowner Services for

Registered Shareowners

5

What Does It Mean To Be A

Shareholder? (Cont)

Direct Deposit of Dividends/Sale Proceeds

A shareowner can advise in writing and provide the

full address if they would like their dividends mailed

directly to another financial institution. Shareowners

can also enroll in direct deposit on the portal.

What should I do if I forget my Unique

ID or password?

Navigate to https://shareowneronline.com, click

on “Login” and then click on “Having trouble

logging in?” Select the appropriate assistance

and proceed through prompts. If you answer

the security questions you set up during your

registration process correctly, your Unique ID or

password will be reset. If not, contact Shareowner

Services customer care desk at 800-356-5343 for

assistance.

Please note that Unique IDs cannot be changed. To

change your password, login to your account at the

above link and navigate to the My Profile tab which

contains password change instructions.

How can I safeguard my password?

Make passwords long, strong and a minimum of

eight (8) characters. Please note, your password

cannot contain anything similar to your previous

assigned 12 passwords and it cannot be your

Unique ID, your first name, or last name.

• Your password should be a mix of upper

and lowercase letters, numbers and symbols

• Don’t share your password

• Your password(s) should be unique and

not something that can easily be guessed

• Choose a different password for each

online account

• Write down your password and store it in a safe

place or you may make use of an electronic

password tracking app on your mobile device

Why am I not able to register my account?

There are several reasons an account cannot be registered for online access:

• The social security number / tax ID number entered does not match our records

• The account number you entered is invalid

• Certain classifications of ownership do not have online access to account information: individual

IRAs, corporate entities, non-resident US citizens and resident aliens

What should I do if I am locked out of my account?

If you have made multiple incorrect login attempts, you may be locked out of your account.

You may use the password reset link to reset your password via our easy self-service option.

6

Transfer of Shares

What is a transfer?

An exchange of ownership of property from

one party to another. Some transactions, like a

name change or custodian change may also be

considered a transfer.

What is the difference between a Registered vs.

Beneficial Shareholder?

A registered owner holds shares with the company

directly. A beneficial owner holds shares indirectly

through a bank or a broker. It is most commonly

referred to as being held in street name. The

most significant difference is that registered

shareholders receive publications and other forms

of correspondence from the Transfer Agent, while

beneficial shareholders receive communication via

their brokerage firm.

How do I transfer shares?

In order to transfer shares, certain documents

are required depending on the current

registration at the transfer agent. Typically, a

transfer of ownership with a Form W-9 must be

completed with a medallion signature guarantee

(see below). A description of the registration

types and requirements can be found in EQ’s

transfer of ownership package at https://

www.shareowneronline.com/media/1311/

stockpowertransferinstructions_dom.pdf

What happens to my shares when I die?

Upon the death of an owner, if you leave a will,

your beneficiaries will have to wait until your estate

is probated to inherit your stocks or as dictated

by other governing laws in the state in which the

shareholder was domiciled. If the registration on

the transfer agent’s records reflects a beneficiary

ownership such as a transfer on death (payable on

death or trust) the assets can be transferred to the

beneficiary listed with certain transfer documents.

What is a medallion signature guarantee?

A medallion signature guarantee verifies the

authenticity of a signature and helps to confirm

that a transfer of securities is authentic. This is done

through a stamp and signature combination. A

medallion signature guarantee is required when

securities need to be transferred from one party to

another or for any transaction that is considered a

transfer.

Where can I obtain a medallion signature

guarantee?

You can obtain a medallion signature guarantee

from a bank, savings and loan association,

brokerage firm or credit union. Go to http://www.

msglookup.com/search. html to find a guarantor.

The guarantor will typically ask for the following:

• Documentation showing the exact and complete

ownership of the security

• Documentation showing the value

of the transaction

• Documentation showing your legal authority (if

you are signing on behalf of another individual)

• Photo identification

• Proof of name change as a result of marriage,

divorce or legal name change

7

Transfer of Shares (Cont)

How do you make sure your signature

is acceptable?

The presenter of the transfer documents must sign

in their legal capacity according to the existing

registration on record at the transfer agent and not

the new registration. For example, if the existing

registration is John Doe and Jane Doe Joint Tenant,

it needs to be signed by both John and Jane. If the

shareholder is deceased, the transfer forms must

be signed by the executor/administrator of the

estate of the decedent. If the shareholder is not

deceased, but is deemed incompetent or unable to

sign, documentary evidence must be submitted to

the transfer agent supporting their role/relationship

to the shareholder. Any document requiring the

affixation of a medallion signature guarantee must

be done in the presence of the guarantor of the

medallion signature guarantee. It is important to

note that a power of attorney becomes null and

void once the maker is deceased.

Why is a W-8 or W-9 required?

This is required to certify your tax ID (U.S. holders)

or verify your country of residence (non-U.S.

holders), and avoid backup withholding upon the

liquidation of your assets. Please refer to the tax

certification section for further details.

How can I transfer and sell my shares?

If the company has a Direct Stock Sale Plan, you

can sell the shares through the company appointed

transfer agent. You will need to include a signed

letter of instruction with your transfer request and

provide the name of the security, account number

and the number of shares you would like to sell.

What is a stock certificate?

A stock certificate is documentation of a

shareholder’s ownership in a corporation. It indicates

the number of shares owned by an individual,

the par value (if any), the class of stock and date

of issuance. Original stock certificate(s) must be

presented to the transfer agent to effectuate a

transfer of ownership.

8

Transfer Types and Security

Registrations

Common transfer types include:

• Transfer from single or joint owner

• Transfer due to name change

• Transfer due to deceased owner

• Custodial transfer

Examples of Security Registrations:

• Joint Tenancy: Form of ownership where two or

more individuals hold shares as joint tenants with

rights of survivorship. When one tenant dies, the

entire tenancy transfers to the surviving tenants.

EX: JOHN BROWN & MARY BROWN JT TEN

• Tenants by Entirety: Joint ownership permits

spouses to mutually own property as a single

legal entity, with the survivor becoming the

sole owner.

EX: JOHN BROWN & MARY BROWN TEN ENT

• Tenants in Common: Form of ownership where

each tenant owns undivided interest. When one

tenant dies, their interest passes to the estate.

EX: JOHN BROWN & MARY BROWN TEN COM

• Community Property: Form of ownership required

by states that have adopted community property

laws for shares owned by husband and wife.

EX: JOHN BROWN & MARY BROWN

COMMUNITY PROPERTY

• Transfer or Payable on Death: Form of ownership

where stock is 100 percent property of owner.

When the owner dies, 100 percent ownership

is transferred to the beneficiary listed.

EX: JOHN BROWN TOD MARY BROWN

OR JOHN BROWN POD MARY BROWN

• Custodial: Form of ownership set up for the

benefit of a beneficiary and administered by a

legal guardian or custodian who has a fiduciary

obligation to the beneficiary.

EX: JOHN BROWN CUST MARY BROWN UNDER

UNIF GIFT TO MINORS ACT CA EX: ABC BANK

AGENT FOR MARY BROWN UA DTD 9-20-80

• Trust: A legal entity in which one person or

institution (trustee) holds the right to manage

a property or assets for the benefit of someone

else (trust beneficiary). The creator of the trust

is known as a grantor or settlor.

EX: JOHN BROWN, TRUSTEE THE MARY BROWN

REV LVG TR UA DTD 2/3/91

9

Transfer Types and Security

Registrations (Cont)

What are book-entry shares?

Investments with ownership recorded electronically,

such as stocks and bonds, are known as book-entry

shares. Common terms that are often used with

book-entry shares include paperless shares,

electronic shares, DRS shares, digital stock

certificates and uncertificated shares.

What should I do if I lose my certificate?

If your stock certificate is lost, accidentally destroyed

or stolen, you should immediately contact the

company appointed transfer agent and request a

stop transfer to prevent ownership of the securities

being transferred from your name. The transfer

agent will send affidavits to replace the shares which

require a Lost Securities Bond from an insurance

company.

How do I keep my shares safe?

We recommend the following:

1) Set up an online account with the transfer agent

and periodically review your ownership

2) Physical stock certificates should be held

in a safety deposit box with a financial

institution or deposited electronically

with your transfer agent for safekeeping

3) Request to convert your physical stock

certificates to book-entry shares

4) Notify your transfer agent if you are moving

to maintain a current address with agent

5) Notify your next of kin of your stock ownership

or make provisions in your will regarding your

beneficiaries

What is an inheritance tax waiver and how can I determine if one is needed?

An inheritance tax waiver is an authorization by the tax department of a deceased’s estate to transfer the

securities of the deceased without charging taxes. Most states do not require an inheritance tax waiver.

However, if the deceased resided in Puerto Rico or any states listed below, you must submit the inheritance

tax waiver to the company appointed transfer agent when transferring those shares.

• Alabama

• Hawaii

• Illinois

• Indiana

• Missouri

• Montana

• New Jersey

• New York

• North Dakota

• Ohio

• Oklahoma

• Pennsylvania

• Rhode Island

• Tennessee

To determine the specific inheritance tax waiver requirements for the states listed above, please contact the

appropriate tax authority, such as the Department of Revenue, Tax Commission, Department of Treasury, etc.

Important Note: Please ensure your address is always up to date with your transfer agent or broker to avoid

missing critical information and to prevent your property from being escheated.

10

Dividend Distribution

When a company declares a dividend, this sends a strong signal about its solid performance

and financial well-being. Companies often provide shareholders with easy options for reinvestment

to grow their investment in the company. EQ works closely with companies to create direct

stock purchase plans and dividend reinvestment strategies.

What is a dividend?

A dividend is money or stock that is paid to

shareholders, normally out of the corporation’s

current earnings or accumulated profits. It is a

distribution (usually quarterly) of a portion of the

company’s earnings, decided by the board of

directors to a class of its shareholders.

How is a cash dividend paid?

Generally, when a company declares a cash

dividend, they notify the transfer agent of the board

of directors’ decision on a record date and payable

date and the dividend rate to pay the shareholders

on their record date holdings in company shares.

Once this is completed, the transfer agent

processes the dividend on a certain record date

(this is a date that the company decides on for the

amount of shares the shareholders are holding at

that time to pay on). The transfer agent will then

send a funding letter to the company to verify and

confirm the number of shares held as of the record

date and the amount due from the company to pay

the dividend. When verified, the company will send

the funds to the transfer agent for distribution to

shareholders on the payable date provided.

How are funds distributed?

On the payable date, the funds can be distributed

in one of four ways:

1) The shareholder can have them sent, via a

physical check to the current name and address

on file

2) A direct deposit ACH sent to the bank account

on file (if allowed by the company paying the

dividend)

3) In some instances, a fee-based wire transaction

4) If a company permits and a shareholder elects

dividend reinvestment, the funds can be

reinvested into additional shares of company

stock within a shareholder’s account

Important Note: Please ensure your address is

always up to date with the transfer agent so physical

checks, statements, tax and ACH notices are sent to

the correct destination.

11

Escheatment

What is escheatment?

Escheatment is the act of reporting property

in which the rightful owner has made no claim,

engaged in no transaction or given no instruction

for a time period meeting the dormancy

determined by each state. Property that qualifies

for the escheatment process includes uncashed

company-issued checks and abandoned stock.

Escheated assets are transferred to the state for

safekeeping until the rightful owner makes a claim

on the assets.

Common forms of unclaimed property include

stocks, checking or savings accounts, uncashed

dividends or payroll checks, refunds, traveler’s

checks, trust distributions, unredeemed money

orders or gift certificates, insurance payments or

refunds, life insurance policies, annuities, certificates

of deposit, customer overpayments, utility security

deposits and contents of safe deposit boxes.

How can you avoid escheatment and keep

your property?

Stay in contact with your transfer agent by taking

the following actions:

• Vote your proxy.

• Cash all checks no matter how small. In some

states, the existence of uncashed checks in an

account may cause the property in that account

to be considered unclaimed.

• Enroll in direct deposit if it is available to you.

• Notify your transfer agent and any other financial

institutions of any changes to your contact

information, including email and any changes

of address. It’s important to do this even if you

primarily view your account information online.

• Act if you receive calls or notices asking you

to update your mailing address, email address

or other contact information. To guard against

identity theft, contact the institution directly to

verify that it requested the update.

• Consolidate small accounts to reduce

management tasks and limit the risk

of forgetting an account.

• Contact your transfer agent and other financial

institutions with at least once each year by phone,

email, in person or by logging into your online

account.

Respond to mailings from the transfer agent:

Be attentive to mailings and respond to them

promptly. Transfer agents mail several types of

letters during the year to the last known address, as

required by law. If you receive one of these mailings,

please sign it and return it as soon as possible in the

envelope provided. If you receive a mailing from a

third party and are unsure of its legitimacy, contact

the transfer agent directly.

How do I reclaim property that has been

escheated?

Once your property has been turned over to

the state you can recover it by contacting the

appropriate state. A list of contact addresses and

phone numbers can be found at: https://www.

missingmoney.com/Main/StateSites.cfm

Links to important industry sites:

• State Contact Information: https://www.

missingmoney.com/Main/StateSites.cfm

• Shareholder Services Association (SSA):

https://www.shareholderservices.org/

• Securities Transfer Association (STA):

http://www.stai.org/

• National Association of Unclaimed Property

Administrators (NAUPA): https://unclaimed.org/

• MissingMoney.com:

https://www.missingmoney.com/en/

12

Restricted

Stock

13

Restricted Stock

What does it mean to have restricted shares?

Restricted shares are securities acquired in

unregistered, private sales from the issuer or from

an affiliate of the issuer. Typically received through

Regulation D offerings, employee stock benefit

plans or as compensation for professional services.

Restricted securities are subject to resale limitations.

They typically have a restrictive legend stating that

they cannot be resold in the public marketplace

unless the sale is exempt from the SEC’s registration

requirements. This restriction is imposed by the

issuer of the securities. These shares can be issued

to you in certificate or book-entry form held

electronically by the issuer’s transfer agent.

Controlled shares are held by an affiliate of the

issuer. If a shareholder obtains securities from a

controlling individual as described above who has

been identified as an affiliate, the securities will

be considered restricted securities, even if such

securities were not otherwise restricted.

There are several types of restricted securities.

Below are common restricted securities handled

by a transfer agent:

• Private Placement: securities acquired either

directly or indirectly from the issuer or an affiliate

of the issuer in a non-public transaction.

• Accredited Investors or Compensatory Benefit:

securities acquired from the issuer subject to the

resale limitations of the Securities Act of 1933

(the Securities Act) Rule 502(d) or Rule 701(c).

How do I sell my restricted shares?

It depends on the type of restriction imposed

by the issuer of the security. Securities are not

considered restricted if the requirements of Rule

144 under the Securities Act of 1933 are met.

When this occurs, securities may be sold or

transferred by the shareholder. Rule 144 provides

common exemptions for holders to sell restricted

securities and you must meet several conditions

which include a six-month or one-year holding

period. Once you meet all the conditions of Rule

144, you cannot sell your restricted securities to

the public until the legend is removed from the

certificate or book-entry position.

• If the shares carry a 1933 Act legend, you must

obtain an opinion from the issuer’s counsel. The

counsel will consider the conditions that you have

met under Rule 144.

• If the issuer has filed a registration statement with

the SEC (Securities & Exchange Commission) and

you are listed on that registration statement, your

shares may be sold by your broker of choice as

long as the registration statement has not been

rescinded and is deemed still in effect. Your

broker will be able to direct you and provide the

necessary documents to effectuate the sale of

your shares.

• If the issuer of the security imposed a restriction

specific to certain requirements being met with

them, a letter of authorization to release the

restrictive stop must be provided from that issuer.

You may choose to sell your clean (unrestricted)

shares through your transfer agent if a plan

prospectus is in place or with any broker

of your choice.

14

Restricted Stock (Cont)

Be in the know:

1. Know your status with the issuer (affiliate or non-affiliate)

2. Understand holding periods needed prior to sale

3. Request items needed to remove restriction with the issuer

or transfer agent

4. Does a sale need to occur prior to restriction being removed?

5. Check with your broker to see if they are capable of performing a sale

How do I gain access to my locked-up shares?

The issuing company may impose a time-based or other company-imposed restrictive stop

on newly-issued or outstanding shares. In order to release or remove any company-imposed

restrictive stop, we require a letter from the issuer authorizing the release of their lock-up;

only the issuer of the security can provide this authorization. If it is a time-based restrictive

stop, the lapse in time must have occurred in order to gain access to your time-based

locked up shares. If shares are held in certificate form, it must be presented to the issuer’s

transfer agent in order to cleanse your shares.

15

Corporate Actions

What is a corporate action?

A corporate action is an event initiated

by a company that will bring a change to the

securities equity or debt issued by the company.

The event can be a merger, reorganization or

exchange, which require intense planning, strategy

and attention to detail. Corporate actions are

typically agreed upon by a company’s board of

directors and authorized by the shareholders.

What is an acquisition?

An acquisition is a corporate action in which

a company buys most, if not all, of the target

company’s ownership stakes to assume control

of the firm. Acquisitions are often made as part

of a company’s growth strategy when it is more

beneficial to take over an existing firm’s operations

rather than expands its own niche. Acquisitions are

often paid in cash, the acquiring company’s stock

or a combination of both cash and stock. To obtain

information on the acquisition you can visit the

company’s website or contact the information agent

or the transfer agent.

In order to participate in the voluntary offer, you

must submit both a letter of transmittal and your

certificates to the depositary agent prior to the

expiration. It is recommended to send certificates

via overnight mail or certified return receipt insured

at the market value of the shares. If your certificates

are lost, you need to contact the transfer agent to

have them replaced to participate in the offer.

What is a merger?

A merger is the combining of two or more

companies. Generally, one company offers

stockholders securities in the acquiring company

in exchange for the surrender of their stock.

The target company ceases to trade once the

merger is effective. The merger can be in the form

of cash, stock or a combination of cash and stock.

When the merger is effective the target shareholder

is entitled to the merger consideration.

In order to receive your merger consideration,

you must submit a letter of transmittal and

your certificates to the exchange agent. It is

recommended to send certificates via overnight

mail or certified return receipt insured at the market

value of the shares. If your certificates are lost, you

will need to contact the transfer agent to have them

replaced to receive your merger consideration.

What should I do if there is a corporate action?

Go to the company’s website, contact the Investor

Relations department via their toll-free number

or if you know who the transfer agent is, contact

them for further direction. With an acquisition or

merger you should receive a mailing with materials

pertaining to the corporate action.

Important Note: Please ensure your address is

always up to date with your transfer agent or broker

to avoid missing critical information and to prevent

your property from being escheated. Additionally,

ensure your account is tax certified with your broker

or transfer agent to avoid any tax withholding from

your merger considerations.

16

IRS Notices

B-Notices

B-Notices are issued by the IRS for missing or

incorrect taxpayer identification numbers (TINs),

based on the information return forms that a

transfer agent files during tax reporting with the IRS.

The official IRS names for B-Notices are CP2100 &

CP2100A. The CP2100 is issued whenever a payer

has 50 or more notices. If there are more than 250

notices the CP2100 will be given to the issuer on

a CD or DVD. A CP2100A is issued when there are

less than 50 accounts. The IRS issues B-Notices

twice per year, during the spring and then during

the fall based on the information returns filed in

the previous year. Transfer agents are required to

determine if an account is to be coded for a first

and second B-Notice. A second B-Notice is issued

when the IRS receives incorrect information for the

same shareholder, within three years after the first

B-Notice was issued. Transfer agents are required

to apply backup withholding of 28 percent within

30 days on all payments to an account with a first

or second B-Notice that remains unresolved.

B-Notices are issued to uncertified foreign accounts

that had backup withholding, but transfer agents

are not required to act on those notices.

C-Notices

C-Notices are issued by the IRS for underreporting

by a shareholder, based on the information returns

that the transfer agent and others have filed during

tax reporting. The official IRS name of C-Notices is a

CP-543 Notice. The IRS issues a C-Notice to instruct

payers that they should impose backup withholding

on dividend or interest payments to the shareholder,

because the IRS has made attempts to resolve the

underreporting with the shareholder, but they were

unsuccessful in their efforts. Unlike B-Notices, it

must be noted that C-Notices do not apply to gross

proceeds payments.

For accounts coded for a C-Notice, the transfer

agent mails a C-Notice letter to the shareholder

informing them that we have received the CP-543

Notice from the IRS and that backup withholding

will continue, until they contact the IRS and resolve

the issue.

The only cure for a C-Notice is a letter from the

IRS, instructing the payer to discontinue backup

withholding on the payments to the affected

shareholder. Once the transfer agent receives the

discontinue notice we will stop any further backup

withholding on payments.

Notices on Levy

A Notice of Levy, IRS Form 668-A(ICS) is issued to a shareholder by the IRS as a means of collecting

taxes owed. The Levy instructs the transfer agent to turn over the shareholder’s property to the IRS,

which includes selling any book shares that we control, and any uncashed checks that we have on

our system. The transfer agent issues a check for the liquidated assets of the shareholder to the

United States Treasury in order to satisfy the Notice of Levy.

17

Tax Forms and Descriptions

Typical IRS Forms

Note: Forms may change on an annual basis as per IRS rules and guidelines.

There are various forms used for tax reporting based on the type of income to be reported and whether

the shareholder is a U.S. or a foreign shareholder.

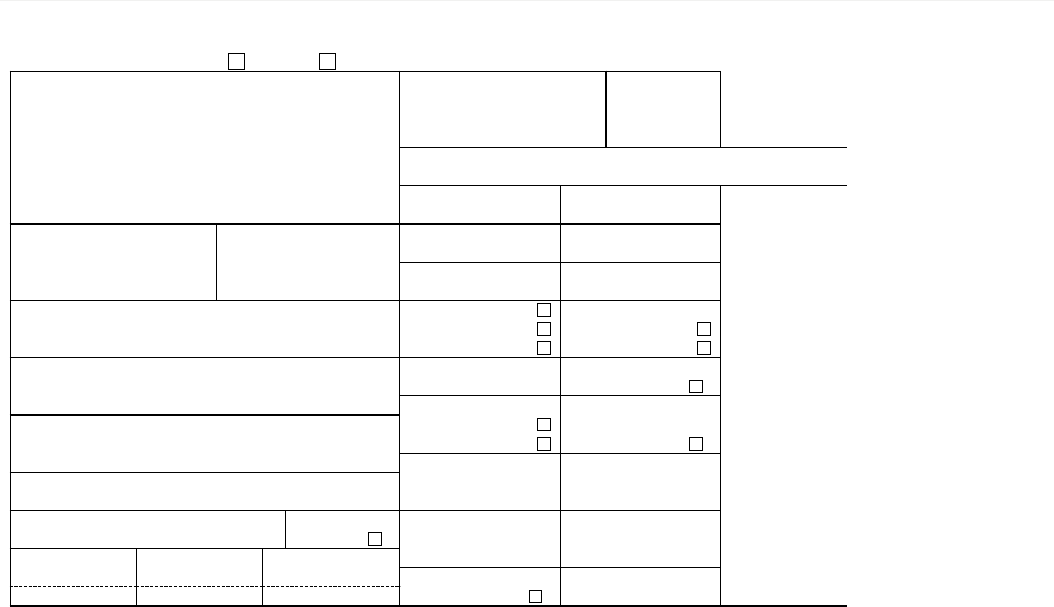

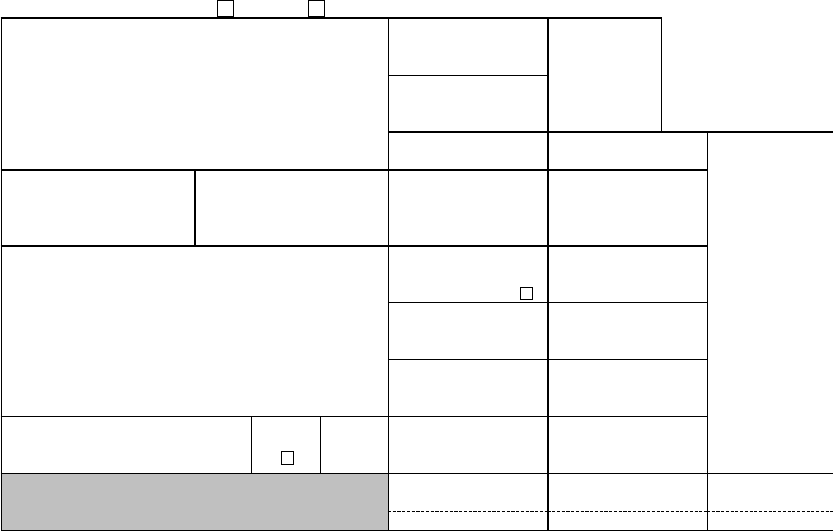

Form 1099-B

• Used to report all gross proceeds payments to U.S. shareholders and to uncertified shareholders

with foreign addresses, because there was backup withholding imposed on their payments.

• The mailing deadline for Form 1099-B is February 15 of the year following the tax year that is being

reported. If February 15 falls on a weekend or is a national holiday, the due date is the next business day.

• The IRS does offer a 30-day mailing extension that must be requested by the due date of February 15.

The current version of Form 1099-B can be found at: https://www.irs.gov/pub/irs-pdf/f1099b.pdf

Form 1099-B

2023

Proceeds From

Broker and

Barter Exchange

Transactions

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0715

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S TIN RECIPIENT’S TIN

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

CUSIP number FATCA filing

requirement

14 State name 15

State identification no.

16 State tax withheld

$

$

Applicable checkbox on Form 8949

1a Description of property (Example: 100 sh. XYZ Co.)

1b Date acquired 1c Date sold or disposed

1d Proceeds

$

1e Cost or other basis

$

1f Accrued market discount

$

1g Wash sale loss disallowed

$

2

Short-term gain or loss

Long-term gain or loss

Ordinary

3 If checked, proceeds from:

Collectibles

QOF

4 Federal income tax withheld

$

5 If checked, noncovered

security

6 Reported to IRS:

Gross proceeds

Net proceeds

7 If checked, loss is not allowed

based on amount in 1d

8 Profit or (loss) realized in

2023 on closed contracts

$

9

Unrealized profit or (loss) on

open contracts—12/31/2022

$

10

Unrealized profit or (loss) on

open contracts—12/31/2023

$

11 Aggregate profit or (loss)

on contracts

$

12 If checked, basis reported

to IRS

13 Bartering

$

Form 1099-B

www.irs.gov/Form1099B

Form 1099-B

There is a de minimis

rule for Forms 1099-B,

stipulating that transfer

agents are not required to

mail, or report aggregated

annual income of less than

$20.00. (related to the

sale of fractional shares).

18

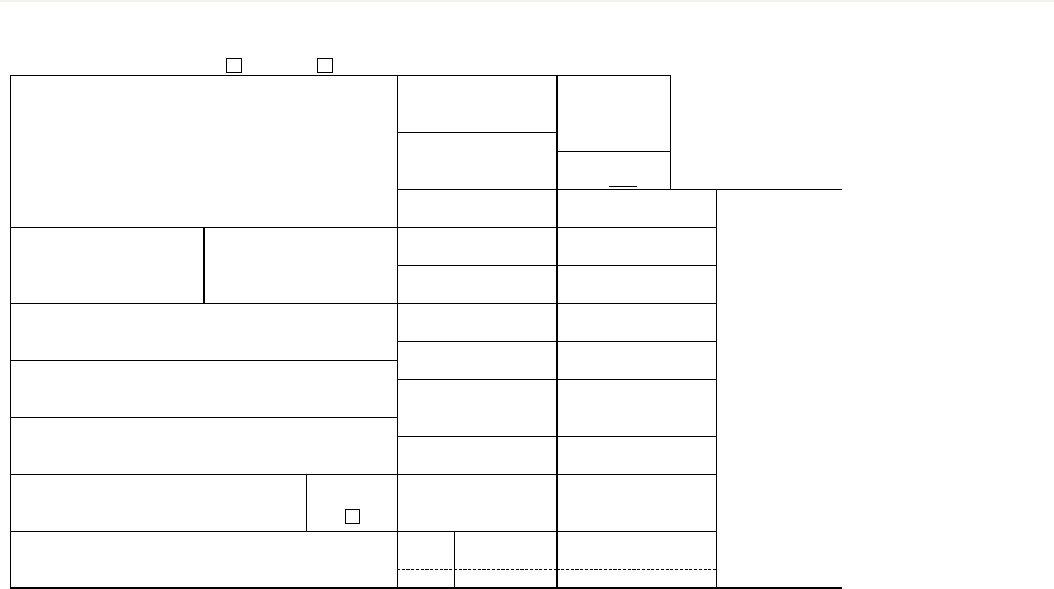

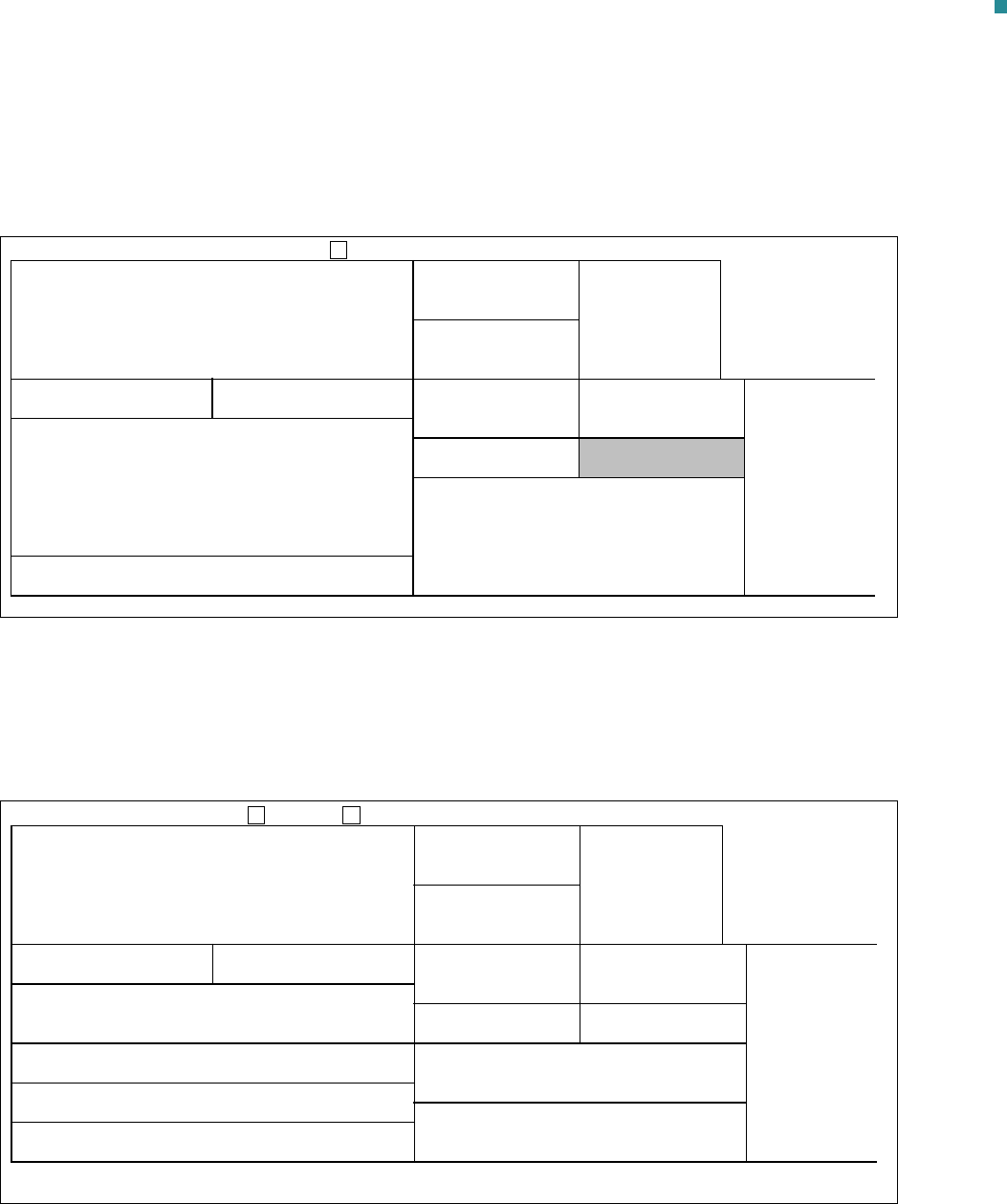

Form 1099-DIV

• This form is used to report dividend income to U.S. shareholders.

• There is a de minimis rule for Form 1099-DIV, stipulating that transfer agents are not required to mail,

or report aggregated annual income of less than $10.00.

• The mailing deadline for Form 1099-DIV is January 31 of the year following the tax year that is being

reported. If January 31 falls on a weekend or is a national holiday, the due date is the next business day.

• The IRS offers a 30-day mailing extension that must be requested by the due date of January 31.

The current version of Form 1099-DIV can be found at: https://www.irs.gov/pub/irs-pdf/f1099div.pdf

Form

1099-DIV

(Rev. January 2022)

Dividends and

Distributions

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0110

For calendar year

20

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S TIN RECIPIENT’S TIN

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1a Total ordinary dividends

$

1b Qualified dividends

$

2a Total capital gain distr.

$

2b Unrecap. Sec. 1250 gain

$

2c Section 1202 gain

$

2d Collectibles (28%) gain

$

2e

Section 897 ordinary dividends

$

2f Section 897 capital gain

$

3 Nondividend distributions

$

4

Federal income tax withheld

$

5 Section 199A dividends

$

6 Investment expenses

$

7 Foreign tax paid

$

8

Foreign country or U.S. possession

9

Cash liquidation distributions

$

10

Noncash liquidation distributions

$

11 FATCA filing

requirement

12 Exempt-interest dividends

$

13 Specified private activity

bond interest dividends

$

14 State 15

State identification no.

16 State tax withheld

$

$

Form 1099-DIV (Rev. 1-2022)

www.irs.gov/Form1099DIV

Tax Forms and Descriptions (Cont)

19

Tax Forms and Descriptions (Cont)

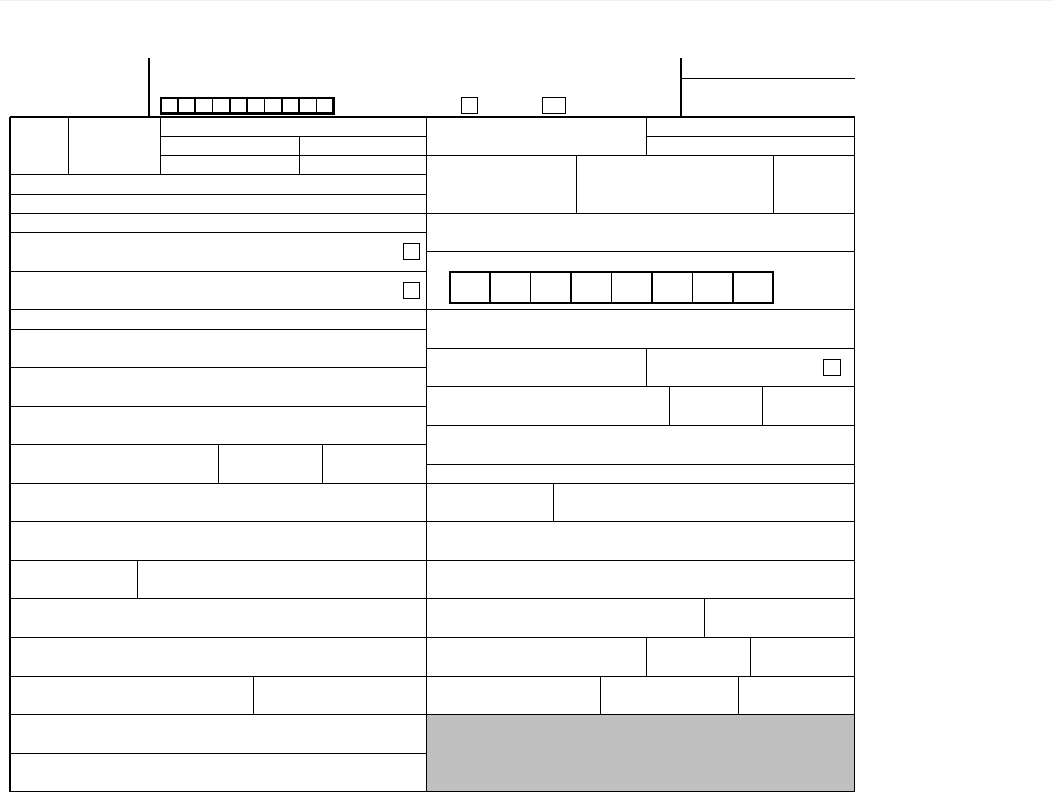

Form 1042-S

Department of the Treasury

Internal Revenue Service

Foreign Person’s U.S. Source Income Subject to Withholding

Go to www.irs.gov/Form1042S for instructions and the latest information.

2023

UNIQUE FORM IDENTIFIER

AMENDED

AMENDMENT NO.

OMB No. 1545-0096

Copy A for

Internal Revenue Service

1 Income

code

2 Gross income

3 Chapter indicator. Enter “3” or “4”

3a Exemption code

3b Tax rate .

4a

Exemption code

4b Tax rate .

5 Withholding allowance

6 Net income

7a Federal tax withheld

7b Check if federal tax withheld was not deposited with the IRS because

escrow procedures were applied (see instructions) . . . . . .

7c Check if withholding occurred in subsequent year with respect to a

partnership interest . . . . . . . . . . . . . .

8 Tax withheld by other agents

9

Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

( )

10 Total withholding credit (combine boxes 7a, 8, and 9)

11 Tax paid by withholding agent (amounts not withheld) (see instructions)

12a Withholding agent

’

s EIN

12b

Ch. 3 status code

12c

Ch. 4 status code

12d Withholding agent

’

s name

12e Withholding agent

’

s Global Intermediary Identification Number (GIIN)

12f Country code 12g Foreign tax identification number, if any

12h Address (number and street)

12i City or town, state or province, country, ZIP or foreign postal code

13a Recipient

’

s name 13b Recipient

’

s country code

13c

Address (number and street)

13d City or town, state or province, country, ZIP or foreign postal code

13e Recipient’s U.S. TIN, if any

13f Ch. 3 status code

13g Ch. 4 status code

13h Recipient’s GIIN

13i

Recipient

’

s

foreign tax identification

number, if any

13j

LOB code

13k Recipient

’

s account number

13l Recipient

’

s date of birth (YYYYMMDD)

14a

Primary Withholding Agent

’

s

Name (if applicable)

14b Primary Withholding Agent

’

s EIN

15 Check if pro-rata basis reporting

15a

Intermediary or flow-through entity’s EIN, if any

15b

Ch. 3 status code

15c

Ch. 4 status code

15d

Intermediary or flow-through entity’s name

15e

Intermediary or flow-through entity’s GIIN

15f Country code 15g Foreign tax identification number, if any

15h Address (number and street)

15i City or town, state or province, country, ZIP or foreign postal code

16a Payer

’

s name 16b Payer

’

s TIN

16c Payer

’

s GIIN

16d

Ch. 3 status code

16e

Ch. 4 status code

17a State income tax withheld 17b Payer

’

s state tax no. 17c Name of state

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 11386R

Form 1042-S (2023)

Form 1042-S

• This form is used to report all income to foreign shareholders. There are specific codes used to define

the type of income.

• The mailing deadline for Form 1042-S is March 15 of the year following the tax year that is being

reported. If March 15 falls on a weekend or it is a national holiday, the due date is the next business day.

• The IRS does offer a 30-day mailing extension that must be requested by the due date of March 15.

The current version of Form 1042-S can be found at: https://www.irs.gov/pub/irs-pdf/f1042s.pdf

20

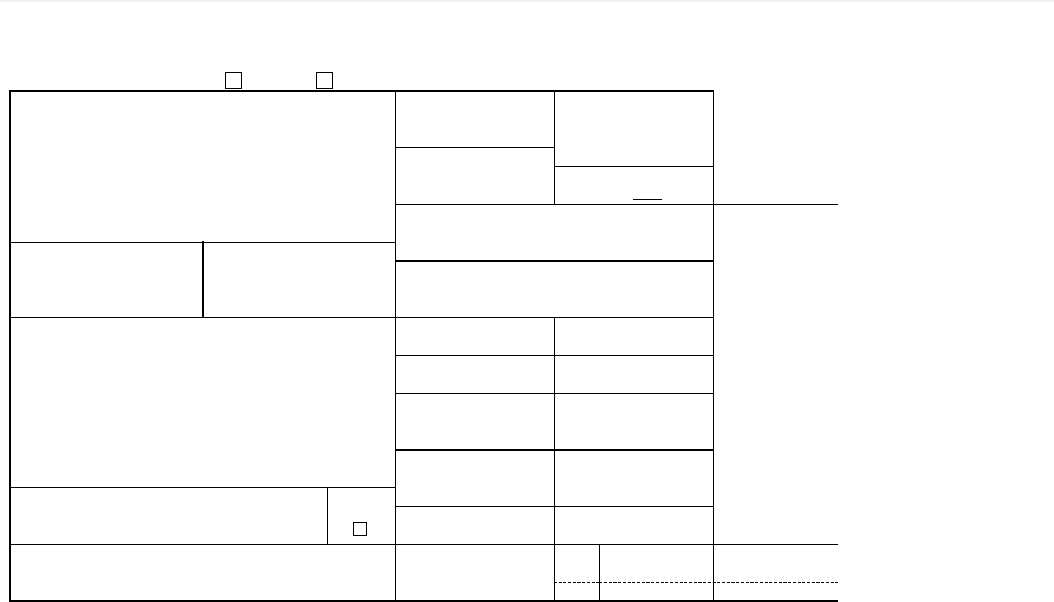

Form 1099-INT

(Rev. January 2022)

Interest

Income

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0112

For calendar year

20

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S TIN

RECIPIENT’S TIN

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

FATCA filing

requirement

Account number (see instructions)

Payer’s RTN (optional)

1 Interest income

$

2 Early withdrawal penalty

$

3 Interest on U.S. Savings Bonds and Treasury obligations

$

4 Federal income tax withheld

$

5 Investment expenses

$

6 Foreign tax paid

$

7

Foreign country or U.S. possession

8 Tax-exempt interest

$

9

Specified private activity bond

interest

$

10 Market discount

$

11 Bond premium

$

12

Bond premium on Treasury obligations

$

13

Bond premium on tax-exempt bond

$

14

Tax-exempt and tax credit

bond CUSIP no.

15

State

16

State identification no.

17 State tax withheld

$

$

Form 1099-INT (Rev. 1-2022)

www.irs.gov/Form1099INT

Form 1099-INT

• This form is used to report interest income to U.S. shareholders. There is a de minimis rule for Form

1099-INT stipulating that we do not have to mail, or report aggregated annual income of less than $10.00.

• The mailing deadline for Form 1099-INT is January 31 of the year following the tax year that is being

reported. If January 31 falls on a weekend or it is a national holiday, the due date is the next business day.

• The IRS offers a 30-day mailing extension that must be requested by the due date of January 31.

The current version of Form 1099-INT can be found at: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

Tax Forms and Descriptions (Cont)

21

Tax Forms and Descriptions (Cont)

Form 1099-MISC

• This form is used to report miscellaneous payments to U.S. shareholders. The mailing deadline

for forms 1099-MISC is January 31 of the year following the tax year that is being reported,

for any firms reporting Employee Compensation in Box 7.

• The mailing deadline is February 15 of the year following the tax year that is being reported

if not reporting Employee Compensation in Box 7. If January 31 or February 15 fall on a weekend

or are a national holiday, the due date is the next business day.

• The IRS does offer a 30-day mailing extension that has to be requested by the due dates

of January 31 or February 15. The current version of Form 1099-MISC can be found at:

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Form 1099-MISC

2021

Miscellaneous

Information

Copy 1

For State Tax

Department

Department of the Treasury - Internal Revenue Service

OMB No. 1545-0115

VOID CORRECTED

PAYER’S name, street address, city or town, state or province, country, ZIP

or foreign postal code, and telephone no.

PAYER’S TIN RECIPIENT’S TIN

RECIPIENT’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions) FATCA filing

requirement

1 Rents

$

2 Royalties

$

3 Other income

$

4

Federal income tax withheld

$

5 Fishing boat proceeds

$

6

Medical and health care payments

$

7

Payer made direct sales

totaling $5,000 or more of

consumer products to

recipient for resale

8

Substitute payments in lieu of

dividends or interest

$

9

Crop insurance proceeds

$

10 Gross proceeds paid to an

attorney

$

11 Fish purchased for resale

$

12 Section 409A deferrals

$

13 Excess golden parachute

payments

$

14 Nonqualified deferred

compensation

$

15 State tax withheld

$

$

16 State/Payer’s state no. 17 State income

$

$

Form 1099-MISC

www.irs.gov/Form1099MISC

22

Annual Meeting Planning Guide TIMELINE

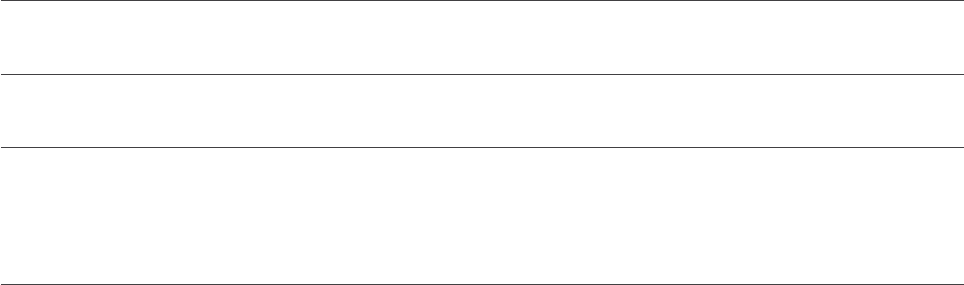

IRS Form 3921

• This form is used to provide employees with information relating to incentive stock options (ISOs) that were

exercised during the calendar year.

• Employers provide one Form 3921 for each exercise of ISOs that occurred during the calendar year.

Tax Forms and Descriptions (Cont)

21

TAX FORMS AND DESCRIPTIONS (CONT.)

IRS Form 3921

• This form is used to provide employees with information relating to incentive stock

options (ISOs) that were exercised during the calendar year.

• Employers provide one Form 3921 for each exercise of ISOs that occurred during

the calendar year.

IRS Form 3922

• This form is used to report the transfer of stock acquired through an Employee

Stock Purchase Plan (ESPP) under Section 423(c).

• The form is for informational purposes only and is not entered into your return.

Form 3921

(Rev. October 2017)

Exercise of an

Incentive Stock

Option Under

Section 422(b)

Copy B

For Employee

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2129

This is important tax

information and is

being furnished to the

IRS. If you are required

to file a return, a

negligence penalty or

other sanction may be

imposed on you if this

item is required to be

reported and the IRS

determines that it has

not been reported.

CORRECTED (if checked)

TRANSFEROR’S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

TRANSFEROR’S TIN EMPLOYEE’S TIN

EMPLOYEE’S name

Street address (including apt. no.)

City or town,

state or province,

country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Exercise price per share

$

4 Fair market value per share

on exercise date

$

5 No. of shares transferred

6 If other than TRANSFEROR, name, address, and TIN of

corporation whose stock is being transferred

Form

3921 (Rev. October 2017)

(keep for your records)

www.irs.gov/Form3921

Form 3922

(Rev. September 2016)

Cat. No. 41180P

Transfer of Stock

Acquired Through

an Employee

Stock Purchase

Plan Under

Section 423(c)

Copy A

For

Internal Revenue

Service Center

Department of the Treasury - Internal Revenue Service

File with Form 1096.

OMB No. 1545-2129

For Privacy Act and

Paperwork Reduction

Act Notice, see the

current version of the

General Instructions for

Certain Information

Returns.

2626

VOID CORRECTED

CORPORATION'S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

CORPORATION'S federal identification number

EMPLOYEE’S identification number

EMPLOYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Fair market value per share

on grant date

$

4 Fair market value per share

on exercise date

$

5

Exercise price paid per share

$

6 No. of shares transferred

7 Date legal title transferred

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1

$

Form 3922 (Rev. 9-2016)

www.irs.gov/form3922

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

IRS Form 3922

• This form is used to report the transfer of stock acquired through an Employee Stock Purchase Plan (ESPP)

under Section 423(c).

• The form is for informational purposes only and is not entered into your return.

21

TAX FORMS AND DESCRIPTIONS (CONT.)

IRS Form 3921

• This form is used to provide employees with information relating to incentive stock

options (ISOs) that were exercised during the calendar year.

• Employers provide one Form 3921 for each exercise of ISOs that occurred during

the calendar year.

IRS Form 3922

• This form is used to report the transfer of stock acquired through an Employee

Stock Purchase Plan (ESPP) under Section 423(c).

• The form is for informational purposes only and is not entered into your return.

Form 3921

(Rev. October 2017)

Exercise of an

Incentive Stock

Option Under

Section 422(b)

Copy B

For Employee

Department of the Treasury - Internal Revenue Service

OMB No. 1545-2129

This is important tax

information and is

being furnished to the

IRS. If you are required

to file a return, a

negligence penalty or

other sanction may be

imposed on you if this

item is required to be

reported and the IRS

determines that it has

not been reported.

CORRECTED (if checked)

TRANSFEROR’S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

TRANSFEROR’S TIN EMPLOYEE’S TIN

EMPLOYEE’S name

Street address (including apt. no.)

City or town,

state or province,

country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Exercise price per share

$

4 Fair market value per share

on exercise date

$

5 No. of shares transferred

6 If other than TRANSFEROR, name, address, and TIN of

corporation whose stock is being transferred

Form

3921 (Rev. October 2017)

(keep for your records)

www.irs.gov/Form3921

Form 3922

(Rev. September 2016)

Cat. No. 41180P

Transfer of Stock

Acquired Through

an Employee

Stock Purchase

Plan Under

Section 423(c)

Copy A

For

Internal Revenue

Service Center

Department of the Treasury - Internal Revenue Service

File with Form 1096.

OMB No. 1545-2129

For Privacy Act and

Paperwork Reduction

Act Notice, see the

current version of the

General Instructions for

Certain Information

Returns.

2626

VOID CORRECTED

CORPORATION'S name, street address, city or town, state or province,

country, and ZIP or foreign postal code

CORPORATION'S federal identification number

EMPLOYEE’S identification number

EMPLOYEE’S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Account number (see instructions)

1 Date option granted

2 Date option exercised

3 Fair market value per share

on grant date

$

4 Fair market value per share

on exercise date

$

5

Exercise price paid per share

$

6 No. of shares transferred

7 Date legal title transferred

8 Exercise price per share determined as if the option was

exercised on the date shown in box 1

$

Form 3922 (Rev. 9-2016)

www.irs.gov/form3922

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

23

Tax ID Certification

and W-8/W-9 Forms

Tax Certification

All U.S. shareholders are required to submit a Form

W-9 to certify their Tax Identification Number (TIN).

A TIN is either a Social Security Number (SSN) for

individuals or an Employer Identification Number

(EIN) for entities. The transfer agent is required to

impose *backup withholding (currently 28 percent)

on payments

to un-certified U.S. shareholders and to deposit

those tax amounts with the IRS in a timely manner.

IRS Form W-9

The Form W-9 is a request for TIN and certification.

The transfer agent as a reporting/paying agent

is required by the IRS to collect a Form W-9 or

Form W-8 from each shareholder.

IRS Form W-8

The IRS issued several versions of Form W-8 to be

used by foreign shareholders for tax certification.

The specific form submitted depends on the type

of shareholder.

Form W-8 BEN

W-8 BEN Form is used by individuals. The form is

valid starting on the date the form is signed and

ending on the last day of the third succeeding

calendar year, unless a change in circumstances

made anyinformation on the form incorrect.

Form W-8 BEN: https://www.irs.gov/pub/irs-pdf/

fw8ben.pdf

Form W-8 BEN-E

Form W-8 BEN-E is used by entities. The form is

valid starting on the date the form is signed and

endingon the last day of the third succeeding

calendar year, unless a change in circumstances

made any information on the form incorrect.

Form W-8 BEN-E: https://www.irs.gov/pub/irs-pdf/

fw8bene.pdf

If an account is held by a non-resident alien or a

foreign entity, the transfer agent must have a W-8

on file. This information is required for U.S. tax

withholding purposes on income earned in your

account. Any uncertified shareholder is subject to

backup withholding.

Important: The IRS requires those who are not

defined as U.S. citizens or resident aliens to use

the appropriate Form W-8 in place of a Form W-9.

24

W-9 Form W-8 BEN Form

Filed by U.S. Persons

Certifies the individual is the beneficial

owner of the account

Provides withholding agent with SSN/TIN

for reporting purposes

Certifies that the individual is a non – U.S. person

Does not expire unless individual

has a change in circumstance

Expires on the last day of the third succeeding

calendar year after it is signed

Ex: Form W-8 BEN signed on September 30, 2019,

remains valid through December 31, 2022

Tax ID Certification

and W-8/W-9 Forms (Cont)

What are long-term gains or losses?

A long-term capital gain or loss results from the sale

of shares that have been owned for longer than 12

months at the time of sale. The long-term capital

gain or loss amount is determined by the difference

in value between the purchase price and sale

price. Long-term capital gains often receive more

favorable tax treatment than short-term gains.

What are short-term gains or losses?

A short-term capital gain or loss results from the

sale of shares that you have owned for less than

12 months. Short-term capital gains or losses are

determined by the net profit or loss when the shares

are sold.

W-9 vs. W-8 Summary

Voluntary withholding on dividends and gross proceeds from registered shares:

U.S. shareholders can request that the company-appointed transfer agent withhold tax from their payments,

although they are properly certified and not subject to withholding. The following conditions must be met for

voluntary withholding to occur:

• The transfer agent must receive a written request from the shareholder to withhold their dividend

payments. This request can either be a signed letter that is mailed to the transfer agent or it can

be an email from the shareholder to the transfer agent.

• The voluntary withholding request must state the percentage that the shareholder wants withheld

from their dividend payments.

• This request will remain in effect until the shareholder submits a written request to stop the voluntary

withholding.

• The transfer agent will deposit all voluntary withholding amounts with the IRS in a timely manner.

25

Cost Basis

What is cost basis reporting and when was it

implemented?

The term cost basis reporting refers to the original

value of an asset for tax purposes (usually the

purchase price), adjusted for events such as wash

sales, stock splits, dividends and return of capital

distributions. This value is used to determine the

capital gain or loss when an asset is discarded. On

October 3, 2008, legislation was passed under

the Emergency Economic Stabilization Act of

2008 that had a substantial impact on many areas

of the financial services industry. As part of the

legislation there are more stringent requirements

on financial intermediaries such as issuers, transfer

agents, brokers, banks and mutual funds, to report

customers’ cost basis in securities transactions to

both their customers and the IRS. Recognizing

financial institutions’ need to adapt their systems

and processes to comply with the new rules, the law

takes a phased approach, requiring them to report

cost basis for:

• Stock acquired on or after January 1, 2011

• Regulated investment companies (RIC) and

dividend reinvestment plans (DRIP) shares

acquired on or after January 1, 2012

• Financial instruments such as debt securities and

options acquired on or after January 1, 2014

What is a covered security?

A covered security is a specified security acquired

for cash on or after the applicable effective date as

per IRS Code §1.6045 (g)(3)(A).

When is cost basis applicable?

The Emergency Economics Act of 2008 came into

effect on January 1, 2011, it mandated brokers and

transfer agents to maintain cost basis of shares.

Shares acquired prior to that date are considered

non-covered, because record of cost basis was

not maintained. In addition, shares acquired via

employee restricted plans are defined by the IRS

as non-covered. There is no exchange of cash for

the restricted award, therefore cost basis may not

be maintained for shares acquired via vesting of

restricted awards/units.

Can EQ provide historical cost basis information?

EQ can provide cost basis information for covered

securities starting January 1, 2011, the effective

date of the new cost basis reporting legislation.

EQ will not provide historical cost basis information

prior to this date.

Does EQ utilize the DTCC CBRS services to

transfer cost basis information?

Yes. EQ is a DTCC limited participant and utilizes

DTCC CBRS for transferring cost basis information

to and from participating brokers.

For more information on DTCC CBRS, click here.

26

How will 1099-B reporting change and will this

require a new version of IRS Form 1099-B?

As a result of the 2011 cost basis reporting

requirements, the only additional modifications

to the Form 1099-B are the addition of Box 1d

stock or other symbol and Box 1e quantity sold. In

order to streamline shareholder reporting, EQ has

produced a combined Form 1099-B, which details

every covered and uncovered sales transaction for

a particular company on a single form. In effect, a

shareholder will receive one combined Form 1099-B

for each group of transactions for a company, rather

than one form for each separate sales transaction.

The boxes on the IRS Form 1099-B are denoted

on the combined form for ease of use. All other

required information on the combined Form 1099-B

remains the same, except for symbol and quantity

sold as previously noted. Please reference the IRS

site for updated information.

I currently receive an Form 1099-B when I

receive a proceed check. Will the Form 1099-B

still be provided with the proceeds check?

The Form 1099-B currently distributed with proceed

checks (Check/1099 Combo) will no longer be

distributed when sales are made throughout the

year. After the tax reporting year, EQ will only

provide Form 1099-B at year-end. For example,

taxable transactions in 2016 produce a 2016

1099-B, which is mailed by February 15, 2017.

Were there any changes for S corporations under

the updated legislation?

Yes. In the past, no broker or transfer agent

reporting on Form 1099-B was required for

corporate customers, including S corporations.

The updated legislation requires broker and

transfer agents to begin Form 1099-B reporting

for S corporations (other than a financial institution)

for sales of covered securities acquired on or after

January 1, 2012.

What is a wash sale?

A wash sale occurs when you sell stock or securities

at a loss and then replace the stock or security

within 30 days. You cannot deduct losses from sales

of stock or securities in a wash sale under IRS rules.

For more information on wash sales, refer to the IRS

regulations and IRS Publication 550 – Investment

Income and Expenses.

What is lot relief and what methods does EQ

support?

Lot relief is a method of computing the cost basis

of an asset that is sold in a taxable transaction. EQ

supports FIFO (First-In-First-Out) and specific lot

identification. As of January 1, 2012, EQ continues

to support average cost for RICs and DRIP accounts.

What is the current status of the cost basis

reporting implementation at EQ?

As the next phases of cost basis reporting

become effective, financial institutions will

continue to adapt their systems and processes to

comply. EQ is compliant and is actively working

on implementing cost basis reporting solutions to

comply with future phases of the legislation.

Where can I access the cost basis reporting

regulations passed under the Economic

Stabilization Act of 2008?

To view the full act, please visit the IRS site.

Cost Basis (Cont)

27

Lost Stock Certificate or Check

What is a stock certificate?

Documentation of a shareholder’s ownership in

a corporation. Certificates indicate the number

of shares owned by an individual, their par value

(if any), the class of stock and date of issuance.

What should I do if I lose my certificate?

If your stock certificate is lost, accidentally destroyed

or stolen, you should immediately contact your

transfer agent and request a stop transfer to prevent

ownership of the securities from being transferred

from your name to another’s. The transfer agent

may send affidavits to replace the shares which

require the purchase of a Lost Securities Bond from

an insurance company.

What is a surety bond?

A bond that guarantees payment if the second party

fails to meet the terms of a contract. The surety

bond protects the first party against any losses that

result from the second party’s failure to meet the

obligation. There are three parties involved:

• The Principal: the business or individual who will

be performing a contractual obligation

• The Obligee: the party who receives the

obligation, which is normally a government entity

• The Surety: who guarantees the principal’s

obligations will be performed

What is a surety premium?

A surety premium is a fee paid by a shareholder to

cover insurance for replacing lost securities or by

an estate of a deceased shareholder who transfers

shares without probate.

How do I replace my lost certificate

with EQ?

A shareholder can access their account online via

shareowneronline.com or contact our Shareholder

Services department to report their certificate

lost, stolen or destroyed. Upon receipt of the

communication, the Lost Securities department

will mail, fax or email Affidavits of Loss forms

for completion. The forms will require notarized

signatures of all shareholders along with the

quoted surety premium. Additional documents and

information may be required.

What is a replacement check?

When a check is created and sent to a shareholder

(e.g.: a cash dividend, a proceeds check for the sale

of shares, escheatment, corporate action or IPO

closing, etc.) it can sometimes be lost, misplaced

or damaged. In such an event, the shareholder can

request a replacement check for the funds.

How do I obtain a replacement check with

EQ?

There are several ways in which a shareholder can

request a replacement check. The shareholder can

go online to www.shareowneronline.com or contact

EQ’s Shareholder Services department via phone

or mail. Once the notification is made a request

is sent to the check replacement department for

processing. When it reaches the department, the

proper banks and departments are notified so no

excess funds are distributed. The request can take

up to 48 hours to be processed. Once completed

and the new check is created it is mailed via the

U.S. Postal Service. Additional documents and

information may be required

once you contact the transfer agent.

Important Note: Please ensure your address is

always up to date so checks are printed and sent

to the correct destination. You should cash checks

regardless of the dollar amount.

28

Direct Registration

System

29

Direct Registration System (DRS)

What is a Direct Registration System (DRS)?

A DRS records shares of stock in book-entry

form. Book-entry means the issuer’s transfer

agent maintains your shares without the need

for a physical stock certificate. Shares held in

uncertificated book-entry form have the same rights

and privileges as shares held in certificate form.

What are the benefits of DRS?

Holding shares in book-entry form through DRS

has many benefits. DRS helps reduce the risks and

costs associated with storing stock certificate(s)

and replacing lost or stolen certificate(s). It also

enables electronic share transactions between the

broker/dealer and transfer agent. DRS reduces

overall administrative costs to the issuer and its

shareholders.

What documents will I receive showing my

shares held through DRS?

You will receive a DRS Transaction Advice form

following each transaction involving your shares.

How do I transfer shares to or from

my brokerage account or sell shares?

If you wish to transfer or sell your shares you will

need to transfer them to your brokerage account,

contact your broker and provide him or her with

your DRS account information (which appears on

the Transaction Advice form you receive when you

become a participant in DRS). Your broker will then

electronically initiate the transfer of your book-entry

shares based on your instructions.

How do I transfer shares held through DRS

to a new owner?

Shares can be transferred to a new owner by

contacting the appointed transfer agent. The

instructions to transfer must include a medallion

signature guarantee (see details below).

What will it cost me to hold my shares through

DRS?

You will not be charged for holding your shares

through DRS. You should contact your brokerage

firm to determine its fees if you transfer your shares

to or sell your shares through a brokerage account.

Book-Entry Share Ownership Through A

Direct Registration System

30

Direct Registration System

(DRS) (Cont)

How do I know my book-entry shares are safe and can’t be transferred

without my consent?

Your written consent with a medallion signature guarantee is required

by the company-appointed transfer agent to transfer shares to any third

party other than your broker. If you choose to supply a broker with your

DRS account information, your broker is responsible for obtaining instructions

and documentation for any transfer or sale.

What is a medallion signature guarantee and how do I obtain one?

A medallion signature guarantee is a statement (stamp and signature)

given by a financial institution such as a commercial bank, credit union,

brokerage firm, etc., that is a member of the Securities Transfer Association

Medallion Program (STAMP), New York Stock Exchange Program or Stock

Exchange Medallion Program (SEMP, MSP). The medallion program is not

a notarization. To obtain a medallion signature guarantee visit a financial

institution that participates in the medallion program.

31

Glossary

Common Financial Acronyms & Abbreviations

The financial industry is full of acronyms. Here are some of the most commonly

used ones you may come across.

ACH

Automatic Clearing House: the way in which electronic

transfer of funds take place.

ADP

Automatic Data Processing

AMEX

American Stock Exchange

CTA

Co-Transfer Agent

CUSIP

Committee on Uniform Securities Identification

Procedure: CUSIP # is a nine-digit, alphanumeric number

that identifies securities.

DPP or DSPP

Direct (Stock) Purchase Plan

DR

Dividend Reinvestment

DRP or DRIP

Dividend Reinvestment Plan

DRS

Direct Registration System

DTCC

The Depository Trust & Clearing Corporation

EFT

Electronic Funds Transfer

ESOP

Employee Stock Option Plan

ESPP

Employee Stock Purchase Plan

IPO

Initial Public Offering: when a company first becomes a

stock company publicly trading on the market.

IR

Investor Relations

IRA

Individual Retirement Account

IVR / AVR

Interactive Voice Response / Automated Voice

Response: a telephony system that interacts with callers,

gathers information and routes calls to the appropriate

department or recipient.

JT TEN

Joint Tenants: a type of ownership where two or more

people own property together, each with equal rights and

obligations. Upon an owner’s death, that owner’s interest

in the property is transferred to the survivors without the

property having to go through probate.

LLC

Limited Liability Company: a type of legal entity where

risks to owners are limited by law.

LP

Limited Partnership

LT

Letter of Transmittal

NASDAQ

National Association of Securities Dealers Automated

Quotation System

NYSE

New York Stock Exchange

OTC

Over The Counter: stock that is purchased without a

broker

PTA

Prior Transfer Agent

RPO

Returned by the Post Office

32

Financial Terms

SEC

Securities and Exchange Commission

STA

Securities Transfer Association

T + 2